Private-label MBS market facing strong headwinds - HousingWire

The pace of MBS issuance in the nonagency market slowed considerably in July and August as rising interest rates and Federal Reserve MBS-purchase policy have combined to dampen the momentum

Private-label MBS market facing strong headwinds

Rate volatility and Fed policy proving to be a drag on nonagency mortgage-backed securities issuanceThe pace of mortgage-backed securities (MBS) issuance in the nonagency market slowed considerably in July and August as rising interest rates and Federal Reserve MBS-purchase policy have combined to dampen the momentum exhibited in the private-label space in 2021 and over the first half of this year.

In July and August of this year, there was a total of 25 residential mortgage-backed securities (RMBS) deals secured by mortgage pools valued at $8.3 billion, according to nonagency RMBS offerings, both prime and nonprime, tracked by the Kroll Bond Rating Agency (KBRA). That’s less than half the volume of private-label securitizations tracked by KBRA over the same two-month period in 2021, when there was a total of 44 RMBS transactions backed by loan pools valued at $19.4 billion.

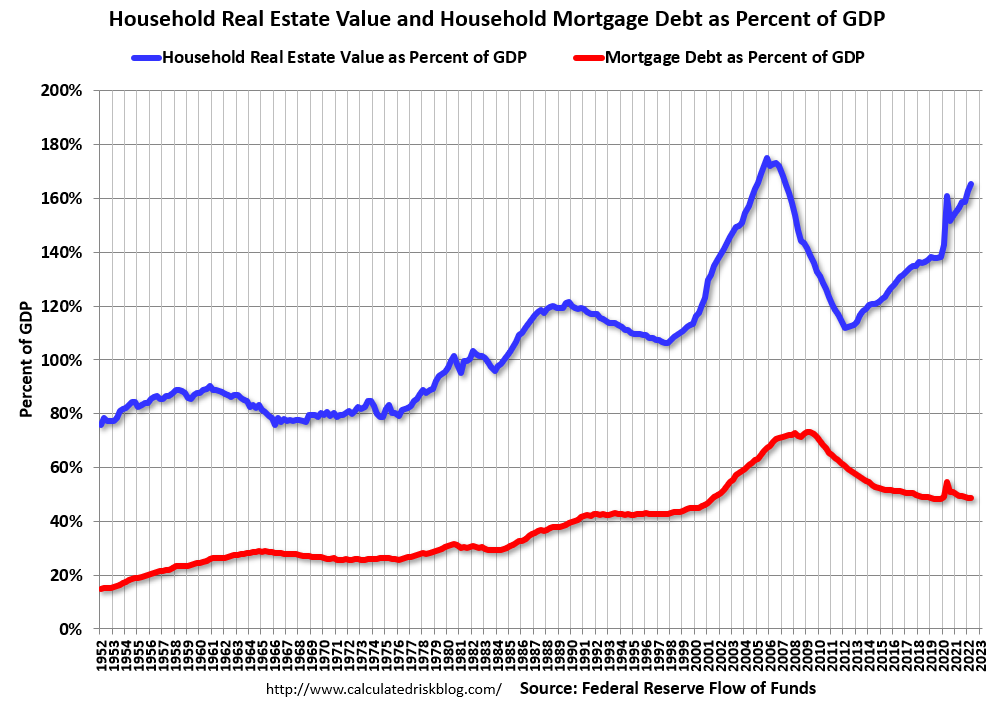

The nonagency share of the MBS market just prior to the housing market crash some 15 years ago exceeded 50% — with the balance being MBS issued by Fannie Mae, Freddie Mac and Ginnie Mae, or agency issuance. By 2012, in the wake of the global financial crisis, private-label MBS market share had shrunk to 1.83%.

The nonagency share of the market has been rising slowly since then, reaching 4.32% in 2021, according to recent analysis by the Urban Institute’s Housing Finance Policy Center. Last year “was the largest year of nonagency securitization since 2008,” the Urban Institute’s report continues.

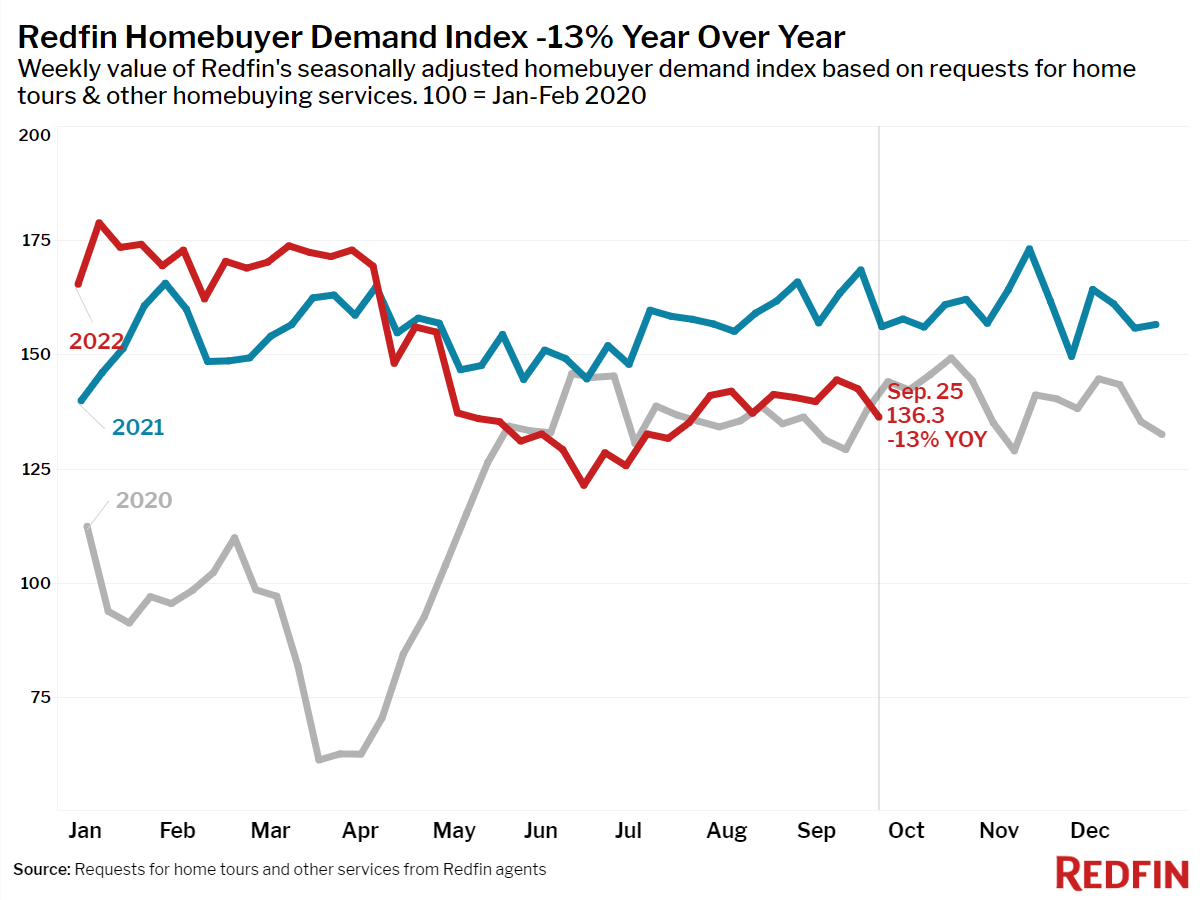

That trend accelerated over the first half of this year, with the nonagency share reaching 6.52%. The frenetic pace of growth in nonagency issuance has since slowed, however, due to a variety of market pressures — chief among them the contraction of mortgage originations in the face of fast-rising interest rates.

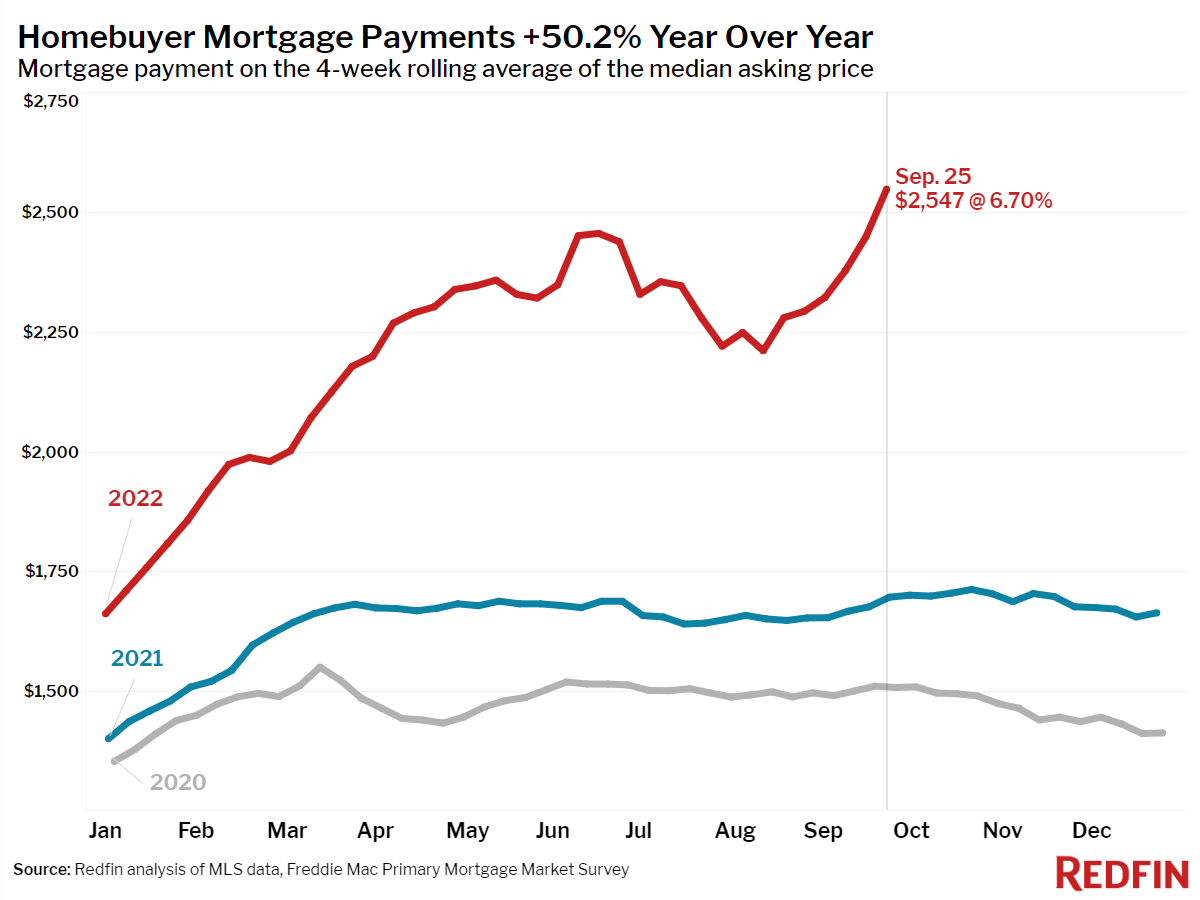

“In August 2021, the 30-year fixed-rate mortgage rate stood at approximately 2.75%,” a recent KBRA report on the nonagency RMBS market states. “Less than one year later, in June 2022, the rate reached 5.8% ….

“In late July 2022, mortgage application rates had fallen for the fourth consecutive week, pushing the MBS mortgage application to its lowest level since February 2000.”

Despite these headwinds, year to date through August of this year, overall issuance volume in the nonagency MBS space is still up slightly over the same period in 2021.

KBRA’s data, based on the deals it tracks, shows a total of 141 RMBS offerings came to market through August of this year backed by mortgage pools valued at $63.1 billion. That compares to 135 RMBS offerings backed by loans valued at $57.1 billion over the same period in 2021.

Declining mortgage originations in the face of rising rates is not the only impediment to nonagency MBS issuance going forward, however. The Federal Reserve’s pullback from the MBS-purchase market — as it pursues a policy of quantitative tightening to fight inflation — also is creating pricing pressures for MBS issuers, compounding pressures sparked by volatile rates.

The [Federal Open Market Committee] intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested …,” the Board of Governors of the Federal Reserve said in a recent statement explaining its policy.

The Fed capped monthly MBS runoff of its $2.7 trillion MBS portfolio over the past three months at $17.5 billion. That cap doubled starting in September, meaning the central bank going forward will now allow up to $35 billion per month in MBS to roll off its balance sheet as the securities mature.

“The additional MBS supply the central bank will allow to roll off from its portfolio and hit the market this month [September] is estimated between $20 and $25 billion,” states an analysis by financial advisory firm Mortgage Capital Trading. “This [rate of runoff] will necessitate private investors to absorb about $250 billion in additional supply per year over the next decade.

“Mortgage spreads widened toward the end of August [an indicator of an increased perception of risk] as a result of investors beginning to take the Fed seriously. Should the Fed decide to speed up the process and begin to actively sell mortgages off its balance sheet (again, not likely), it will be the [MBS] production coupons from the past few years that will bear the brunt of it.”

The Fed’s pullback from the MBS market and the additional MBS supply now available for sale, primarily agency MBS, creates pricing pressures for MBS issuers generally. In addition, in a rising rate environment such as the one we are experiencing, MBS pricing is subject to something known as “negative convexity” — which is the tendency for MBS prices to decrease at an increasing rate as interest rates rise.

The 30-year fixed mortgage rate averaged 5.89% this week, up from 5.66% the prior week, according to the most recent Freddie Mac Primary Mortgage Market Survey (PMMS).

“Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation,” said Freddie Mac Chief Economist Sam Khater, reacting to the release of this week’s PMMS survey results.

Interest rate stability offers the best environment for MBS performance. That stability, so far this year, has been elusive.

KBRA’s RMBS report notes that hard times in the mortgage industry, such as the existing environment, will require mortgage originators to adapt or face the prospect of failure.

“Industry headlines have trumpeted layoffs at large bank originators like JPMorgan Chase, Flagstar, and Wells Fargo, as well as many more nonbanks,” the KBRA report states. “Some companies have shut down entirely, such as Sprout Mortgage, or filed for bankruptcy protection, as is the case for First Guaranty Mortgage Corporation.

“As has been the case over the past 30 years, lenders will continue to fail for various reasons, particularly in challenging economic environments and when they are dependent on external funding.”

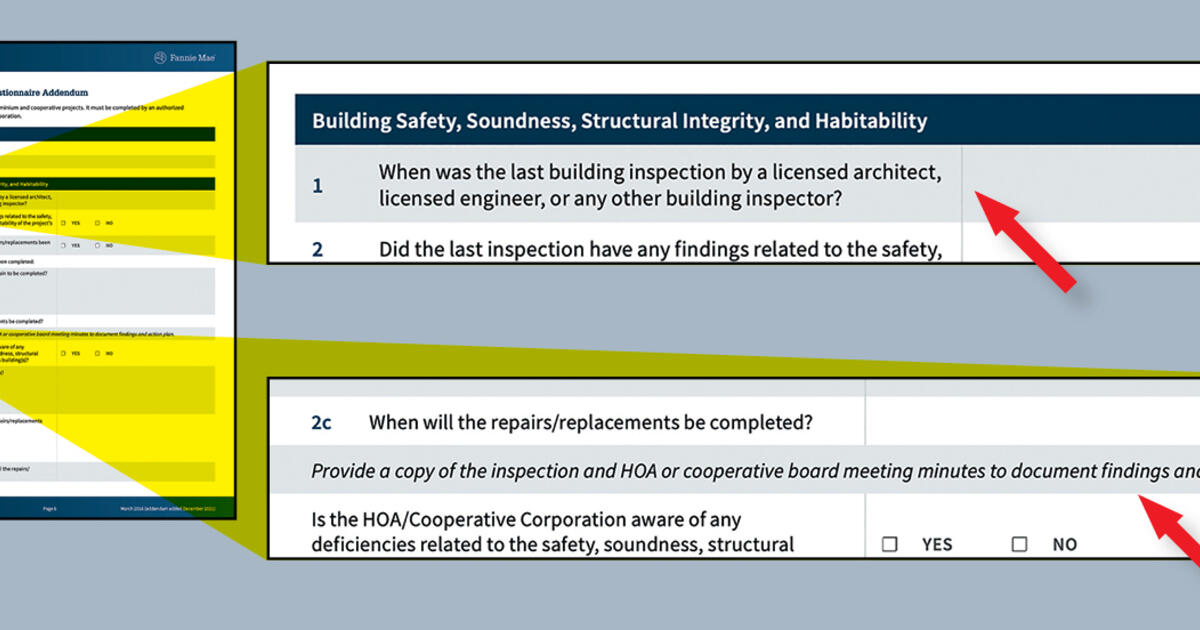

Still, unlike the lax underwriting environment that accompanied the housing-industry crash earlier in the century, KBRA said the mortgages that are being originated today are vastly superior in credit quality overall, which bodes well long-term for the health of the mortgage-securitization market as well — once some market stability is achieved and investor confidence is bolstered.

“Originators’ legal and reputational liabilities have increased, as have pre-securitization loan-quality verification procedures,” the KBRA report stresses. “In KBRA’s view, while lender failures will continue, the RMBS market has many features that reduce the correlation between lender failure and future loan performance.”