What is in store for 2021 and beyond? With rates at record lows, stocks at record highs, the fed pumping 100s of billions into the system, what can go wrong right?

Here is my roadmap (for fun ofc):

2021 --> deflation. CBs money printing + Fiscal stimulus creates a trading environment that lifts asset prices as investors search for yield. Works until it doesnt. Fed policy errors are likely to trigger a bust at some point this year.

2022 --> stagflation. CBs keep printing to combat the bust. Sets up a longer term inflationary cycle

2023-2025 --> inflation starts to creep in. 10yr rates breach 4%. hard assets performing well. commodity supercycle in play

2026-2029 --> inflation gets out of control. a modern day Volcker is needed

Here is my roadmap (for fun ofc):

2021 --> deflation. CBs money printing + Fiscal stimulus creates a trading environment that lifts asset prices as investors search for yield. Works until it doesnt. Fed policy errors are likely to trigger a bust at some point this year.

2022 --> stagflation. CBs keep printing to combat the bust. Sets up a longer term inflationary cycle

2023-2025 --> inflation starts to creep in. 10yr rates breach 4%. hard assets performing well. commodity supercycle in play

2026-2029 --> inflation gets out of control. a modern day Volcker is needed

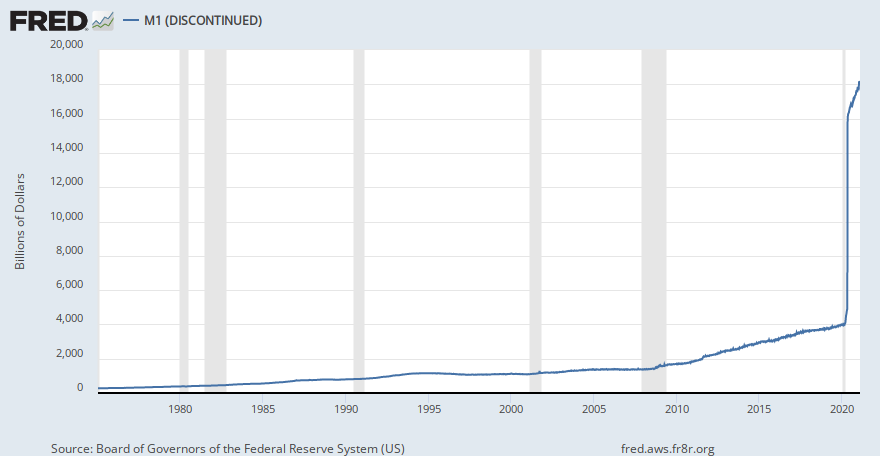

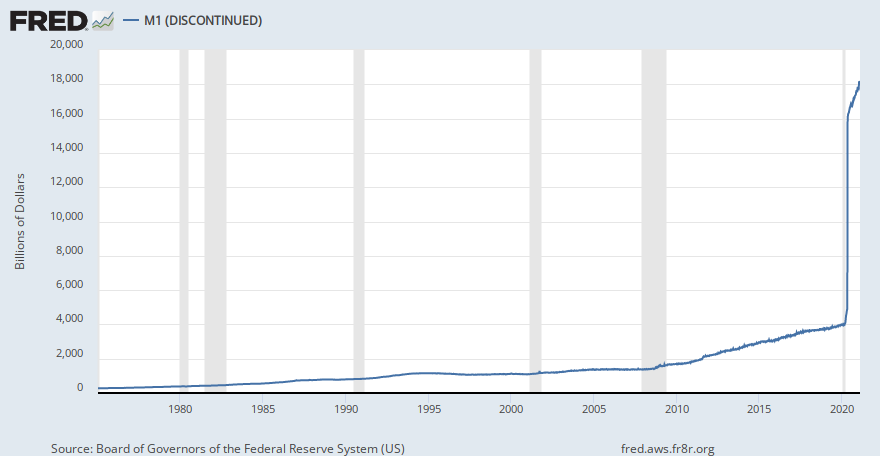

M1 (DISCONTINUED)

View a measure of the most-liquid assets in the U.S. money supply: cash, checking accounts, traveler's checks, demand deposits, and other checkable deposits.

fred.stlouisfed.org