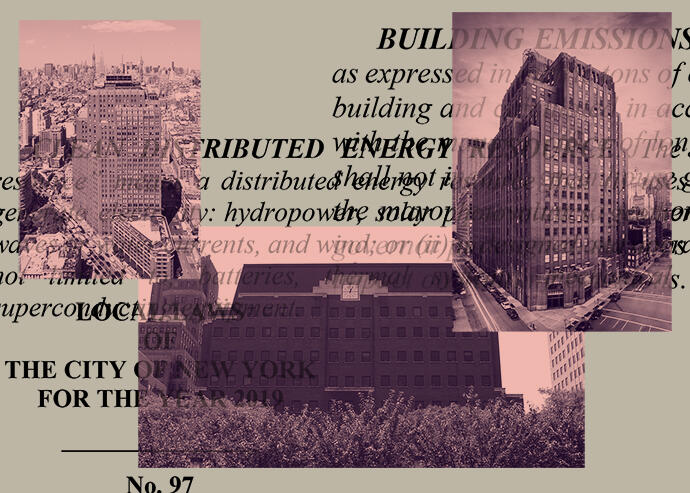

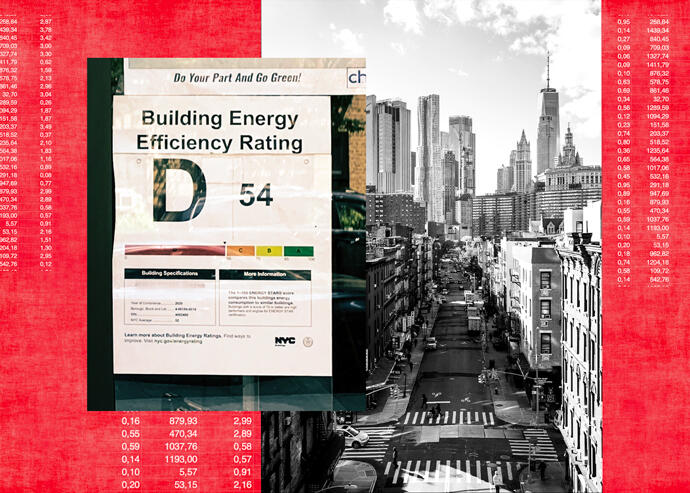

The first round of emission caps for Local Law 97 takes effect in 2024. Here are the ways to meet its terms and avoid fines.

therealdeal.com

How to comply with looming emissions law? “Start yesterday”

Some building owners have only two years before Local Law 97 kicks in

It’s still two years before landlords of most buildings exceeding 25,000 square feet need to slash emissions. But experts say to avoid fines, they should have already started.

Multifamily owners in particular.

Apartment buildings make up the bulk of properties affected by the measure,

Local Law 97. They use more energy than any other sector and most of it comes from natural gas, the Urban Green Council

reported.

The good news for their owners is the 2024 cap only applies to the worst offenders, or about 3,000 properties citywide. Those buildings are more likely to be mid-sized, between 25,000 and 50,000 square feet, and be packed with tenants.

“About 80 percent of the buildings of any one type should [be able to] comply without having to do a lot of work,” said Gina Bocra, chief sustainability officer for the city’s Department of Buildings.

But that’s not 100 percent, and steeper limits coming in 2030 will hit three out of four buildings.

Given supply chain challenges and labor shortages, and an expected surge in demand for contractors as the first deadline nears, experts are adamant as to when landlords should begin planning retrofits: yesterday.

“When I talk to building owners, I want them to be aware that there are no magic beans like Jack used for the beanstalk to make a building efficient,” said Jimmy Carchietta, founder of the Cotocon Group, a sustainable engineering firm that helps owners meet efficiency standards.

Retrofits can be time-intensive, expensive and complicated. But there are steps that owners can take to understand their building’s carbon output, where they can cut emissions, and how to get the biggest bang for their buck.

Step one: Know your building

“Buildings are all different, just like people,” said Carchietta. Deciding what to upgrade requires knowing what, specifically, is producing emissions, he said.

Is the building old? Is it sufficiently insulated? Are the windows single-paned? Are systems in place to regulate energy use?

Assessing such variables and more is a monster project for owners with businesses to run and tenants to tend to. The logical choice is to outsource that work. There are a few options.

Bocra recommends turning first to the New York City

Accelerator, a free service that can tell owners what their building emits, what near-term retrofits will lower that output and what longer-term options can get them under the looming caps.

“For many buildings, [the city] already has very specific information about that building at its fingertips,” Bocra said. The Accelerator can pull up specs on a building’s age, energy systems and energy audit report — tools it can use to recommend projects.

The Accelerator can also connect landlords with a contractor and financing options, such as the

Property Assessed Clean Energy program.

PACE can cover up to 100 percent of upgrades through a loan that is paid back in installments tacked on to property tax payments.

The state’s

Flexible Technical Assistance program covers half of the cost of an energy study on any multifamily building that pays into Con Edison’s System Benefits Charge, a fee included on electricity bills.

Various private options provide the same services. They are not free, but using them means owners need not divulge the entirety of their buildings’ energy usage to the city.

Carchietta’s

firm produces building-specific energy models that evaluate the greenhouse gases released by lighting, energy systems and leaky envelopes, then recommends the most cost-effective changes.

“Before you spend $3 million on a boiler investment, it’s probably more advantageous to go spend 2 percent of that cost to first evaluate your building through an energy model,” Carchietta said.

And though neither Bocra nor Carchietta recommends owners go it alone, there are free energy modeling products such as

eQuest, a tool developed by the U.S. Department of Energy that allows owners to determine emissions by entering their building’s specifications.

Step two: Start small if you can

Equipped with a holistic understanding of their buildings’ emissions, owners not in the worst 20 percent of offenders can prioritize retrofits, starting with smaller fixes and budgeting for bigger upgrades needed to meet the 2030 limits.

https://eb2.3lift.com/pass?tl_click...20&bcud=3376&sid=18819&ts=1644374895&cb=55226

The three main areas that an owner can upgrade are lighting, HVAC systems and building envelope, Carchietta said. Lighting is the cheapest.

“If you want to implement a low-cost measure that is going to give you a big return relatively fast, that comes from the lighting system,” he said.

For most owners that means replacing inefficient fluorescents or energy-sucking incandescent bulbs with LEDs.

Installing LEDs can cost $90 to $250 per fixture, plus $75 an hour for labor, according to home management platform

ThumbTack. Owners pressed for money can opt for lighting that is better (fluorescent, a 75 percent improvement over incandescent) instead of the best (LED, 90 percent more efficient and far brighter).

Owners who opt for LEDs should reduce their overall wattage or tell their tenants to “make sure to wear sunglasses,” Charchietta joked.

Lighting retrofits pay for themselves in just three years, on average, according to data from the city.

Installing thermostat controls is another low-cost option. Systems that better regulate tenants’ energy usage to combat waste pay for themselves in two or three years.

Step three: Go big if in bad shape

If a landlord undergoes energy modeling and finds his building among the worst 20 percent of offenders, it is time to consider major capital improvements, Carchietta said.

Buildings heated by gas and cooled via window ACs, for example, should consider a heat pump, an electric alternative that regulates heating and cooling.

The upgrade will run an owner about $10,000 per unit, Banker & Tradesman

calculated, twice what a standard boiler might cost. But there’s money out there to help.

In addition to PACE loans, the state agency NYSERDA, National Grid and Con Edison all offer incentives for energy-efficiency upgrades.

The

state will cover up to $1,500 per unit for upgrades that cut energy use by 35 percent or more. National Grid offers

rebates of up to $1,000 on high-efficiency gas boilers — not as efficient as a heat pump, but far better than an old boiler.

And the

Con Edison Commercial and Industrial Energy Efficiency program gives owners rebates for installing efficient equipment, such as lighting and HVAC systems. Some incentives cover up to 50 percent of a project’s cost, with a cap of $1 million for electricity upgrades and $250,000 if the project targets gas.

Owners of buildings in better shape should replace old boilers over the next eight years, before their heating system fails.

Ann Korchak, a landlord and member of the group Small Property Owners of New York, said when her building’s system went kaput, she paid about $10,000 to use a temporary boiler for two weeks.

“The cost of adding these electric water heaters was not much more than that,” she said.

Electric water heaters are a step up from gas boilers but a more wasteful option than heat pumps, which cost more up front.

Step four: Beware the leaky building

Carchietta warns that some upgrades are undermined if the building’s exterior is unsound.

“Let’s say you’re going to put in whole new LED lighting or a new heat pump. That sounds great,” he said. “But if you don’t have good windows or an insulated outer shell, that’s a problem, because that’s what holds all that energy in.”

Among upgrade options, envelope work is the priciest. Swapping out single-pane windows for double-pane can cost $700 per window, not including installation, according to

Modernize, a home improvement tool.

Facade work is also expensive. A state-sponsored retrofit of a 2,500-square-foot multifamily building that installed insulated panels on exterior walls ran over $100,000. Now consider that the buildings needing retrofits for the 2024 emissions caps are 10 times larger.

And the payback takes a while. Owners can expect to make their money back on envelope investments in 14 years, on average.

For that reason, Carchietta recommends looking at HVAC upgrades in tandem with envelope work.

“Maybe I don’t need $10 million windows. Maybe I could go with the $5 million package because another change that I’m making is going to complement the other,” Carchietta said.

Is it worth it?

Some buildings may need such extensive work that they will be unable to meet the city’s requirements.

“You can only do so much,” Carchietta said.

In those instances, the watchdog group

Citizens Budget Commission warned, owners may just eat the fines. They can buy greenhouse-gas offsets created by projects like tree-planting, but can only use them to wipe out 10 percent of a building’s emissions.

However, Carchietta said most building owners are better off spending on retrofits than risking annual fines. The budget watchdog calculated that penalties in 2030 could average about $1 per square foot across building classes.

Market-rate owners might be able to pass the costs of upgrading along to tenants through rent hikes. Affordable housing providers and owners of rent-stabilized units, who don’t have that option, have less stringent benchmarks to meet.

Landlords of buildings where more than 35 percent of the units are regulated, can avoid fines in 2024 by hitting a number of checkpoints, such as installing temperature controls and weatherizing windows. Income-restricted housing has until 2035 to meet emissions limits.

What’s the state got to do with it?

The emissions benefits of building electrification could be limited if New York state fails to meet its targets for a carbon-free electric grid.

The city leans

heavily on fossil fuels to generate electricity. In 2019, the state mandated that by 2040, all of New York’s energy must stem from renewable sources or nuclear energy. In 2020, those sources made up

60 percent of New York’s in-state energy generation.

New York City’s problem is that renewable sources such as hydropower plants and solar farms are concentrated

upstate, with limited means to carry their energy south.

Bocra worries that some owners might forgo improvements. “Some owners might say, ‘The state has already taken care of this, the grid is going to be clean and I don’t have to do anything,’” she said.

Bocra stressed that owners must switch from gas-powered systems to electric so their building can harness that cleaner power promised by the state and meet the city’s benchmarks.

The city is obliged to release more rules for owners to comply with Local Law 97 by the end of the year, she said, though the Adams administration hopes to unveil them much sooner.

“We all need to be planning to make every building based on an electric grid and a much cleaner one in New York City,” Bocra said.

ny.curbed.com

ny.curbed.com