I don't think that's right. We are already in the mid to high 4s in mortgage rates. If the Fed raises rates another 4% I find it hard to conceive mortgages only go up 75bps to 125bps.5.5-6%? I think we got a few intra meeting fed hikes coming. 4% 10yr on way? Equities in this environment?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How long can the Fed whistle past the "There is no inflation" graveyard before raising rates?

- Thread starter David Goldsmith

- Start date

I think it’d push mortgages to 5-6%. As the forward curve currently stands, resets on ARMs over the next 5 years are looking to come in at 5-6%. With FFR at 4-5%, that’d make resets come in at 6-8%. Either way, a far cry from the 2.x% ARMs and fixed rates people were using as recently as 6 months ago as the basis for their purchases.If he is right (and it's hard for me to argue against it since I've been feeding this thread for a year and a half) where does that push mortgage rates to and what is the impact on Real Estate?

You have to remember the market is already expecting the Fed to raise ~3% from here as it stands by 2023. So the Summers view would “only” be another 75bps to 175bps atop that.I don't think that's right. We are already in the mid to high 4s in mortgage rates. If the Fed raises rates another 4% I find it hard to conceive mortgages only go up 75bps to 125bps.

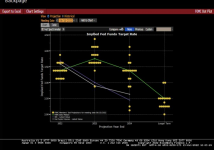

Absent direct Fed intervention in the MBS market, 30yr fixed mortgages have tended to set at the 10yr treasury rate plus ~2%. Right now, the forward yield curve is very flat a year out. So the 10yr treasury yield is ~2.5% and 30yr fixed is ~4.5%.

If the Summers view is applied, then FFR in 2023 should become 4-5%. But I don’t believe he thinks it needs to stay there for 10 years. Rather, after a few years, it can normalize to what economists consider a neutral stance at 2.x%. So that means 10yr treasuries at 3-4%, and hence my guess of 5-6% for 30yr fixed mortgages.

Of course, this whole episode could shift the market’s notions of “neutral stance”. The Fed will be working down the $9T balance sheet it had been accumulating over the past 14 years. As the shocks of inflation-fighting ripple through these upcoming years, somehow I don’t think the Fed is going to be as trigger-happy with QE as it has in the past, having seen a demonstration that they can indeed take it too far.

At this point I don't have much faith in Fed jawboning, but if somehow they both stop buying MBS and actually "run off" their existing MBS holdings, I don't see enough money in the mortgage market. From what I've been hearing from bankers, at this point their interest in lending their own money won't even start until mortgage rates hit 6%

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SEDWTPY7BZPJJFLX4SQ42FMMAI.jpg)

www.reuters.com

F

www.reuters.com

F

Fed's balance sheet runoff will be rapid, Brainard says

Federal Reserve Governor Lael Brainard on Tuesday said she expects a combination of interest rate increases and a rapid balance sheet runoff to bring U.S. monetary policy to a "more neutral position" later this year, with further tightening to follow as needed.

The Fed on Wednesday releases minutes of its March meeting that are expected to provide fresh details on its plans to reduce its bond holdings, and Brainard's remarks provided a bit of a preview.

"I think we can all absolutely agree inflation is too high and bringing inflation down is of paramount importance," Brainard said at a conference at the Minneapolis Fed.

The rapid portfolio reductions "will contribute to monetary policy tightening over and above the expected increases in the policy rate reflected in market pricing and the Committee’s Summary of Economic Projections," she said.

The hawkish tone from one of the Fed's usually more dovish policymakers sent stocks down and Treasury yields up to multi-year highs, as investors digested the implications of a more aggressive policy path.

Investors are concerned by "the speed and aggressiveness of the Fed with its balance sheet reductions," said CFRA Research's Sam Stovall.

The Fed raised rates last month for the first time in three years, and released projections showing most policymakers thought the policy rate would end the year at least in the range of 1.75%-2%, if not higher. That would require quarter-point rate increases at all six remaining Fed meeting this year.

Markets see the Fed moving faster, delivering half-point rate hikes in May, June and July, to bring the rate to 2.5%-2.75% by the end of this year. Most policymakers view 2.4% as a "neutral" level, above which borrowing costs start to reduce growth.

"Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19," Brainard said.

Back then, the Fed began by limiting runoff from its $4.5 trillion balance sheet to $10 billion a month, and took a year to ramp that up to a maximum of $50 billion a month. Analysts expect a pace about twice that this time around.

The Fed targets 2% inflation, as measured by the personal consumption expenditures price index. In February the PCE price index was up 6.4% from a year earlier, and Brainard said she sees risks of it rising further, as Russia's invasion of Ukraine pushes up gas and food prices, and COVID lockdowns in China worsen supply chain bottlenecks.

Report ad

And though the geopolitical events could pose risks to growth, she noted, the U.S economy has considerable momentum and the labor market is strong, with unemployment now at 3.6%, just a hair above its pre-pandemic level.

The Fed's signaling on policy has already tightened financial conditions, Brainard said, with mortgage rates up a full percentage point in the past few months.

"We are prepared to take stronger action" if warranted by readings on inflation or inflation expectations, Brainard said, adding that she would also be watching the yield curve for any signs of downside risks to the economy.

It was unclear from Brainard's remarks whether she feels a rapid portfolio runoff would render bigger-than-usual rate hikes unnecessary.

Kansas City Fed President Esther George, who also supports a faster balance sheet runoff, left that door open.

"I think 50 basis points is going to be an option that we’ll have to consider, along with other things," George told Bloomberg TV on Tuesday.

If the Fed does raise rates as fast as markets now predict, that would mark at least for a few months the fastest pace of policy tightening in decades.

Fed Chair Jerome Powell says he believes the Fed can manage a "soft landing," where the central bank raises borrowing costs enough to slow the economy and bring inflation down, but not enough to send unemployment surging or push the economy into recession.

Economists say that will be difficult, if not impossible: in a recent paper Harvard University's Larry Summers noted that since 1955 there has never been a time when wage growth exceeded 5% and the unemployment rate was below 5% that was not followed within two years by a recession.

Hourly wages for non-managerial employees rose 6.7% from a year earlier in each of January, February and March, Labor Department data show.

Fed officials argue however that past is not necessarily prelude. For one thing, workers are already coming off the labor market sidelines as the pandemic eases, and more of that trend could ease wage pressures.

For another, the United States is a net oil exporter, so rising energy prices won't slow the economy as much as they did in the 1970s, making stagflation less likely.

"I'm not expecting that we'll fall into recession," San Francisco Fed Bank President Mary Daly told a meeting of the Native American Finance Officers Association in Seattle.

As the Fed tightens policy to fight inflation, she said, "we could slow so it looks like we are teetering close to it, that's possible, but it will be a short-lived event I expect, and then we'll be back up."

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SEDWTPY7BZPJJFLX4SQ42FMMAI.jpg)

Fed's balance sheet runoff will be rapid, Brainard says

Federal Reserve Governor Lael Brainard on Tuesday said she expects a combination of interest rate increases and a rapid balance sheet runoff to bring U.S. monetary policy to a "more neutral position" later this year, with further tightening to follow as needed.

Fed's balance sheet runoff will be rapid, Brainard says

Federal Reserve Governor Lael Brainard on Tuesday said she expects a combination of interest rate increases and a rapid balance sheet runoff to bring U.S. monetary policy to a "more neutral position" later this year, with further tightening to follow as needed.

The Fed on Wednesday releases minutes of its March meeting that are expected to provide fresh details on its plans to reduce its bond holdings, and Brainard's remarks provided a bit of a preview.

"I think we can all absolutely agree inflation is too high and bringing inflation down is of paramount importance," Brainard said at a conference at the Minneapolis Fed.

To do so, she said, the Fed will raise rates "methodically" and, as soon as next month, begin to reduce its nearly $9 trillion balance sheet, quickly arriving at a "considerably" more rapid pace of runoff than the last time the Fed shrank its holdings.The rapid portfolio reductions "will contribute to monetary policy tightening over and above the expected increases in the policy rate reflected in market pricing and the Committee’s Summary of Economic Projections," she said.

The hawkish tone from one of the Fed's usually more dovish policymakers sent stocks down and Treasury yields up to multi-year highs, as investors digested the implications of a more aggressive policy path.

Investors are concerned by "the speed and aggressiveness of the Fed with its balance sheet reductions," said CFRA Research's Sam Stovall.

The Fed raised rates last month for the first time in three years, and released projections showing most policymakers thought the policy rate would end the year at least in the range of 1.75%-2%, if not higher. That would require quarter-point rate increases at all six remaining Fed meeting this year.

Markets see the Fed moving faster, delivering half-point rate hikes in May, June and July, to bring the rate to 2.5%-2.75% by the end of this year. Most policymakers view 2.4% as a "neutral" level, above which borrowing costs start to reduce growth.

"Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19," Brainard said.

Back then, the Fed began by limiting runoff from its $4.5 trillion balance sheet to $10 billion a month, and took a year to ramp that up to a maximum of $50 billion a month. Analysts expect a pace about twice that this time around.

The Fed targets 2% inflation, as measured by the personal consumption expenditures price index. In February the PCE price index was up 6.4% from a year earlier, and Brainard said she sees risks of it rising further, as Russia's invasion of Ukraine pushes up gas and food prices, and COVID lockdowns in China worsen supply chain bottlenecks.

Report ad

And though the geopolitical events could pose risks to growth, she noted, the U.S economy has considerable momentum and the labor market is strong, with unemployment now at 3.6%, just a hair above its pre-pandemic level.

The Fed's signaling on policy has already tightened financial conditions, Brainard said, with mortgage rates up a full percentage point in the past few months.

"We are prepared to take stronger action" if warranted by readings on inflation or inflation expectations, Brainard said, adding that she would also be watching the yield curve for any signs of downside risks to the economy.

It was unclear from Brainard's remarks whether she feels a rapid portfolio runoff would render bigger-than-usual rate hikes unnecessary.

Kansas City Fed President Esther George, who also supports a faster balance sheet runoff, left that door open.

"I think 50 basis points is going to be an option that we’ll have to consider, along with other things," George told Bloomberg TV on Tuesday.

If the Fed does raise rates as fast as markets now predict, that would mark at least for a few months the fastest pace of policy tightening in decades.

Fed Chair Jerome Powell says he believes the Fed can manage a "soft landing," where the central bank raises borrowing costs enough to slow the economy and bring inflation down, but not enough to send unemployment surging or push the economy into recession.

Economists say that will be difficult, if not impossible: in a recent paper Harvard University's Larry Summers noted that since 1955 there has never been a time when wage growth exceeded 5% and the unemployment rate was below 5% that was not followed within two years by a recession.

Hourly wages for non-managerial employees rose 6.7% from a year earlier in each of January, February and March, Labor Department data show.

Fed officials argue however that past is not necessarily prelude. For one thing, workers are already coming off the labor market sidelines as the pandemic eases, and more of that trend could ease wage pressures.

For another, the United States is a net oil exporter, so rising energy prices won't slow the economy as much as they did in the 1970s, making stagflation less likely.

"I'm not expecting that we'll fall into recession," San Francisco Fed Bank President Mary Daly told a meeting of the Native American Finance Officers Association in Seattle.

As the Fed tightens policy to fight inflation, she said, "we could slow so it looks like we are teetering close to it, that's possible, but it will be a short-lived event I expect, and then we'll be back up."

Producer Price Index is a leading indicator for consumer prices. To me this says inflation is continuing to rise.

www.cnbc.com

Supplier prices rose 11.2% from a year ago in March, the biggest gain on record

www.cnbc.com

Supplier prices rose 11.2% from a year ago in March, the biggest gain on record

The prices that goods and services producers receive rose in March at the fastest pace since records have been kept, the Bureau of Labor Statistics reported Wednesday.

The producer price index, which measures the prices paid by wholesalers, increased 11.2% from a year ago, the most in a data series going back to November 2010. On a monthly basis, the gauge climbed 1.4%, above the 1.1% Dow Jones estimate and also a record.

Stripping out food, energy and trade services, so-called core PPI rose 0.9% on a monthly basis, nearly double the 0.5% estimate and the biggest monthly gain since January 2021. Core PPI increased 7% on a year-over-year basis.

PPI is considered a forward-looking inflation measure as it tracks prices in the pipeline for goods and services that eventually reach consumers.

Wednesday's release comes the day after the BLS reported that the consumer price index for March surged 8.5% over the past year, above expectations and the highest reading since December 1981.

On the producer side, prices for final demand goods led with a 2.3% monthly rise, while services prices gained 0.9%, up sharply from the 0.3% February increase. Goods inflation has outstripped services during the Covid pandemic, but March's numbers indicate that services are now catching up as consumer demand shifts.

Energy prices were the biggest gainer for the month, rising 5.7%, while food costs increased 2.4%.

Swelling inflation has prompted the Federal Reserve to begin tightening monetary policy.

In March, the Fed increased its benchmark short-term borrowing rate by 0.25 percentage point as the first step in what is expected to be a series of hikes through the year. Markets are pricing in an almost certainty that the central bank will double that move at its May meeting, and will keep going until the fed funds rate hits about 2.5% by the end of the year.

Markets initially showed no reaction to the PPI news, with stock market futures hovering around flat and Treasury yields also little changed.

Supplier prices rose 11.2% from a year ago in March, the biggest gain on record

The PPI, which measures the prices paid by wholesalers, increased 11.2% from a year ago, the most in a series going back to November 2010.

- The producer price index, which measures prices paid by wholesalers, rose 1.4% in March and 11.2% from a year ago, both records for data going back to 2010.

- Prices for final demand goods led with a 2.3% monthly rise, while services prices gained 0.9%.

- Wednesday's release comes the day after the BLS reported the consumer price index for March surged 8.5% over the past year.

The prices that goods and services producers receive rose in March at the fastest pace since records have been kept, the Bureau of Labor Statistics reported Wednesday.

The producer price index, which measures the prices paid by wholesalers, increased 11.2% from a year ago, the most in a data series going back to November 2010. On a monthly basis, the gauge climbed 1.4%, above the 1.1% Dow Jones estimate and also a record.

Stripping out food, energy and trade services, so-called core PPI rose 0.9% on a monthly basis, nearly double the 0.5% estimate and the biggest monthly gain since January 2021. Core PPI increased 7% on a year-over-year basis.

PPI is considered a forward-looking inflation measure as it tracks prices in the pipeline for goods and services that eventually reach consumers.

Wednesday's release comes the day after the BLS reported that the consumer price index for March surged 8.5% over the past year, above expectations and the highest reading since December 1981.

On the producer side, prices for final demand goods led with a 2.3% monthly rise, while services prices gained 0.9%, up sharply from the 0.3% February increase. Goods inflation has outstripped services during the Covid pandemic, but March's numbers indicate that services are now catching up as consumer demand shifts.

Energy prices were the biggest gainer for the month, rising 5.7%, while food costs increased 2.4%.

Swelling inflation has prompted the Federal Reserve to begin tightening monetary policy.

In March, the Fed increased its benchmark short-term borrowing rate by 0.25 percentage point as the first step in what is expected to be a series of hikes through the year. Markets are pricing in an almost certainty that the central bank will double that move at its May meeting, and will keep going until the fed funds rate hits about 2.5% by the end of the year.

Markets initially showed no reaction to the PPI news, with stock market futures hovering around flat and Treasury yields also little changed.

If You Must Point Fingers on Inflation, Here’s Where to Point Them

As the midterm elections draw nearer, a central conservative narrative is coming into sharp focus: President Joe Biden and the Democratic-controlled Congress have a made a mess of the American economy. Republicans see pure political gold in this year’s slow-motion stock market crash, which seems to be accelerating at the perfect time for a party seeking to regain control of Congress in the fall.

The National Republican Congressional Committee in a tweet last month quipped that the Democratic House agenda includes a “tanking stock market.” Conservatives have been highlighting a video clip from 2020 when then-president Donald Trump warned about a Joe Biden presidency: “If he’s elected, the stock market will crash.” Right wing pundit Sean Hannity’s blog featured the clip under the headline: “TRUMP WAS RIGHT.”

But the narrative pinning blame for the economy’s woes squarely on Democrats’ shoulders elides the true culprit: the Federal Reserve. The financial earthquakes of 2022 trace their origin to underground pressures the Fed has been steadily creating for a over a decade.

It started back in 2010, when the Fed embarked on the unprecedented and experimental path of using its power to create money as a primary engine of American economic growth. To put it simply, the Fed created years of super-easy money, with short-term interest rates held near zero while it pumped trillions of dollars into the banking system. One way to understand the scale of these programs is to measure the size of the Fed’s balance sheet. The balance sheet was about $900 billion in mid-2008, before the financial market crash. It rose to $4.5 trillion in 2015 and is just short of $9 trillion today.

All of this easy money had a distinct impact on our financial system — it incentivized investors to push their money into ever riskier bets. Wall Street-types coined a term for this effect: “search for yield.” What that means is the Fed pushed a lot of money into a system that was searching for assets to buy that might, in return, provide a decent profit, or yield. So money poured into relatively risky assets like technology stocks, corporate junk debt, commercial real estate bonds, and even cryptocurrencies and nonfungible tokens, known as NFTs. This drove the prices of those risky assets higher, drawing in yet more investment.

The Fed has steadily inflated stock prices over the last decade by keeping interest rates extremely low and buying up bonds — through a program called quantitative easing — which has the effect of pushing new cash into asset markets and driving up prices. The Fed then supercharged those stock prices after the pandemic meltdown of 2020 by pumping trillions into the banking system. It was the Fed that primarily dropped the ball on addressing inflation in 2021, missing the opportunity to act quickly and effectively as the Fed chairman, Jerome Powell, reassured the public that inflation was likely to be merely transitory even as it gained steam. And it’s the Fed that is playing a frantic game of financial catch-up, hiking rates quickly and precipitating a wrenching market correction.

So, now the bill is coming due. Unexpectedly high inflation — running at the hottest levels in four decades — is forcing the Fed to do what it has avoided doing for years: tighten the money supply quickly and forcefully. Last month, the Fed raised short-term rates by half-a-percentage point, the single largest rate hike since 2000. The aggressiveness of the move signaled that the Fed could take similarly dramatic measures again this year.

A sobering realization is now unfolding on Wall Street. The decade of super-easy money is likely over. Because of inflation’s impact, the Fed likely won’t be able to turn on the money spigots at will if asset prices collapse. This is the driving force behind falling stock prices, and why the end of the collapse is probably not yet in sight. The reality of a higher-interest-rate world is working its way through the corridors of Wall Street and will likely topple more fragile structures before it’s all over.

After the stock and bond markets adjust downward, for example, investors must evaluate the true value of other fragile towers of risky assets, like corporate junk debt. The enormous market for corporate debt began to collapse in 2020, but the Fed stopped the carnage by directly bailing out junk debt for the first time. This didn’t just save the corporate debt market, but added fuel to it, helping since 2021 to inflate bond prices. Now those bonds will have to be re-priced in light of higher interest rates, and history indicates that their prices will not go up.

And while the Fed is a prime driver of this year’s volatility, the central bank continues to evade public accountability for it.

Just last month, for instance, the Senate confirmed Mr. Powell to serve another four-year term as Fed chairman. The vote — more than four to one in favor — reflects the amazingly high level of bipartisan support that Mr. Powell enjoys. The president, at a White House meeting in May, presented Mr. Powell as an ally in the fight against inflation rather than the culprit for much of this year’s financial market volatility. “My plan is to address inflation. It starts with a simple proposition: Respect the Fed and respect the Fed’s independence,” the president said.

This leaves the field open for the Republican Party to pin the blame for Wall Street’s woes on the Democratic Party’s inaction. As Jim Jordan, the Republican congressman from Ohio, phrased it on Twitter recently, “Your 401k misses President Trump.” This almost certainly presages a Republican line of attack over the summer and fall. It won’t matter that this rhetoric is the opposite of Mr. Trump’s back in 2018 and 2019, when the Fed was tightening and causing markets to teeter. Back then, Mr. Trump attacked Mr. Powell on Twitter and pressured the Fed chairman to cut interest rates even though the economy was growing. (The Fed complied in the summer of 2019.) But things are different now. Mr. Biden is in office, and the Fed’s tightening paves a clear pathway for the Republican Party to claim majorities in the House and Senate.

Republicans have also honed in on Mr. Biden’s $1.9 trillion American Rescue Plan, meant to mitigate the impact of the Covid-19 pandemic, as a cause for runaway inflation. Treasury Secretary Janet Yellen rejected that, noting in testimony before members of Congress: “We’re seeing high inflation in almost all of the developed countries around the world. And they have very different fiscal policies. So it can’t be the case that the bulk of the inflation that we’re experiencing reflects the impact” of the American Rescue Plan.

Advertisement

Continue reading the main story

Democrats would be wise to point to the source of the problem: a decade of easy money policies at the Fed, not from anything done at the White House or in Congress over the past year and a half.

The real tragedy is that this fall’s election might reinforce the very dynamics that created the problem in the first place. During the 2010s, Congress fell into a state of dysfunction and paralysis at the very moment when its economic policymaking power was needed most. It should be viewed as no coincidence that the Fed announced that it would intensify its experiments in quantitative easing on Nov. 3, 2010, the day after members of the Tea Party movement were swept into power in the House. The Fed was seen as the only federal agency equipped to forcefully drive economic growth as Congress relegated itself to the sidelines.

With prices for gas, food and other goods still on the rise and the stock market in a state of flux, there may still be considerable pain ahead for consumers. But Americans shouldn’t fall for simplistic rhetoric that blames this all on Mr. Biden. More than a decade of monetary policy brought us to this moment, not 17 months of Democratic control in Washington. Voters should be clear-eyed about the cause of this economic chaos, and vote for the party they think can best lead us out of it.

Fed Intensifies Efforts to Locate Lost Plot

It has to restore its own credibility and fight inflation while avoiding a huge recession. Best of luck.

This complexity is only a taste of the Fed’s dilemma as it tries to squelch a raging inflation inferno without destroying the economy in the process. The Fed today raised its key interest rate by 75 basis points, the biggest move since 1994, as markets expected. But Chairman Jay Powell said policy makers might not raise rates by that much in July, which made markets happy. But making markets happy is bad because that makes it harder to fight inflation. But making markets sad makes it likelier we have a financial crisis/depression.

So did the Fed do the right thing or not? Before the decision, Mohamed El-Erian wrote central bankers needed to do much more than just raise 75 basis points in order to restore what he argues is shredded credibility. The necessary steps included making people feel better about the Fed’s predicting skills and sounding tougher on inflation. It’s hard to say just how much today’s efforts succeeded.

After the decision, Mohamed tweeted the Fed had raised and front-loaded its rate expectations while cutting its growth expectations, which sounds pretty hawkish. He called this “Consistent with a stagflationary baseline, a fatter recession left tail, and a thinner right tail.” Which, uh, yay?

A lot of people think the Fed will have to trigger a recession to stop inflation. Powell said that wasn’t his aim, which sounds kind of dovish. At the same time, the Fed is predicting higher unemployment by the time this nightmare is over. Bloomberg’s editorial board writes that being more aggressive now might mean getting inflation under control sooner, meaning it can be less aggressive later. But figuring out the precise volume, frequency and timing of aggression is dicier than a 70-step basketball shot.

Because with so many moving parts, it’s not always clear a rate hike at one end of the Rube Goldberg machine will result in lower prices at the other. For example, Conor Sen points out surging mortgage rates could

shut down the housing market so abruptly that it turns off builders and hollows out the real-estate-industrial complex. That will mean housing shortages persist, keeping prices high. In conclusion, it’s complicated.

Bonus Central-Bank Reading: The ECB’s emergency meeting was a big nothing burger and won’t help peripheral bonds.

It has to restore its own credibility and fight inflation while avoiding a huge recession. Best of luck.

Good Luck, Fed

A key artifact in any future Museum of the American Coronavirus Experience will be the absolutely bonkers Rube Goldberg machine a YouTuber named Creezy spent two lockdown months creating in his backyard between March and May of 2020. The 70-step basketball shot takes nearly three minutes to complete, with interlocking toys, ropes, garden implements and sportsballs covering what must be an acre of hilly land. There’s even a water feature.This complexity is only a taste of the Fed’s dilemma as it tries to squelch a raging inflation inferno without destroying the economy in the process. The Fed today raised its key interest rate by 75 basis points, the biggest move since 1994, as markets expected. But Chairman Jay Powell said policy makers might not raise rates by that much in July, which made markets happy. But making markets happy is bad because that makes it harder to fight inflation. But making markets sad makes it likelier we have a financial crisis/depression.

So did the Fed do the right thing or not? Before the decision, Mohamed El-Erian wrote central bankers needed to do much more than just raise 75 basis points in order to restore what he argues is shredded credibility. The necessary steps included making people feel better about the Fed’s predicting skills and sounding tougher on inflation. It’s hard to say just how much today’s efforts succeeded.

After the decision, Mohamed tweeted the Fed had raised and front-loaded its rate expectations while cutting its growth expectations, which sounds pretty hawkish. He called this “Consistent with a stagflationary baseline, a fatter recession left tail, and a thinner right tail.” Which, uh, yay?

A lot of people think the Fed will have to trigger a recession to stop inflation. Powell said that wasn’t his aim, which sounds kind of dovish. At the same time, the Fed is predicting higher unemployment by the time this nightmare is over. Bloomberg’s editorial board writes that being more aggressive now might mean getting inflation under control sooner, meaning it can be less aggressive later. But figuring out the precise volume, frequency and timing of aggression is dicier than a 70-step basketball shot.

Because with so many moving parts, it’s not always clear a rate hike at one end of the Rube Goldberg machine will result in lower prices at the other. For example, Conor Sen points out surging mortgage rates could

shut down the housing market so abruptly that it turns off builders and hollows out the real-estate-industrial complex. That will mean housing shortages persist, keeping prices high. In conclusion, it’s complicated.

Bonus Central-Bank Reading: The ECB’s emergency meeting was a big nothing burger and won’t help peripheral bonds.

It Gets Ugly: Inflation Shifts to Services. Food, Fuel Spike Too. Dollar’s Purchasing Power Swoons.

Oh dearie, the Fed is going to meet in late July, and it’s going to talk about services inflation.

Services are now starting to power this inflation. And services are where people spend the biggest part of their budget. It’s where inflation is now getting entrenched, independent of commodity prices, and where it’s very tough to bring inflation under control. The declining commodities prices may help contain food prices and gasoline prices, but not services.Inflation in June was also driven by food and gasoline where it’s staring consumers in the face on a daily basis, though some of the price pressures are now abating. And prices of durable goods, such as cars and electronics, are rising at a less ugly pace.

The headline Consumer Price Index (CPI-U), released today by the Bureau of Labor Statistics, spiked by 1.3% in June from May, and by 9.1% year-over-year, the worst since 1981:

The Consumer Price Index for “all urban wage earners & clerical workers” (CPI-W), whose third-quarter average is used to adjust the COLAs for Social Security next year, spiked by 9.8% in June:

Services Inflation gets ugly and is hard to control.

Inflation in services is not related to commodities. And the recent declines in commodities that will eventually show up as lower inflation in gasoline and some food items has no impact on services.The CPI for services spiked by 1.0% in June from May, and by 6.2% from a year ago, the worst since 1991. And this isn’t going to turn around anytime soon, and this is why the Fed is going to dish out some salty rate hikes to get this under control:

Services include housing costs, which we’ll get to in a moment, and other key items, most prominently these (year-to-year % change):

- Housing: +5.7%;

- Hotels & motels: +11.5%

- Health insurance: +17.3%

- Medical care services: +4.8%

- Airline fares, summer special: +34.1%

- Delivery services: +14.4%

- Other personal services: +6.7% (personal care: +6.3%; laundry and dry-cleaning services: +10.2%, haircuts: 6.3%)

- Video and audio services: +4.9%

- Pet services, including veterinary: +7.9%

- Telephone services: -0.1%

- Car and truck rental: -7.7%

- Admission to sporting events: -6.1%

Food, oh dearie…

For people in the lower part of the income spectrum spend most of their money on necessities, and a relatively big portion of their income goes to food, and they’re getting crushed by this food inflation.The CPI for “food at home” – food bought in stores and at markets – spiked by 1.0% in June from May, and by 12.2% year-over-year, the ugliest spike since 1979:

In some categories, the price spikes earlier this year are running into resistance, and prices dipped on a month-to-month basis, such as beef and pork. But prices in other categories are now going haywire, such as cereals, poultry and eggs, as inflation jumps from product category to product category.

Major food-at-home categories, and % change from a year ago:

- Cereals and cereal products: +15.1%

- Beef and veal: +4.1%

- Pork: +9.0%

- Poultry: +17.3%

- Fish and seafood: +11.0%

- Eggs: +33.1%

- Dairy and related products: +13.5%

- Fresh fruits: +7.3%

- Fresh vegetables: +6.5%

- Juices and nonalcoholic drinks: +11.6%

- Coffee: 15.8%

- Fats and oils: 19.5%

- Baby food: 14.0%

Energy…

The Energy CPI spiked by 7.5% in June from May and by 41.6% from a year ago. This was driven by:- Gasoline: +11.2% for the month, +59.9% year-over-year.

- Utility natural gas to the home: +8.2% for the month, +38.4% year-over-year.

- Electricity service: +1.7% for the month, +13.7% year-over-year.

Housing costs – they’re spiking with a lag.

The CPI for “rent of shelter” accounts for 31.9% of total CPI and is the largest component. It attempts to measure housing costs as a service (not as an asset to be purchased). It comes in two components:“Rent of primary residence” (accounts for 7.2% of total CPI) jumped by 0.8% in June from May, and by 5.8% year-over-year (red in the chart below). It tracks what a large panel of tenants reported about their actual rent payments over time, including in rent-controlled apartments.

“Owner’s equivalent rent of residences” (accounts for 23.7% of total CPI) jumped by 0.7% for the month and by 5.5% year-over-year (green line). It tracks the costs of homeownership as a service, based on what a large panel of homeowners report their home would rent for.

Both measures, though spiking, are still below the overall CPI and therefor are still holding down CPI, but they’re holding it down less each month, and in a few months, they will become the primary driver of CPI inflation:

CPI for housing costs, Asking Rents, and Home Prices.

The CPI for housing costs consists of two above rent measures: the first tracks rents as experienced by tenants that have been renting these homes for a while; the second tracks what homeowner think their own homes would rent for.“Asking rents” track advertised rents of apartments and houses listed for rent. They’re a measure of rents that landlords are trying to get on their vacant units. They do not reflect actual rents paid by tenants. But they show where landlords think the current market is.

The Zillow Rent Index reflects asking rents. It jumped by 0.8% in June from May, to a record of $2,007, but that jump was smaller than the prior spikes. On a year-over-year basis, it spiked by 14.8%, which is a huge and gigantic spike, but it was smaller than the prior spikes.

But it takes a while for asking rents to become actual rents that tenants have to start paying when their lease expires and that they are then reporting as part of the CPI panel.

The “rent of primary residence” (purple) and the “owner’s equivalent rent” (green) are slowly catching up with the Zillow Rent Index (red), and they will continue to rise well into 2023 even if asking rents tracked by Zillow rise less (my discussion of this phenomenon):

Home prices spiked by 20.4% year-over-year, according to the latest Case-Shiller Home Price Index (purple line below). I have been documenting this raging mania with my series, The Most Splendid Housing Bubbles in America.

But the CPI attempts to measure the cost of the service that a home provides – shelter – via its “owner’s equivalent or rent” (red). Both indices here are set to 100 for January 2000:

Durable goods CPI.

New vehicles, used vehicles, consumer electronics, furniture, appliances, etc. Month-to-month, CPI for durable goods rose 0.7% in June, after having ticked up just 0.1% in May and April, and having dipped in March.Year-over-year, durable goods still spiked by 8.4%, but this was way down from the 18.7% spike in February:

Some major categories of durable goods:

Used vehicles CPI: +1.6% in June from May, +7.1% compared to the sky-high spike a year ago exceeding 40% at one point. In February, March, and April, prices had dropped. But in May and June, prices jumped again.This chart shows the index value (not the year-over-year % change of the index value):

The new vehicle CPI: + 0.7% in June from May, +11.4% year-over-year. The last few months have seen the worst price spikes in the data going back to the 1950s, amid still widespread new-vehicle shortages and “above-sticker” prices. Much higher interest rates would help bring demand down, which would relieve some of the price pressures.

This chart shows the index value (not the year-over-year % change of the index value):

Information technology (computers, software, accessories, smartphones, etc.): +0.3% in June from May, -6.7% year-over-year. These types of products have gotten immeasurably more powerful over the years. Today’s smartphone runs circles around super computers in 1980 that cost millions of dollars back then. So the amount of money that you pay for what you get – which is what inflation measures – tends to fall year after year.

“Core” CPI.

The “core” CPI, which excludes the volatile commodities-dependent food and energy components, tracks inflation in the broader economy. It jumped by 0.7% in May from June, the biggest jump since February – accelerating again, now driven by services!

Year-over-year, it rose 5.9% from the red-hot levels a year ago. The sharper month-to-month increases and the spike in services will start to push the core CPI higher later this year.

Purchasing Power of the dollar goes WHOOSH.

The CPI tracks the loss of the purchasing power of the consumer’s dollar and the purchasing power of labor. In June, the purchasing power of $100 in January 2000 dropped to $56.90 in June 2022. No wonder Americans are in a rotten mood:

A Recession Alarm Is Ringing on Wall Street (Published 2022)

An inversion of the bond market’s yield curve has preceded every U.S. recession for the past half century. It is happening again.

An inversion of the bond market’s yield curve has preceded every U.S. recession for the past half century. It is happening again.

Wall Street’s most-talked-about recession indicator is sounding its loudest alarm in two decades, intensifying concerns among investors that the U.S. economy is heading toward a slowdown.

That indicator is called the yield curve, and it’s a way of showing how interest rates on various U.S. government bonds compare, notably three-month bills, and two-year and 10-year Treasury notes.

Usually, bond investors expect to be paid more for locking up their money for a long stretch, so interest rates on short-term bonds are lower than those on longer-term ones. Plotted out on a chart, the various yields for bonds create an upward sloping line — the curve.

But every once in a while, short-term rates rise above long-term ones. That negative relationship contorts the curve into what’s called an inversion, and signals that the normal situation in the world’s biggest government bond market has been upended.

An inversion has preceded every U.S. recession for the past half century, so it’s seen as a harbinger of economic doom. And it’s happening now.

The difference between two- and 10-year Treasury yields

The yield curve has predictive power that other markets don’t.

On Wednesday, the yield on two-year Treasury notes stood at 3.23 percent, above the 3.03 percent yield on 10-year notes. A year ago, by comparison, two-year yields were over one percentage point lower than the 10-year yields.The Fed’s mantra on inflation back then was that inflation would be transitory, meaning that the central bank did not see a need to rapidly raise interest rates. As a result, shorter-dated Treasury yields remained low.

But over the past nine months, the Fed has become increasingly concerned that inflation isn’t going to fade on its own, and it has begun to tackle rapidly rising prices by raising interest rates quickly. By next week, when the Fed is expected to raise rates again, its policy rate will have jumped about 2.5 percentage points from near zero in March, and that has pushed up yields on short-term Treasurys like the two-year note.

Investors, on the other hand, have become increasingly fearful that the central bank will go too far, slowing the economy to such an extent that it sets off a severe downturn. This worry is reflected in falling longer-dated Treasury yields like the 10-year, which tell us more about investors’ expectations for growth.

Such nervousness is also reflected in other markets: Stocks in the United States have fallen close to 17 percent this year, as investors have reassessed companies’ ability to withstand a slowdown in the economy; as the price of copper, a global bellwether because of its use in an array consumer and industrial products, has fallen over 25 percent; and with the U.S. dollar, a haven in periods of worry, at its strongest in two decades.

What sets the yield curve apart is its predictive power, and the recession signal it is sending right now is stronger than it has been since late 2000, when the bubble in technology stocks had begun to burst and a recession was just a few months away.

That recession hit in March 2001 and lasted about eight months. By the time it started, the yield curve was already back to normal because policymakers had begun to lower interest rates to try to return the economy to health.

The yield curve also foretold the global financial crisis that began in December 2007, initially inverting in late 2005 and staying that way until mid-2007.

That track record is why investors across the financial markets have taken notice now that the yield curve has inverted again.

“The yield curve is not the gospel, but I think to ignore it is at your own peril,” said Greg Peters, co-chief investment officer at the asset manager PGIM Fixed Income.

But which part of the yield curve matters?

On Wall Street, the most commonly noted part of the yield curve is the relationship between two-year and 10-year yields, but some economists prefer to focus on the relationship between the yield on three-month bills and 10-year notes instead.That group includes one of the pioneers of research into the yield-curve’s predictive power.

Campbell Harvey, an economics professor at Duke University, remembers being asked to develop a model that could forecast U.S. growth while he was a summer intern at the now-defunct Canadian mining company Falconbridge in 1982.

Mr. Harvey turned to the yield curve, but the United States was already roughly a year into recession and he was soon laid off because of the economic climate.

It wasn’t until the mid-1980s, when he was a Ph.D. candidate at the University of Chicago, that he completed his research showing that an inversion of the three-month and 10-year yields preceded recessions that began in 1969, 1973, 1980 and 1981.

Mr. Harvey said he preferred to look at three-month yields because they were close to current conditions, while others have noted that they more directly capture investors’ expectations of immediate changes in Fed policy.

For most market watchers, the different ways to measure the yield curve all broadly point in the same direction, signaling slowing economic growth. They are “different flavors,” said Bill O’Donnell, an interest rate strategist at Citibank, “but they are all still ice cream.”

Three-month yields remain below 10-year yields. So by this measure, the yield curve hasn’t inverted, but the gap between them has been shrinking rapidly as concerns about a slowdown have escalated. By Wednesday, the difference between the two yields had fallen from over two percentage points in May to around 0.5 percentage points, the lowest it has been since the pandemic-induced downturn in 2020.

The yield curve can’t tell us everything.

Some analysts and investors argue that the attention on the yield curve as a popular recession signal is overdone.One common criticism is that the yield curve tells us little about when a recession will start, only that there probably will be one. The average time to a recession after two-year yields have risen above 10-year yields is 19 months, according to data from Deutsche Bank. But the range runs from six months to four years.

The economy and financial markets have also evolved since the 2008 financial crisis, when the model was last in vogue. The Fed’s balance sheet has ballooned as it has repeatedly bought Treasurys and mortgage bonds to help support financial markets, and some analysts argue that those purchases can distort the yield curve.

These are both points that Mr. Harvey accepts. The yield curve is a simple way to forecast the trajectory for U.S. growth and the potential for a recession. It has proved reliable, but it is not perfect.

He suggests using it in conjunction with surveys of economic expectations among chief financial officers, who typically pull back on corporate spending as they become more worried about the economy.

He also pointed to corporate borrowing costs as an indicator of the risk that investors perceive in lending to private companies. Those costs tend to rise as the economy slows. Both of these measures tell the same story right now: Risk is rising, and expectations for a slowdown are mounting.

“If I was back in my summer internship, would I just look at the yield curve? No,” Mr. Harvey said.

But that also doesn’t mean it has stopped being a helpful indicator.

“It’s more than helpful. It’s quite valuable,” Mr. Harvey said. “It is incumbent upon any company’s managers to take the yield curve as a negative signal and engage in risk management. And for people, too. Now is not the time to max out your credit card on an expensive holiday.”

Retail’s ‘Dark Side’: As Inventory Piles Up, Liquidation Warehouses Are Busy

Consumers are buying fewer discretionary goods and returning more. To clear their shelves, retailers are selling to liquidators at steep discounts.

Retail’s ‘Dark Side’: As Inventory Piles Up, Liquidation Warehouses Are Busy

Consumers are buying fewer discretionary goods and returning more. To clear their shelves, retailers are selling to liquidators at steep discounts.Once upon a time, when parents were scrambling to occupy their children during pandemic lockdowns, bicycles were hard to find. But today, in a giant warehouse in northeastern Pennsylvania, there are shiny new Huffys and Schwinns available at big discounts.

The same goes for patio furniture, garden hoses and portable pizza ovens. There are home spas, Rachael Ray’s nonstick pans and a backyard firepit, which promises to make “memories every day.”

The warehouse is run by Liquidity Services, a company that collects surplus and returned goods from major retailers like Target and Amazon and resells them, often for cents on the dollar. The facility opened last November and is operating at exceptionally high volumes for this time of year.

The warehouse offers a window into a reckoning across the retail industry and the broader economy: After a two-year binge of consumer spending — fueled by government checks and the ease of e-commerce — a nasty hangover is taking hold.

The warehouse is nearly the size of two football fields.

With consumers cutting down on discretionary purchases because of high inflation, retailers are now stuck with more inventory than they need. While overall spending rebounded last month, some major retailers say shoppers are buying less clothing, gardening equipment and electronics and focusing instead on basics like food and gas.

Adding to that glut are all the things people bought during the pandemic — often online — and then returned. In 2021, shoppers returned an average of 16.6 percent of their purchases, up from 10.6 percent in 2020 and more than double the rate in 2019, according to an analysis by the National Retail Federation, a trade group, and Appriss Retail, a software and analytics firm.

Last year’s returns, which retailers are not always able to resell themselves, totaled $761 billion in lost sales. That, the retail federation noted, is more than the annual budget for the U.S. Department of Defense.

It’s becoming clear that retailers badly misjudged supply and demand. Part of their miscalculation was caused by supply chain delays, which prompted companies to secure products far in advance. Then, there is the natural cycle of booms — whether because of optimism or greed, companies rarely pull back before it’s too late.

“It is surprising to me on some level that we saw all that surge of buying activity and we weren’t collectively able to see that it was going to end at some point,” J.D. Daunt, chief commercial officer at Liquidity Services, said in an interview at the Pennsylvania warehouse earlier this month.

“You would think that there would be enough data and enough history to see that a little more clearly,” he added. “But it also suggests that times are changing and they are changing fast and more dramatically.”

Strong consumer spending may have saved the economy from ruin during the pandemic, but it has also led to enormous excess and waste.

Retailers have begun to slash prices on inventory in their stores and online. Last Monday, Walmart issued the industry’s latest warning when it said that its operating profits would drop sharply this year as it cut prices on an oversupply of general merchandise.

The warehouse opened in November and is operating at exceptionally high volumes.

Adding to the glut are the things people bought during the pandemic and then returned.

Many companies cannot afford to let discounted items linger on their shelves because they have to make room for new seasonal goods and the necessities that consumers now prefer. While some retailers are discounting the surplus within their stores, many would rather avoid holding big sales themselves for fear of hurting their brands by conditioning buyers to expect big price cuts as the norm. So retailers look to liquidators to do that dirty work.

Additionally, industry executives say the glut is so large that some retailers could run out of space to house it all.

“It’s unprecedented,” said Chuck Johnston, a former Walmart executive, who is now chief strategy officer at goTRG, a firm which helps retailers manage returns. “I have never seen the pressure in terms of excess inventory as I am seeing right now.”

So, much of the industry’s flotsam and jetsam washes up in warehouses like this one, located off Interstate 81, a few exits from the President Biden Expressway in Scranton, the president’s hometown.

The giant facility is part of an industrial park that was built above a reclaimed strip mine dating back to when this region was a major coal producer. Today, the local economy is home to dozens of e-commerce warehouses that cover the hilly landscape like giant spaceships, funneling goods to the population centers in and around New York and Philadelphia.

Liquidity Services, a publicly traded company founded in 1999, decided to open its new facility as close as it could to the Scranton area’s major e-commerce warehouses, making it easy for retailers to dispense with their unwanted and returned items.

Even before the inventory glut appeared this spring, returns had been a major problem for retailers. The huge surge in e-commerce sales during the pandemic — increasing more than 40 percent in 2020 from the previous year — has only added to it.

The National Retail Federation and Appriss Retail calculate that more than 10 percent of returns last year involved fraud, including people wearing clothing and then sending it back or stealing goods from stores and returning them with fake receipts. But more fundamentally, industry analysts say the increasing returns reflect consumer expectations that everything can be taken back.

“It’s getting worse and worse,” Mr. Johnston said.

Some of the returns and excess inventory will be donated to charities or returned to the manufacturers. Others get recycled, buried in landfills or burned in incinerators that generate electricity.

Early in the pandemic, children’s bicycles could be hard to find. Now, they’re available at big discounts.

Liquidators say they offer a more environmentally responsible option by finding new buyers and markets for unwanted products, both those that were returned and those that were never bought in the first place. “We are reducing the carbon footprint,” said Tony Sciarrotta, executive director of the Reverse Logistics Association, the industry trade group. “But there is still too much going to landfills.”

Retailers will probably receive only a fraction of the items’ original value from the liquidators but it makes more sense to take the losses and move the goods off the store shelves quickly.

Still, liquidation can be a sensitive topic for the big companies that want customers to focus on their “A-goods,” not the failures.

Mr. Sciarrotta calls it “the dark side” of retail.

On a tour through the Pennsylvania warehouse, Mr. Daunt and the warehouse manager, Trevor Morgan, said they were not allowed to discuss where the products originated. But it was not difficult to figure out.

An 85-inch flat-screen TV had an Amazon Prime sticker still on the box. Bathroom vanities came from Home Depot. There was a “home theater” memory foam futon with a built-in cup holder from a Walmart return center.

Many unopened boxes on the warehouse floor carried the familiar bull’s-eye logo of Target. Air fryers, baby strollers and towering stacks of Barbie’s “Dream House,” which features a swimming pool, elevator and a home office. (Even Barbie, it seems, has grown tired of working from home.)

When Target’s sales exploded during the first year of the pandemic, the company was a darling of Wall Street. But in May, the retailer said it was stuck with an oversupply of certain goods and the company’s stock price plummeted nearly 25 percent in one day. Other retailers’ share prices have also fallen.

Walter Crowley regularly buys goods from the warehouse, focusing mostly on discounted home improvement goods, which he resells to local contractors.

Target’s stumbles have been an opportunity for people like Walter Crowley.

Mr. Crowley regularly rents a U-Haul and drives back and forth to the liquidation warehouse from his home near Binghamton, N.Y.

Mr. Crowley, who turns 54 next month, focuses mostly on discounted home improvement goods, which he resells to local contractors, like multiple pallets of discontinued garage door openers, tiles and flooring.

But on a sweltering day earlier this month, he stood outside the warehouse in his U-Haul loading up on items from Target.

“I saw its stock got tanked,” said Mr. Crowley, a cigarette dangling from his mouth and sweat pouring down his face. “It’s an ugly situation for them.”

He bought several cribs, a set of sheets for his own house and a pink castle for a girl in his neighborhood who just turned 5.

“I end up giving a lot of it away to my neighbors, to be honest,” he said. “Some people are barely getting by.”

The buyers bid for the goods through online auctions and then drive to the warehouse to pick up their winnings.

It’s a diverse group. There was a science teacher who stocked up on plastic parts for his class, as well as a woman who planned to resell her purchases — neon green Igloo coolers, a table saw, baby pajamas — in the Haitian and Jamaican communities of New York. She ships other items to Trinidad.

The Pennsylvania warehouse, one of eight that Liquidity Service operates around the country, employs about 20 workers, some of whom have been hired on a temporary basis. The starting pay is $17.50 an hour.

Charles Benincasa, a temporary worker at the warehouse, said he’s watched the boxes pile up and worries about the implications for the economy.

Charles Benincasa, 39, is a temporary worker who has had numerous “warehousing” jobs, the most recent at the Chewy pet food distribution center in nearby Wilkes-Barre.

Mr. Benincasa said his friends and family had gotten in the habit of returning many of the goods they buy online. But as he’s watched the boxes pile up in the Liquidity Services warehouse, he worries about the implications for the economy.

“Companies are losing a lot of money,” he said. “There is no free lunch.”

$15 French Fries and $18 Sandwiches: Inflation Hits New York

As food prices rise at the fastest rate in decades, it’s become more expensive to eat and drink in New York City.

This was supposed to be a summer of long-awaited celebrations in New York City, the return of a packed calendar full of birthday dinners and happy hours. But New Yorkers are confronting sticker shock everywhere they look, whether they’re shopping for barbecue supplies at the grocery store, ordering a beer after work or grabbing a late-night slice of pizza.

While rent and the cost of Uber trips have reached eye-popping levels, rising food prices are among the most painful results of inflation. In May, food prices in the New York City area rose at their fastest annual pace since 1981, according to the Bureau of Labor Statistics. The effects have been especially visible throughout the city — everybody has to eat.

The increase slowed in June, the most recent inflation report showed, but food prices were still 9.1 percent higher than a year earlier in New York and 10.4 percent higher nationwide.

Rising prices have come for beloved New York staples like the ice cream cones at Mister Softee trucks and the bacon, egg and cheese sandwiches at bodegas. And they have worsened the city’s hunger crisis; the number of children visiting food pantries was 55 percent higher earlier this year than it was before the pandemic, according to City Harvest, the largest food rescue organization in New York City.

Many restaurants and bars that survived the pandemic resisted raising prices last year, afraid of scaring away customers during a fragile recovery. Now, as businesses have increased wages to attract workers in a competitive labor market while facing soaring food and energy costs, higher prices are popping up on menus across the city.

We followed five New Yorkers last month during their weekly eating routines to document where they were seeing the effects of inflation.

The cart’s owner, Ali Apdelwyhap, had just raised coffee prices by 50 cents. Almost every single item in his cart had become more expensive, even the bags of ice he uses to store drinks. He was hesitant to go beyond 50 cents, worried his regulars — who include a large number of construction workers — would stop coming. “It’s too much for people,” he said.

Before the pandemic, Mr. Apdelwyhap’s breakfast cart had been parked in Midtown, serving lawyers and bankers who seemed less sensitive to price increases. Now, with most office workers no longer commuting five days a week, he said he can’t sustain his business there. He settled on this new corner along the northeastern waterfront in Queens after noticing construction sites nearby, hoping it would be a place where workers were required to show up in person.

His hourly wage recently increased by 5.4 percent, from $24.62 to $25.95, as part of a citywide cost-of-living adjustment given to certain nonprofit workers. But, Mr. Jalloh said, it has done little to defray the impact of inflation. “It’s helping, but it’s not really helping,” he said.

Mr. Dunne, 25, brought the pastries back to his family in the Bronx. He moved in with them after leaving his Manhattan apartment early in the pandemic, and now, with rents surging, he cannot afford his own place.

Mr. Dunne was excited about a summer of eating out with friends, but on days when he has hospital shifts, he more frequently brings granola bars from home or eats from the dollar menu at McDonald’s.

“You almost don’t want to get too mad because you know the restaurant owners are also paying a hefty price,” he said. “So you feel empathy, but you’re upset about the price increases.”

At Veniero’s, the staff was juggling an onslaught of pandemic disruptions. A new refrigerator took more than a year to arrive. Butter prices have surged, partly because of high costs for cattle feed, exacerbated by a drought in parts of the United States. A waitress who quit because she was unvaccinated has not yet been replaced.

Robert Zerilli, the fourth-generation owner, said he “had no choice” but to raise prices last month. “We have to make a profit,” he said.

The owners of Win Son said they have increased prices to deal with rising food and labor costs, but declined to detail by how much. The price of eggs, an ingredient in several Win Son items, is projected to jump 78 percent this year, according to the U.S. Department of Agriculture, after a major bird flu outbreak decimated chicken flocks and lowered egg production.

Mr. Lopez said the coffee at Win Son was still cheaper than the typical price in Midtown, where he commutes four days a week to his job for a fashion retailer. The average price of a 16-ounce cold brew around there is $4.88, according to the prices listed at 13 coffee shops.

Mr. Lopez said he has been bringing lunch to the office more after he recently paid $6 for a matcha latte in Midtown. “It’s symptomatic of New York,” he said, sighing. “You’re just like, this is what I need to do to live in the city and get through the day.”

“For the first time in my life, I am really feeling the effects of the increasing cost of food,” said Ms. Rodgers, 79.

Ken Migliorelli, who sells produce at the market from his family farm in Dutchess County, said he has had to raise prices across the board. As the war in Ukraine constrained the supply of oil, high gas prices made it more expensive for Mr. Migliorelli’s trucks to drive produce 100 miles from the Hudson Valley to the city. The price of fertilizer has soared, exacerbated by the supply-chain and export disruptions of the war.

This year, Mr. Migliorelli raised the price of blueberries by $2 to $3; they’re now $8 a pint. A pound of peaches rose to $5, from $3.50 last year.

Zaid Kurdieh of Norwich Meadow Farms, another vendor at the Union Square market, said he is trying to minimize price increases on staples like zucchini and carrots, but plans to raise prices by as much as 30 percent on items that are in demand at high-end restaurants, like baby squash. A pound of cherry tomatoes at his stand is now $12, up from $10 last year.

“I can’t keep up with expenses at the moment,” Mr. Kurdieh said. “I’m not seeing the light at the end of the tunnel.”

Ms. Li, 30, said the financial firm where she works provides free breakfast, lunch and snacks, which frees up her budget to go out frequently for drinks or dinner.

This summer, the Skylark raised prices on its chips and guacamole by $1.25 after avocado prices skyrocketed. (The United States temporarily suspended avocado imports from the Mexican state of Michoacan after a U.S. inspector there faced a safety threat.)

Because of the pandemic, the bar stayed shut until October 2021, and then the Omicron variant prompted widespread cancellations of holiday parties in December, typically the bar’s most lucrative month, according to David Rabin, a Skylark co-owner.

ADVERTISEMENT

Mr. Rabin has been trying to recover from those losses while also contending with high employee turnover. He increased wages for some managers and spent more on training new hires for positions like security guards.

Mr. Rabin and the bar’s managers had a monthslong debate about whether to raise alcohol prices by $1 and charge $20 per cocktail, a threshold that Mr. Rabin had long resisted.

“We’re not trying to make anyone feel like we’re trying to fleece them,” Mr. Rabin said. But after noticing similar bars in the area charging at least $20, the bar owners decided to make the move. “It has become, unfortunately, the norm,” he said.

As food prices rise at the fastest rate in decades, it’s become more expensive to eat and drink in New York City.

This was supposed to be a summer of long-awaited celebrations in New York City, the return of a packed calendar full of birthday dinners and happy hours. But New Yorkers are confronting sticker shock everywhere they look, whether they’re shopping for barbecue supplies at the grocery store, ordering a beer after work or grabbing a late-night slice of pizza.

While rent and the cost of Uber trips have reached eye-popping levels, rising food prices are among the most painful results of inflation. In May, food prices in the New York City area rose at their fastest annual pace since 1981, according to the Bureau of Labor Statistics. The effects have been especially visible throughout the city — everybody has to eat.

The increase slowed in June, the most recent inflation report showed, but food prices were still 9.1 percent higher than a year earlier in New York and 10.4 percent higher nationwide.

Rising prices have come for beloved New York staples like the ice cream cones at Mister Softee trucks and the bacon, egg and cheese sandwiches at bodegas. And they have worsened the city’s hunger crisis; the number of children visiting food pantries was 55 percent higher earlier this year than it was before the pandemic, according to City Harvest, the largest food rescue organization in New York City.

Many restaurants and bars that survived the pandemic resisted raising prices last year, afraid of scaring away customers during a fragile recovery. Now, as businesses have increased wages to attract workers in a competitive labor market while facing soaring food and energy costs, higher prices are popping up on menus across the city.

We followed five New Yorkers last month during their weekly eating routines to document where they were seeing the effects of inflation.

$3.50 for a Bagel

On a recent Monday morning, shortly after arriving at work, Mamadu Jalloh paid $3.50 for an everything bagel with plain cream cheese and $1.50 for a hot coffee at a street cart near his job in Queens, where he works at a nonprofit organization that helps formerly homeless adults.The cart’s owner, Ali Apdelwyhap, had just raised coffee prices by 50 cents. Almost every single item in his cart had become more expensive, even the bags of ice he uses to store drinks. He was hesitant to go beyond 50 cents, worried his regulars — who include a large number of construction workers — would stop coming. “It’s too much for people,” he said.

Before the pandemic, Mr. Apdelwyhap’s breakfast cart had been parked in Midtown, serving lawyers and bankers who seemed less sensitive to price increases. Now, with most office workers no longer commuting five days a week, he said he can’t sustain his business there. He settled on this new corner along the northeastern waterfront in Queens after noticing construction sites nearby, hoping it would be a place where workers were required to show up in person.

The State of Jobs in the United States

Employment gains in July, which far surpassed expectations, show that the labor market is not slowing despite efforts by the Federal Reserve to cool the economy.

Mr. Jalloh, 28, is one of them, driving in five days a week from his home in the South Bronx. Since high food and gas prices have strained his budget, he will sometimes skip breakfast or lunch to make his $700 monthly rent, or shop at 99-cent stores.His hourly wage recently increased by 5.4 percent, from $24.62 to $25.95, as part of a citywide cost-of-living adjustment given to certain nonprofit workers. But, Mr. Jalloh said, it has done little to defray the impact of inflation. “It’s helping, but it’s not really helping,” he said.

$3.75 for Ice Cream

Patrick Dunne, a second-year medical student, stopped by Veniero’s Pasticceria & Caffe, a bakery in the East Village of Manhattan, for a midday snack. It cost him $3.75 for one scoop of strawberry ice cream, an order that increased by 25 cents this summer. He also bought a box of pastries, including a $7 portion of tiramisù, which increased by 50 cents.Mr. Dunne, 25, brought the pastries back to his family in the Bronx. He moved in with them after leaving his Manhattan apartment early in the pandemic, and now, with rents surging, he cannot afford his own place.

Mr. Dunne was excited about a summer of eating out with friends, but on days when he has hospital shifts, he more frequently brings granola bars from home or eats from the dollar menu at McDonald’s.

“You almost don’t want to get too mad because you know the restaurant owners are also paying a hefty price,” he said. “So you feel empathy, but you’re upset about the price increases.”

At Veniero’s, the staff was juggling an onslaught of pandemic disruptions. A new refrigerator took more than a year to arrive. Butter prices have surged, partly because of high costs for cattle feed, exacerbated by a drought in parts of the United States. A waitress who quit because she was unvaccinated has not yet been replaced.

Robert Zerilli, the fourth-generation owner, said he “had no choice” but to raise prices last month. “We have to make a profit,” he said.

$18 for a Sandwich

During his lunch break on a work-from-home day, Mychal Lopez, 32, walked to Win Son Bakery, a Taiwanese cafe near his apartment in Brooklyn’s East Williamsburg neighborhood. He spent $30.48 — a cold brew coffee for $4, a shrimp scallion pancake sandwich for $18 and a berry rice cake for $6.The owners of Win Son said they have increased prices to deal with rising food and labor costs, but declined to detail by how much. The price of eggs, an ingredient in several Win Son items, is projected to jump 78 percent this year, according to the U.S. Department of Agriculture, after a major bird flu outbreak decimated chicken flocks and lowered egg production.

Mr. Lopez said the coffee at Win Son was still cheaper than the typical price in Midtown, where he commutes four days a week to his job for a fashion retailer. The average price of a 16-ounce cold brew around there is $4.88, according to the prices listed at 13 coffee shops.

Mr. Lopez said he has been bringing lunch to the office more after he recently paid $6 for a matcha latte in Midtown. “It’s symptomatic of New York,” he said, sighing. “You’re just like, this is what I need to do to live in the city and get through the day.”

$8 for Blueberries

For years, Margaret Rodgers, a retiree who lives in Astoria, Queens, has shopped for fruits and vegetables at the Union Square farmers’ market in Manhattan. She keeps track of her food budget by filling a pouch with $80 in cash. But lately, the pouch has emptied after just two trips to the market. She was shocked to discover that a pint of berries was now at least $8.“For the first time in my life, I am really feeling the effects of the increasing cost of food,” said Ms. Rodgers, 79.

Ken Migliorelli, who sells produce at the market from his family farm in Dutchess County, said he has had to raise prices across the board. As the war in Ukraine constrained the supply of oil, high gas prices made it more expensive for Mr. Migliorelli’s trucks to drive produce 100 miles from the Hudson Valley to the city. The price of fertilizer has soared, exacerbated by the supply-chain and export disruptions of the war.

This year, Mr. Migliorelli raised the price of blueberries by $2 to $3; they’re now $8 a pint. A pound of peaches rose to $5, from $3.50 last year.

Zaid Kurdieh of Norwich Meadow Farms, another vendor at the Union Square market, said he is trying to minimize price increases on staples like zucchini and carrots, but plans to raise prices by as much as 30 percent on items that are in demand at high-end restaurants, like baby squash. A pound of cherry tomatoes at his stand is now $12, up from $10 last year.

“I can’t keep up with expenses at the moment,” Mr. Kurdieh said. “I’m not seeing the light at the end of the tunnel.”

$15 for French Fries

After a day of work, Kathy Li met up with a colleague at the Skylark, a cocktail bar near Times Square. She ordered a neon blue gin and vodka cocktail for $20, and then split $15 French fries and $19 chips with guacamole — a price she described as “ridiculous.”Ms. Li, 30, said the financial firm where she works provides free breakfast, lunch and snacks, which frees up her budget to go out frequently for drinks or dinner.

This summer, the Skylark raised prices on its chips and guacamole by $1.25 after avocado prices skyrocketed. (The United States temporarily suspended avocado imports from the Mexican state of Michoacan after a U.S. inspector there faced a safety threat.)

Because of the pandemic, the bar stayed shut until October 2021, and then the Omicron variant prompted widespread cancellations of holiday parties in December, typically the bar’s most lucrative month, according to David Rabin, a Skylark co-owner.

ADVERTISEMENT

Mr. Rabin has been trying to recover from those losses while also contending with high employee turnover. He increased wages for some managers and spent more on training new hires for positions like security guards.

Mr. Rabin and the bar’s managers had a monthslong debate about whether to raise alcohol prices by $1 and charge $20 per cocktail, a threshold that Mr. Rabin had long resisted.

“We’re not trying to make anyone feel like we’re trying to fleece them,” Mr. Rabin said. But after noticing similar bars in the area charging at least $20, the bar owners decided to make the move. “It has become, unfortunately, the norm,” he said.

Consumer Income & Spending Still Out-Hobble Inflation, Despite Everything

So today, the Bureau of Economic Analysis reported consumer income and spending in July. Adjusted for inflation (= “real”) by the PCE inflation measure, in July from June, the change in the “seasonally adjusted annual rates” were:

Spending fell in these three categories, in July from June, without inflation adjustment:

In other words, inflation adjustments had little impact overall on income and spending growth in July from June, though they did impact year-over-year growth.

This includes income from wages and salaries, dividends, interest, rentals, farms, businesses, and government transfer payments such as stimulus, Social Security, unemployment, welfare, etc., but does not include capital gains/losses.

Compared to July 2021, real income fell 1.6%; compared to July 2020, it fell 2.2%; compared to July 2019, it was up 5.9%. It dipped below pre-pandemic trend at the beginning of this year and has remained there.