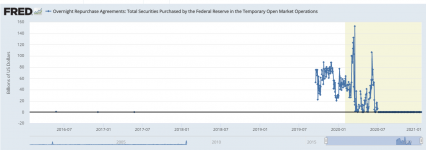

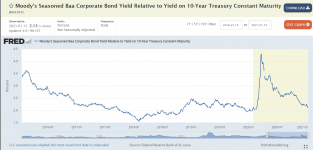

My feeling is that this fed induced mania will come to a stop sometime in 2021 as we purge excesses of malinvestment due to a massive search for yield. Credit spreads, an indicator of short term lending stress, peaked in spring 2020 as the pandemic hit and has since narrowed to the levels seen pre-covid as evidence by this chart.

This ofcourse fueled an epic rally in risk assets as the Fed and Govt try to reflate against deflatoinary forces. The result is this on the SP 500 index:

If you notice when the credit markets blew out and spreads widened, risk OFF took hold of the stock market. Same is true on the flip side. As spreads narrow, a risk ON trade will take hold, to the suprise of many. This is where we find ourselves now, at the peak of an extreme move.

I expect the meltup to continue as a new administration takes the first 100 days to introduce new relief and aid packages. I wouldnt be suprised to see them GO BIG, as Janet Yellen has been recently talking about. This could fuel a final surge in risk assets that could ultimately mark the euphoric peak of this crazy cycle. Ill be watching credit spreads for widening for any risk OFF signals.

2020 was chaotic, awful, and a year to forget

2021 may be its fraternal twin, different, but very similar underneath

Is all of this normal? Ofcourse not. Normal left town years ago. But it is what it is, and after we get through the insolvency phase of this down cycle that is likely to hit hard this year, one can make the argument that what lies ahead may be someting we havent seen in decades, since the 70s; inflation. Looking ahead, if 2009 was 2020, and 2010 is 2021, then we got the high growth years of 2011 through 2015 ahead of us to start out the 2020s decade. I actually think our markets will see a stronger and longer duration growth cycle that surpasses the cycle following the great financial crisis, driven by nobody's friend...inflation. We just need to get past this year.

This ofcourse fueled an epic rally in risk assets as the Fed and Govt try to reflate against deflatoinary forces. The result is this on the SP 500 index:

If you notice when the credit markets blew out and spreads widened, risk OFF took hold of the stock market. Same is true on the flip side. As spreads narrow, a risk ON trade will take hold, to the suprise of many. This is where we find ourselves now, at the peak of an extreme move.

I expect the meltup to continue as a new administration takes the first 100 days to introduce new relief and aid packages. I wouldnt be suprised to see them GO BIG, as Janet Yellen has been recently talking about. This could fuel a final surge in risk assets that could ultimately mark the euphoric peak of this crazy cycle. Ill be watching credit spreads for widening for any risk OFF signals.

2020 was chaotic, awful, and a year to forget

2021 may be its fraternal twin, different, but very similar underneath

Is all of this normal? Ofcourse not. Normal left town years ago. But it is what it is, and after we get through the insolvency phase of this down cycle that is likely to hit hard this year, one can make the argument that what lies ahead may be someting we havent seen in decades, since the 70s; inflation. Looking ahead, if 2009 was 2020, and 2010 is 2021, then we got the high growth years of 2011 through 2015 ahead of us to start out the 2020s decade. I actually think our markets will see a stronger and longer duration growth cycle that surpasses the cycle following the great financial crisis, driven by nobody's friend...inflation. We just need to get past this year.