You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

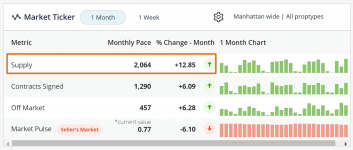

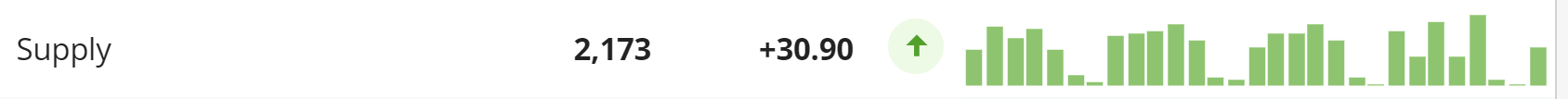

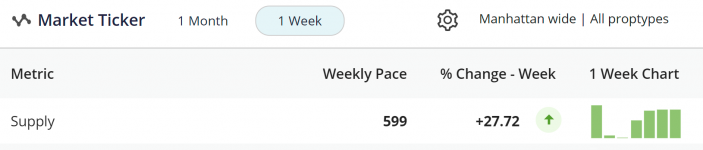

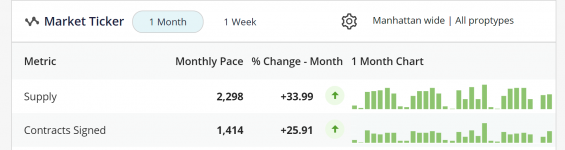

New listing activity breaks the 2k mark over last 30 days. No more net deficit of supply

- Thread starter Noah Rosenblatt

- Start date

Upstairs Realty

Well-known member

Early to call it, but ...macro, I think.

RTO is ramping up, but it's pretty apparent that lots of people will be going forward in a hybrid world, and I think that this is another leg of the push to trade a convenient location for more space at home which can include office space. After all, for most workers*, a 1.5 hr. or even 2 hr. round-trip three days a week is still roughly equivalent to a 1 hr. round-trip five days a week, and that difference can move you from Manhattan to Queens or Westchester.

/insert your own New Jersey comment/slam on New Jersey Transit here/

*we can get into the finer points of people with young kids being able to get home for bedtime, if you want to go off on that tangent.

RTO is ramping up, but it's pretty apparent that lots of people will be going forward in a hybrid world, and I think that this is another leg of the push to trade a convenient location for more space at home which can include office space. After all, for most workers*, a 1.5 hr. or even 2 hr. round-trip three days a week is still roughly equivalent to a 1 hr. round-trip five days a week, and that difference can move you from Manhattan to Queens or Westchester.

/insert your own New Jersey comment/slam on New Jersey Transit here/

*we can get into the finer points of people with young kids being able to get home for bedtime, if you want to go off on that tangent.

Interesting...Add in rising rates + geopolitical as well. Interesting confluence of macro forces at playEarly to call it, but ...macro, I think.

RTO is ramping up, but it's pretty apparent that lots of people will be going forward in a hybrid world, and I think that this is another leg of the push to trade a convenient location for more space at home which can include office space. After all, for most workers*, a 1.5 hr. or even 2 hr. round-trip three days a week is still roughly equivalent to a 1 hr. round-trip five days a week, and that difference can move you from Manhattan to Queens or Westchester.

/insert your own New Jersey comment/slam on New Jersey Transit here/

*we can get into the finer points of people with young kids being able to get home for bedtime, if you want to go off on that tangent.

New York City Home Sale Listings Set Record in February

In February, sellers put 4,078 homes on the market across New York City, a record for the month. But inventory remains low.

therealdeal.com

NYC home listings surge, setting February record

Sellers put 4,078 homes on the market, but inventory remains low

With home shopping season around the corner, perhaps sellers are doing a bit of spring cleaning.Last month they listed 4,078 homes across New York City, according to a report by StreetEasy — the most ever recorded in February by the company. The previous high was 3,538 in February 2018.

“It’s been two years of unpredictability in the New York City market, but this data shows that the seasonality of the sales market is back,” Casey Roberts, a StreetEasy Home Trends Expert, said in a statement.

A total of 16,622 New York City homes were for sale in February, 549 more than in January. Even with the record number of new listings, February inventory was 12 percent lower than it was in February last year, in part because buyers have been scooping up homes at a rapid rate.

Homes spent a median of 88 days on the market last month, four weeks faster than they did a year ago. Of the boroughs analyzed in the report, homes in Brooklyn moved off the market fastest: 79 days.

Strong buyer demand usually means fewer price cuts. In February, 8 percent of New York City listings advertised a price cut — the same as last February, but lower than the 10 percent in February 2020, just prior to the pandemic.

The median asking price for a home in New York City last month was $950,000, virtually unchanged from a year prior.

“This spring will be competitive for homebuyers, but the increase we’re seeing in new inventory is promising,” Roberts said in a statement. “The recent rise in home prices should motivate even more sellers to list their homes for sale, making it easier and more likely for buyers to find and win a home they love.”

In Manhattan, 1,926 homes were added to the market in February, 26 percent more than in the previous February. In total, 8,099 Manhattan homes were for sale in February — still down 18 percent from last year.

Increased demand coupled with the reduced inventory pushed the median asking price in Manhattan up to $1.47 million — 9 percent higher than last year, but down $25,000 from January, when it was $1.495 million.

Median asking rents reached a new high of $3,800 in Manhattan. That’s 36 percent higher than last year. There were 10,327 rentals available in Manhattan in February, 66 percent fewer than the previous year.

In Brooklyn, 1,180 homes hit the market in February. That’s 24 percent more than the previous year. But the borough, like the city as a whole, is still playing catch-up: The 4,423 Brooklyn homes for sale in February represented a 12 percent drop from last year. The median asking price was $928,000 (take note, future political candidates).

On the Brooklyn rental market, median asking rent reached a record of $2,800, up 17 percent from February 2021. Rental inventory was down 53 percent, with 8,563 units available in the borough. That was only 5 percent lower than how much inventory was available in February 2020, prior to the pandemic.

Queens was the only borough in the report where the median asking price dropped in February. It fell by 4 percent, to $588,000.

There were 755 new homes added to the Queens market, 15 percent more than last February. Total sales inventory was stagnant, with 3,072 homes on the market.

The median asking rent in Queens was $2,300 in February, up 15 percent from last year but flat over the past three months now. Rental inventory dropped 43 percent year-over-year, with 4,057 available units across the borough. Compared to Brooklyn and Manhattan, Queens rental inventory has been relatively stable throughout the pandemic, according to the report.

there it is - John is working on a piece about elevated new listing and deal vol compared to other years and how its ALL ABOUT WHAT BREAKS FIRST

New York City Home Sale Listings Set Record in February

In February, sellers put 4,078 homes on the market across New York City, a record for the month. But inventory remains low.therealdeal.com

NYC home listings surge, setting February record

Sellers put 4,078 homes on the market, but inventory remains low

With home shopping season around the corner, perhaps sellers are doing a bit of spring cleaning.

Last month they listed 4,078 homes across New York City, according to a report by StreetEasy — the most ever recorded in February by the company. The previous high was 3,538 in February 2018.

“It’s been two years of unpredictability in the New York City market, but this data shows that the seasonality of the sales market is back,” Casey Roberts, a StreetEasy Home Trends Expert, said in a statement.

A total of 16,622 New York City homes were for sale in February, 549 more than in January. Even with the record number of new listings, February inventory was 12 percent lower than it was in February last year, in part because buyers have been scooping up homes at a rapid rate.

Homes spent a median of 88 days on the market last month, four weeks faster than they did a year ago. Of the boroughs analyzed in the report, homes in Brooklyn moved off the market fastest: 79 days.

Strong buyer demand usually means fewer price cuts. In February, 8 percent of New York City listings advertised a price cut — the same as last February, but lower than the 10 percent in February 2020, just prior to the pandemic.

The median asking price for a home in New York City last month was $950,000, virtually unchanged from a year prior.

“This spring will be competitive for homebuyers, but the increase we’re seeing in new inventory is promising,” Roberts said in a statement. “The recent rise in home prices should motivate even more sellers to list their homes for sale, making it easier and more likely for buyers to find and win a home they love.”

In Manhattan, 1,926 homes were added to the market in February, 26 percent more than in the previous February. In total, 8,099 Manhattan homes were for sale in February — still down 18 percent from last year.

Increased demand coupled with the reduced inventory pushed the median asking price in Manhattan up to $1.47 million — 9 percent higher than last year, but down $25,000 from January, when it was $1.495 million.

Median asking rents reached a new high of $3,800 in Manhattan. That’s 36 percent higher than last year. There were 10,327 rentals available in Manhattan in February, 66 percent fewer than the previous year.

In Brooklyn, 1,180 homes hit the market in February. That’s 24 percent more than the previous year. But the borough, like the city as a whole, is still playing catch-up: The 4,423 Brooklyn homes for sale in February represented a 12 percent drop from last year. The median asking price was $928,000 (take note, future political candidates).

On the Brooklyn rental market, median asking rent reached a record of $2,800, up 17 percent from February 2021. Rental inventory was down 53 percent, with 8,563 units available in the borough. That was only 5 percent lower than how much inventory was available in February 2020, prior to the pandemic.

Queens was the only borough in the report where the median asking price dropped in February. It fell by 4 percent, to $588,000.

There were 755 new homes added to the Queens market, 15 percent more than last February. Total sales inventory was stagnant, with 3,072 homes on the market.

The median asking rent in Queens was $2,300 in February, up 15 percent from last year but flat over the past three months now. Rental inventory dropped 43 percent year-over-year, with 4,057 available units across the borough. Compared to Brooklyn and Manhattan, Queens rental inventory has been relatively stable throughout the pandemic, according to the report.

Off Market also seems to have slowed a bit this year.