The industry is drawing workers while nearly every other job sector has struggled with hiring. As few as 10 percent of them will last long enough to make a full-time living selling homes.

www.nytimes.com

Why So Many People Became Real Estate Agents in the Pandemic

The industry is drawing workers while nearly every other job sector has struggled with hiring. As few as 10 percent of them will last long enough to make a full-time living selling homes.

In March 2020 when the pandemic hit, the restaurant where Amy Bieganek was working as a waitress announced a temporary closure. By August, it turned into a permanent one.

Unemployment was a shock for Ms. Bieganek, 53, who had been working in the Minneapolis restaurant industry for 30 years. “That was heartbreaking,” she said. “Being in the restaurant industry, I never thought I would be out of a job ever.”

She thought it might be time to explore a new career.

After talking to a friend who is a real estate agent, Ms. Bieganek signed up for classes. In February 2021 she got her real estate license.

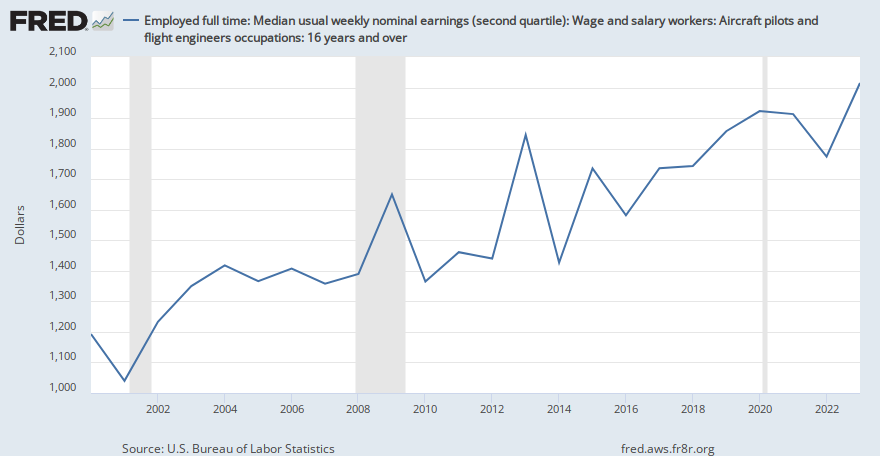

From burned-out health care workers to parents looking for flexible careers during remote schooling to laid-off sales executives taking their skills to cash in on a booming market, real estate has drawn an abundance of workers while nearly every other industry has struggled with hiring. In 2021, there were a record number of real estate agents in the United States, according to the National Association of Realtors. More than 156,000 people joined their ranks in 2021 and 2020 combined — nearly 60 percent more than did in the two years prior.

“At a time when there’s a worker shortage everywhere it seems, there’s almost a surplus of people coming to real estate,” said Lawrence Yun, the chief economist for the Realtors’ association. “What’s amazing is we keep hitting new high after new high.”

Where Are People Getting Real Estate Licenses?

A record number of real estate licenses were issued between Jan. 2021 and Jan. 2022, according to the National Association of Realtors.

And many more will likely join their ranks this year. According to Google search trends, the top job-related search between January 2021 and January 2022 was “how to become a real estate agent.”

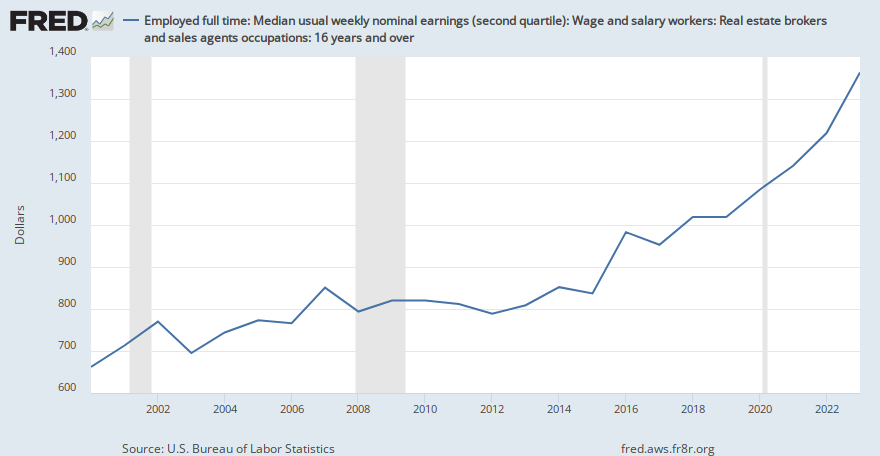

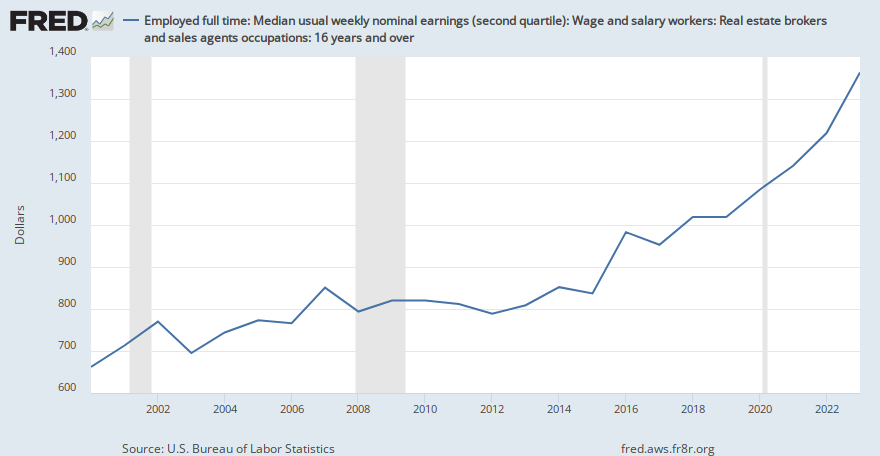

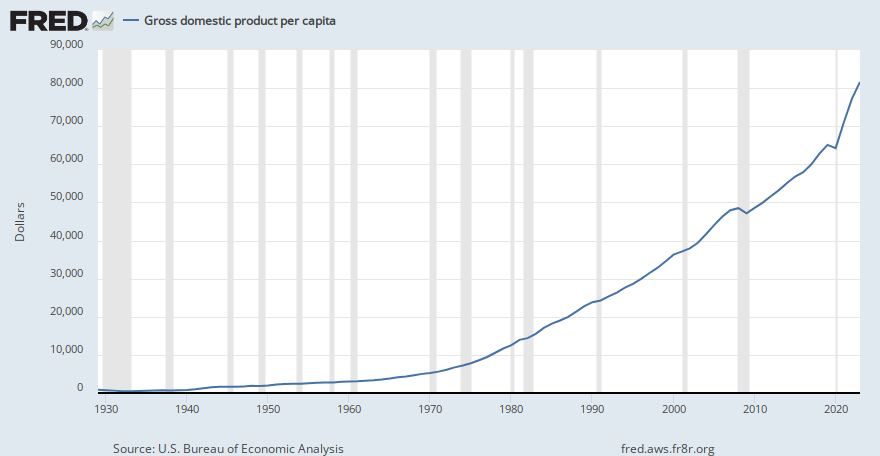

In a commission-based industry, record high prices are a powerful lure. The median home

now sells for $408,000 — up 13.7 percent from a year ago. Agents aren’t typically salaried but get paid a 2 to 3 percent commission on the price of a home when they represent buyers or sellers. As much as half of that can go to their brokerage firm and to pay for marketing fees.

“Even in the middle of the pandemic, you talk to almost any Realtor and they’ll tell you 2021 was their best year ever,” said Maggie Gwin, a Los Angeles-based agent with Sotheby’s.

Ms. Gwin is also an actress who says her biggest break yet was on the horizon in 2020 — a role in the Will Smith film “King Richard.” But Covid restrictions pushed shooting back multiple times and then, when filming finally resumed, her role was cut. Selling homes seemed like a job that could offer her the flexibility to continue auditioning and to support her family — even as the pandemic slowed other industries down. “Real estate made so much sense,” said Ms. Gwin.

When the market looked like it was coming to a standstill

at the beginning of the pandemic, Redfin, the Seattle-based brokerage with branches nationwide, furloughed about a third of its more than 3,000 agents, said Glenn Kelman, the chief executive of the firm. (Unlike most brokerages, Redfin pays their agents a salary with benefits, in addition to commission — making them costly to keep on staff during market lulls).

By May 2020,

when the market picked up, the company started bringing furloughed employees back and more were recruited, “it was a nonstop hiring frenzy,” said Mary Gallagher, a senior director of recruitment for the company.

In 2022, she said Redfin is taking it “week to week” to monitor the market and see if hiring should continue at the same pace.

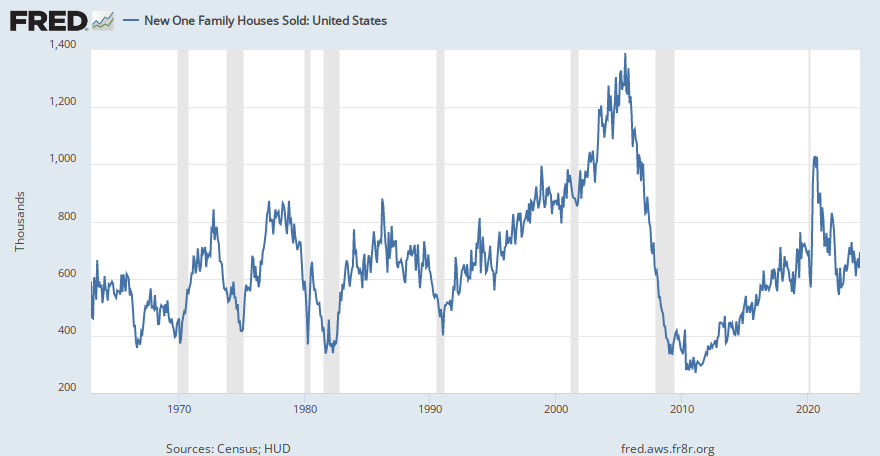

Historically, the number of agents tends to grow in boom markets. In 2005 and 2006 — the frenzied years leading up to the market collapse in 2007 — more than 250,000 people became agents. In 2008, after the market crashed, the ranks of real estate agents declined by more than 10 percent, according to data from the Realtors’ association.

But, unlike during previous booms, the number of homes for sale today is at a record low. In December, there were 910,000 homes on the market, down 14 percent from a year prior. That same month, the association said its membership hit a record high of more than 1.5 million.

Carolyn Lee, a new Redfin agent based outside Seattle, said she trudged through a snowstorm with clients in January to see a home that just hit the market. They made an offer on the home and got it — beating out six other offers. “You have to be willing to do what it takes, especially right now,” she said.

Though she’s putting in long hours getting her real estate career going, in many ways it’s less stressful than her previous job, she said.

Two years ago, she was logging 60-hour weeks as the manager of a health care clinic where she oversaw Covid testing during shortages of personal protective equipment and high death rates from the virus.

By last summer, after vaccines rolled out and the worst of the crisis seemed past, “a lot of people started to have these conversations like, ‘What do you want do with your life?’” she said. One day, a Redfin alert popped up on a job website offering agent training in the company’s career accelerator program, which targets potential new agents from outside the industry.

Ms. Lee, 40, jumped at the opportunity to try something new. “I think I’m well suited to this,” she said. “As a clinic manager you have to be ready at any moment and do well under pressure.”

Ms. Bieganek, in Minneapolis, and Ms. Gwin, in Los Angeles, say their previous careers have also prepared them for selling homes. Ms. Bieganek, who invested about $3,000 in training and multiple listing service fees to get started, described real estate as just another a hospitality-based job where a service mentality is key. “I have a good sense of how to adapt to people from being at a restaurant and being a bartender,” she said.

ADVERTISEMENT

Ms. Gwin is starting by working with a mentor from her brokerage to build up a client base. “They say you gotta build a thick skin for rejection,” which her decades as an actress have well prepared her for. “I eat rejection for breakfast.”

Real estate also is appealing in part because of its relatively low barrier to entry, said Ken H. Johnson, a professor at Florida Atlantic University who specializes in real estate economics. Training typically takes two or three months and costs just a couple hundred dollars, though brokerage and multiple listing service fees can cost a few thousand dollars more.

But making a real living doing it is harder. Mr. Johnson, who shifted to academia after 12 years as an agent himself, estimates that as few as one in 10 agents survive long enough to make a full-time living selling homes. “It’s a really empowering feeling to be your own boss,’” he said. “But it’s usually around a year where you look around and realize, ‘I can’t do this.’” Income is typically entirely based on commission, and expenses for marketing and brokerage fees can be high.

Most new agents start out by working with buyers — typically friends or family. Listings are harder to get, but are the key to making a good living — particularly in a market that highly favors sellers, said Mr. Johnson. “Brokers who focus more on listing property as opposed to selling property to people make more money on average,” he said.

Many newbies juggle real estate with other work. Ricardo Cooper, who lives in Washington, D.C., helps run a nonprofit and works as a pandemic contact tracer for the District of Columbia. In October 2020, he also started selling homes. “Real estate, it’s your own business. You can control the time you put into it,” said Mr. Cooper, 32. So far he’s worked mostly with buyers, closing on six home purchases in his first year.

“Helping people makes me happy,” he said.

With real estate, “I’m helping families create generational wealth, specifically African-American families and young people,” Mr. Cooper said, adding, “With my nonprofit I support low income families and youth.”

Like Mr. Cooper, many new agents are holding onto their old professions. Ms. Bieganek said she’s still waitressing at a restaurant two or three nights a week, but hopes to transition to real estate full time in a few years. Ms. Gwin said she continues to audition for roles. For her, it’s more of a companion to her creative work. (Her email signature says “actress/realtor.”)

Others are going all-in. Isaac Teplinsky, 25, graduated from the University of Kansas in 2019 and moved to New York City to work in experiential marketing. He was just four months into the job when the pandemic hit. He flew back to visit his parents in Minnesota for what he thought might be a week or so. A few days later he was laid off from his job, along with about half of his company.

While living with his parents that summer and contemplating his next career move, he started watching the show, “Million Dollar Listing New York,” and read a book written by one of its stars, Ryan Serhant. He also watched YouTube videos on getting into real estate. “I was taking notes,” he said. “And at a certain point I was like, ‘this is 100 percent it.’”

He spent $800 on a Kaplan real estate course, got his license last spring and joined a local branch of Coldwell Banker in April of 2021. He said his father told him to think of his first three years like law school — an investment in an education without an immediate payoff. “But if you just keep going it will pay off like it would for a doctor or someone in grad school,” he said. He’s since sold seven houses and condos and has handled several rentals, hitting his goal of $1.5 million in sales in his first six months.

Mike Mogavero, a 54-year-old Austin-based agent with Compass, said he was making more than he expected within his first year. When the pandemic hit, he was working remotely in sales for a Silicon Valley-based tech company and his job shifted from a staff position to a contract job. With his children, now 10 and 17, attending school remotely and his wife’s job as an architect busy as ever, he decided to take some time off to figure out his next move. “I looked around for other jobs and people kept saying I was quote-unquote overqualified, which to me is a little like a code word for ageism,” he said.

After stumbling on a Groupon for real estate training, Mr. Mogavero signed up and got his license in 2020. His timing was fortuitous. Austin’s home prices rose nearly 40 percent between 2020 and 2021, making it one of the hottest markets in the country. Buyers were flooding in from California, where he’d grown up and spent most of his life and career before moving to Austin in 2013. He said he did $30.8 million in sales in 2021. “The amount of satisfaction you got from selling technology to helping people buy and sell real estate is vastly different,” he said.

Some new agents say the pandemic prompted them to pivot and turn a strong interest in real estate into a career. Frankie Norstad grew up in and out of foster care until she was 13, living in dozens of different houses and, at times, facing housing insecurity. “It sort of tumble weeded into me obsessing about real estate,” she said, especially after seeing her adoptive grandparents retire comfortably, despite their modest income, because they owned a plot of land north of San Francisco .

As an adult, Ms. Norstad, now 39, worked as a photographer, but often spent her free time helping friends find houses by scouring listings online or encouraging them to buy homes as a path to financial security. In 2017, her husband sold a TV pilot, and she convinced him to buy a 760-square-foot bungalow in Los Angeles. “Putting money into that equity, that’s how you retire and stay safe and breathe a little easier,” said Ms. Norstad, who has two young children.

During the pandemic, she finally decided to pursue her passion. Encouraged by her own real estate agent, she got her license and signed with Sotheby’s.

“My target market is my friends who don’t think they can buy a house,” Ms. Norstad said. “People who told themselves, ‘This is impossible.’”