You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The deals just keep on coming...

- Thread starter Noah Rosenblatt

- Start date

Forgetting about Real Estate - as a trader, what does it mean when you see prices receding on a high volume of trades?

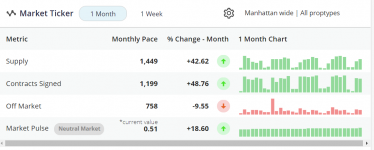

Yeah, but this is a bit diff...stocks are liquid and realtime. Real estate sales are a rear view mirror look at what was signed into contract 4-6 months ago, so when the price discovery print arrives, it tells a story about a moment in time that passed. The return of liquidity is a beautiful to thing to see, the market doing what the market wants to do, when it wants to do it. Its normalizing after a year of chaos and buyers are more comfortable placing bids and signing deals. Transparency in the markets I think helped this realtime surge in demand, and I got a podcast out with Fred Peters later today where he identified this surge as "mostly locals" who are familiar with NYC, cycles, and seeing a deal when it presents itself.Forgetting about Real Estate - as a trader, what does it mean when you see prices receding on a high volume of trades?

Great topic though David

Unless you have evidence that prices are rising, the annecdotes I'm hearing are like the accepted offer on an "it" building condo where the previous sale price was $1.65M and the deal done over the weekend was at $1M. That's not old info, that's now.

Anectdotal. The fastest info we can get is the report we do on list disc at time of contract signing, to sniff out the trends improving or not. But its a lag too. The evidence will come in, and I think it will be skewed to the downward side, as it represents a market 5-6 months ago and YoY analysis likely will show downward movement..but lets see. I also know that when you see liquidity go from zero to 100 in a 5+ month period, there will not be nearly as much of a dislocation or widening in the bid/ask spread

$38 million off listing price.

Jeffrey Epstein’s NYC Townhouse In Contract For $50M

The Upper East Side townhouse at 9 East 71st Street owned by late financier and convicted sex offender Jeffrey Epstein is in contract.

therealdeal.com