Today Mayor DeBlasio announced a projected $9 billion revenue shortfall in the city's budget.

This has to be made up by a combination of budget cuts and revenue increases (and history has shown us the shortfalls have usually been underestimated - just a month or so ago the estimate was $7.4 billion). He's currently threatening cutting 22,000 jobs, but we know there will be pushback on that. The only place I know the City can raise significant revenue without needing State approval is by increasing Real Estate Taxes. Current revenue from those is about $30.8 billion:

brandondonnelly.com

If in the end half of the shortfall ends up being made up by increasing RET that would indicate about a 15% increase. As the projected deficit increases, so would that increase.

brandondonnelly.com

If in the end half of the shortfall ends up being made up by increasing RET that would indicate about a 15% increase. As the projected deficit increases, so would that increase.

NYC may fire 22,000 city workers to make up for massive revenue shortfall: Mayor de Blasio

The city may have to let go as many as 22,000 employees in order to make up for staggering revenue shortfalls, Mayor de Blasio said Wednesday. “We have to talk about the last resort. The last…

www.nydailynews.com

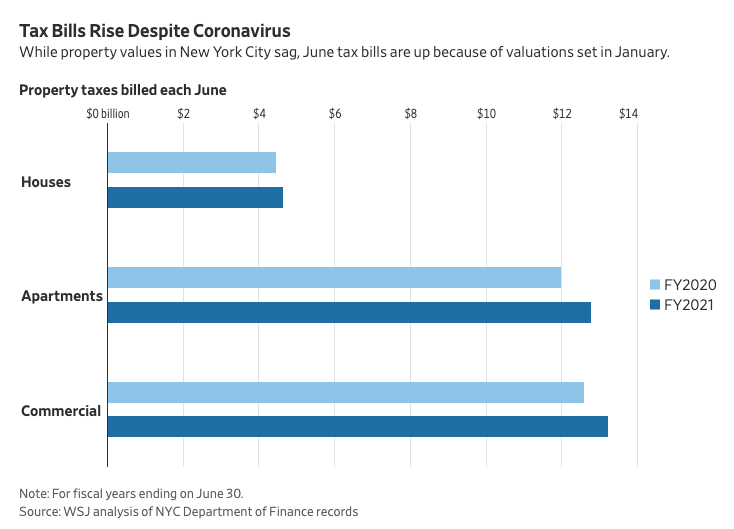

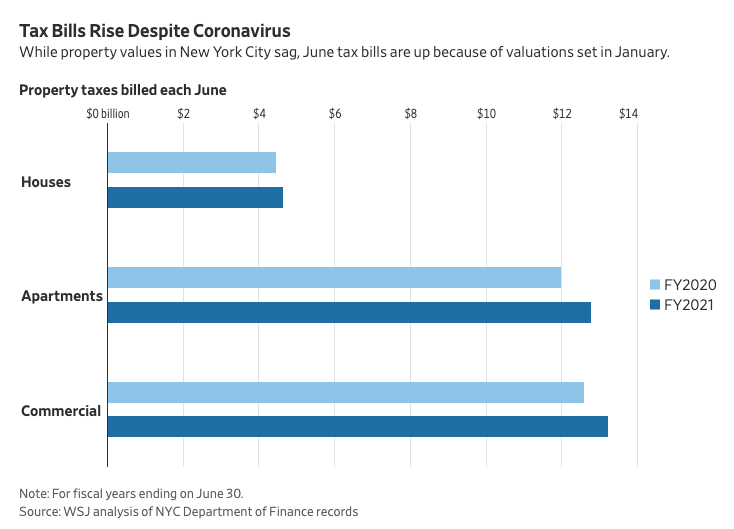

This has to be made up by a combination of budget cuts and revenue increases (and history has shown us the shortfalls have usually been underestimated - just a month or so ago the estimate was $7.4 billion). He's currently threatening cutting 22,000 jobs, but we know there will be pushback on that. The only place I know the City can raise significant revenue without needing State approval is by increasing Real Estate Taxes. Current revenue from those is about $30.8 billion:

New York City is budgeting $30.8 billion in property tax collections

According to the WSJ, New York City is budgeting to collect $30.8 billion in property taxes for fiscal year 2021. These tax bills will go out on June 1 and payments will start becoming due on July …

brandondonnelly.com

brandondonnelly.com