CUF report finds most national retailers in the city haven’t come close to reaching their pre-pandemic levels

nycfuture.org

REPORT COMMENTARY/OP-ED - DECEMBER 2022

STATE OF THE CHAINS, 2022

Our fifteenth annual ranking of national retailers in New York City finds a slight 0.3 percent uptick in chain stores across the five boroughs. However, despite the continued recovery from the sector’s steep contraction in 2020, this year’s bump in chain locations was a fraction of last year’s 2.7 percent increase.

by Jonathan Bowles, Charles Shaviro, and Sophia Annabelle Klein

Tags:

chains economic growth data new york city boroughs

Read the full report by clicking here (PDF).

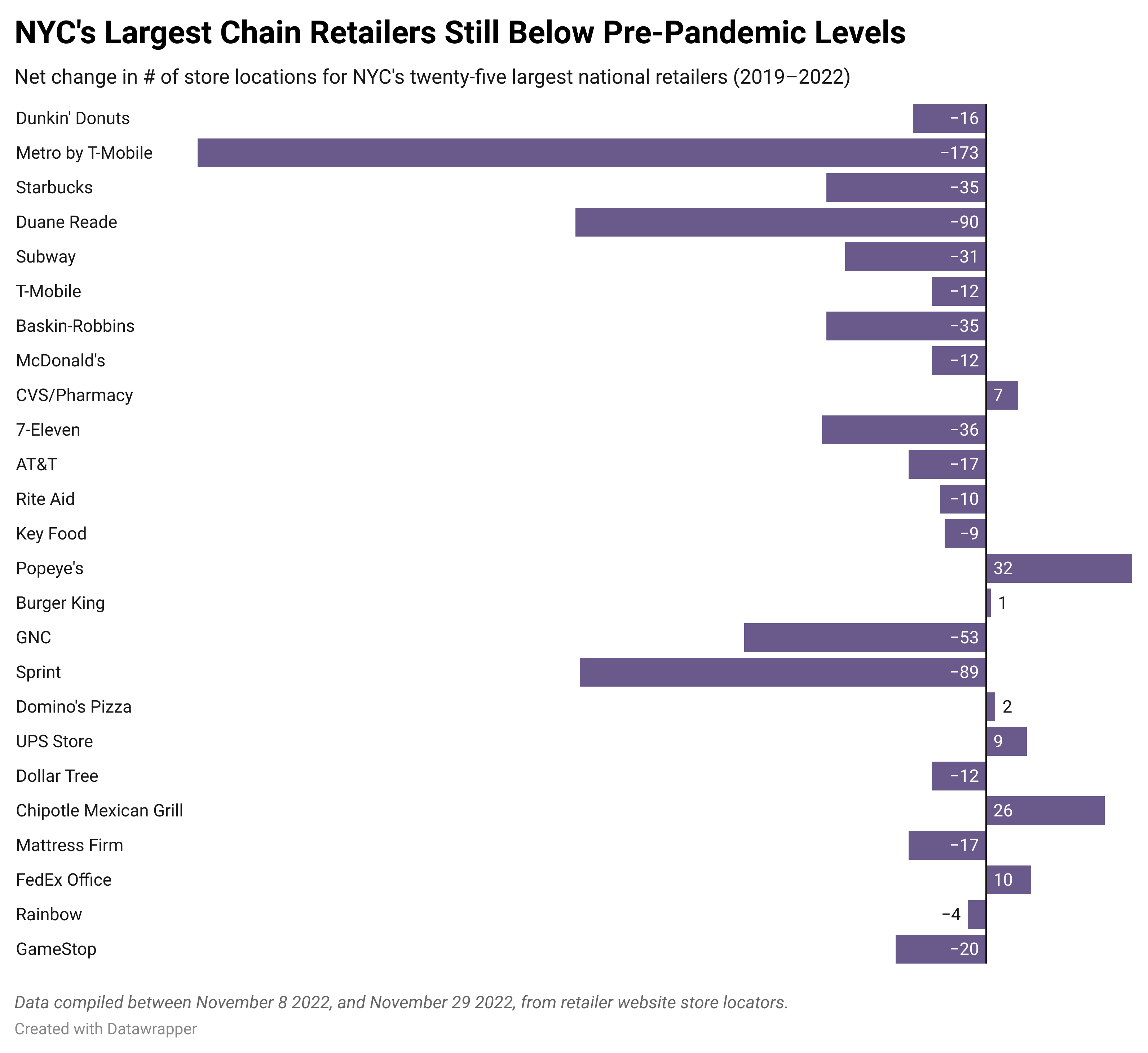

The number of chain retail stores in New York City ticked up slightly over the past year, increasing by 0.3 percent. However, despite the continued recovery from the sector’s steep contraction in 2020, this year’s bump in chain locations was a fraction of last year’s 2.7 percent increase, and most national retailers in the city haven’t come close to reaching their pre-pandemic levels. In fact, the number of chain stores in the city in November 2022 was still 9.8 percent below the total from late 2019—or 782 fewer stores than before the pandemic.

The Center for an Urban Future’s fifteenth annual report tracking chain retail trends in New York finds that 57 percent of the retailers that were featured in our 2019

State of the Chains report have fewer locations today than they did before the pandemic, including 11 percent who no longer have any stores here. Additionally, all eight of the city’s largest chain retailers have fewer locations today than they did in 2019.

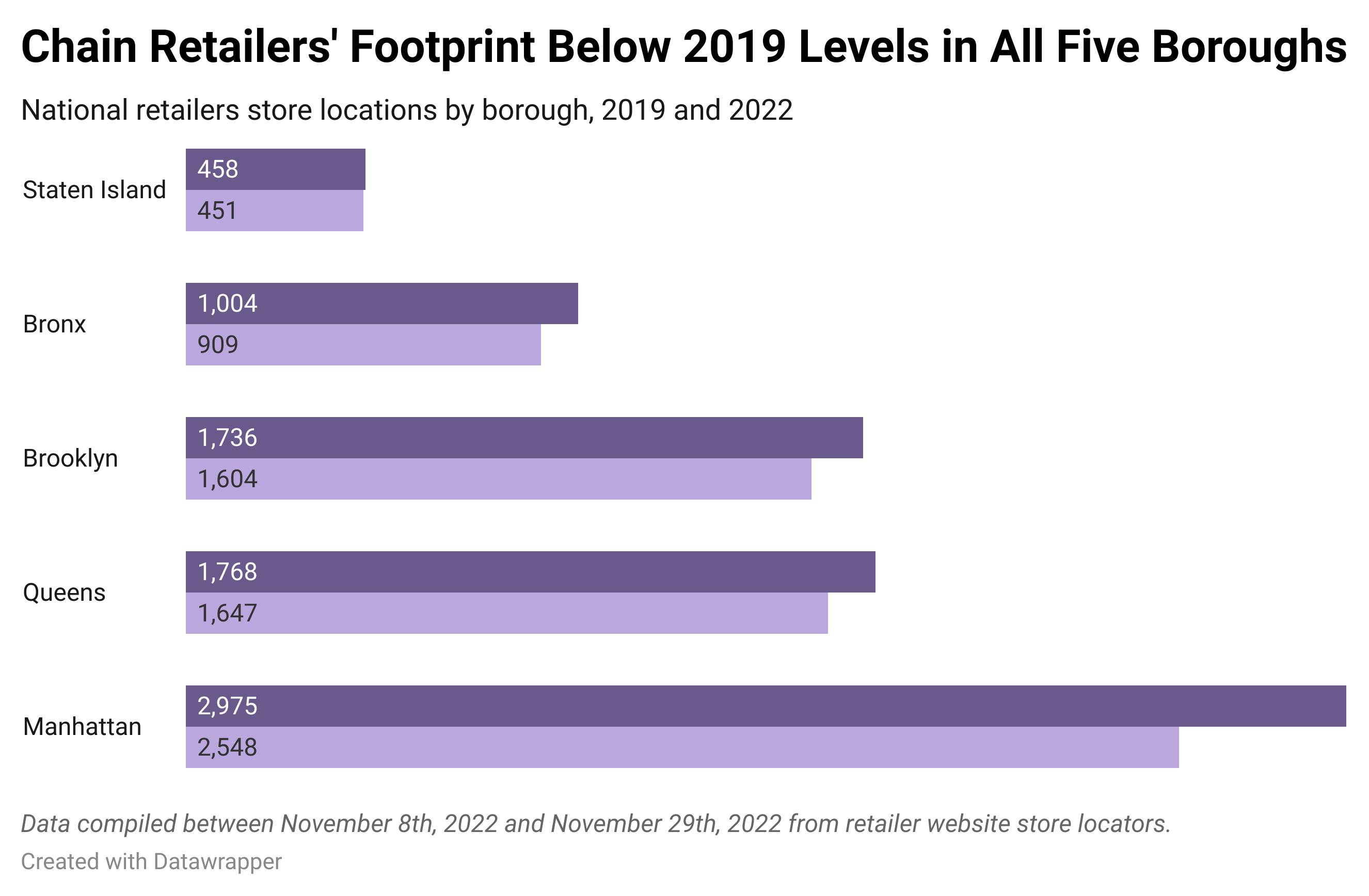

No borough has fully bounced back to its pre-pandemic chain store level, but Manhattan’s losses are significantly greater than those of any other borough—perhaps unsurprisingly, given diminished office occupancy. Today, there are still 14.4 percent fewer chain stores in Manhattan than in 2019—or 427 fewer stores. Staten Island (still down 1.5 percent) and Queens (6.8 percent lower today) have come the closest to reaching their pre-pandemic totals, while Brooklyn (-7.6 percent) and the Bronx (-9.5 percent) have further to go.

Over the past year, Brooklyn saw the largest one-year numerical increase in chain retailer locations, adding 33 stores—a 2.1 percent increase. Three of the four other boroughs experienced virtually no change in chain store locations between 2021 and 2022—Manhattan had a net gain of 3 chain stores (+0.1 percent), Queens added 4 locations (+0.2 percent), Staten Island experienced a contraction of 3 stores (-0.7 percent) while the Bronx had a net drop of 17 stores (-1.8 percent).

Although remote work and its effect on office occupancy levels in Midtown and other central business districts is a likely driver of the slow recovery in chain retail, our research suggests that the acceleration of online shopping is another factor. Indeed, for the fourth year in a row, chain retailers selling clothing, shoes, accessories, vitamins, and other merchandise have done worse than food retailers. The retail subsectors with the biggest year-over-year declines were all merchandisers: electronics (-8 percent), vitamin and food supplements (-7.8 percent), games and toys (-3.9 percent), beauty salons/equipment/supplies (-3.6 percent), pet supplies (-3.6 percent), office supplies (-3.1 percent), and shoes (-0.9 percent). Overall, 13 of the 19 chains that closed at least 10 percent of their stores in the past year were merchandise retailers. In contrast, a wide majority (19 of the 33 chains) that increased their footprint by at least 10 percent were food retailers.1

| Number of Chain Stores by Borough, 2021 and 2022 | | | | | �

|---|

| Borough | 2022 | 2021 | Change (#) | Change (%) |

|---|

| Bronx | 914 | 931 | -17 | -1.8% |

| Brooklyn | 1621 | 1588 | 33 | 2.1% |

| Queens | 1659 | 1655 | 4 | 0.2% |

| Manhattan | 2649 | 2646 | 3 | 0.1% |

| Staten Island | 456 | 459 | -3 | -0.7% |

| NYC | 7300 | 7279 | 20 | 0.3% |

This year’s

State of the Chains report, based on data compiled from store locators between November 8, 2022, and November 29, 2022, finds that most of the national retailers with the biggest footprints in New York either contracted or saw minimal growth in store locations since 2021. Of this year’s top 15 retailers, 6 have fewer stores this year, 3 registered no change and 6 had increases. Overall, the top 15 retailers recorded a net change of 41 fewer stores than last year.

Dunkin’ Donuts is again the retailer with the most stores in the five boroughs, a title it has held all fifteen years since we started tracking chain store trends in New York. But whereas in 2008, the first year that this report was published, Dunkin’ had just six more stores than the second-place chain (Subway), today Dunkin’ has over 300 more stores than the number two retailer in the city, Starbucks, which boasts 316 store locations. However, despite adding five stores over the past year, growing from 615 to 620 in total, Dunkin’ still has fewer store locations now than it did before the pandemic (636 in 2019).

Starbucks now has the second-most chain stores in New York, its highest position in the fifteen-year history of this report. Over the past year, Starbucks had a net increase of six stores, from 310 to 316. Although Starbucks still has significantly fewer locations than it did pre-pandemic (351 in 2019), the coffee chain moved into second position on our list by surpassing Metro by T-Mobile, which reduced its footprint in the city by 16 locations, from 311 to 295.

The other retailers in the top ten include Subway (which now has 254 stores after registering a decline of 15 stores since 2021); T-Mobile (233 stores, -8); Duane Reade (227, -22); McDonald’s (191, no change); Baskin-Robbins (182, +7); CVS/Pharmacy (174, -1); and Popeye’s (137, +3).

Retailers Adding Stores Since Last Year

- Food chains registered most of the biggest gains over the past year, including: Chipotle (adding 10 locations, from 95 to 105 stores), Wingstop (+9, from 19 to 28), Just Salad (+7, from 22 to 29), Taco Bell (+7, from 68 to 75), Baskin-Robbins (+7, 175 to 182), Chick-fil-a (+5, from 12 to 17), Pizza Hut (+5, from 34 to 39), Van Leeuwen (+4, from 17 to 21), Panera (+4, from 13 to 17), Sweetgreen (+3, from 34 to 37), Paris Baguette (+3, from 23 to 26), and Krispy Kreme (+3, from 10 to 13).

- All four bubble tea shops on our list added stores in 2022, including three by at least 15 percent. That includes Kung Fu Tea (increasing its footprint by 4 stores, from 26 to 30), Gong Cha (+4, from 25 to 29), Tiger Sugar (+2, from 5 to 7), and Vivi’s Bubble Tea (+1, from 25 to 26).

- There were several non-food retailers that added multiple store locations since last year, including: Tumi (+11, from 16 to 27), FedEx Office (+7, from 65 to 72), Target (+4, from 32 to 36), Burlington Coat Factory (+4, from 18 to 22), Victoria’s Secret (+3, from 9 to 12), and Bed Bath & Beyond (+2, from 10 to 12).

Retailers Shedding Stores Since Last Year

- No retailer contracted more than pharmacy chain Duane Reade, which closed 22 stores over the past year, bringing its store total down to 227, from 249 last year.

- Metro by T-Mobile dropped the second-most store locations, closing 16 locations to fall to 295 from 311 last year.

- Two sandwich chains were also among the retailers shedding the most stores: Subway (-15, from 269 to 254) and Pret A Manger (-14, from 62 to 48).

- 7-Eleven was the only other retailer with a double-digit decline in stores over the past year. It reduced its footprint by 11 stores, from 116 to 105.

- Most of the notable year-over-year declines in chain stores were among retailers selling clothing, shoes, accessories, vitamins, and other merchandise, including: Danice Stores (-8, from 18 to 10), Mandee (-7, from 9 to 2), Footaction (-4, from 10 to 6), Vitamin Shoppe (-4, from 29 to 25), Anthropologie (-2, from 6 to 4), Dashing Diva (-2, from 6 to 4), DSW (-2, from 9 to 7), Sally Beauty (-2, from 14 to 12), Kiehl’s (-2, from 10 to 8), Best Buy (-2, from 17 to 15), Carter’s (-2, from 18 to 16), and Party City (-2, from 20 to 18).

- Some other food chains contracted over the past year, including Boston Market (-2, from 17 to 15), Milk Bar (-2, from 9 to 7), 5 Napkin Burger (-2, from 4 to 2), and TGI Fridays (-2, from 4 to 2).

- Three retailers closed all their remaining New York City stores since last year: department store Sears (-2), clothing and accessories store Strawberry (-1), and fast-casual restaurant chain Wichcraft (-1).

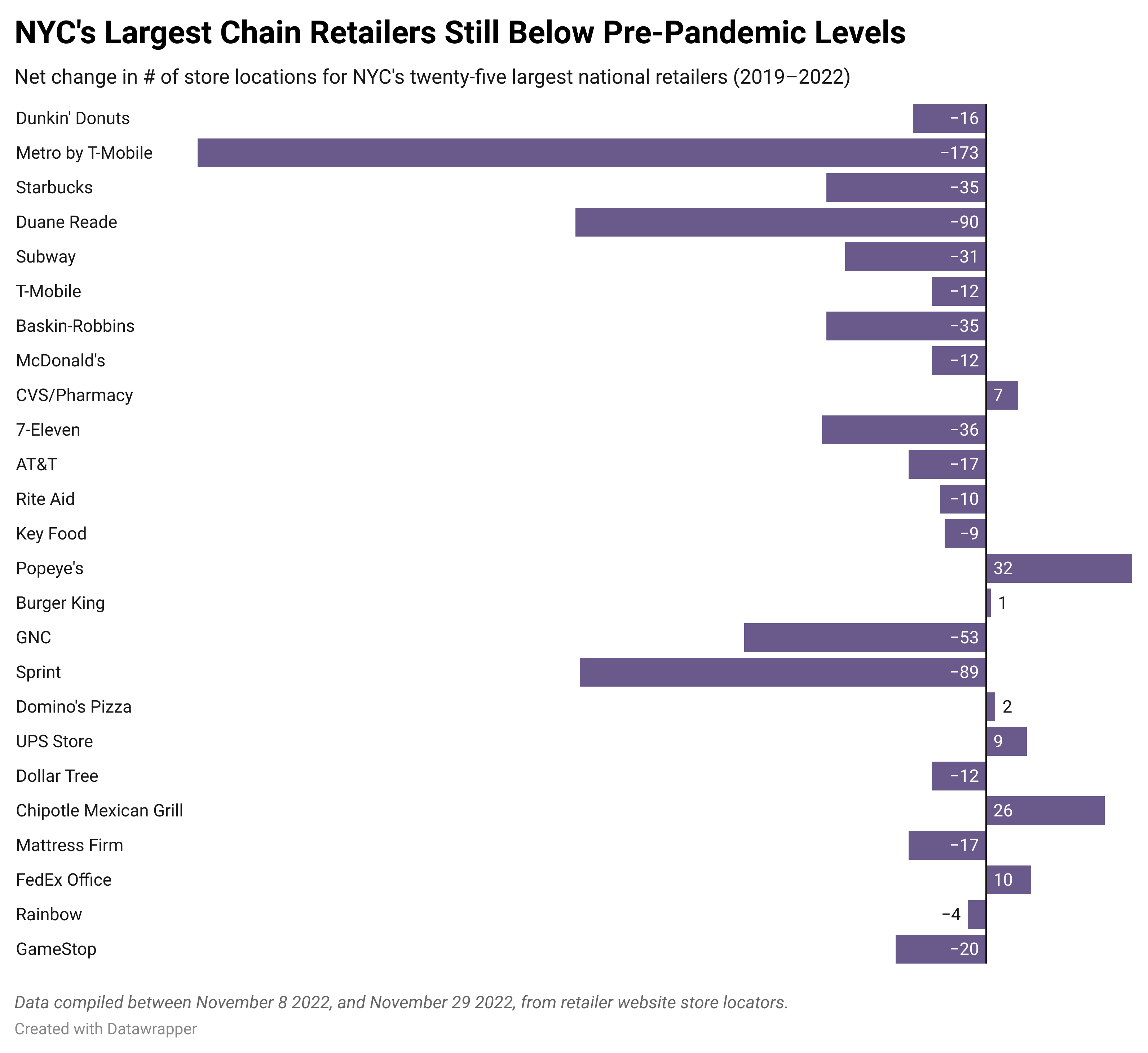

Retailers with Notable Changes Since the Pandemic

A majority of national retailers in our list still have fewer store locations than 2019, but some of the notable contractions since the pandemic include:

- Metro by T-Mobile (-173, from 468 stores in 2019 to 295 in 2022)

- Duane Reade (-90, from 317 to 227)

- GNC (-53, from 99 to 46)

- NY Sports Clubs (-32, from 53 to 21)

- 7-Eleven (-36, from 141 to 105)

- Starbucks (-35, from 351 to 316)

- Baskin-Robbins (-35, from 217 to 182)

- Subway (-33, from 287 to 254)

- GameStop (-20, from 61 to 41)

- Mattress Firm (-17, from 68 to 51)

- AT&T (-17, from 136 to 119)

- Dunkin’ Donuts (-16, from 636 to 620)

- M·A·C Cosmetics (-12, from 34 to 22)

- Dollar Tree (-12, from 84 to 72)

- McDonald’s (-12, from 203 to 191)

- T-Mobile (-12, from 245 to 233)

- Children’s Place (-13, from 35 to 22)

- Aldo (-10, from 24 to 14)

- Victoria’s Secret (-10, from 22 to 12)

- Vitamin Shoppe (-10, from 35 to 25)

- Rite Aid (-10, from 119 to 109)

Several national retailers have bucked the larger trends and added a significant number of stores since 2019, including:

- Popeye’s (+32, from 105 to 137)

- Taco Bell (+35, from 40 to 75)

- Chipotle (+26, from 79 to 105)

- Pizza Hut (+25, from 14 to 39)

- Enterprise (+21, from 25 to 46)

- Wingstop (+18, from 10 to 28)

- Jimmy Jazz (+18, from 26 to 44)2

- Tumi (+14, from 13 to 27)

- Target (+14, from 22 to 36)

- Sweetgreen (+12, from 25 to 37)

- Shake Shack (+11, from 25 to 36)

- Gong Cha (+11, from 18 to 29)

- Foot Locker (+11, from 43 to 54)

Changes Over 15 Years

- 7 of the 10 largest chains from our first ever State of the Chains report (2008) have fewer store locations today than they did then.

- While Dunkin has had a net gain of 279 store locations in those fifteen years (from 341 to 620), the other nine retailers in that original top 10 had a combined decline of 473 stores.

- Two of the original ten largest chains— Radio Shack and Payless—have since shut down all their stores in the five boroughs.

- In that first State of the Chains report, long-since-closed video rental store Blockbuster still had 46 locations in the city.

| Top Ten Chain Retailers in Each Borough | | | | | �

|---|

| Bronx | Brooklyn | Manhattan | Queens | Staten Island |

|---|

| Dunkin' (90) | Dunkin' (136) | Starbucks (191) | Dunkin' (195) | Dunkin' (38) |

| Metro by T-Mobile (69) | Metro by T-Mobile (108) | Dunkin' (161) | Subway and T-Mobile (71) | CVS/Pharmacy (18) |

| T-Mobile (44) | T-Mobile (58) | Duane Reade (96) | Metro by T-Mobile (66) | Subway (16) |

| McDonald's (40) | McDonald's (50) | Subway (84) | Baskin Robbins (61) | Metro by T-Mobile (15) |

| Subway (37) | Duane Reade (48) | CVS/Pharmacy (66) | Duane Reade (54) | Starbucks (14) |

| Popeye's and Baskin-Robbins (26) | Starbucks, Subway, and Popeye's (46) | FedEx Office (58) | Starbucks (49) | Burger King and Carvel (11) |

| Duane Reade (19) | Baskin-Robbins (43) | Chipotle (57) | CVS/Pharmacy (48) | T-Mobile, Duane Reade, 7-Eleven and Verizon (10) |

| Rite Aid (18) | Key Food (35) | UPS Store (51) | McDonald's (45) | Baskin-Robbins (8) |

| Burger King and Domino's (17) | Rite Aid and Burger King (34) | T-Mobile (50) | 7-Eleven (42) | McDonald's, Dollar Tree, and Domino's (7) |

| Stabucks and Rainbow (16) | AT&T (29) | McDonald's (49) | Popeye's and Key Food (37) | Wendy's and Autozone (6) |

Borough Trends

Starbucks has more stores in Manhattan than any other national retailer, with 191 total locations. In all other boroughs, Dunkin’ is the top retailer with 195 locations in Queens, 136 locations in Brooklyn, 90 locations in the Bronx, and 38 locations on Staten Island.

Brooklyn and the Bronx share the same list of top three chain retailers: Dunkin’, Metro by T-Mobile, and T-Mobile. The top three retailers in Queens are Dunkin’, Metro by T-Mobile, and T-Mobile (the same three from 2020). Manhattan’s three biggest retailers are: Starbucks, Dunkin’, and Duane Reade. Finally, Staten Island’s top three are: Dunkin’, Subway, and Metro by T-Mobile.

Zip Code Trends

For the fourth consecutive year in our study, zip code 10001, home to Hudson Yards and the area around Penn Station, claims the top spot for chain store locations with 189 stores. The area saw an increase of six stores, rising 3.3 percent from 183 stores in 2021 to 189 stores in 2022. In second place for the third year in a row was zip code 10314 (New Springville), home to the Staten Island Mall, with 161 stores (increasing from 160 in 2021), and a full 35.2 percent of the total store locations located on Staten Island. Coming in third was 11201 (Downtown Brooklyn), remaining Brooklyn’s most dense zip code for chain retailers with 155 store locations, an increase of 3.3 percent from 150 in 2021. The zip code with the fourth-most chain store locations was 10019 (Mid-town West) at 148, just surpassing zip code 10003 (East Village), which had previously ranked fourth in 2021. 10003 saw a decline of 7 chain locations (-4.9 percent), as it dropped from 143 to 136.

In Queens, 11373 (Elmhurst), home to the Queens Center Mall, was the top zip code for chain retailer locations with 128 stores (up from 125 in 2021). In the Bronx, zip code 10475 (Baychester / Co-op City), home of the Bay Plaza Shopping Center, has the highest number of chain stores of any zip code in that borough with 89. 11373 (Elmhurst) saw a year-over-year increase of 3 locations (+2.4 percent), while 10475 had a year- over-year decrease of 1 location (-1.1 percent).

After last year’s study, 2022 saw much less growth per zip code. In 2021, 103 zip codes (47 percent) saw an increase in the number of chain store locations and 18 different zip codes saw growth in chain store locations of 15 percent or higher. This year, 67 zip codes (30.5 percent) saw an increase in the number of chain store locations, only five zip codes saw growth of 15 percent or more, and just four zip codes added more than 5 chain store locations. 64 zip codes (29.1 percent) saw a decrease, while the remaining 89 of the city’s zip codes (40.5 percent) maintained their 2021 numbers.

| Where the Change is Occuring | | | | | | | | �

|---|

| The largest national retailers have locations all over the city. The following shows where the ten largest retailers added locations or contracted over the past year. For example, the number of Dunkin’ locations increased by 5 stores citywide since last year, including a net decrease of two stores in Brooklyn and a net increase of four stores in Queens, two in the Bronx, one in Manhattan, and zero on Staten Island. | | | | | | | | �

|---|

| Retailer | Number of Stores, 2022 | Difference, 2021-22 | Brooklyn | Bronx | Queens | Manhattan | Staten Island |

|---|

| Dunkin' | 620 | 5 | -2 | 2 | 4 | 1 | 0 |

| Starbucks | 316 | 6 | -1 | 0 | 1 | 4 | 2 |

| Metro by T-Mobile | 295 | -16 | 1 | -4 | -9 | -4 | 0 |

| Subway | 254 | -15 | -1 | -4 | 0 | -8 | -2 |

| T-Mobile | 233 | -8 | -2 | -2 | -2 | -2 | 0 |

| Duane Reade | 227 | -22 | -4 | -8 | -3 | -7 | 0 |

| McDonald's | 191 | 0 | 0 | 0 | 0 | 0 | 0 |

| Baskin-Robbins | 182 | 7 | 24 | -7 | -1 | -5 | -4 |

| CVS/Pharmacy | 174 | -1 | -1 | 1 | -1 | 1 | -1 |

| Popeye's | 137 | 3 | -3 | 0 | 3 | 3 | 0 |

The largest increase was in the 10007 (Lower Manhattan / TriBeCa) zip code, where seven stores (+9.5 percent) were added in 2022. Following 10007 were 10016 (Murray Hill, +6.3 percent), ) 11234 (Flatlands, +4.7 percent), and 10001 (Garment District / Koreatown, +3.3 percent), adding six locations each. Tied for fifth place, 11430 (JFK Airport, +13.5 percent), 11226 (East Flatbush / Flatbush, +7.2 percent), and 11201 (Brooklyn Heights, +3.3 percent), each added five locations.

Of the 67 zip codes that saw a year-over-year increase from 2021 to 2022, 21 zip codes (31.3 per- cent) were located within Brooklyn. Queens just barely surpassed Manhattan, historically the leading borough in this statistic, with 20 zip codes seeing gains (29.9 percent), while Manhattan followed with 19 (28.3 percent), far less than the borough’s 33 such zip codes in 2021. In the Bronx, four zip codes (6 percent) saw increases in chain store locations, while Staten Island had 3 (4.5 percent).

Of all national retailer locations in New York City, 36.3 percent are located within Manhattan, a plurality that has held since the beginning of the State of the Chains reports. Queens ranks second with 22.7 percent, followed closely by Brooklyn which contains 22.2 percent of total chain store locations in the five boroughs. The Bronx contains 12.5 percent and 6.2 percent are in Staten Island.

Manhattan continued to rank the borough with the highest concentration of chain store locations, with 116 locations per square mile in 2022, far beyond that of the other boroughs. There are 22.9 chains per square mile in Brooklyn, 21.7 per square mile in the Bronx, 15.3 per square mile in Queens, and 7.8 per square mile on Staten Island. Overall there are 24.1 chain stores per square mile across NYC, up from 23.6 last year.

Click here to read the full report and view our comprehensive rankings of national chains in New York City by their number of store locations, the number of store locations in each zip code, zip codes with the most and least number of chains, and zip codes with the most and least number of chains by borough.

Notes

- This analysis includes retailers that registered an increase or decrease of 10 percent or more and had a net change of at least 2 stores.

- Jimmy Jazz was acquired by German brand Snipes in 2021, and the growth of Jimmy Jazz stores reflects the footprint of the combined company.