https://calculatedrisk.substack.com...id=105481989&isFreemail=true&utm_medium=email

CalculatedRisk by Bill McBride

7 hr ago

15

Some interesting data from housing economist Tom Lawler:

In its earnings press release and during its conference call, the company said that its single-family acquisitions program was currently “on hold.” Here is an excerpt from the press release.

“The Company’s acquisition programs currently remain on hold given capital market uncertainty and potentially improving future investment opportunities. Until market conditions change, the Company’s current 2023 outlook does not contemplate any material acquisition activity.”

And here is an excerpt from the earnings conference call.

“Currently, our traditional and national builder channels are largely on pause. As today, it remains difficult to acquire properties in an accretive and responsible manner with expected return to today's pricing still too low to clear our required return thresholds.”

Company officials suggested that current “cap rates” were about 50 bp lower than what the company found “attractive.”

AMH still expects that its SF rental portfolio will increase somewhat this year, with all of the expected growth coming from its “development pipeline” (build-to rent). AMH expects to add about 2,300 homes (1,850 wholly-owned and 450 in joint ventures) via its build-to-rent program. As of 12/31/2022 the company’s owned or optioned lots totaled 14,507, up from 13,134 a year earlier and 7,071 at the end of 2020.

In the fourth quarter of last year Invitation Homes, which owns over 83,000 single-family properties, acquired (wholly owned or via JVs) 166 SF properties, 81 of which were from “build-to-rent” builders, while it sold 199 homes. As such, the company was also a net seller of existing SF homes.

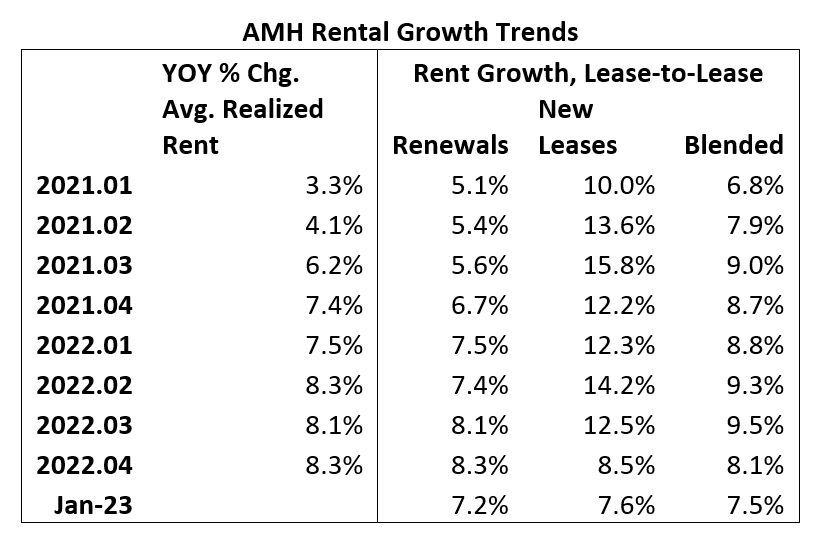

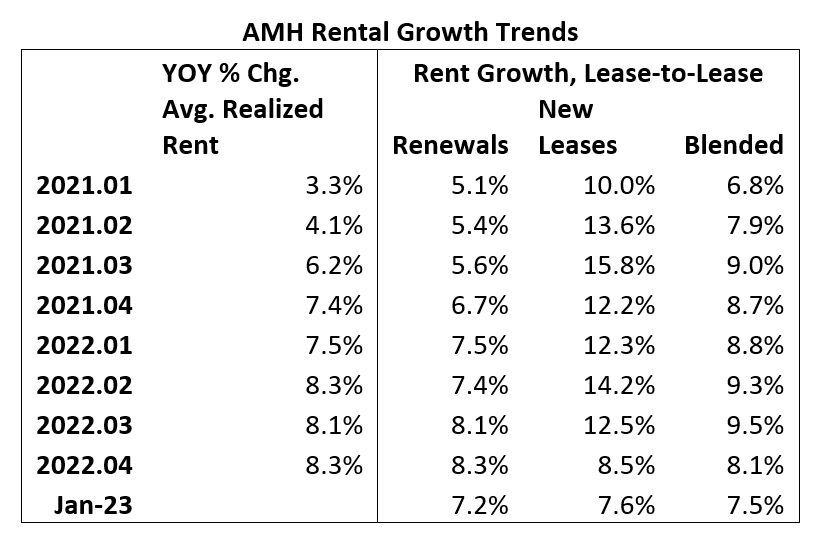

In terms of rent trends, here is a table showing Are’s rent growth for rent renewals and re-leases, as well as the YOY % growth in average rents for “same-store” properties.

Here is Redfin’s definition of “investor”:

“We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.”

Lawler: AMH Net Seller of Existing Single-Family Homes, “Investor” Home Purchases Plunged

CalculatedRisk by Bill McBride

7 hr ago

15

Some interesting data from housing economist Tom Lawler:

AMH Net Seller of Existing Single-Family Homes Last Quarter

AMH (American Homes 4 Rent), which rents single-family homes and which owned almost 59,000 single-family homes at the end of last year, reported that it was a net seller of existing single-family homes last quarter. The company acquired 489 homes last quarter, but 415 of those homes were “deliveries” from its own build-to-rent program, and “most” of the remaining 74 homes were acquired under its National Builder Program. The company sold 457 homes last quarter, well above the average quarterly sales of 161 in the previous four quarters. The company also increased its inventory of single-family homes held for sale to 1,115 in December from 1,057 in September and 659 in December 2021, and company officials suggested that additional home sales were likely this quarter.In its earnings press release and during its conference call, the company said that its single-family acquisitions program was currently “on hold.” Here is an excerpt from the press release.

“The Company’s acquisition programs currently remain on hold given capital market uncertainty and potentially improving future investment opportunities. Until market conditions change, the Company’s current 2023 outlook does not contemplate any material acquisition activity.”

And here is an excerpt from the earnings conference call.

“Currently, our traditional and national builder channels are largely on pause. As today, it remains difficult to acquire properties in an accretive and responsible manner with expected return to today's pricing still too low to clear our required return thresholds.”

Company officials suggested that current “cap rates” were about 50 bp lower than what the company found “attractive.”

AMH still expects that its SF rental portfolio will increase somewhat this year, with all of the expected growth coming from its “development pipeline” (build-to rent). AMH expects to add about 2,300 homes (1,850 wholly-owned and 450 in joint ventures) via its build-to-rent program. As of 12/31/2022 the company’s owned or optioned lots totaled 14,507, up from 13,134 a year earlier and 7,071 at the end of 2020.

In the fourth quarter of last year Invitation Homes, which owns over 83,000 single-family properties, acquired (wholly owned or via JVs) 166 SF properties, 81 of which were from “build-to-rent” builders, while it sold 199 homes. As such, the company was also a net seller of existing SF homes.

In terms of rent trends, here is a table showing Are’s rent growth for rent renewals and re-leases, as well as the YOY % growth in average rents for “same-store” properties.

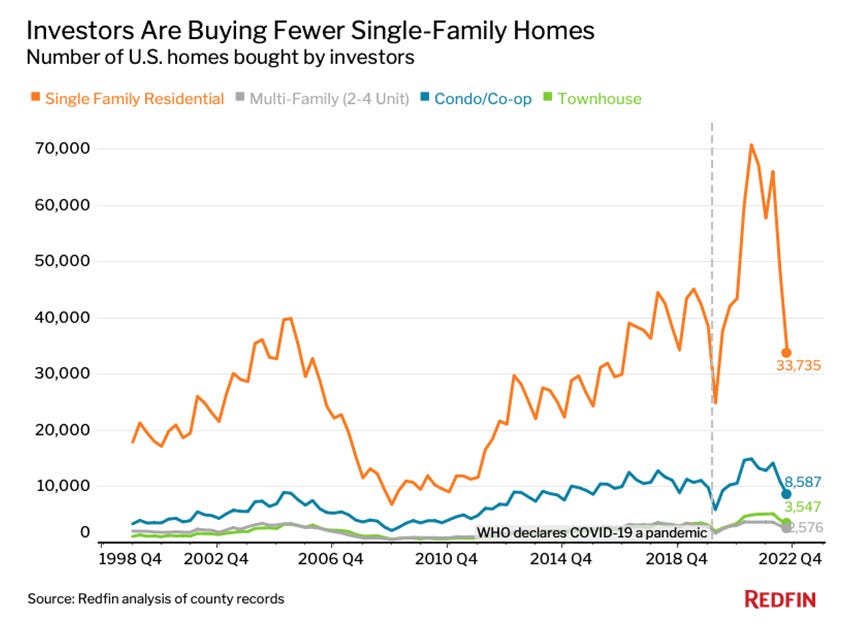

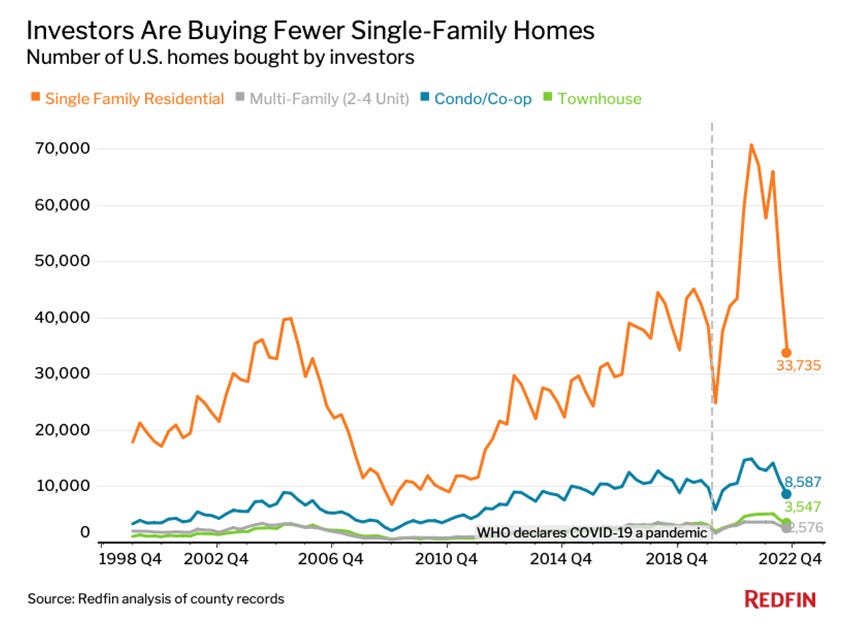

Redfin: “Investor” Home Purchases Plunged Last Quarter

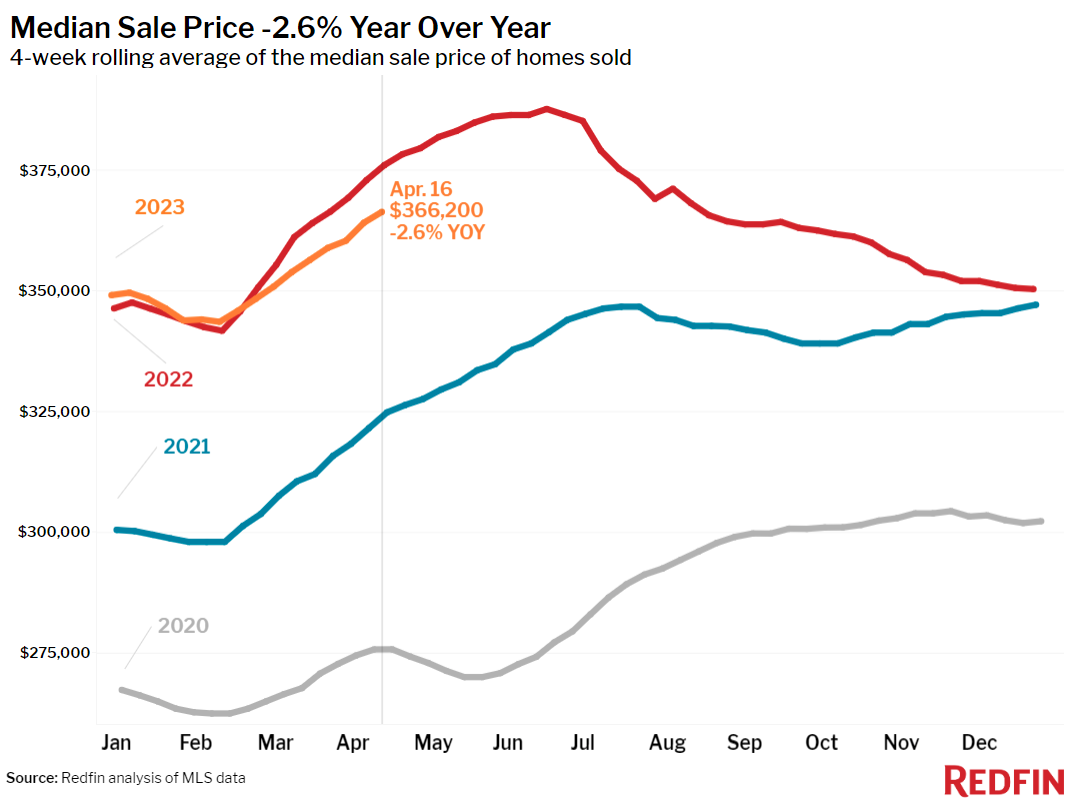

Based on property records in 40 large metro areas, Redifn reported that “investor” residential purchases in these areas totaled 48,445 homes last quarter, down 27.0% from the previous quarter and down 45.8% from the comparable quarter of 2021. Investor purchases of single-family homes were down 49.8% YOY.

Here is Redfin’s definition of “investor”:

“We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.”