Shaun Donovan and Raymond J. McGuire, candidates for mayor of New York, were way, way off when asked to estimate the median home price in the borough.

www.nytimes.com

It’s a Home in Brooklyn. What Could It Cost? $100,000?

Shaun Donovan and Raymond J. McGuire, candidates for mayor of New York, were way, way off when asked to estimate the median home price in the borough

Shaun Donovan, a former housing secretary, guessed the median price of Brooklyn homes was $100,000. He later said he was referring to the assessed value.

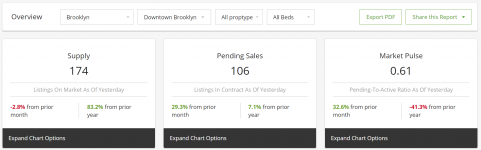

Do you know the median sales price for a home in Brooklyn?

The question, which was recently posed to eight mayoral candidates by The New York Times editorial board, was not a trick. Brooklyn is a notoriously expensive borough in one of America’s most expensive cities, and New York City’s housing crisis promises to be a major issue in the coming years.

Yet the range of responses given by two of the candidates — off by roughly an order of magnitude — has touched off incredulity among New Yorkers.

“In Brooklyn, huh? I don’t for sure,” Shaun Donovan, who has touted his experience as housing secretary under President Barack Obama and housing commissioner under Mayor Michael R. Bloomberg,

answered. “I would guess it is around $100,000.”

The

guess from Raymond J. McGuire, an investment banker and former executive at Citigroup who has sought to woo voters with his financial acumen, included similar numbers.

“It’s got to be somewhere in the $80,000 to $90,000 range, if not higher,” he said.

Eric Adams, the Brooklyn borough president, said he believed the number was about $550,000. Maya Wiley, a former counsel to Mayor Bill de Blasio, guessed $1.8 million. Only Andrew Yang, who has been criticized in the past for seeming out of touch with the city’s issues, guessed correctly: $900,000.

Kathryn Garcia, a former sanitation commissioner, guessed $800,000; Dianne Morales, a former nonprofit executive, $500,000; and Scott M. Stringer, the city comptroller, $1 million.

While Mr. Donovan and Mr. McGuire are not considered among the leading candidates in the race, it was their answers that drew the most attention, with many people suggesting that they did not have a grasp on the problems of working people. As several people pointed out on social media, among the things that can be purchased

in Brooklyn for $100,000 or less, according to the website Zillow: a parking space and two vacant lots.

“It’s hard to imagine these men solving a problem they don’t know exists,” said Monica Klein, a political consultant. The Working Families Party, which has endorsed two other candidates, Ms. Morales and Ms. Wiley, is a client of Ms. Klein’s firm, Seneca Strategies.

“If you don’t spend your days refreshing StreetEasy and obsessing over apartments you will never afford, are you really a New Yorker?” Ms. Klein asked.

According to a note appended to a transcript of the editorial board’s interview with Mr. Donovan, he had sent an email the day after the interview to say that his $100,000 answer referred to the assessed value of homes in Brooklyn, which tends to be much lower than their selling price.

“I really don’t think you can buy a house in Brooklyn today for that little,” he wrote, according to the transcript.

Jeremy Edwards, a spokesman for Mr. Donovan, said Tuesday that Mr. Donovan “misinterpreted the question and made a mistake.”

“He had been volunteering on a complex housing assessment lawsuit and just got the numbers mixed up,” Mr. Edwards said. “As Shaun says, he is a housing nerd and public servant who has dedicated 30 years of his life to solving the problems of housing affordability and homelessness, and the wrong number slipped out.”

In an emailed response on Tuesday, Mr. McGuire said he “messed up when accounting for the cost of housing in Brooklyn.”

“I am human,” he said. “But make no mistake, I care deeply about our city’s affordable housing crisis. I know what it’s like not being able to afford a home because it was my own experience. At the heart of my housing plan, which addresses the entire housing spectrum from homelessness to homeownership, are New Yorkers who want leadership that will bring creative, data-driven solutions to housing in New York City.”

Ray McGuire, a former Citigroup executive, guessed that the median home price in Brooklyn was “$80,000 to $90,000 range, if not higher.”Credit...Desiree Rios for The New York Times

Nicole Gelinas, a senior fellow with the Manhattan Institute who is focused on urban economics and infrastructure, said the more inaccurate answers showed “a real sense of being out of touch with what’s going on in the city,” particularly regarding affordability.

She said the last time the median home price in Brooklyn was around $100,000 may have been in the 1980s.

“Buying salvaged houses in Bushwick when it was recovering from all of the fires of the 1970s — that was a unique period of time. You’re looking at 35 years or more since you could really buy anything below six figures, never mind seven figures,” she said.

Of the eight candidates questioned, five — Mr. Adams, Ms. Wiley, Mr. Donovan, Ms. Morales and Ms. Garcia — live in Brooklyn.

The candidates’ answers, Ms. Gelinas said, recalled a comment that George H.W. Bush made when he visited the National Grocers Association convention in Florida during the 1992 campaign. In an article that February,

The New York Times reported that “a look of wonder flickered across his face” as he saw the price of a quart of milk, among other items, registered on a grocery store scanner — cementing the impression that he did not understand middle-class life. (Other media outlets

have since suggested that the characterization was inaccurate.)

“I think the candidate should at least have a number in the rough vicinity of what is the right number,” Ms. Gelinas said.

She said that the candidates’ answers could hurt them politically, particularly as many voters in New York City seem to not be paying attention to the mayoral race and have, according to polls, not decided who they are voting for.

“This is going to be the way that a lot of people are introduced to McGuire and Donovan,” she said.