In Manhattan, 64% of WeWork's leases are in Class-B and Class-C buildings.

www.bisnow.com

Ominous Sign: Nearly Two-Thirds Of WeWork Locations In NYC Are In Older Buildings

WeWork is edging closer to bankruptcy, threatening to leave scores of New York landlords in the lurch with no recourse in an unkind market.

Placeholder

Bisnow/Miriam Hall

A WeWork location in Manhattan

The New York Stock Exchange Wednesday suspended trading of SoftBank-backed firm's warrants and began to delist them, because of low trading levels and a penny stock share price. The company, which reported “substantial doubt” regarding its ability to continue operations earlier this month, has reportedly hired real estate advisers and lawyers to counsel the firm on how to restructure and stay out of bankruptcy court.

But keeping Chapter 11 at bay comes down to managing the firm's massive real estate footprint, negotiating lower rents or terminating leases with landlords.

That will be a bitter pill in Manhattan, where 64% of WeWork's leases are in Class-B and Class-C buildings, according to Avison Young, leaving many landlords who are ill-equipped to deal with replacing a major tenant caught in the crosshairs.

“It's rarely ever a good situation for a commercial landlord to have your tenant teetering on bankruptcy,” said John Giampolo, a bankruptcy, restructuring and real estate litigation attorney at Rosenberg & Estis. “You're making matters worse in a market for commercial tenants that many analysts are saying is not great in general.”

WeWork famously became the city’s biggest private tenant, surpassing JPMorgan Chase, when it announced in September 2018 that it had leased 5.3M SF of office space. Its expansion somehow accelerated after that, with giant leases signed at decades-old buildings.

It signed a 236K SF deal at CIM's 1440 Broadway in December 2018, for example, and a 200K SF deal at One Seaport Plaza in February 2019. In September that same year, WeWork signed a 362K SF lease at William Kaufman Organization’s 437 Madison Ave.

Today WeWork occupies more than 8.6M SF of office space in Manhattan, according to Avison Young data provided to Bisnow. That accounts for 1.7% of the borough’s total inventory.

WeWork lists four locations in Queens and Brooklyn, including at Rudin and Boston Properties’ Dock 72 in the Brooklyn Navy Yard, where the coworking firm leases 220K SF. At the Jacx, Tishman Speyer’s building in Long Island City, WeWork has 217K SF, The Real Deal reported. Tishman and Rudin declined to comment.

“They’re not even 2% of the market right now,” Danny Mangru, manager of market intelligence at Avison Young in New York City, told Bisnow. “Obviously, with what's going on, any new addition of supply … will certainly have an impact on the market.”

Its market share has come down somewhat from its peak following the tumult at the business, starting with a failed initial public offering, the ouster of former CEO Adam Neumann and an aggressive cost-cutting campaign thereafter.

In October 2021, it went public after merging with BowX Acquisition Corp. Its share price debuted at $10, then went up to $11.79 on its first ever day of trading. On Thursday afternoon, after a 10% rally in intraday trading, it was trading at 13.4 cents a share.

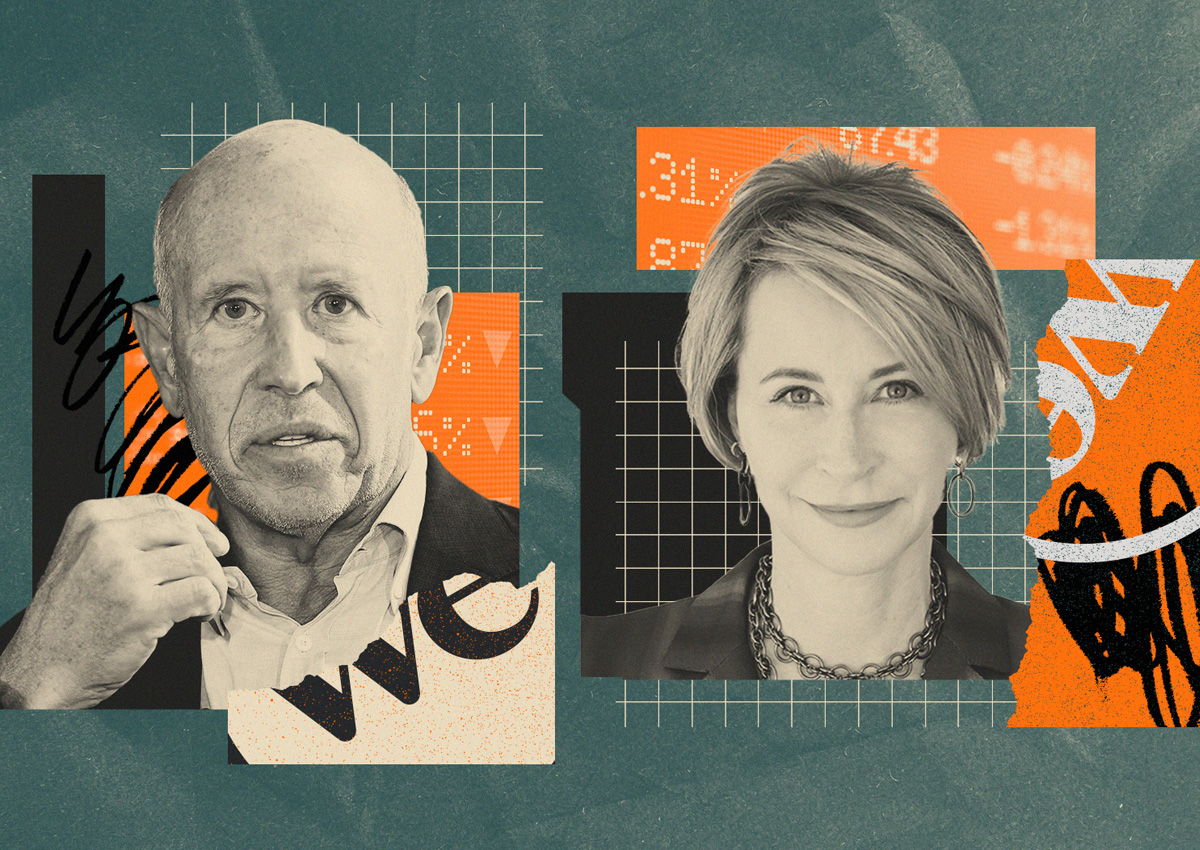

In May, CEO Sandeep Mathrani abruptly left his position, and its chief financial officer left a few weeks later. David Tolley is leading the company as interim CEO.

Placeholder

Bisnow/Miriam Hall

Dock 72 in the Brooklyn Navy Yard, viewed from the water.

Brokerage Savills pegs WeWork's Manhattan footprint at 6.9M SF, Commercial Observer reported. A WeWork spokesperson declined to clarify how much space the firm occupies in the city.

As of Dec. 31, WeWork said it occupies 18.3M rentable SF in Canada and the U.S., per a filing with the Securities and Exchange Commission.

WeWork has greater market share in some neighborhoods than others. About 17% of WeWork’s NYC footprint is in the Gramercy/Flatiron submarket, where it occupies 3.7% of that area’s inventory, according to Avison Young. A total of 13.6% of WeWork’s space is in the Penn Station submarket, accounting for 2.2% of that area's inventory.

Across Manhattan, availability is at a record 19.9% Mangru said — and if WeWork moves to hand space back in large quantities, it would push a decades-high availability rate further northwards.

"If you’ve got a couple million square feet coming back to the market — and that's obviously not going to be absorbed right away," Mangru said. "What that's gonna look like, it's still a bit uncertain."

It is that uncertainty that will be the big challenge for landlords. Giampolo of Rosenberg & Estis said landlords who are owed substantial outstanding rent by WeWork, in the event of a bankruptcy, will have their rent arrears seen as a “nonpriority general unsecured claim.”

That means landlords who have been owed rent before the bankruptcy may not have a good chance for recovery. A priority claim, he said, would be rent that accrues after bankruptcy is filed.

“Typically, general unsecured claims do not receive substantial recovery, even in Chapter 11 bankruptcy, because secured and priority claims have to be satisfied first,” he said. “If I were a landlord with WeWork, I’d be asking myself, 'What are my prospects for a replacement tenant?' … Some landlords might do well to start soft shopping.”

Many landlords are already a step ahead, like RXR Realty CEO Scott Rechler, whose company has WeWork as a tenant at 75 Rockefeller Plaza and 620 Sixth Ave. Earlier this year, Amazon leased 90K SF with WeWork at the building — along with a 210K SF deal at 1440 Broadway.

"I think all of us that have been attuned to this for some time, have been cognizant that WeWork was a credit risk," Rechler said. "Lenders, everyone's afraid of WeWork."

Over the last 18 months or so, he said RXR has negotiated to better position itself, including baking in the right to cancel with WeWork. He added that there are no traditional WeWork coworking spaces in the RXR portfolio, but enterprise locations only, meaning there is a “substantial” user in the space, like Amazon.

"The advantage of that is you can have direct conversations with that user," Rechler said. "Rather than doing a membership WeWork, you can do a direct deal with that company."

Placeholder

Google Maps

RXR Realty's 75 Rockefeller Plaza in Midtown Manhattan, where WeWork is a tenant

Not everyone will be in that position, however, and the stakes are high. Nationally, there are 48 properties with WeWork as a top five tenant backing CMBS loans, with a combined outstanding loan balance of $7.1B, according to Trepp data.

The median exposure to WeWork across these 48 properties is 76K SF, or about 22% of a property’s total leasable space. In some cases, WeWork competitors could consider taking the space, but they will be able to be choosy about the spaces they select and likely the price they will pay.

Industrious CEO Jamie Hodari said in an interview that landlords and occupiers alike had been reaching out to his firm — the third-largest U.S. coworking operator after IWG and WeWork — in the wake of WeWork's going concern warning at triple the rate of an ordinary week.

“They're trying to very quickly get their thoughts together and make some decisions,” he said. “I think a lot of landlords are trying to figure out, 'Does that mean I need to try to front-run a bankruptcy and do something quickly before an official bankruptcy is filed?'”

But for many, there is not a huge amount to be done but to wait, said Ruth Colp, the CEO of Wharton Property Advisors, who has arranged WeWork deals on both sides and runs her business in a WeWork space.

"If you're a landlord and you’ve got WeWork as a tenant, and WeWork is paying their rent, you're going to cross your fingers, and you're going to hope WeWork is just going to continue to pay their rent," she said. "There's nothing really else that you could do. You can start to look around at other potential operators to take that space. But none of those deals are going to be easy."