How a Non-Compete Ban Could Affect Real Estate

Brokerages could face fewer legal options if FTC bans non-compete clauses in employment contracts nationwide.

therealdeal.com

What a ban on noncompetes could mean for real estate

Common contract provision hurts workers, according to the FTC

Brokerages may have fewer arrows in their legal quiver if the Federal Trade Commission makes good on its new goal of banning noncompete clauses in employment contracts nationwide.The contract provision restricts managers and executives from benefiting rival brokerages by switching jobs, usually within a defined geographic area or time period once a contract ends. Noncompete clauses do not typically affect agents, who are independent contractors.

“The higher you go in the food chain, the more common they are,” said New York real estate attorney Adam Leitman Bailey, who said he sees, and litigates, both sides of the issue.

Noncompete clauses “constitute an unfair method of competition,” according to the FTC, and have forced some real estate professionals into de facto unemployment — albeit compensated.

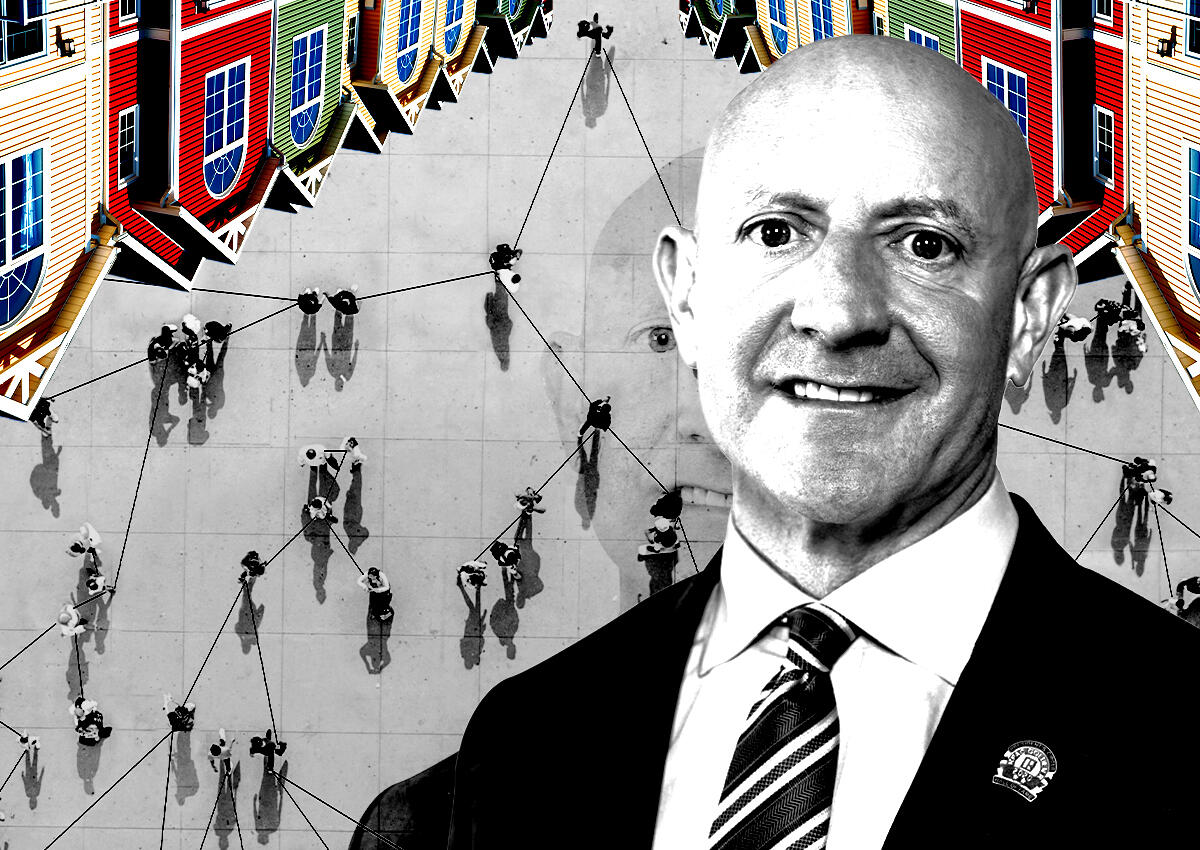

Steven James and Brad Loe waited out year-long noncompete clauses after leaving Douglas Elliman to join Berkshire Hathaway HomeServices as CEO and director of sales, respectively.

“People should be free to work where they want and associate with who they want,” said Jonathan Sack, an employment attorney in New York City opposed to broad noncompetes.

“Parties are free to contract,” said Sack, but trying to enforce overly broad restrictions can be “a total disaster.” Once a noncompete clause is found invalid for one worker, others working under the same restrictions are more likely to be freed. “They can be very difficult to enforce,” he said.

WeWork had to release 1,400 workers from an overly broad noncompete clause and reduced restrictions on a further 1,800 people after New York and Illinois attorneys general challenged the company in 2018.

The result has not stopped other real estate companies from trying to enforce noncompetes.

Cushman & Wakefield sued rival brokerage JLL in October after two former salesmen changed jobs, claiming they had violated the noncompete provision in their employment contract. Cushman also sued over a non-solicitation clause, which aims to stop workers who have changed jobs from recruiting others to join them at the new company — in this case, non-producing supportive staff.

Sack defended the ability of teams of workers to relocate, likening them to a musical quartet that needs the talents of each individual to function as a whole. Proving damages can also be tricky, he suggested, because the beneficiary of someone changing companies — such as a landlord who wants to close a deal — is unlikely to testify against their own broker.

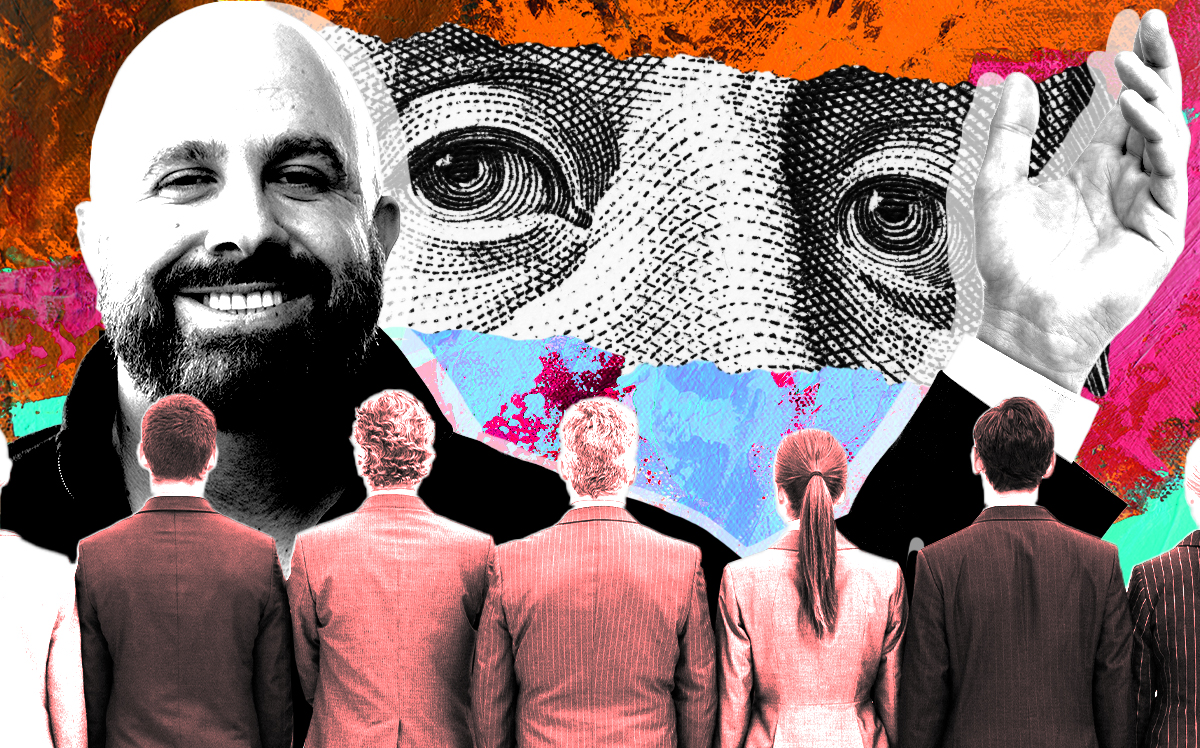

Compass became a target of litigation for poaching managers of rival brokerages in order to build its company in the late 2010s. While Compass claims not to use noncompete clauses, it has gone to court to enforce non-solicitation clauses.

In one such dispute in California, rival brokerage The Agency countersued Compass to argue that its non-solicitation provision was illegal. Noncompete clauses are unenforceable in California due to state law, but the ban does not cover non-solicitation agreements.

The FTC’s noncompete agreement ban must still undergo a 60-day public comment period, though a final proposal is unlikely to proscribe non-solicitation. Nor will it ban other contract provisions that real estate professionals may enter into, such as clawback agreements that require agents to repay commission advances if they leave a brokerage prematurely.

Job seekers may lack leverage to negotiate specific language with employers, but real estate professionals who spoke with The Real Deal advised retaining an employment attorney to ensure noncompete restrictions are narrowly tailored. Several people spoke harshly of noncompete clauses but objected less to non-solicitation agreements. They asked to remain anonymous in order to preserve their relationship with an employer.

Bailey said he recently viewed a noncompete clause that would restrict a real estate professional from working for rival firms in New York City, the Hamptons and Miami — a geographical range he felt was too broad.

“If you’re paying people millions of dollars, you don’t want them competing against you in a year or two,” said Bailey. “But are they needed at brokerages? I think the free market should reign.”

The FTC claims that as many as 30 million Americans toil under noncompete clauses, dampening their total earning potential by as much as $300 billion per year.