According to Jay "Failure" Martin the MINIMUM number of vacant Rent Stabilized units being held hostage is 26,000. Sherwin "Shilley" Belkin chimes in with his usual Red Herring of "The 2019 law has made it impossible to bring those apartments back to market. They generally need lots of work to bring them up to building standard, rentability and the 2019 law provides that no matter how much an owner puts into an apartment the maximum return is $83 [a month], and only for 15 years.” Which we all know as horse hockey because since the units are currently vacant the return is THE BASE RENT PLUS $83. But they figure if the keep telling The Big Lie long enough people are going to believe it BECAUSE THEY THINK YOU ARE STUPID.

Of course you also have to remember that according to these 2 the Supreme Court was already guaranteed to have outlawed Rent Stabilization entirely already.

www.thecity.nyc

www.thecity.nyc

BY GREG DAVID FEB. 14, 2024, 5:00 A.M.

The official U.S. Census report that found New York City’s apartment vacancy rate is a record-low 1.4%. It also shows in the fine print that that number doesn’t count tens of thousands more units that are offline entirely — and the source of heated debate about why.

The latest New York City Housing and Vacancy survey estimates that last year 26,310 rent-stabilized apartments were “vacant but unavailable for rent,” down from about 43,000 in the same survey two years ago.

Even with that post-pandemic decline, that’s nearly as many rent stabilized units held off the market as the 33,210 units of any type of housing that the Census Bureau estimated to be available for rent between January and July 2023, when it last conducted the survey.

The new numbers won’t put to rest an ongoing debate between tenant advocates and landlords about why so many rent stabilized apartments remain vacant.

Landlords say that many units are off the market because they need substantial renovation after being vacated by long-term tenants — repairs that are cost-prohibitive because of 2019 changes to state rent regulations that make it impossible to recoup the investment needed. The reforms sharply limited the ways landlords could raise rents on vacant apartments and prohibited the removal of apartments from regulation in most cases.

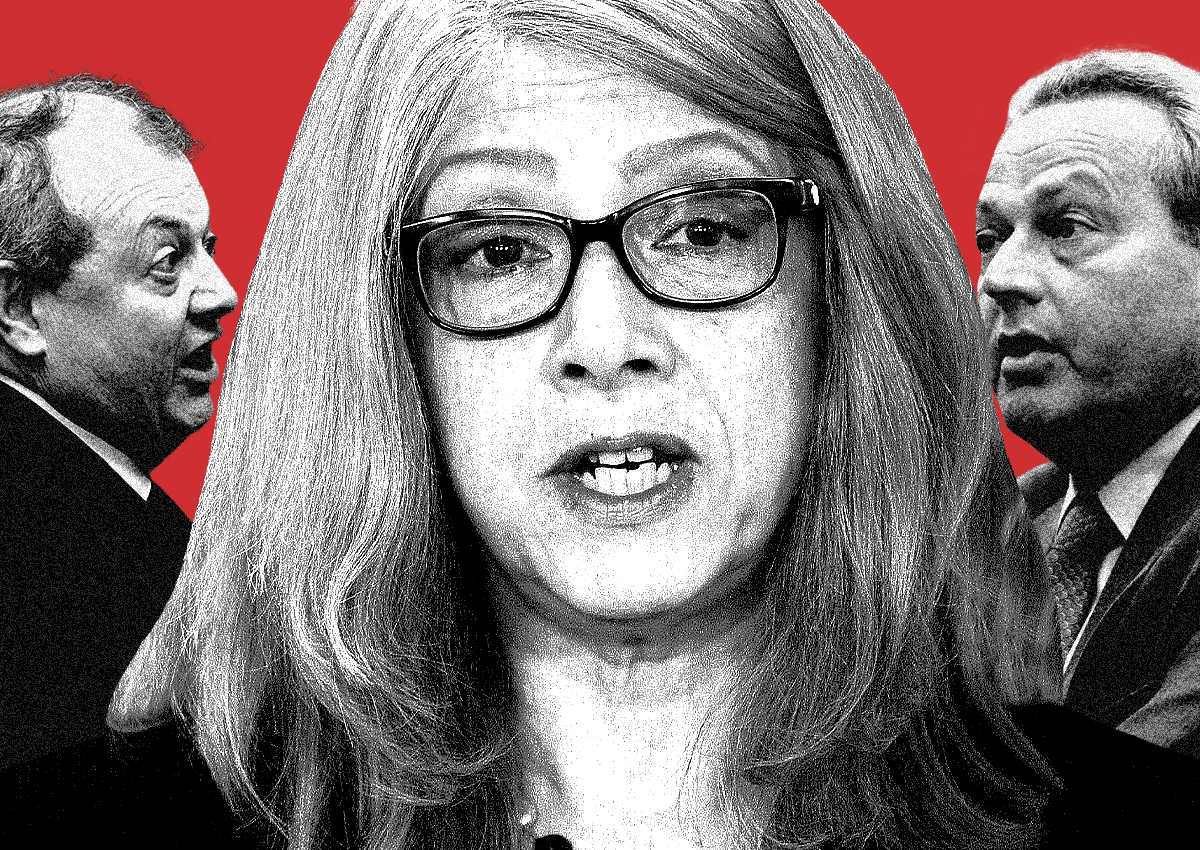

The 2019 law has made it impossible to bring those apartments back to market,” said Sherwin Belkin,” an attorney representing landlords at Belkin, Burden Goldman. “They generally need lots of work to bring them up to building standard, rentability and the 2019 law provides that no matter how much an owner puts into an apartment the maximum return is $83 [a month], and only for 15 years.”

In between the 2021 survey and the new findings, THE CITY and others sought other measures of apartment vacancies amid widespread reports of empty housing during the pandemic.

Using figures reported directly by landlords to the state, THE CITY counted about 61,000 vacant apartments in 2021. The city housing agency, counting both apartments listed as “available” and “unavailable” for rent, said the number of potential vacancies was even higher, at nearly 89,000.

Seeking a picture of long-term warehousing of apartments, last summer, the city Independent Budget Office counted how many apartments landlords reported to the state as vacant for two years in a row, and came up with a figure a little over 13,000.

The latest number from the Housing and Vacancy Survey is based on interviews with 10,000 occupants and the findings are then extrapolated.

“It’s a snapshot,” said Jay Martin, Executive Director of the Community Housing Improvement Program, which represents owners of small and medium-sized rent regulated buildings. “It’s like a political poll.”

The decline could mean that landlords are putting units back into the market. It could also be that many of the unavailable units in 2021 were pieds-a-terre or short term rentals which were vacant because of the pandemic, said Oksana Mironova, a housing specialist at the Community Service Society, an antipoverty research organization.

“This is a very good sign, showing that rent stabilization is doing what it is supposed to do– balancing the scales between tenants and landlords in a tight housing market,” she said.

Others aren’t so sure.

Housing numbers reported for 2021 may not have been accurate because of the effects of the pandemic, said Howard Slatkin, executive director at Citizens Housing and Planning Council.

The best guess on the bottom line may come from Martin at CHIP.

“The 26,000 figure is the minimum number of rent regulated units off the market,” he said, “there are probably more.”

Of course you also have to remember that according to these 2 the Supreme Court was already guaranteed to have outlawed Rent Stabilization entirely already.

Tens of Thousands of Rent-Stabilized Apartments Remain Off the Market During Record Housing Shortage

Landlords kept an estimated 26,000 regulated units offline last year — rekindling a debate about the role of New York’s strict rent laws.

Tens of Thousands of Rent-Stabilized Apartments Remain Off the Market During Record Housing Shortage

Landlords kept an estimated 26,000 regulated units offline last year — rekindling a debate about the role of New York’s strict rent laws.BY GREG DAVID FEB. 14, 2024, 5:00 A.M.

The official U.S. Census report that found New York City’s apartment vacancy rate is a record-low 1.4%. It also shows in the fine print that that number doesn’t count tens of thousands more units that are offline entirely — and the source of heated debate about why.

The latest New York City Housing and Vacancy survey estimates that last year 26,310 rent-stabilized apartments were “vacant but unavailable for rent,” down from about 43,000 in the same survey two years ago.

Even with that post-pandemic decline, that’s nearly as many rent stabilized units held off the market as the 33,210 units of any type of housing that the Census Bureau estimated to be available for rent between January and July 2023, when it last conducted the survey.

The new numbers won’t put to rest an ongoing debate between tenant advocates and landlords about why so many rent stabilized apartments remain vacant.

Landlords say that many units are off the market because they need substantial renovation after being vacated by long-term tenants — repairs that are cost-prohibitive because of 2019 changes to state rent regulations that make it impossible to recoup the investment needed. The reforms sharply limited the ways landlords could raise rents on vacant apartments and prohibited the removal of apartments from regulation in most cases.

Tenant advocates and allied politicians have charged that landlords deliberately held apartments off the market in order to find ways out of rent regulation, furthering New York City’s housing shortage.The 2019 law has made it impossible to bring those apartments back to market,” said Sherwin Belkin,” an attorney representing landlords at Belkin, Burden Goldman. “They generally need lots of work to bring them up to building standard, rentability and the 2019 law provides that no matter how much an owner puts into an apartment the maximum return is $83 [a month], and only for 15 years.”

‘There Are Probably More’

The Housing and Vacancy Survey is usually conducted every three years by the U.S. Census Bureau at the request of the City of New York. The survey’s findings have big implications for tenants. By law, New York City can only renew rent regulations if the City Council votes to find a “rent emergency,” defined as a vacancy rate of under 5%.In between the 2021 survey and the new findings, THE CITY and others sought other measures of apartment vacancies amid widespread reports of empty housing during the pandemic.

Using figures reported directly by landlords to the state, THE CITY counted about 61,000 vacant apartments in 2021. The city housing agency, counting both apartments listed as “available” and “unavailable” for rent, said the number of potential vacancies was even higher, at nearly 89,000.

Seeking a picture of long-term warehousing of apartments, last summer, the city Independent Budget Office counted how many apartments landlords reported to the state as vacant for two years in a row, and came up with a figure a little over 13,000.

The latest number from the Housing and Vacancy Survey is based on interviews with 10,000 occupants and the findings are then extrapolated.

“It’s a snapshot,” said Jay Martin, Executive Director of the Community Housing Improvement Program, which represents owners of small and medium-sized rent regulated buildings. “It’s like a political poll.”

The decline could mean that landlords are putting units back into the market. It could also be that many of the unavailable units in 2021 were pieds-a-terre or short term rentals which were vacant because of the pandemic, said Oksana Mironova, a housing specialist at the Community Service Society, an antipoverty research organization.

“This is a very good sign, showing that rent stabilization is doing what it is supposed to do– balancing the scales between tenants and landlords in a tight housing market,” she said.

Others aren’t so sure.

Housing numbers reported for 2021 may not have been accurate because of the effects of the pandemic, said Howard Slatkin, executive director at Citizens Housing and Planning Council.

The best guess on the bottom line may come from Martin at CHIP.

“The 26,000 figure is the minimum number of rent regulated units off the market,” he said, “there are probably more.”