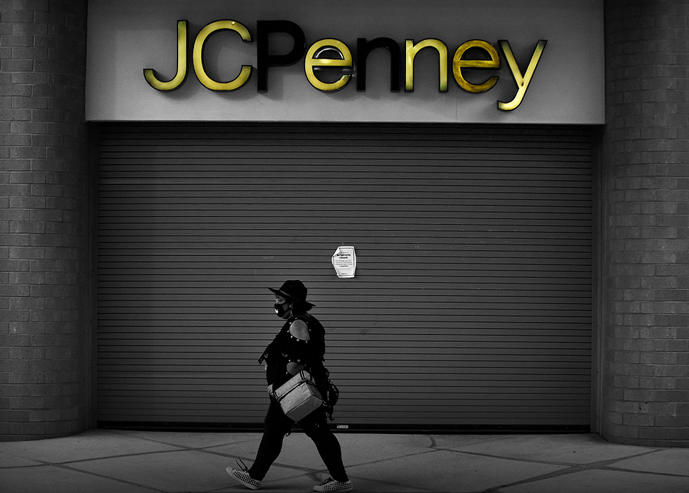

Prominent retailers have been turning to “impossibility of performance” and the doctrine of “frustration” to get out of pricey leases, but top real estate lawyers don’t think courts will buy it.

therealdeal.com

Commercial real estate lawyers: You’re stuck with that lease

Barrack, Mechanic confident that courts will back landlords over retailers

As the coronavirus has shuttered stores, reduced foot traffic to a trickle and dampened consumer demand,

growing numbers of

retailers are looking towards “impossibility of performance” and the doctrine of “frustration” as a way out of pricey leases.

But the real estate industry’s top lawyers say judges won’t buy it.

“The courts have said that frustration of purpose is really more nuanced in terms of the circumstances where it would come into play,” said Jonathan Mechanic, chairman of Fried Frank’s real estate department, on Wednesday’s edition of

TRD Talks.

“If you applied that to every circumstance today by virtue of the pandemic, then no one’s paying rent. And obviously the result of that would be a sea of defaults” in New York and across the country, he added.

Mechanic was joined by Luise Barrack of Rosenberg & Estis, who heads the firm’s litigation department. TRD editor Erik Engquist moderated the discussion.

“The argument that just because this occurred, I don’t have to pay rent, neither one of us see this as a viable argument,” Barrack agreed. To the extent that a contract doesn’t provide specific carveouts for circumstances like force majeure, she continued, “you’re going to have to show something a lot more than just ‘I was in the Times Square area and I was expecting a lot of foot traffic, and now I’m not getting foot traffic.’”

The courts’ protection of contracts is crucial to the business world, she noted.

“Contracts require, and the world requires, certainty in terms of entering into contracts, to be able to rely on what it is the parties agreed to,” she said. “It’s not as if the owner did something that resulted in the shutdown of this business. The owner’s as much in the line of fire from government directives as are the tenants here.”

At the same time, the panelists recognized that even far-fetched appeals to obscure common law doctrines were coming from a place of real economic pain.

“I think you’re seeing a lot of arguments that you might otherwise think of as ridiculous, only because people are struggling,” Mechanic said. “These are difficult times out there.”

Legal rights aside, recognition of the extraordinary economic circumstances has led to many disputes being resolved out of court, the panelists said.

“There are a lot of cases where the tenant comes in and says, ‘My business is being adversely affected, I can’t function the way I functioned,’” Mechanic said. “So what I can do is take my rent for this six-month period and accrue it and pay it back over the next three years when the world opens back up again.”

“The landlord is making a sensible decision and saying look, in this circumstance what I really want is to preserve my tenancy, so I’m going to make a deal that allows them to function in this limited environment,” he continued.

Barrack noted that the limited capacity of courts to handle disputes during the pandemic has also played a role. “There hasn’t been a court system, so people have had to actually try to work things out on their own,” she said. “Many have, many have not.”

Meanwhile, the patchwork response of city, state and federal governments to the pandemic has made it harder for commercial landlords and tenants.

“There’s all these overlays of different laws and dates they’re expiring, and then they’re extended or they’re not, and everyone’s waiting for what’s the next installment, what’s going to happen next,” Barrack said, pointing to a recent city law temporarily suspending the enforcement of

personal liability provisions as an example.

At the same time, a crisis of this magnitude does appear to demand a government response for leasing in the future, the lawyers said.

“We will all be better off if we can find some government-sponsored resolution that is akin to TRIA, but for the pandemic,” said Mechanic, referring to the Terrorism Risk Insurance Act implemented after the 9/11 attacks, creating a federal backstop for terrorism insurance. “There’s no easy solution otherwise.”

In the meantime, while landlords and tenants will certainly have pandemics on their mind while entering into new deals, terms are still likely to vary significantly from one contract to the next.

“It’s hard to say that there will be a standard going forward,” Mechanic said. “A lot will depend on the leverage of the parties — how important it is for the landlord to have that tenant in the building, or for the tenant to have that space.”

%20plus%20Build%2FQPWS30.61-21-9%3B%20wv)%20AppleWebKit%2F537.36%20(KHTML%2C%20like%20Gecko)%20Version%2F4.0%20Chrome%2F83.0.4103.101%20Mobile%20Safari%2F537.36%20%5BFB_IAB%2FFB4A%3BFBAV%2F274.0.0.46.119%3B%5D&seg_cnt=2&ga_id=541933534.1591415201&ga_property=UA-97981691-2&qs_utm_source=facebook.com&qs_xid=socialflow_facebook_peoplemag&qs_utm_medium=social&qs_utm_campaign=peoplemag&krux_os=Android%201.x&krux_device=Mobile&krux_manufacturer=Google%20Inc.&krux_browser=Chrome%20Mobile&muuid_session=e0ec569c-4721-4668-8cce-6645869e91fa&muuid_ts_delta=411889&_gid=GA1.2.412272019.1591913394&pageview_count=3&visit_ts=1591913392037&previous_ts=1591501505950&globalTI_SID=5fffbbd4-a854-4787-aeaa-6e6ada82abbd&UID_BIZRATE=15900094534591367336160949904014763&_ga=GA1.2.541933534.1591415201&ajs_anonymous_id=01570b25-b5b8-4b7f-8158-5af99d40b97c&mdp.privacy.loc=2&meta_canonical=https%3A%2F%2Fpeople.com%2Ffood%2Fchuck-e-cheese-approaches-bankruptcy-possibly-close-all-stores%2F&meta_title=chuck%20e.%20cheese%20approaches%20bankruptcy%2C%20could%20have%20to%20close%20all%20stores&meta_published=2020-06-11&meta_brand=PEOPLE.com&meta_caas_name=people&meta_graph_id=cms%2Fonecms_posts_people_12198334&meta_env=production&meta_valid=1&meta_id=ppl&meta_author=georgia%20slater&meta_type=article&meta_taxonomy=%5B%2211002%22%2C%2211053%22%2C%2212821%22%2C%2213085%22%2C%2222370%22%5D&meta_cms_id=12198334&meta_category=%5B%22food%22%5D&meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_sentiment=-1&meta_entities=%5B%22restaurant%22%2C%22stores%22%5D&meta_categories=%5B%22%2Ffood%20%26%20drink%2Frestaurants%22%5D&meta_docsentiment=%5B%22negative%22%2C%2210.4%22%2C%22-0.1%22%5D&seg_segmentId=01570b25-b5b8-4b7f-8158-5af99d40b97c&seg_request_id=35cc9e8a-3346-4932-82dc-fc7e36367dfe&muuid_date=1584743952087)

%20plus%20Build%2FQPWS30.61-21-9%3B%20wv)%20AppleWebKit%2F537.36%20(KHTML%2C%20like%20Gecko)%20Version%2F4.0%20Chrome%2F83.0.4103.101%20Mobile%20Safari%2F537.36%20%5BFB_IAB%2FFB4A%3BFBAV%2F274.0.0.46.119%3B%5D&seg_cnt=2&ga_id=541933534.1591415201&ga_property=UA-97981691-2&qs_utm_source=facebook.com&qs_xid=socialflow_facebook_peoplemag&qs_utm_medium=social&qs_utm_campaign=peoplemag&krux_os=Android%201.x&krux_device=Mobile&krux_manufacturer=Google%20Inc.&krux_browser=Chrome%20Mobile&muuid_session=e0ec569c-4721-4668-8cce-6645869e91fa&muuid_ts_delta=411889&_gid=GA1.2.412272019.1591913394&pageview_count=3&visit_ts=1591913392037&previous_ts=1591501505950&globalTI_SID=5fffbbd4-a854-4787-aeaa-6e6ada82abbd&UID_BIZRATE=15900094534591367336160949904014763&_ga=GA1.2.541933534.1591415201&ajs_anonymous_id=01570b25-b5b8-4b7f-8158-5af99d40b97c&mdp.privacy.loc=2&meta_canonical=https%3A%2F%2Fpeople.com%2Ffood%2Fchuck-e-cheese-approaches-bankruptcy-possibly-close-all-stores%2F&meta_title=chuck%20e.%20cheese%20approaches%20bankruptcy%2C%20could%20have%20to%20close%20all%20stores&meta_published=2020-06-11&meta_brand=PEOPLE.com&meta_caas_name=people&meta_graph_id=cms%2Fonecms_posts_people_12198334&meta_env=production&meta_valid=1&meta_id=ppl&meta_author=georgia%20slater&meta_type=article&meta_taxonomy=%5B%2211002%22%2C%2211053%22%2C%2212821%22%2C%2213085%22%2C%2222370%22%5D&meta_cms_id=12198334&meta_category=%5B%22food%22%5D&meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_sentiment=-1&meta_entities=%5B%22restaurant%22%2C%22stores%22%5D&meta_categories=%5B%22%2Ffood%20%26%20drink%2Frestaurants%22%5D&meta_docsentiment=%5B%22negative%22%2C%2210.4%22%2C%22-0.1%22%5D&seg_segmentId=01570b25-b5b8-4b7f-8158-5af99d40b97c&seg_request_id=35cc9e8a-3346-4932-82dc-fc7e36367dfe&muuid_date=1584743952087)

%20plus%20Build%2FQPWS30.61-21-9%3B%20wv)%20AppleWebKit%2F537.36%20(KHTML%2C%20like%20Gecko)%20Version%2F4.0%20Chrome%2F83.0.4103.101%20Mobile%20Safari%2F537.36%20%5BFB_IAB%2FFB4A%3BFBAV%2F274.0.0.46.119%3B%5D&seg_cnt=2&ga_id=541933534.1591415201&ga_property=UA-97981691-2&qs_utm_source=facebook.com&qs_xid=socialflow_facebook_peoplemag&qs_utm_medium=social&qs_utm_campaign=peoplemag&krux_os=Android%201.x&krux_device=Mobile&krux_manufacturer=Google%20Inc.&krux_browser=Chrome%20Mobile&muuid_session=e0ec569c-4721-4668-8cce-6645869e91fa&muuid_ts_delta=411889&_gid=GA1.2.412272019.1591913394&pageview_count=3&visit_ts=1591913392037&previous_ts=1591501505950&globalTI_SID=5fffbbd4-a854-4787-aeaa-6e6ada82abbd&UID_BIZRATE=15900094534591367336160949904014763&_ga=GA1.2.541933534.1591415201&ajs_anonymous_id=01570b25-b5b8-4b7f-8158-5af99d40b97c&mdp.privacy.loc=2&meta_canonical=https%3A%2F%2Fpeople.com%2Ffood%2Fchuck-e-cheese-approaches-bankruptcy-possibly-close-all-stores%2F&meta_title=chuck%20e.%20cheese%20approaches%20bankruptcy%2C%20could%20have%20to%20close%20all%20stores&meta_published=2020-06-11&meta_brand=PEOPLE.com&meta_caas_name=people&meta_graph_id=cms%2Fonecms_posts_people_12198334&meta_env=production&meta_valid=1&meta_id=ppl&meta_author=georgia%20slater&meta_type=article&meta_taxonomy=%5B%2211002%22%2C%2211053%22%2C%2212821%22%2C%2213085%22%2C%2222370%22%5D&meta_cms_id=12198334&meta_category=%5B%22food%22%5D&meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_meta_tags=%5B%22food%22%2C%22food%20news%22%2C%22news%22%5D&meta_sentiment=-1&meta_entities=%5B%22restaurant%22%2C%22stores%22%5D&meta_categories=%5B%22%2Ffood%20%26%20drink%2Frestaurants%22%5D&meta_docsentiment=%5B%22negative%22%2C%2210.4%22%2C%22-0.1%22%5D&seg_segmentId=01570b25-b5b8-4b7f-8158-5af99d40b97c&seg_request_id=35cc9e8a-3346-4932-82dc-fc7e36367dfe&muuid_date=1584743952087)