Bonus season always causes a bump. The size of bonuses often determines the amplitude and duration of that bump. The amplitude wasn't as much as usual and I think mortgages rates will act as a damping factor and accelerate decay. Countering that will be usual seasonality so it will be difficult to attribute which factors are causing what.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Still doing 1400+ deals a month..but for how long?

- Thread starter Noah Rosenblatt

- Start date

I think the amplitude of the (say) Dec => Feb bump this year was higher than past years. Dec sales ran 23% lower than their 10-year average while Feb sales were only 15% lower. So the bump, relative to historical bumps, was larger this year.

Personally, I don’t think the blip down in mortgage rates were the major driver. They helped, but in the current environment cash is king. Looking at MND headline jumbo rates, they’ve been at 6% +/- 0.5% since September, after a fast rise from 3% a year prior. The fluctuation around 6% is small potatoes compared to the big picture. I think it was more:

1) Buyers waiting in the wings to know their bonuses. We’re in a rate environment where people will finance less, so knowing how much cash you’ll have to deploy directly into RE matters more.

2) Better price negotiability.

I think the latter will continue, but the former won’t.

Personally, I don’t think the blip down in mortgage rates were the major driver. They helped, but in the current environment cash is king. Looking at MND headline jumbo rates, they’ve been at 6% +/- 0.5% since September, after a fast rise from 3% a year prior. The fluctuation around 6% is small potatoes compared to the big picture. I think it was more:

1) Buyers waiting in the wings to know their bonuses. We’re in a rate environment where people will finance less, so knowing how much cash you’ll have to deploy directly into RE matters more.

2) Better price negotiability.

I think the latter will continue, but the former won’t.

I think looking at the percentage is wrong headed. The percentage was higher because the numbers were so low. The absolute number of contracts signed was low and still is low. Everyone is celebrating saying "Look! It's not nearly as shitty as it was a few months ago!"

But it still is shitty compared not just to last year, but to historical norms. And with mortgage rates rising it's not likely to be improving.

If you follow Mike Simonsen at Altos Research (who runs a data site similar to UrbanDigs) he's been consistently pointing out for the past 6 months that currently 7% mortgage rates appear to be "The Line of Death" for homebuyers, and we just passed that mark.

But it still is shitty compared not just to last year, but to historical norms. And with mortgage rates rising it's not likely to be improving.

If you follow Mike Simonsen at Altos Research (who runs a data site similar to UrbanDigs) he's been consistently pointing out for the past 6 months that currently 7% mortgage rates appear to be "The Line of Death" for homebuyers, and we just passed that mark.

What's the over under on Contracts Signed for March?

Shall we put it at 1,100?

Shall we put it at 1,100?

So down by a full third from March 2022. Slightly higher than 946 from March 2019.I think it’ll come in right around 1000.

What do we think now?I think it’ll come in right around 1000.

So what are we thinking for April?

I was way off on March, no? Clearly, I have no clue.

Have you noticed the divergence in the high-end market vs the rest? Most of the market has been enjoying a spring pop, but not the top. For example, pending sales at the $1-2M range is “only” down 20% YoY while $10M+ is down 55%.

Have you noticed the divergence in the high-end market vs the rest? Most of the market has been enjoying a spring pop, but not the top. For example, pending sales at the $1-2M range is “only” down 20% YoY while $10M+ is down 55%.

Upper East Side Townhouses Top Manhattan Luxury Market

Manhattan luxury real estate posted average activity in the first quarter after last year’s record, according to Olshan Realty.

therealdeal.com

Manhattan luxury market’s first quarter back to average

A deal for two UES townhouses claimed priciest contract to close out MarchFirst-quarter grades are in for Manhattan luxury real estate, and the market finished with an unremarkable average amount of activity.

The period counted 313 contracts signed for homes in the borough asking $4 million or more, according to Olshan Realty’s weekly report, ranking it fifth for activity over the past 10 years. If the average pace seems slow, it’s because last year’s first quarter counted a record 416 contracts signed.

The priciest contract signed last week was for a property that includes two townhouses, sold by the same owner. The homes at 15 and 17 East 77th Street went into contract asking $32.5 million, down from $38 million when they were first listed a year ago.

Both homes, which need to be renovated, are five stories and just under 17 feet wide. They combine for nearly 9,800 square feet. The seller bought the houses between 2010 and 2012 for $22.5 million.

The second most expensive home to enter contract last week was unit PH at 993 Fifth Avenue, with an asking price just under $20 million, down from $39.5 million when it was listed at the end of June.

The duplex penthouse co-op, which has not been renovated, has four bedrooms and 4.5 bathrooms and a total of 12 rooms.The downstairs has a 40-foot living room, gallery and formal dining room, which all open onto a 51-foot terrace overlooking Central Park. Three of the four bedrooms are on the second floor, surrounded by terraces.

Of the 32 homes to enter contract last week, 21 were condos, eight were co-ops and three were townhouses.

The homes combined for nearly $265 million in asking price volume. The average asking price was $8.3 million and the median was $6 million. The typical home received a 16 percent discount and spent 799 days on the market.

I'm going to let it ride with 1,100 again for April.

Hard to say that it's low inventory which is keeping contracts signed well below last year's levels.

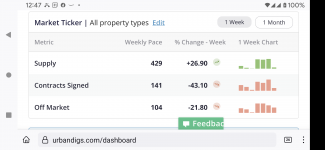

They happen every year and I don't recall seeing that kind of drop before. April is usually peak selling season. Last year same week 310 contracts signed. Prior week 399. So 22% drop. But not 43%. And 55% drop year-on-year for same week. Oooooof.Good Friday & Easter happened?

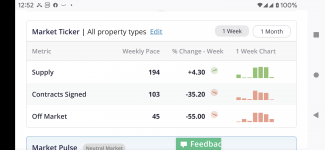

Just to note this thread started almost a year ago with "Still doing 1400+ deals a month..but for how long?" and the pace for the last 30 days is now 992. In Brooklyn it's 666.This stat is incredible considering what is going on with rates, equities, and other risk assets. Sugar high, then sugar low? Sellers, take advantage of this gift of liquidity.

Bookmarking now so we can revisit in 4-6 months and see how this market handles the macro changes that are happening

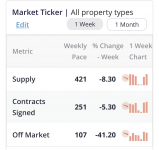

View attachment 608

Looks like nothing changed from my prior post. I'm not really hearing much talk about the fairly shocking year over year drop in contract volume.