You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is this the end of expensive office space in New York??

- Thread starter David Goldsmith

- Start date

Bobby Zar buys Midtown office building for 15% less than 2015 price

Bobby Zar’s ZG Capital Partners bought an office building at 43 East 53rd Street for $103 million — $18 million less than its 2015 price.

therealdeal.com

Bobby Zar buys Midtown office building for 15% less than 2015 price

ZG Capital pays $103M for 20-story property at 43 East 53rd Street

New York

Jul. 28, 2022 07:05 PM

By Pat Ralph | Research By Jay Young

Share on FacebookShare on TwitterShare on LinkedinShare via EmailShare via Shortlink

43 East 53rd Street with ZG Capital Partners’ James Tamborlane and Bobby Zar (Google Maps, LinkedIn)

Bobby Zar and James Tamborlane’s ZG Capital Partners has closed on another Midtown East office building — at a substantial discount to its previous sale price.

An entity connected to the real estate investment firm bought the 20-floor, 113,000-square-foot tower at 43 East 53rd Street in Midtown East for $102.5 million from an entity tied to Florida-based MEK Management Services Inc., according to city property records filed Thursday. The contract for the acquisition was reported in April.

Tamborlane signed for ZG Capital Partners. MEK Management’s Richard Ostrovsky signed for the seller.

Ackman-Ziff’s Ross Mezzo is arranging the sale. Newmark’s Jordan Roeschlaub and Dustin Stolly arranged a $120 million loan from ACRES Capital and $55 million of limited-partner equity from Rialto Capital for the acquisition and renovation.

Built in 1990, the office building was bought by MEK Management for $120.3 million in 2015, according to city property records. The new owners are planning to spend upwards of $80 million to upgrade the 20-story, 134,000-square-foot property, which was formerly known as the Santander building.

The Manhattan office market has been dragged down by vacancies and subleasing as employees cling to their work-from-home routines. Older, unrenovated buildings have been especially punished.

ZG Capital’s purchase of 43 East 53rd Street is the latest of a number of deals that the investment firm has completed for buildings across New York in recent years.

The investment firm also purchased the largely vacant office building at 836 Broadway in Union Square last October for $40 million. The six-story, 81,000 square-foot building previously housed New York University.

And ZG bought the 20,000-square-foot, mixed-use building at 654 Broadway in NoHo for $10 million last year and the waterfront Bruckner Building at 2417 Third Avenue in the South Bronx for $65 million in 2019.

Nearly Half of Companies Will Cut Office Space Next Year: Survey Nearly half of companies plan to cut their office space in the next year, joining a growing number who have already done the same, according to a July survey from flexible workspace software provider Robin.

Robin’s survey of 250 U.S. companies found that 46 percent plan to reduce their office footprint over the next 12 months. Of those, 59 percent said they would shrink their space by more than half. To make matters worse, for the office market at least, a potential recession will likely encourage firms to start subletting their offices rather than fire workers, according to the survey.“For most folks’ balance sheets, it’s people and real estate which are No. 1 and 2 on the budget,” said Zach Dunn, co-founder and vice president of customer experience at Robin. “You get a lot more out of people than real estate in the average company nowadays, and I think that people being prioritized during a recession is not inherently a bad thing.”

About 73 percent of firms that have most of their employees working in person said they would consider going hybrid before resorting to other cost-saving measures such as layoffs. Office brokers and lenders have seen remote work as a greater threat to the real estate market than a recession, but the survey’s findings show many companies will ax space first during an economic downturn.

While companies may start cutting back, hybrid work could also encourage firms to open satellite outposts for remote employees and prioritize efficient, smaller offices, Dunn said. Only 11 percent of the companies surveyed were using all of their space, and 45 percent were using only half or less than half of their current footprint.

“If you look at any one single office, it probably doesn’t need to be as sprawling as it was before to serve the same number of people,” Dunn said. “But as opposed to just shedding office space indiscriminately, people are being more deliberate about what they need that office to do for them in this new world.”

Plenty of firms have started cutting underutilized space or ditching plans to open new offices in recent months. Yelp announced in June that it would eliminate mandatory in-person work and closed 450,000 square feet of its offices in New York City, Washington, D.C., and Chicago. Amazon and Meta followed suit, announcing that each tech tycoon would slow its expansion in the Big Apple while reevaluating workplace strategy. Salesforce put more than 412,000 square feet of its San Francisco office on the sublease market in July while Twitter recently announced plans to close and downsize offices around the world, including trying to offload a full floor of its New York City outpost.

The news dashed the hope of commercial real estate brokers that the office market will return to normal, though they weren’t feeling very optimistic to begin with. The Real Estate Board of New York found that in July New York City brokers’ confidence about the market hit the lowest it’s been since 2020. Both commercial and residential brokers cited concerns over a recession, rising inflation and higher interest rates as the reasons for their worries.

Jamie Dimon blasts remote work as 'management by Hollywood Squares'

He also argued that returning to in-person work would help corporate diversity, calling the office a "rainbow room."

JPMorgan CEO Jamie Dimon rips remote work and Zoom as ‘management by Hollywood Squares’ and says returning to the office will aid diversity

JPMorgan Chase CEO Jamie Dimon rolled out a new argument in his battle against remote work: that in-person work is needed to support diversity.

JPMorgan Chase CEO Jamie Dimon blasted working from home and Zoom as “management by Hollywood Squares,” using the dated TV show reference on a call with the bank’s wealthy clients last week to reiterate his long-held preference that workers return to the office, Yahoo Finance reports.

Dimon argued on the Tuesday call that remote work creates a working environment that’s less honest and more prone to procrastination. “A lot of people at home are texting each other, sometimes saying what a jerk that person is,” said Dimon. (His Hollywood Squares comment referred to the decades-old game show—that’s no longer in production—in which celebrities sat in a three-by-three grid to answer questions from contestants.)

Dimon’s remarks come as the tussle between management and employees on a return to the office heats up and a possible economic slowdown threatens to erode employees’ leverage to stay home.

Why Is NYC’s Economy Still Lagging? Take a Close Look at Construction, Entertainment and Retail

In the summer of 2022, as the city still struggles to recover from the pandemic recession, the number of jobs at restaurants, hotels, arts and cultural institutions stands at 404,000 — a tumble by almost 15%.

Cranes crowded the skyline in that summer three years ago and some 163,000 people worked putting up new hotels, office buildings and residential buildings. This summer, 20,000 fewer people are employed in the construction industry, a number that hasn’t budged in months.

The rise of online shopping had begun to pinch retailers by mid 2019, but still 346,000 people worked in stores. Despite the recovery from the pandemic, that number is only 306,000 today, with little prospect of significant gains in the coming months.

To understand why New York City’s economy is still struggling to recover its pre-pandemic mojo, looking at the reasons behind lagging job numbers in those key areas of entertainment and hospitality, construction and retail is the place to start.

July represented a watershed, as the nation recovered all the jobs lost in the pandemic. New York, however, has regained only 82%.

Experts are quick to point to the areas of strength in the economy.

The technology sector is well ahead of its pre-pandemic job level and gains in the city have outpaced those in the rest of the country. Finance, especially Wall Street, remained strong throughout the recession, and the recent market rebound has lessened fears of layoffs there. Health care too is expanding.

Those areas, however, haven’t been enough. And the story behind the weaknesses of leisure and hospitality, retail and construction connect the city’s new biggest problems: not enough big-spending international tourists and not enough office workers, period. And, of course, New York was hit first and harder by both the coronavirus and the resulting business shutdown.

“The pandemic crushed the hospitality industry in New York so hard especially compared to other cities that had fewer restrictions and where businesses may have received more support,” said Andrew Rigie, executive director of the New York Hospitality Alliance.

The city Independent Budget Office compared the sector’s rebound in New York to that in other major tourism destinations like Orlando, Las Vegas, Washington, South Florida and San Francisco. All have regained a higher percentage of lost jobs than New York.

One reason is that some 19,000 hotel rooms remained shuttered, according to the Hotel Association of New York City. Several of those are concentrated along Lexington Avenue in Midtown, whose primarily clientele was business people coming to visit clients in Midtown.

“When you don’t have offices occupied you don’t have business travel,” said Vijay Dandapani, president of the association.

While many international tourists have returned in surprising numbers, their ranks do not include the Chinese, who are still unable to travel because of that country’s strict coronavirus protocols. China before the pandemic had been expected to be the No. 1 source of visitors to the city.

Restaurants are also suffering from the lack of office workers. Last week, Rigie talked to the owner of two Midtown eateries. The full-service restaurant is doing well. “But the limited service eatery is struggling because of the lack of office workers to stop by in the morning to pick up a bagel or rush out for something at lunch,” he said.

It isn’t just hotels and restaurants, of course.

Broadway attendance is still only about 80% of pre-pandemic levels, and long running shows are closing this summer, including “Dear Evan Hansen” and “Come From Away.”

Transportation jobs are still 10,000 below early 2020, as fewer tourists means less need for businesses and limos, while fewer office workers need fewer taxis and Ubers.

And retail districts, especially in Midtown, are simply not seeing their traffic recover. Almost half the stores in Herald Square, a mecca for both tourists and office workers, are vacant, according to data from Cushman & Wakefield.

The pandemic has chilled the climate for construction, which is stalled at 15% below its pre-pandemic level.

Virtually all the construction underway is on buildings started before the pandemic, notes Louis Coletti, president of the Building Trades Employer Association, with little new activity in housing, commercial and government-funded construction.

Prospects for the remaining four months of the year have been pared back because of surveys that show that office workers are unlikely to return to large numbers.

“I think there is reason to be concerned about growth in the rest of the year,” said Michael Jacobs, chief economist for the Independent Budget Office, “particularly in respect to office employment.”

A city comptroller report earlier this month said surveys show no significant increase for in-person office attendance is likely this fall. A report from the Federal Reserve Bank of New York last week titled “Remote Work is Sticking” suggested the current levels of in- and out-of-office work are likely to persist for years.

“Given New York was at 40% office occupancy for the last two months it has become harder and harder and harder to break through 40% and get to 50% or 60%,” said Rahul Jain, deputy state comptroller.

These three sectors explain why NYC just can’t get its groove back.

In the summer of 2019, with the city’s economy booming and with tourists arriving in such numbers that a record 67 million would visit New York by the end of the year, leisure and hospitality jobs hit a record 474,000.In the summer of 2022, as the city still struggles to recover from the pandemic recession, the number of jobs at restaurants, hotels, arts and cultural institutions stands at 404,000 — a tumble by almost 15%.

Cranes crowded the skyline in that summer three years ago and some 163,000 people worked putting up new hotels, office buildings and residential buildings. This summer, 20,000 fewer people are employed in the construction industry, a number that hasn’t budged in months.

The rise of online shopping had begun to pinch retailers by mid 2019, but still 346,000 people worked in stores. Despite the recovery from the pandemic, that number is only 306,000 today, with little prospect of significant gains in the coming months.

To understand why New York City’s economy is still struggling to recover its pre-pandemic mojo, looking at the reasons behind lagging job numbers in those key areas of entertainment and hospitality, construction and retail is the place to start.

July represented a watershed, as the nation recovered all the jobs lost in the pandemic. New York, however, has regained only 82%.

Experts are quick to point to the areas of strength in the economy.

The technology sector is well ahead of its pre-pandemic job level and gains in the city have outpaced those in the rest of the country. Finance, especially Wall Street, remained strong throughout the recession, and the recent market rebound has lessened fears of layoffs there. Health care too is expanding.

Those areas, however, haven’t been enough. And the story behind the weaknesses of leisure and hospitality, retail and construction connect the city’s new biggest problems: not enough big-spending international tourists and not enough office workers, period. And, of course, New York was hit first and harder by both the coronavirus and the resulting business shutdown.

“The pandemic crushed the hospitality industry in New York so hard especially compared to other cities that had fewer restrictions and where businesses may have received more support,” said Andrew Rigie, executive director of the New York Hospitality Alliance.

The city Independent Budget Office compared the sector’s rebound in New York to that in other major tourism destinations like Orlando, Las Vegas, Washington, South Florida and San Francisco. All have regained a higher percentage of lost jobs than New York.

One reason is that some 19,000 hotel rooms remained shuttered, according to the Hotel Association of New York City. Several of those are concentrated along Lexington Avenue in Midtown, whose primarily clientele was business people coming to visit clients in Midtown.

“When you don’t have offices occupied you don’t have business travel,” said Vijay Dandapani, president of the association.

While many international tourists have returned in surprising numbers, their ranks do not include the Chinese, who are still unable to travel because of that country’s strict coronavirus protocols. China before the pandemic had been expected to be the No. 1 source of visitors to the city.

Restaurants are also suffering from the lack of office workers. Last week, Rigie talked to the owner of two Midtown eateries. The full-service restaurant is doing well. “But the limited service eatery is struggling because of the lack of office workers to stop by in the morning to pick up a bagel or rush out for something at lunch,” he said.

It isn’t just hotels and restaurants, of course.

Broadway attendance is still only about 80% of pre-pandemic levels, and long running shows are closing this summer, including “Dear Evan Hansen” and “Come From Away.”

Transportation jobs are still 10,000 below early 2020, as fewer tourists means less need for businesses and limos, while fewer office workers need fewer taxis and Ubers.

And retail districts, especially in Midtown, are simply not seeing their traffic recover. Almost half the stores in Herald Square, a mecca for both tourists and office workers, are vacant, according to data from Cushman & Wakefield.

The pandemic has chilled the climate for construction, which is stalled at 15% below its pre-pandemic level.

Virtually all the construction underway is on buildings started before the pandemic, notes Louis Coletti, president of the Building Trades Employer Association, with little new activity in housing, commercial and government-funded construction.

Prospects for the remaining four months of the year have been pared back because of surveys that show that office workers are unlikely to return to large numbers.

“I think there is reason to be concerned about growth in the rest of the year,” said Michael Jacobs, chief economist for the Independent Budget Office, “particularly in respect to office employment.”

A city comptroller report earlier this month said surveys show no significant increase for in-person office attendance is likely this fall. A report from the Federal Reserve Bank of New York last week titled “Remote Work is Sticking” suggested the current levels of in- and out-of-office work are likely to persist for years.

“Given New York was at 40% office occupancy for the last two months it has become harder and harder and harder to break through 40% and get to 50% or 60%,” said Rahul Jain, deputy state comptroller.

KPMG downsizing Manhattan headquarters from 800,000SF to 550,000SF. That's over 6 football fields of space they are shedding. Or more than a third more space than the Flatiron Building.

KPMG consolidating to 450K sf at Two Manhattan West

KPMG consolidating to 450K sf at Two Manhattan West

Early in the pandemic, KPMG published a survey revealing nearly 70 percent of CEOs expected to downsize office space as a result of the pandemic.

The firm is joining those ranks.

The global audit and consulting firm announced Tuesday its move to Brookfield Properties’ Two Manhattan West, where it will occupy approximately 450,000 square feet. KPMG expects to transition over once construction is completed in late 2025, where up to 5,500 people will work.

The office lease is the largest this year in New York City, a Brookfield representative told The Real Deal. The 20-year commitment will span floors 13 through 24. No additional terms of the lease were disclosed.

The tower will serve as KPMG’s headquarters. It is the third tenant to sign at the building, which is 56 percent leased.

According to a Brookfield representative, CBRE’s Michael Geoghegan and Lewis Miller were among those representing KPMG, while Brookfield was represented in-house by a team including Jeremiah Larkin and Duncan McCuaig, as well as by Cushman and Wakefield.

KPMG has been on the hunt for new office space since 2018, according to the Wall Street Journal. But the company hadn’t been planning on cutting space until the pandemic dictated it was the correct move for the firm, which is operating under a hybrid work model.

While Brookfield is popping the bubbly, things for the greater office market are less positive. KPMG, for example, is leaving a significant void to fill. It has been working out of three offices in Manhattan, spanning approximately 800,000 square feet. Its move will result in a net loss of about 350,000 square feet of leased office space in Manhattan.

Landlords that will soon have big spaces to fill are Rudin Management (345 Park Avenue and 560 Lexington Avenue) and SL Green (1350 Sixth Avenue).

In June, Brookfield announced that international law firm Clifford Chance was leasing 144,000 square feet at Two Manhattan West. Financial terms of that lease were also not disclosed.

Construction on the 58-story, 1.9-million-square-foot Hudson Yards office property is set to be completed early next year. Tenant amenities at the building include a 3,200-square-foot landscaped terrace, bike storage, conference centers and a fitness and wellness center.

Cravath Swaine & Moore, another law firm, is set to take 350,000 square feet at the building. Amazon was reportedly considering space at the property too, but a deal never materialized.

Brookfield filed plans for the building in 2017, setting the stage for one of the last buildings of its five-building Manhattan West complex. Construction was initially pegged to wrap this year.

KPMG consolidating to 450K sf at Two Manhattan West

The move to the developing Brookfield Properties building will reduce KPMG’s NYC office footprint by 40 percent.

therealdeal.com

Early in the pandemic, KPMG published a survey revealing nearly 70 percent of CEOs expected to downsize office space as a result of the pandemic.

The firm is joining those ranks.

The global audit and consulting firm announced Tuesday its move to Brookfield Properties’ Two Manhattan West, where it will occupy approximately 450,000 square feet. KPMG expects to transition over once construction is completed in late 2025, where up to 5,500 people will work.

The office lease is the largest this year in New York City, a Brookfield representative told The Real Deal. The 20-year commitment will span floors 13 through 24. No additional terms of the lease were disclosed.

The tower will serve as KPMG’s headquarters. It is the third tenant to sign at the building, which is 56 percent leased.

According to a Brookfield representative, CBRE’s Michael Geoghegan and Lewis Miller were among those representing KPMG, while Brookfield was represented in-house by a team including Jeremiah Larkin and Duncan McCuaig, as well as by Cushman and Wakefield.

KPMG has been on the hunt for new office space since 2018, according to the Wall Street Journal. But the company hadn’t been planning on cutting space until the pandemic dictated it was the correct move for the firm, which is operating under a hybrid work model.

While Brookfield is popping the bubbly, things for the greater office market are less positive. KPMG, for example, is leaving a significant void to fill. It has been working out of three offices in Manhattan, spanning approximately 800,000 square feet. Its move will result in a net loss of about 350,000 square feet of leased office space in Manhattan.

Landlords that will soon have big spaces to fill are Rudin Management (345 Park Avenue and 560 Lexington Avenue) and SL Green (1350 Sixth Avenue).

In June, Brookfield announced that international law firm Clifford Chance was leasing 144,000 square feet at Two Manhattan West. Financial terms of that lease were also not disclosed.

Construction on the 58-story, 1.9-million-square-foot Hudson Yards office property is set to be completed early next year. Tenant amenities at the building include a 3,200-square-foot landscaped terrace, bike storage, conference centers and a fitness and wellness center.

Cravath Swaine & Moore, another law firm, is set to take 350,000 square feet at the building. Amazon was reportedly considering space at the property too, but a deal never materialized.

Brookfield filed plans for the building in 2017, setting the stage for one of the last buildings of its five-building Manhattan West complex. Construction was initially pegged to wrap this year.

Tax code change led to today's office glut

Tax changes early in Reagan’s presidency, along with easy loans, the Great Recession and Covid, contributed to today’s office surfeit.

therealdeal.com

Tax code change led to today’s office glut

The pandemic has shone a harsh spotlight on office vacancies. The glut of space long predates Covid, though.In fact, analysts and investors trace its origins all the way back to a Ronald Reagan era tax change, the Wall Street Journal reported. The change led to a building boom that ultimately outstripped demand for desk space.

In 1981, the Reagan administration changed the tax code in a bid to amp up the economy, for example, by allowing investors to depreciate commercial real estate at a faster pace. As a result, they put more money into office development than was justified by demand.

On top of that, developers found it easy to borrow money to build office projects, at least until the savings-and-loan crisis. From 1981 to 1989, completion of new office space in the top 50 markets topped 100 million square feet annually, peaking in 1985 at 182 million square feet, according to Moody’s Analytics.

While vacancy rates declined in the 1990s, the trend reversed with the Great Recession as companies slashed their office footprints to lower costs. Empty offices have been abundant since then, yet tax subsidies have continued to fuel office development.

The office vacancy rate in the United States hasn’t dipped below 12 percent in the past 17 years, according to JLL. The 18.9 percent vacancy rate last quarter was the highest of that period.

Meanwhile, markets in the Asia-Pacific region and the Europe, Africa and Middle East regions have consistently had lower vacancy rates than their American counterparts. The rate was roughly 14 percent in Asia-Pacific last quarter and 7 percent in Europe, the Middle East and Africa.

The long-term nature of the problem, combined with the post-pandemic rise of remote work, means vacancy rates aren’t likely to ebb anytime soon. Meanwhile, a flight to quality has exacerbated the problem for older buildings, which for a variety of reasons are difficult to convert to other uses.

Silverstein CEO: RIP Five days a week in the office

Marty Burger, CEO of one of New York City's largest office landlords, says he's confident in a return to work — just not five days a week.

therealdeal.com

Silverstein CEO: RIP Five days a week in the office

Marty Burger says "new normalcy" for offices will be 3-4 days a week at 70-80% occupancy

It’s been a year since Manhattan landlords first pinned their hopes on Labor Day as the end of the remote-work era, and the city’s office buildings haven’t gotten much busier.But Silverstein Properties CEO Marty Burger says he’s confident more workers will finally return to their desks in the coming months.

“We’re experiencing people coming back,” Burger said on CNBC’s “Squawk on the Street” Monday. “I think after Labor Day, you’re gonna see an increase in people coming back to the office, and I think by the end of the year, you’ll have some new normalcy in what happens in the office market.”

Asked by host David Faber what that “new normalcy” will be, Burger acknowledged that few tenants will be back five days a week.

“I think Tuesday through Thursday, you’re going to see maybe 70-80 percent office occupancy,” Burger said. “It’s interesting because if you ask someone if they want to work remotely, they’ll say yes. If you ask them if they want to give up their office space, they’ll say no.”

Silverstein, one of the city’s largest office landlords, has some decent evidence that its properties are still in demand: Last week, it signed the law firm Freshfields Bruckhaus Deringer to a 15-year lease on 180,000 square feet at 3 World Trade Center, where the asking rent was believed to be upwards of $100 per square foot.

Earlier last month, it signed the city’s Housing Development Corporation to 109,000 square feet at nearby 120 Broadway, the century old office tower it recently spent $50 million restoring with amenities like a fitness center and 10th-floor speakeasy.

But that deal came just a few weeks after the law firm Kaufman Borgeest & Ryan ditched its 48,000 square feet in the building for a smaller space at Eyal Ofer’s 875 Third Avenue in Midtown.

Manhattan’s office market appears to be gaining momentum. Tenants signed leases for nearly 3.2 million square feet in July, according to data from Colliers, the most in any month since the start of the pandemic. Available space in Midtown fell for the fifth straight month.

Still, there’s a long way to go. The vacancy rate in July stood at 17 percent, little improved from February’s record 17.4 percent. And while leasing is ticking up, occupancy is not. The city’s office buildings were 35.3 percent occupied in the week ending Aug. 24, according to Kastle Systems, which tracks card-swipe data. The occupancy rate hasn’t gotten above 43 percent since the onset of the pandemic, but decisions by Goldman Sachs and Morgan Stanley to relax Covid policies after Labor Day could prompt other employers to get workers back to the office more often.

Burger didn’t directly respond when asked whether the plan to build millions of square feet of additional offices in several towers surrounding Penn Station makes sense, but suggested there will always be a need for new space.

“You’ve got great talent in New York City,” he said. “That’s where people want to be, so you have companies coming here to tap into that talent and they’re going to continue to do so.”

Burger also pushed back on the notion, reported by the Wall Street Journal last week, that a Reagan-era tax code change spurred today’s office space glut.

“I really don’t think there’s an office glut,” he said. “I think office evolves over time and becomes different things.”

He pointed to Silverstein and Metro Loft Management’s plans to convert the 30-story office building at 55 Broad Street, which the firms bought in May for about $180 million, into a 571-unit apartment building.

“If you look at New York City, it’s got a very old stock of office buildings and it’ll be reused as different things over time,” Burger said. “I think there will be a lot of [redevelopment], but not a ton of it, because not every building can be repurposed like that.”

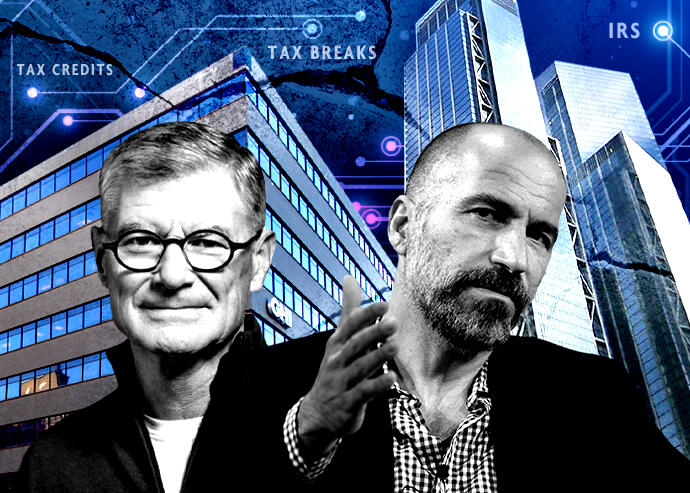

Tech Struggles Could Threaten NY Property Tax Credits

A slew of tech companies helped fund NYC office space with tax credits in exchange for job creation. Now they may struggle to claim them.

therealdeal.com

Big tech’s struggles threaten tax breaks that propped up NYC offices

Companies that pledged job creation are now cutting back on expenses

In the heyday of ping pong and free lattes in the workplace, many of the city’s fastest-growing startups paid for their high-priced office space with help from the state in the name of economic development.One-time unicorns like Peloton, Snap and Casper agreed in recent boom years to create hundreds of jobs in exchange for tax credits offered under the state’s lucrative but controversial Excelsior Jobs Program, which aims to keep jobs from leaving the state.

With the economy now slowing, a number of these companies have made layoffs, downsized offices or otherwise transitioned from growth mode to focus on profitability, and may struggle to deliver all the jobs they pledged.

A review of program disclosures by The Real Deal suggests many of the tax breaks are in danger.

A spokesperson for Empire State Development, which administers the program, noted the pandemic and macroeconomic factors affected many companies, particularly those in New York City..

.

Big tech’s struggles threaten tax breaks that propped up NYC offices

Companies that pledged job creation are now cutting back on expenses

In the heyday of ping pong and free lattes in the workplace, many of the city’s fastest-growing startups paid for their high-priced office space with help from the state in the name of economic development.One-time unicorns like Peloton, Snap and Casper agreed in recent boom years to create hundreds of jobs in exchange for tax credits offered under the state’s lucrative but controversial Excelsior Jobs Program, which aims to keep jobs from leaving the state.

With the economy now slowing, a number of these companies have made layoffs, downsized offices or otherwise transitioned from growth mode to focus on profitability, and may struggle to deliver all the jobs they pledged.

A review of program disclosures by The Real Deal suggests many of the tax breaks are in danger.

A spokesperson for Empire State Development, which administers the program, noted the pandemic and macroeconomic factors affected many companies, particularly those in New York City.

“The 10-year term of Excelsior tax credits accommodates short-term market fluctuations,” spokesperson Kristin Devoe said by email. “Companies that fall short of job commitments in one year can still receive tax credits the following year if they deliver on their job-creation goal.”

The program, launched by former Gov. David Paterson’s administration in 2010, offers companies $2,500 to $5,000 for each job they create in the state. Officials typically offer the incentives to retain growing companies seeking more office space.

Peloton, for example, agreed to quadruple its roughly 400-person New York City workforce in 2018 when it relocated from a small office in Chelsea to a 300,000-square-foot spread at Cove Property Group and Baupost Group’s Hudson Commons office redevelopment at 441 Ninth Avenue.

The fitness company said it would add 1,263 jobs over 10 years in exchange for $20 million worth of tax credits. In 2019, its first year in the program, Peloton exceeded its goal by creating 206 jobs, earning about $265,000 in tax credits.

Peloton’s business exploded in the early months of the pandemic, when lockdowns shuttered gyms and fitness enthusiasts eagerly shelled out thousands of dollars for its stationary bikes. But the company has since run into huge problems: It replaced its CEO in February and announced plans to cut 2,800 jobs, or 20 percent of its workforce, and to stop making its own bikes and treadmills.

In June, Peloton put about a third of its Hudson Commons office space up for sublease.

A spokesperson for Peloton did not respond to a request for comment, but new CEO Barry McCarthy told employees in an August memo that while the company is cutting jobs in certain areas, “we continue to fill roles on key teams to drive the business forward.”

It’s not clear how the job cuts and hiring will affect Peloton’s job numbers in New York.

Another once-hot tech company, Snapchat parent Snap, entered the Excelsior program in 2016, pledging to create 396 new jobs in exchange for $5 million in credits.

The social media company had just expanded its office at Columbia Property Trust’s 229 West 43rd Street in Times Square, and its last disclosure shows that it fell just six jobs short of its 2018 goal to create 211 jobs. Companies can receive a proportional share of their credits if they reach at least 75 percent of their goal in a year.

In an August SEC filing, Snap disclosed that it plans to cut 20 percent of its more than 6,400-person global workforce to stem its losses.

In 2015, the direct-to-consumer mattress company Casper Sleep had just 12 employees in the city. It said it would create 307 jobs in exchange for $3.1 million in tax credits.

The company had just signed a lease for 31,000 square feet at TF Cornerstone’s 320 Park Avenue, and by 2019 it had relocated to 70,000 square feet at Silverstein Properties’ 3 World Trade Center.

But Capser struggled to meet its goals, falling short in three of its first four years in the program. Last year, it reportedly cut dozens of jobs and laid off three members of its C-suite. In November, it sublet 43,000 square feet at 3 World Trade Center to the advertiser marketplace Index Exchange.

Office math

The tax breaks can be lucrative for companies that meet the benchmarks.BlackRock, which is taking about 1 million square feet at Related Companies’ 55 Hudson Yards, is eligible to claim $25 million in credits, or 20 percent of the $1.25 billion cost of its lease. The asset manager will need to create 700 jobs to receive the credits, but it won’t have to start reporting its progress until next year.

The Excelsior program is designed to lure or retain companies that might otherwise hire elsewhere, but it’s been criticized as a giveaway to firms that likely would have expanded in the state anyway.

When BuzzFeed struck an agreement for $4 million in credits in 2015, it cited the “excessive” cost of renting New York City office space and building out a video studio as reasons it had considered relocating those jobs to New Jersey or Los Angeles.

Critics argued the company never really intended to leave the news and media capital of the world. Buzzfeed had been making progress toward its goal of 475 jobs, but has gone through a series of restructurings and cut hundreds of employees since 2019. In August, it consolidated its office space in the city to 110,000 square feet in Times Square.

A 2016 audit of the Excelsior program by state Comptroller Thomas DiNapoli found that Empire State Development could not verify that companies actually created the jobs they said they would, and that the agency lowered job-creation goals after companies didn’t meet them.

The program came under particular scrutiny in 2018, when the Cuomo administration offered $1.2 billion worth of credits to lure Amazon to Long Island City. Public pushback eventually led Amazon to scrap its plans for Queens. But the tech company is still the largest applicant in Excelsior.

It’s eligible for up to $43 million in credits, for which it says it will create 4,750 jobs across a corporate headquarters and two fulfillment centers in the five boroughs.

Behind Amazon, Uber is the second-largest applicant. The company, which signed a lease for more than 300,000 square feet at 3 World Trade Center in 2019, is eligible for up to $29 million in credits. The next spring it announced plans to lay off about a quarter of its workforce.

Uber CEO Dara Khosrowshahi said in May that the company was focusing on cutting costs, adding cryptically that it would “treat hiring as a privilege.”

Company spokesperson Josh Gold said during the pandemic that Uber applied for an extension under the program and will begin reporting its job growth next year.

“We are well on our way to hitting our 2023 target,” he said.

Manhattan Office Leasing Has Busiest Month of Covid Era: Colliers

The 3.4 million square feet of Manhattan office space leased in August was the most since January 2020, according to Colliers.

therealdeal.com

Manhattan office leasing has busiest month of Covid era

Still, 67 percent more space is available than in March 2020: Colliers

Companies still want a piece of Manhattan.Some 3.4 million square feet of office space was leased in August, the most since January 2020, when the first Covid cases began to pop up in New York City, according to a Colliers’ report.

Notably, space in Midtown is steadily getting harder to find. More space was newly leased than became available in Manhattan’s central business district decreased for the sixth straight month, as was the case for Manhattan as a whole.

“If demand continues at the same rate, Midtown is on pace to nearly match 2019 leasing volumes of 15 million square feet,” said Franklin Wallach, director of research at Colliers.

A little more than 1.3 million square feet of office space was leased in Midtown in August, a decrease from the previous month and slightly lower than in August 2021.

Noteworthy deals in Midtown included asset manager Cohen & Steers and hedge fund Brevan Howard signing leases for 161,000 square feet at Minskoff Equities’ 1166 Sixth Avenue and 83,000 square feet at Fisher Brothers’ 1345 Sixth Avenue, respectively.

However, Midtown’s available office space has increased by 36 percent since March 2020. Wallach said that number is modest compared to Midtown South (where it has more than doubled), Downtown (up 95 percent), and Manhattan overall (up 67 percent.) Prospective tenants in Manhattan now have approximately 90 million square feet to choose from, according to Colliers.

Midtown South was the stage for the largest deal this year in New York City: KPMG’s move to Brookfield Properties’ Two Manhattan West, where it will occupy about 450,000 square feet. The tower will serve as the global audit and consulting firm’s headquarters. Another positive sign for office landlords was public relations firm Edelman renewing its 174,000-square-foot lease at 250 Hudson Street.

The good news for Midtown South owners is the neighborhood’s asking rent average was higher than Midtown’s for the sixth consecutive month. Wallach surmised that the growth of TAMI (technology, advertising, media and information) companies, and millions of square feet of new construction and major renovations in nearly all eight Midtown South submarkets, were chiefly responsible for driving up the average asking rent.

Downtown, the deal that made the biggest splash was Freshfields Bruckhaus Deringer signing a lease at Silverstein Properties’ 3 World Trade Center for 180,000 square feet. The New York City Housing Development Corporation inked a deal at 120 Broadway for 109,000 square feet of offices.

Despite Downtown’s availability dropping slightly to 20 percent, Wallach cautioned that there is a long way to go to get back to its pre-pandemic availability of 10 percent. Downtown has more availability than in the aftermath of 9/11 and the Great Recession.

The average annual rents per square foot in Midtown, Midtown South and Downtown in August were $79.55, $80.90 and $59.21, respectively.

NYC Office Owners Pass on Fall Selling Season

Labor Day usually kicks off the end-of-year sales season with big office listings. But interest rates and economic winds have owners holding back.

therealdeal.com

Where are all the trophy office listings?

NYC traditionally welcomes fall with big office properties hitting the market. Not this year

Like a kid with a new pair of school shoes, real estate traditionally observes the end-of-summer vibe shift with big office listings that set the tone for the rest of the year.This September, however, investors have largely avoided putting their trophy properties up for sale, an acknowledgment of the difficulties in the investment sales market brought on by rising interest rates and an economic slowdown.

“If I owned an office building right now I’d be hesitant to bring it to market, because there’s still so much uncertainty around what happens next,” said MSCI Real Estate’s Jim Costello.

The back half of the year usually generates an outsized share of investment sales, particularly in the fourth quarter as sellers look to get deals done by year’s end for tax purposes. But most investors avoid bringing big properties to market in late summer, when much of the industry is on vacation. The first few weeks of September tend to see several trophy assets put up for sale.

But more than a week after Labor Day, no large offices have hit the market in New York, and sources in the investment sales market told The Real Deal that they don’t see any lined up for the near future. They point to a tough market for buyers and sellers alike, with uncertainty about whether or not workers will return to offices in large numbers and an economic recession looming.

On top of that, rising interest rates have made it more difficult to finance acquisitions — and that’s if you can find someone willing to offer a loan at all.

“A number of lenders have drawn a line in the sand and said they won’t lend on any office,” said one of the city’s top commercial brokers.

At least one trophy office property may soon come up for sale: 245 Park Avenue, which SL Green Realty said this week it had acquired out of bankruptcy. During a presentation with Bank of America on Tuesday, SL Green executives said they plan to bring the 1.8 million-square-foot building to market “immediately” by offering a stake to a joint venture partner, though the precise timing wasn’t clear.

Offices generally make up the bulk of Manhattan investment sales, but this year they’ve taken a back seat to hot multifamily assets.

Offices made up about 31 percent of the borough’s investment sales in the second quarter, compared to multifamily’s 58 percent, according to CBRE. That was basically an inversion of the split seen over the past year.

This year got off to a good start, with major deals like Blackstone’s purchase of a 49 percent stake in One Manhattan West in March, valuing the Midtown tower at $2.8 billion, and Google’s $2.1 billion acquisition of the St. John’s Terminal at 550 Washington Street, which closed in April.

But as the months went by, the market started to struggle. Property & Building Corp.’s deal to sell the HSBC Tower at 452 Fifth Avenue for $855 million fell apart when buyer Andrew Chung’s Innovo Group failed to secure financing. And Steven Roth’s Vornado Realty Trust recently reached a deal to sell 40 Fulton Street to David Werner for around $110 million — about a 20 percent discount to what it sought when it placed the Financial District property on the market in May.

Still, Manhattan office sales totaled $3.88 billion in the first half of the year, according to Ariel Property Advisors, quadrupling last year’s lethargic start. But commercial real estate saw a surge of investment at the end of 2021, setting a high bar for the second half of this year to match.

“We can see activity levels more broadly being down 25 to 30 percent depending on how things shake out over the next few months,” said JP Morgan commercial real estate analyst Anthony Paolone.

As for now, the choppy investment sales market has disrupted the normal ebb and flow of real estate’s fall selling season.

“There’s a seasonal pattern there,” MSCI’s Costello said. “If you want to get something sold, you’ve got to get it listed.”

New York’s Empty-Office Problem Is Coming to Big Cities Everywhere

Remote work could swipe $456 billion in value from US offices

New York City’s Empty Offices Reveal a Global Property Dilemma

The rise of remote work will hurt older buildings, leaving landlords in the lurch

In the heart of midtown Manhattan lies a multibillion-dollar problem for building owners, the city and thousands of workers.

Blocks of decades-old office towers sit partially empty, in an awkward position: too outdated to attract tenants seeking the latest amenities, too new to be demolished or converted for another purpose.

It’s a situation playing out around the globe as employers adapt to flexible work after the Covid-19 pandemic and rethink how much space they need. Even as people are increasingly called back to offices for at least some of the week, vacancy rates have soared in cities from Hong Kong to London and Toronto.

Office Vacancies in Major Cities Jumped During the Pandemic

Office vacancy rates

15%

New York

Hong Kong

10

Toronto

London

Frankfurt

5

Tokyo

0

Q1 2019

Q2 2022

Source: Savills

“There’s no part of the world that is untouched by the growth of hybrid working,” said Richard Barkham, global chief economist for commercial real estate firm CBRE Group Inc.

In some cases, companies are simply cutting back on space to reduce their real estate costs. Others are relocating to shiny new towers with top-of-the-line amenities to attract talent and employees who may be reluctant to leave the comforts of working from home. Left behind are older buildings outside of prime locations.

The US is likely to have a slower office-market recovery than Asia and Europe because it began the pandemic with a higher vacancy rate, and long-term demand is expected to drop around 10% or more, Barkham said. New York, America’s biggest office real estate market, is at the center of the issue.

A study this year by professors at Columbia University and New York University estimated that lower tenant demand because of remote work may cut 28%, or $456 billion, off the value of offices across the US. About 10% of that would be in New York City alone.

The implications of obsolete buildings stretch across the local economy. Empty offices have led to a cascade of shuttered restaurants and other street-level businesses that depended on daytime worker traffic. And falling building values mean less property-tax revenue for city coffers.

Sign up for the Work Shift newsletter for reporting, data, and insights to futureproof your business and career delivered to your inbox every Tuesday.

A strip on Manhattan’s Third Avenue, from 42nd to 59th streets, shows the problem of older properties in stark terms. While New York leasing demand has bounced back toward pre-pandemic levels, the corridor has 29% of office space available for tenants, nearly double the amount four years ago and above the city’s overall rate of 19%, according to research from brokerage firm Savills.

The area is clustered with buildings from the 1950s to 1980s, many of which haven’t been meaningfully upgraded in decades. The few that have been renovated struggle to compete with counterparts in tonier addresses on Park, Fifth and Madison avenues and new mega-developments on Manhattan’s far west side.

The Third Avenue buildings have become “leave-behind space” rather than the types of offices that attract world-class tenants, said Nick Farmakis, vice chairman at Savills.

There’s no easy fix for landlords, who rely on rental income to pay down debt. Some cities are exploring options to turn downtown offices to residential buildings: Calgary, for instance, has an incentive program for such redevelopments. While New York has had some conversions, the hefty costs and zoning and architectural restrictions make it a difficult proposition.

As cities try to recover from the pandemic, the towers along Third Avenue demonstrate the types of challenges faced by building owners in Manhattan and beyond.

Third Ave.

East 34 St.

East 44 St.

East 49 St.

East 53 St.

East 57 St.

MURRAY HILL

MIDTOWN EAST

TO UPTOWN

TO UPTOWN

655 Third Ave.This building scored among the lowest on the corridor for possible residential conversion, according to an analysis by architecture firm Gensler.

Over the past few years, major finance, tech and law firms have been relocating to the west side of Manhattan, where a new crop of glassy skyscrapers has emerged to create a new business district.

KKR & Co. and BlackRock Inc. are shifting their headquarters to Related Cos. and Oxford Properties’ Hudson Yards mega-development, while Wells Fargo & Co. relocated its New York corporate and investment banking business to the area. Brookfield Properties’ Manhattan West project has drawn international law firm Clifford Chance and hedge fund titan D.E. Shaw & Co. from Midtown offices.

Central

Park

NEW YORK

919 THIRD AVE.

THE SPIRAL

Manhattan

Debevoise & Plimpton LLP, an anchor tenant at SL Green Realty Corp.’s 919 Third Ave., signed a 20-year lease to relocate its headquarters to the Spiral, a new skyscraper by the Hudson Yards development, leaving behind more than 400,000 square feet. About half of that has been leased. (Bloomberg News parent Bloomberg LP, which already has offices in the building, took some of the law firm’s space.)

The Spiral, owned by Tishman Speyer, is a 1,031-foot (314-meter) tower set to be completed this year. It will have 2.85 million square feet of offices and retail space, with cascading outdoor terraces, hanging gardens and sweeping views of the Hudson River. Amenities include a penthouse clubhouse with panoramic city views, a lounge and open-air terrace.

When Debevoise & Plimpton announced the move in 2020, Michael Blair, the law firm’s presiding partner, touted the “truly modern, efficient and eco-friendly space,” and said it will be “a highly functional workspace that will better foster the collaboration that is a hallmark of our firm’s culture.” The firm declined to comment further.

Rendering of the Spiral shows its outdoor cascading terraces on each floor. Image from Tishman Speyer

“In this environment, you can be in a lot better building in a better location at a similar rent,” said Richard Litton, president of Harbor Group International, an owner of $19 billion in real estate. He said his firm would have “little, if any, interest in Third Avenue right now.”

One large Manhattan landlord is betting that renovations will lure tenants to Third Avenue. The Durst Organization has put roughly $150 million into renovating 825 Third Ave., a 530,000-square-foot, 40-story building that was largely left empty when tenant Advance Publications departed after 25 years. When the lease expired in 2019, Durst explored a potential residential conversion but opted for a commercial upgrade.

The building, which reopens in October, will be the ultimate market tester for demand for upgraded Third Avenue space. Durst’s renovations included new glass for upper floors, new heating and cooling systems, an updated lobby and an outdoor wraparound terrace. Smaller floor plates spanning 10,000 to 12,000 square feet in the upper part of the tower could draw interest from boutique firms seeking less space than vast, open layouts. Durst has signed three leases at the building, totaling 45,000 square feet.

Durst installed new glass that changes color depending on the sunlight. Image from Durst Organization and March Made LLC

The obvious solution to lower office demand in a city straining for affordable housing may seem to be converting the buildings into apartments. There’s precedent: After the Sept. 11, 2001, attacks and the 2008 global financial crisis, many offices in lower Manhattan were turned into luxury condominiums or rental buildings.

But many of those downtown conversions took place in buildings from the late 19th to early 20th centuries, which had smaller floor plates and better light, making them more attractive for housing units. In contrast, the struggling towers across Midtown are largely 1950s to 1980s offices, with giant, dark floors that are far harder to convert.

Zoning changes and subsidies post-9/11 also gave developers incentives to build thousands of apartments downtown. In Midtown, there are currently no financial incentives for developers to make the costly renovations, and many offices aren’t eligible for residential zoning.

Bloomberg, working with architectural firm Gensler, examined two buildings, 655 Third Ave. and 767 Third Ave., to illustrate the opportunity – and complexity – in converting an office tower.

655 Third Ave.

This building, with a more than 40% availability rate, isn’t ideal for conversion to residential use, according to Gensler.

655 THIRD AVE.

East 42nd St.

Third Ave.

Core-to-window depth determines how far sunlight and air reach into a building and how well-proportioned housing units can be

Typical tower floor

in 655 Third Ave.

Typical podium floor

in 655 Third Ave.

In 655 Third, the core-to-window depth ranges from about 50 feet in the tower to about 90 feet in the podium, both larger than the ideal

Size of the floor plate also helps determine how each floor can be divided into residential units

Smaller floor plates for residential

conversion, like 8,000 square feet,

are often more ideal

Typical tower floor

in 655 Third Ave.

is 14,000 square feet

Typical podium floor

in 655 Third Ave.

is 23,400 square feet

both larger than the ideal size

While three sides of the building are unobstructed, the east façade is partially solid due to its configuration and an adjacent building, which could hamper sunlight for a large portion of units.

“The problem with Midtown is a lot of buildings need air and lights that the city requires, and you don’t always get that,” said Ran Eliasaf, founder and managing partner of investment firm Northwind Group, which is exploring residential conversions in the city. “Not every Class B building is an ideal target for conversion.”

767 Third Ave.

This building is ranked as one of the best-suited for residential conversion on the Third Avenue strip, based on its smaller floor plates and good core-to-window depth, according to Gensler. Yet it too faces challenges.Zoning laws in New York dictate that certain towers being converted to residential use are subject to residential floor area restrictions. While some older buildings can be fully converted, that generally applies to towers in certain areas built before 1962, and in lower Manhattan, 1977, according to Robert Fuller, studio director and principal at Gensler. 767 Third Ave. was built in the early 1980s.

767 THIRD AVE.

Third Ave.

East 48th St.

Typical tower floor

in 767 Third Ave.

The core-to-window depth is

approximately 43 feet in the tower

and the floor plate size

is about 7,800 square feet,

both more suitable

for residential conversion

Hypothetical residential floor

Depending upon the unit mix,

the tower floorplate can be

divided into 5 to 8 units

767 THIRD AVE.

However only about half of the building can be converted to residential use due to NYC zoning regulations.

This means residents would have to share an elevator system with office workers.

The tower’s owner, Sage Realty Corp., ran the numbers on a conversion years ago, but found it wouldn’t make sense because zoning rules meant the company couldn’t maximize its square footage, said Chief Executive Officer Jonathan Iger. The landlord would also have to buy out the leases of the remaining office tenants, a costly proposition.

“Unless we see the level of private/public partnership that we saw post-9/11 in downtown Manhattan to help spur office-to-residential conversion, it’s not impossible, but it’s much harder to pencil out,” Iger said.

Another option for Third Avenue buildings would be luring tenants outside of the traditional finance, law and technology industries. Memorial Sloan Kettering Cancer Center recently agreed to buy a portion of 885 Third Ave., also known as the Lipstick Building, and plans to use it for academic and research offices.

But the longer-term shifts in work habits still loom, and it matters to more than just building owners. New York, like other cities, relies heavily on property taxes to fund schools, police and firefighters, as well as other services. Property taxes are the biggest source of revenue for the city, delivering about $1 out of every $3 taken in. And offices account for about a fifth of that.

Before the pandemic, the levies had climbed by about 6% a year on average, driven by rising property values. That helped finance new programs and services, as well as keep up with rising labor costs, said Ana Champeny, the vice president for research at the Citizens Budget Commission, a nonpartisan budget watchdog and research firm.

Manhattan’s major office districts were no exception, generating steadily more revenue. But, in the fiscal year that ended June 30, the first to take into account the impact the pandemic had on real estate, tax levies from those areas declined by 11% to $5.24 billion.

Empty offices have led to a cascade of shuttered restaurants and other street-level businesses that depended on daytime worker traffic. Photographer: Amir Hamja/Bloomberg

The biggest drop was in a part of Midtown East north of Grand Central that the city’s Department of Finance calls “Plaza,” which contains some of the Third Avenue properties.

Shrinking Revenue

Property Tax Levies on Offices in Manhattan’s Major Work AreasPlaza

Midtown West

Midtown South

Grand Central

Financial/WTC

Insurance/Civic Center

$6B

5

4

3

2

1

0

FY2008

FY2022

Note: Figures don’t account for tax abatement programs.

Source: NYC Department of Finance, Bloomberg calculations

Tax bills for the current year suggest a slight rebound in revenue from office buildings citywide, but the recovery could take years to play out, especially if tenant demand remains depressed. New York also raises almost $1 billion annually from a tax on large commercial leases, which could fall if demand from big tenants like law and financial-services firms remains soft, said Champeny. Office use also has ripple effects on other important parts of the economy, from the transit system to retail and hotels.

“It’s still early to tell what the structural change will be in both the economy and working and commuting,” she said. “But clearly, the city is facing some short-term challenges.”

Source: Office availability data provided by Savills and building owners. Availability rate refers to all space available for lease in a building, including vacant or a sublease space.

Once again the claims of huge boosts in the amount of back in office post Labor Day fall short.

After a surge in occupancy post-Labor Day, attendance already appears to be leveling off, Bloomberg reported. Kastle Systems card-swipe data on the week of Sept. 21 show occupancy in New York City, the country’s largest office market, was down slightly from the previous week at 46.1 percent.

The stall came after occupancy surged by more than 10 percentage points in the two weeks between Aug. 31 and Sept. 14.

Transit use, an important barometer in commuter-heavy New York City, is also stalling. On Sept. 21, use of the Long Island Rail Road was at 71 percent of its 2019 average, maintaining the same level from the previous week. Subway ridership increased slightly between Sept. 14 and Sept. 21.

The picture is slightly more rosy nationally, at least in terms of occupancy. The average occupancy of 10 big cities tracked by Kastle Systems was 47.3 percent the week of Sept. 21, a slight drop-off from 47.5 percent the previous week. San Jose and Houston were among the cities recording occupancy increases.

Landlords trying to look at the glass nearly half full may find relief that occupancy didn’t crater significantly after the post-Labor Day push.

Offices across the city were emptied out during the pandemic, putting the properties in dire straits. At one point, occupancy was barely above 10 percent. It wasn’t until June that office occupancy hit even 40 percent in the city, and that didn’t prove to be a permanent accomplishment.

There’s a possibility, however, the September occupancy numbers may represent a new normal. More companies are settling into a wide range of work policies, whether that means calling back workers full-time, never or somewhere in between.

The pandemic-induced drop in office use is projected to have a devastating effect on the market. An analysis from a team at NYU and Columbia estimated that by 2029, the city’s office buildings will fall in value by 28 percent, or $49 billion.

Office occupancy stalls after Labor Day push

Office occupancy was stuck below 50 percent in New York City after a Labor Day push, according to card swipe data by Kastle Systems.

therealdeal.com

Office occupancy stalls after Labor Day push

Occupancy jumped in late August, but fewer than half of workers back in person

For the second straight year, Labor Day was cast as a flashpoint for post-pandemic office life. And for the second straight year, the holiday left properties feeling empty.After a surge in occupancy post-Labor Day, attendance already appears to be leveling off, Bloomberg reported. Kastle Systems card-swipe data on the week of Sept. 21 show occupancy in New York City, the country’s largest office market, was down slightly from the previous week at 46.1 percent.

The stall came after occupancy surged by more than 10 percentage points in the two weeks between Aug. 31 and Sept. 14.

Transit use, an important barometer in commuter-heavy New York City, is also stalling. On Sept. 21, use of the Long Island Rail Road was at 71 percent of its 2019 average, maintaining the same level from the previous week. Subway ridership increased slightly between Sept. 14 and Sept. 21.

The picture is slightly more rosy nationally, at least in terms of occupancy. The average occupancy of 10 big cities tracked by Kastle Systems was 47.3 percent the week of Sept. 21, a slight drop-off from 47.5 percent the previous week. San Jose and Houston were among the cities recording occupancy increases.

Landlords trying to look at the glass nearly half full may find relief that occupancy didn’t crater significantly after the post-Labor Day push.

Offices across the city were emptied out during the pandemic, putting the properties in dire straits. At one point, occupancy was barely above 10 percent. It wasn’t until June that office occupancy hit even 40 percent in the city, and that didn’t prove to be a permanent accomplishment.

There’s a possibility, however, the September occupancy numbers may represent a new normal. More companies are settling into a wide range of work policies, whether that means calling back workers full-time, never or somewhere in between.

The pandemic-induced drop in office use is projected to have a devastating effect on the market. An analysis from a team at NYU and Columbia estimated that by 2029, the city’s office buildings will fall in value by 28 percent, or $49 billion.

There is a rumor circulating tonight that Facebook/Meta is going to shed all of its space at 225 Park Avenue South.

The more reports I see the less I believe the optimistic forecasts I've seen of a strong return for office space.

The U.S. office property outlook has grown increasingly dark in recent months as big companies make plans to formalize a roll back of more than two 1/2 years of mostly remote work.

Early results, following a post-Labor Day burst of office visits, indicate that U.S. commercial real estate landlords and investors should brace for a tough road ahead, given the embrace of flexible work arrangements, maturing property debt and higher borrowing costs.

New York City, the largest U.S. office market, saw only 9% of Manhattan office workers reporting to jobs in-person five days a week (see chart), according to a survey of major employers conducted by The Partnership for New York City, a group of the city’s key real-estate developers and business leaders.

The survey was conducted over two weeks, ending in mid-September, and found that while half of workers showed up in the office in an average week, only 37% were in three days a week, the largest category among returning workers.

Head count in offices matter for property owners and tenants alike, because it helps gauge actual office use, potential future office-space needs and rent levels.

While the office utilization has been improving, it isn’t expected to “return to pre-pandemic conditions,” according to a new Fitch Ratings report, which pegged utilization near 70% before the pandemic.

Tracking office building access swipes also has become a popular gauge of office use during the pandemic.

On that front, the Kastle Systems’ weekly 10-city index last pegged occupancy near 47%, up from a pandemic low of under 20%, but still far below full occupancy levels preferred by lenders to refinance property debt.

Office ‘apocalypse’

Meta Platform Inc. this week became the latest big technology player to announce plans to shrink its office space, while putting roughly $2.4 billion in property debt exposure in the spotlight, according to Barclays analysts.

Twitter Inc. announced a similar move in July.

But office buildings have yet to flash the sort of warning signs that became a hallmark of the pandemic’s early months, as tourists and business travelers abandoned hotels and shopping malls stayed dark.

That’s partially been due to record corporate earnings, which only lately have been pegged to retreat, but also to the prevalence of long, 10-year office leases taken out by many big companies.

Those factors helped keep delinquencies on office loans low during the pandemic, even though Deutsche Bank researchers expect to potentially see lower payoff rates in the next few years as some $21.5 billion of office debt in bond deals comes due through 2024, in a higher rate environment.

“It hasn’t hit a point yet where there’s clarity on where deals are going to get done,” said Shlomo Chopp, a specialist in distressed commercial real estate restructurings and a managing partner at CPS, by phone.

Still, Chopp said property borrowers and lenders both worry about office buildings that might now be leased up, but still sit largely empty. “If you have a 20,000 square foot office floor plate in Manhattan that’s empty, you can’t put a bedroom in the middle of a trading floor,” he said.

A working paper released by the National Bureau of Economic Research in September warned of an office property “apocalypse,” with New York City office buildings expected to tumble a 39.2% in value due to remote work, or a $49.6 billion loss over the long-run.

The paper, which has yet to be peer reviewed, pegged the national toll for office buildings over time as likely near $453.6 billion.

The damage already done to households and financial markets has been sharp this year as the Federal Reserve has aggressively raised interest rates to fight inflation at a 40-year high. The Dow Jones Industrial Average joined the S&P 500 index in a bear market in September, while the benchmark 10-year Treasury rate briefly topped 4% last week before pulling back to about 3.8%.

Higher borrowing costs for landlords, plus potentially slower cash flow growth, led BofA Global strategists in September to suggest that commercial property values could fall by as much as 20%-30% over the next few years.

The cloudy backdrop has meant slower loan originations, particularly in the office sector, “for a lot of the obvious reasons,” said D.J. Lucey, senior portfolio manager, fixed income at SLC Management, by phone.

Lucey also said investors in commercial mortgage bonds now benefit from higher yields, roughly approaching 10% on debt with BBB- ratings, when looking at pools of different property loan types, but also that deals have more conservative underwriting standards than in the run-up to the global financial crisis.

The question is whether that will be enough if an office apocalypse comes to Wall Street.

Commercial property woes grow with only 9% of Manhattan office workers back in the office full time

The U.S. office property outlook has grown increasingly dark in recent months as big companies make plans to formalize a roll back of more than two 1/2 years of mostly remote work.

Early results, following a post-Labor Day burst of office visits, indicate that U.S. commercial real estate landlords and investors should brace for a tough road ahead, given the embrace of flexible work arrangements, maturing property debt and higher borrowing costs.

New York City, the largest U.S. office market, saw only 9% of Manhattan office workers reporting to jobs in-person five days a week (see chart), according to a survey of major employers conducted by The Partnership for New York City, a group of the city’s key real-estate developers and business leaders.

The survey was conducted over two weeks, ending in mid-September, and found that while half of workers showed up in the office in an average week, only 37% were in three days a week, the largest category among returning workers.

Head count in offices matter for property owners and tenants alike, because it helps gauge actual office use, potential future office-space needs and rent levels.

While the office utilization has been improving, it isn’t expected to “return to pre-pandemic conditions,” according to a new Fitch Ratings report, which pegged utilization near 70% before the pandemic.

Tracking office building access swipes also has become a popular gauge of office use during the pandemic.

On that front, the Kastle Systems’ weekly 10-city index last pegged occupancy near 47%, up from a pandemic low of under 20%, but still far below full occupancy levels preferred by lenders to refinance property debt.

Office ‘apocalypse’

Meta Platform Inc. this week became the latest big technology player to announce plans to shrink its office space, while putting roughly $2.4 billion in property debt exposure in the spotlight, according to Barclays analysts.

Twitter Inc. announced a similar move in July.

But office buildings have yet to flash the sort of warning signs that became a hallmark of the pandemic’s early months, as tourists and business travelers abandoned hotels and shopping malls stayed dark.

That’s partially been due to record corporate earnings, which only lately have been pegged to retreat, but also to the prevalence of long, 10-year office leases taken out by many big companies.

Those factors helped keep delinquencies on office loans low during the pandemic, even though Deutsche Bank researchers expect to potentially see lower payoff rates in the next few years as some $21.5 billion of office debt in bond deals comes due through 2024, in a higher rate environment.

“It hasn’t hit a point yet where there’s clarity on where deals are going to get done,” said Shlomo Chopp, a specialist in distressed commercial real estate restructurings and a managing partner at CPS, by phone.

Still, Chopp said property borrowers and lenders both worry about office buildings that might now be leased up, but still sit largely empty. “If you have a 20,000 square foot office floor plate in Manhattan that’s empty, you can’t put a bedroom in the middle of a trading floor,” he said.

A working paper released by the National Bureau of Economic Research in September warned of an office property “apocalypse,” with New York City office buildings expected to tumble a 39.2% in value due to remote work, or a $49.6 billion loss over the long-run.

The paper, which has yet to be peer reviewed, pegged the national toll for office buildings over time as likely near $453.6 billion.

The damage already done to households and financial markets has been sharp this year as the Federal Reserve has aggressively raised interest rates to fight inflation at a 40-year high. The Dow Jones Industrial Average joined the S&P 500 index in a bear market in September, while the benchmark 10-year Treasury rate briefly topped 4% last week before pulling back to about 3.8%.

Higher borrowing costs for landlords, plus potentially slower cash flow growth, led BofA Global strategists in September to suggest that commercial property values could fall by as much as 20%-30% over the next few years.

The cloudy backdrop has meant slower loan originations, particularly in the office sector, “for a lot of the obvious reasons,” said D.J. Lucey, senior portfolio manager, fixed income at SLC Management, by phone.

Lucey also said investors in commercial mortgage bonds now benefit from higher yields, roughly approaching 10% on debt with BBB- ratings, when looking at pools of different property loan types, but also that deals have more conservative underwriting standards than in the run-up to the global financial crisis.

The question is whether that will be enough if an office apocalypse comes to Wall Street.

Franklin Templeton Takes Space at One Madison

SL Green’s One Madison Avenue office property, set for completion next year, signed Franklin Templeton for 347,000 square feet.

therealdeal.com

Franklin Templeton takes 347K sf at SL Green’s One Madison Avenue

Mutual fund’s deal at $145 psf asking brings office tower to 55% leased

After contemplating a move for the better part of a year, a mutual fund giant has committed to a large slice of One Madison Avenue.Franklin Templeton signed a 15-year lease for 347,000 square feet at the Midtown South office development with landlord SL Green. The investment management firm will occupy floors 11 through 22 of the tower, which is still more than a year from completion.

An SL Green representative told The Real Deal that asking rent was $145 per square foot.

A Cushman & Wakefield team including Jeff and John Cushman represented Franklin Templeton in the deal. A JLL team including Paul Glickman and Alex Chudnoff represented the landlord. The brokers position Midtown South as work-and-play hub for the creative sector.

Bloomberg reported at the beginning of the year that the investment firm was eyeing north of 200,000 square feet at the office tower. IBM was also looking at space in the building.

IBM took the plunge in March, signing a 16-year lease for 328,000 square feet to become the anchor tenant at the Flatiron District office property. Chelsea Piers Fitness was the first tenant, signing a 20-year lease for 56,000 square feet last fall.

SL Green chairman Marc Holliday noted the IBM and Franklin Templeton deals are two of the three biggest office leases of 2022. Franklin Templeton’s lease brings the property up to 55 percent leased.

The property occupies a full-block site, bound by Park and Madison Avenues, as well as East 23rd and East 24th Streets. SL Green acquired the 1.4 million-square-foot property in 2005 for $918 million before announcing a $2.3 billion redevelopment for the site. Amenities include fitness products and experiences, an upscale restaurant, a dining market, a tenant-exclusive lounge and a rooftop deck.

The investment firm has a history with the landlord. In 2015, Franklin Templeton and subsidiary Fiduciary Trust International signed a 15-year lease for 126,000 square feet at SL Green and Vornado Realty Trust’s 280 Park Avenue.

NYC office market faces ‘real estate apocalypse’