About 8 months ago, right after the Housing Security and Tenant Protection Act of 2019 had passed, I posted elsewhere:

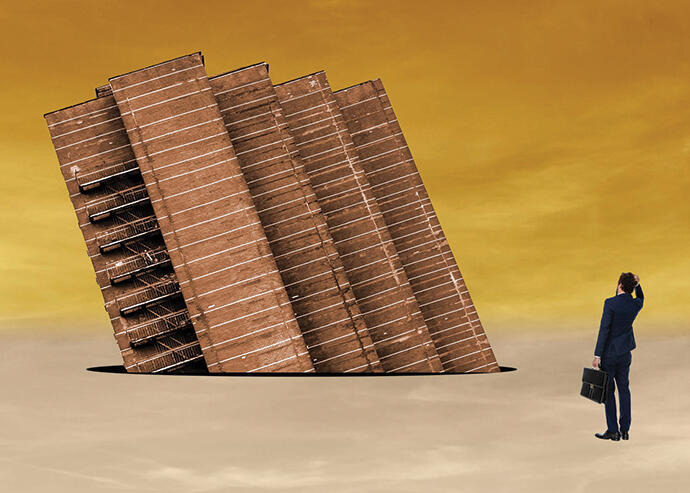

"I've been fielding calls from clients since Friday about the impact of the Rent Regulation changes passed in Albany on Friday, and here is my takeaway of the immediate affects: A shocking amount of buyers currently in contract to buy multi-family buildings are planning on walking away from their deposits to get out of their deals. One I spoke to who is in contract to buy 5 deals is planning on walking away from approx $1.5 million in contract deposits (he says he'll sue to get the deposits back even though he has absolutely no just cause just to see if he can recoup any funds by simply being a nuisance). Pretty much everyone agrees that there is no longer any upside, and everyone was buying these based on upside. Now, they are all going a little overboard and saying they are now "worthless," but that's obviously a bit of hyperbole. However, things most probably will go back to the way they were before the 1993 changes. That means that rather than buying for upside, there has to be cash-on-cash returns. So, a couple of years ago they were trading at 3% Cap Rate. A couple of months ago they were trading at 4.5 - 5/% cap rate. But back in 1992 they were trading at %8 to 12% Cap Rate. There is a building I have been marketing in Woodside that would have traded for close to $3 million a few years ago. Since February, the offers we have gotten were between $1.9 million and $2.2 million. But now if things go back to the old ways, the cap rates would indicate a value of under $1.5 million. The second thing which has occurred is the impact on renovations/contractors. Since the renovation increases have been capped at $15,000 no matter what the landlord actually spends, and lowered from 6% of the amount spent to 2% of the amount spent, everyone is cancelling projects. I spoke with one contractor who had 5 jobs scheduled to start this week and had all of them cancelled. He has about 40 people working for him and now none of them have work starting this week. https://www.cityandstateny.com/arti...rs-strike-sweeping-deal-rent-regulations.html "

But more recently we've seen prices actually come down, the market stabilize:

https://www.wsj.com/articles/buyers...l-slams-new-york-apartment-values-11580817601

Some disinformation in this article:

"“This is bad news for a city and state already facing down big budget gaps,” Mr. Whelan said Monday, arguing that a “fire sale” of regulated buildings would mean lower valuations and thus less money in the form of property taxes collected by the city."

Valuations going down doesn't impact the amount of Real Estate Taxes New York City collects. The City decides how much money it wants to collect from Real Estate Taxes and Assessed Valuations merely decides how the bills are apportioned.

However the real takeaway from the article is now that both buyers and sellers have adjusted to a new reality in terms of prices, the speculators which defined the market are being replaced with the long term owners who were always the bread and butter of the deals on these types of properties. Is it possible that in the long run returning to a less disruptive and speculative market could be healthier for our business?

"I've been fielding calls from clients since Friday about the impact of the Rent Regulation changes passed in Albany on Friday, and here is my takeaway of the immediate affects: A shocking amount of buyers currently in contract to buy multi-family buildings are planning on walking away from their deposits to get out of their deals. One I spoke to who is in contract to buy 5 deals is planning on walking away from approx $1.5 million in contract deposits (he says he'll sue to get the deposits back even though he has absolutely no just cause just to see if he can recoup any funds by simply being a nuisance). Pretty much everyone agrees that there is no longer any upside, and everyone was buying these based on upside. Now, they are all going a little overboard and saying they are now "worthless," but that's obviously a bit of hyperbole. However, things most probably will go back to the way they were before the 1993 changes. That means that rather than buying for upside, there has to be cash-on-cash returns. So, a couple of years ago they were trading at 3% Cap Rate. A couple of months ago they were trading at 4.5 - 5/% cap rate. But back in 1992 they were trading at %8 to 12% Cap Rate. There is a building I have been marketing in Woodside that would have traded for close to $3 million a few years ago. Since February, the offers we have gotten were between $1.9 million and $2.2 million. But now if things go back to the old ways, the cap rates would indicate a value of under $1.5 million. The second thing which has occurred is the impact on renovations/contractors. Since the renovation increases have been capped at $15,000 no matter what the landlord actually spends, and lowered from 6% of the amount spent to 2% of the amount spent, everyone is cancelling projects. I spoke with one contractor who had 5 jobs scheduled to start this week and had all of them cancelled. He has about 40 people working for him and now none of them have work starting this week. https://www.cityandstateny.com/arti...rs-strike-sweeping-deal-rent-regulations.html "

But more recently we've seen prices actually come down, the market stabilize:

https://www.wsj.com/articles/buyers...l-slams-new-york-apartment-values-11580817601

Some disinformation in this article:

"“This is bad news for a city and state already facing down big budget gaps,” Mr. Whelan said Monday, arguing that a “fire sale” of regulated buildings would mean lower valuations and thus less money in the form of property taxes collected by the city."

Valuations going down doesn't impact the amount of Real Estate Taxes New York City collects. The City decides how much money it wants to collect from Real Estate Taxes and Assessed Valuations merely decides how the bills are apportioned.

However the real takeaway from the article is now that both buyers and sellers have adjusted to a new reality in terms of prices, the speculators which defined the market are being replaced with the long term owners who were always the bread and butter of the deals on these types of properties. Is it possible that in the long run returning to a less disruptive and speculative market could be healthier for our business?