Does anyone remember why we got rid of the OTB parlors?

www.nytimes.com

www.nytimes.com

Have we not learned a lesson from what a disaster legalized casinos have been for Atlantic City?

The legalization of online Sports Books is already leading to growing problems.

With the collapse of FTX and in general people losing their savings on cryptocurrency "investment" after listening to actors/quarterbacks/models/musicians telling them "fortune favors the bold," perhaps it's time to look into the celebrity endorsement of gambling/sports book apps.

#sports #cryptocurrency #investment #endorsement

lnkd.in

lnkd.in

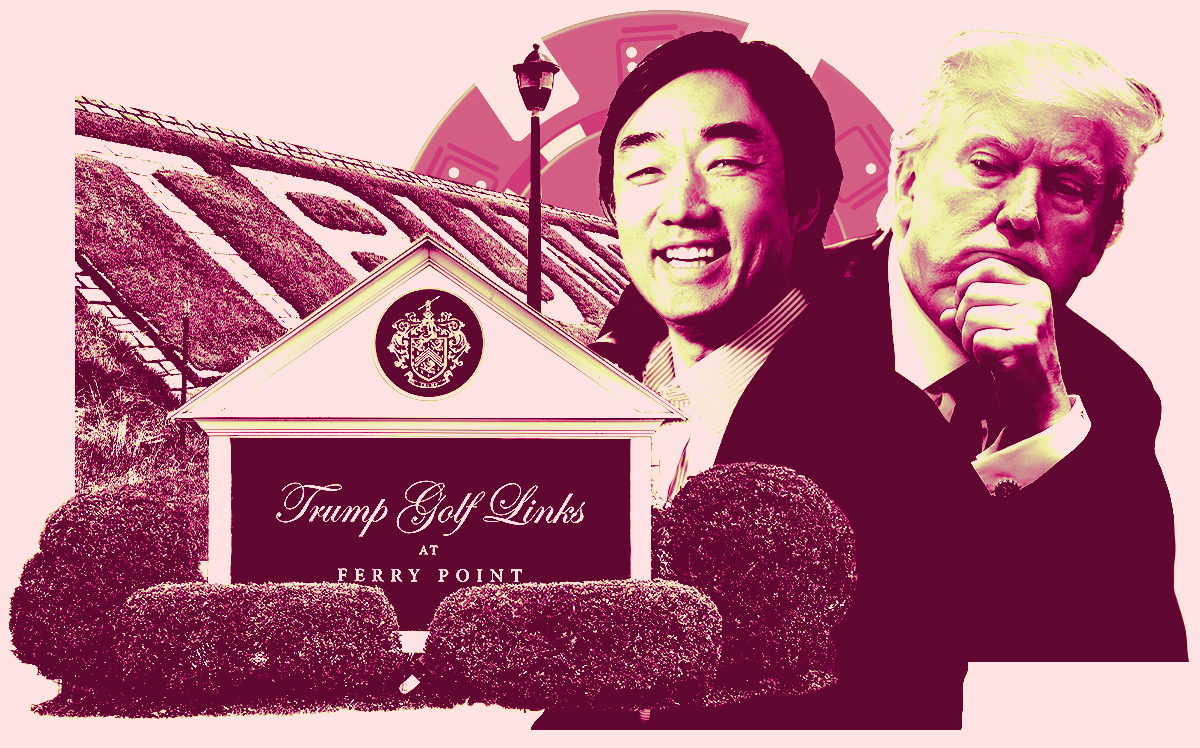

But now we have proposals from big developers for casinos everywhere from Tomes Square to Hudson Yards to to United Nations Coney Island.

www.nytimes.com

www.nytimes.com

The Cyclone roller coaster. The boardwalk. The famous hot dogs. Not to mention the aquarium, baseball stadium and wide expanse of ocean beach. What more could Coney Island need?

In the opinion of Joseph J. Sitt, a longstanding Coney Island landlord, the answer is a beachfront casino.

On Tuesday, Mr. Sitt, the chief executive of Thor Equities, will announce a proposal, in partnership with Saratoga Casino Holdings and the Chickasaw Nation, to try to secure one of up to three new casino licenses aimed at the New York City region.

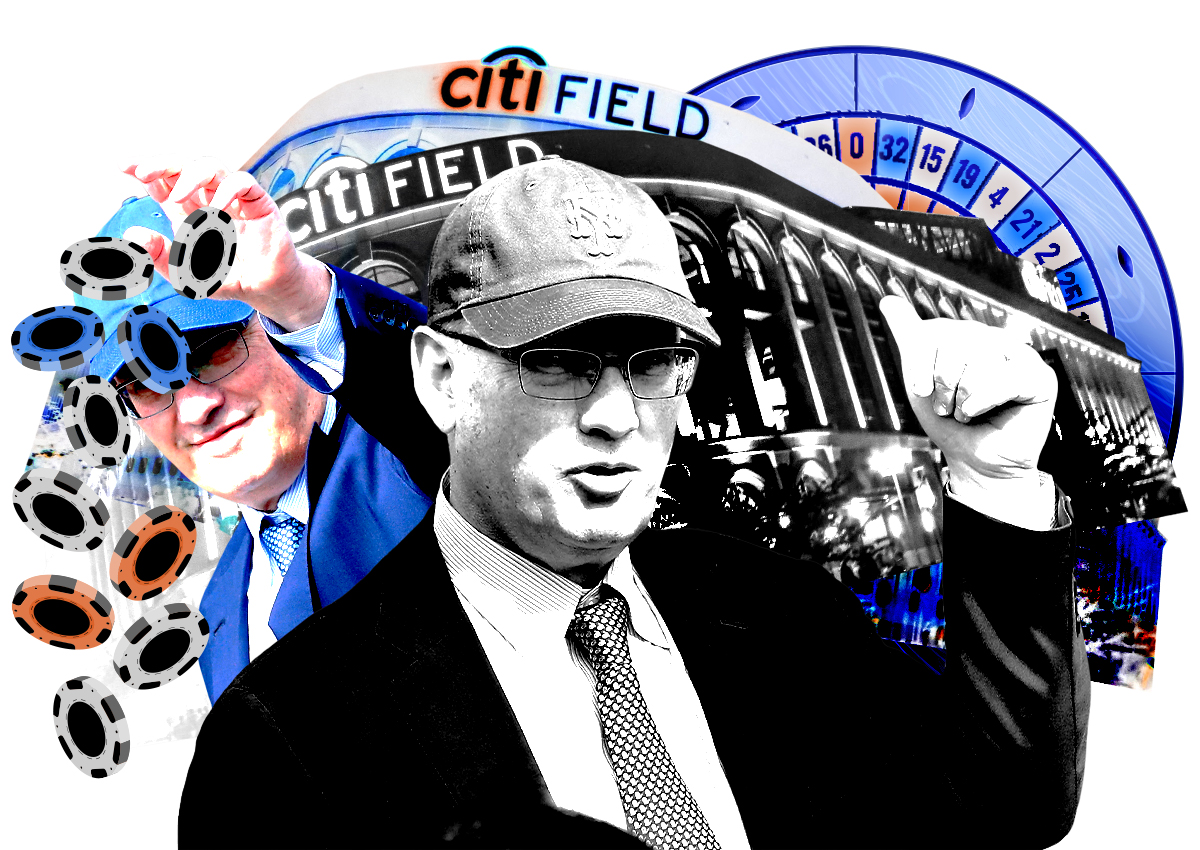

He joins a race that is expected to feature a crowded field of heavyweight contenders, including the hedge fund manager who owns the New York Mets, the billionaire developer of Hudson Yards and the owners of casino-like racetracks with slot machines in Queens and Yonkers.

Mr. Sitt acknowledges that a Coney Island casino might be something of a long shot, but he says that his proposal, unlike some others, would build on an existing buffet of entertainment options and help further restore one of New York City’s iconic attractions.

“People want to see the good guy win, the underdog win,” Mr. Sitt said in an interview from Abu Dhabi, where he attended the Formula One Grand Prix this weekend. “As opposed to all the bougie projects.”

Mr. Sitt’s proposal is evocative of the past, both distant and otherwise. He envisions a roller coaster that loops beneath the Coney Island boardwalk, an indoor water park whose glass walls afford views of a snow-covered beach, multiple hotels and museums.

In spirit, his plans harken back to the beach town’s early 20th-century heyday. More proximately, they recall a more recent era, when Mr. Sitt unsuccessfully tried to sell the Bloomberg administration on a similar proposal, albeit without the casino.

Mr. Sitt, who founded the plus-size women’s clothing brand Ashley Stewart, stressed that the casino would be more than a vehicle for gambling. The project, he said, would be in keeping with Coney Island’s rich and often off-kilter past, a place where for more than a century pleasure-seeking outlandishness has been the local currency.

“We don’t want to be known as Coney Island, the place to gamble,” Mr. Sitt said, repeatedly using the word “zany.” “We really want it to be known as the total entertainment story: eat, drink, rides, fun, water parks, roller coasters.”

The proposed casino location is the first bid from Brooklyn, New York City’s most populous borough. The formal application process has not yet begun, but casino operators and real estate developers have already been publicly announcing their intended bids, a sign of how hotly contested the competition will be.

By law, the application process must open by Jan. 6. And state regulators have said that any decisions on the casino locations will not be announced “until sometime later in 2023 at the earliest.”

Sign up for the New York Today Newsletter Each morning, get the latest on New York businesses, arts, sports, dining, style and more. Get it sent to your inbox.

Two other bids have been publicly announced so far, both in Manhattan. Related Companies and Wynn Resorts are proposing a casino on an undeveloped portion of Hudson Yards on the west side of Manhattan; SL Green Realty Corp. and Caesars Entertainment are pitching a casino inside a skyscraper located in the heart of Times Square. And Steven Cohen, the owner of the Mets, is in talks with Hard Rock on a bid in Queens.

Mr. Sitt argues that Coney Island — which has struggled to regain its footing since its heyday — was the most in need of the economic boost and had the strongest local support.

Some Coney Island stalwarts are skeptical. Dennis Vourderis, the co-owner of Deno’s Wonder Wheel Amusement Park, said that business has been booming without a casino, and that Coney Island is inherently seasonal in nature, no matter Mr. Sitt’s round-the-year ambitions. He also raised concerns that the electrical grid and sewer infrastructure were already strained.

In the winter, “it’s freezing here,” Mr. Vourderis said in an interview. “A casino in Coney Island? I have a lot of unanswered questions. I’m not convinced.”

Mr. Sitt, who grew up in south Brooklyn, describes the idea as a passion project, the product of a childhood spent skipping school to hang out at amusement parks. He says his childhood nickname was Joey Coney Island, and he still lives nearby in the Gravesend neighborhood of Brooklyn.

Known as the “People’s Playground” since the turn of the 20th century, Coney Island featured roller coasters and freak shows and even new technologies — there was a time when incubators populated by premature babies were a popular attraction. It was also the progenitor of the modern-day amusement park.

Mr. Sitt made his name investing in retail properties across the country, but on the side, he has accumulated large tracts of land in Coney Island, becoming one of the largest private property owners there.

His efforts to revitalize the beachfront neighborhood — which is also home to a cluster of public housing developments — have been halting.

Nearly two decades ago, Mr. Sitt pitched city officials on turning Coney Island into a year-round entertainment hub. In a 2005 interview with New York magazine, Mr. Sitt described his hopes that a Las Vegas-style Bellagio Hotel would rise by the boardwalk.

Mr. Sitt’s thirst for city subsidies and desire to build luxury housing and time-shares in Coney Island prompted opposition from the Bloomberg administration, which developed its own plans for the area.

Ultimately, the city bought much of Mr. Sitt’s land and leased it out to an amusement operator.

Mr. Sitt now says that to make his current $3 billion vision fly, a casino is required. Otherwise he says he cannot lure major retailers and hotel operators to open in Coney Island.

But potential obstacles await. The area currently only has a handful of smaller hotels, including a Best Western near the beach.

And although the Coney Island beach and boardwalk are right off the subway, it is still about an hour on the Q train from Midtown Manhattan — and potentially even longer than that by car.

Bill Rhoda, the president of Legends Global Planning, the project’s entertainment and hospitality adviser, said the goal was to build out the area in such a way that it would lure people year-round. One possibility, he said, was to build a convention center in Coney Island that could attract business travelers and potentially rival the Jacob K. Javits Convention Center in Manhattan.

The neighborhood is already home to the annual Nathan’s Famous International Hot Dog Eating Contest and the Mermaid Parade, along with the Cyclone, the wooden roller coaster that opened in 1927. And, if Mr. Sitt has his way, perhaps a casino.

“The sun, the moon and the stars have aligned for this potential moment for Coney Island,” Mr. Sitt said.

New York Betting Parlors Close Doors (Published 2010)

After a bill designed to save the long-failing Off-Track Betting Corporation stalled, about 50 parlors closed.

Have we not learned a lesson from what a disaster legalized casinos have been for Atlantic City?

The legalization of online Sports Books is already leading to growing problems.

With the collapse of FTX and in general people losing their savings on cryptocurrency "investment" after listening to actors/quarterbacks/models/musicians telling them "fortune favors the bold," perhaps it's time to look into the celebrity endorsement of gambling/sports book apps.

#sports #cryptocurrency #investment #endorsement

LinkedIn: Log In or Sign Up

1 billion members | Manage your professional identity. Build and engage with your professional network. Access knowledge, insights and opportunities.

lnkd.in

lnkd.in

But now we have proposals from big developers for casinos everywhere from Tomes Square to Hudson Yards to to United Nations Coney Island.

Coney Island Has a Bit of Everything. Does It Need a Casino?

A developer is seeking one of three new casino licenses for Coney Island, hoping to sell the project as a way to revitalize the Brooklyn neighborhood.

Coney Island Has a Bit of Everything. Does It Need a Casino?

A developer is seeking one of three new casino licenses for Coney Island, hoping to sell the project as a way to revitalize the Brooklyn neighborhood.The Cyclone roller coaster. The boardwalk. The famous hot dogs. Not to mention the aquarium, baseball stadium and wide expanse of ocean beach. What more could Coney Island need?

In the opinion of Joseph J. Sitt, a longstanding Coney Island landlord, the answer is a beachfront casino.

On Tuesday, Mr. Sitt, the chief executive of Thor Equities, will announce a proposal, in partnership with Saratoga Casino Holdings and the Chickasaw Nation, to try to secure one of up to three new casino licenses aimed at the New York City region.

He joins a race that is expected to feature a crowded field of heavyweight contenders, including the hedge fund manager who owns the New York Mets, the billionaire developer of Hudson Yards and the owners of casino-like racetracks with slot machines in Queens and Yonkers.

Mr. Sitt acknowledges that a Coney Island casino might be something of a long shot, but he says that his proposal, unlike some others, would build on an existing buffet of entertainment options and help further restore one of New York City’s iconic attractions.

“People want to see the good guy win, the underdog win,” Mr. Sitt said in an interview from Abu Dhabi, where he attended the Formula One Grand Prix this weekend. “As opposed to all the bougie projects.”

Mr. Sitt’s proposal is evocative of the past, both distant and otherwise. He envisions a roller coaster that loops beneath the Coney Island boardwalk, an indoor water park whose glass walls afford views of a snow-covered beach, multiple hotels and museums.

In spirit, his plans harken back to the beach town’s early 20th-century heyday. More proximately, they recall a more recent era, when Mr. Sitt unsuccessfully tried to sell the Bloomberg administration on a similar proposal, albeit without the casino.

Mr. Sitt, who founded the plus-size women’s clothing brand Ashley Stewart, stressed that the casino would be more than a vehicle for gambling. The project, he said, would be in keeping with Coney Island’s rich and often off-kilter past, a place where for more than a century pleasure-seeking outlandishness has been the local currency.

“We don’t want to be known as Coney Island, the place to gamble,” Mr. Sitt said, repeatedly using the word “zany.” “We really want it to be known as the total entertainment story: eat, drink, rides, fun, water parks, roller coasters.”

The proposed casino location is the first bid from Brooklyn, New York City’s most populous borough. The formal application process has not yet begun, but casino operators and real estate developers have already been publicly announcing their intended bids, a sign of how hotly contested the competition will be.

By law, the application process must open by Jan. 6. And state regulators have said that any decisions on the casino locations will not be announced “until sometime later in 2023 at the earliest.”

Sign up for the New York Today Newsletter Each morning, get the latest on New York businesses, arts, sports, dining, style and more. Get it sent to your inbox.

Two other bids have been publicly announced so far, both in Manhattan. Related Companies and Wynn Resorts are proposing a casino on an undeveloped portion of Hudson Yards on the west side of Manhattan; SL Green Realty Corp. and Caesars Entertainment are pitching a casino inside a skyscraper located in the heart of Times Square. And Steven Cohen, the owner of the Mets, is in talks with Hard Rock on a bid in Queens.

Mr. Sitt argues that Coney Island — which has struggled to regain its footing since its heyday — was the most in need of the economic boost and had the strongest local support.

Some Coney Island stalwarts are skeptical. Dennis Vourderis, the co-owner of Deno’s Wonder Wheel Amusement Park, said that business has been booming without a casino, and that Coney Island is inherently seasonal in nature, no matter Mr. Sitt’s round-the-year ambitions. He also raised concerns that the electrical grid and sewer infrastructure were already strained.

In the winter, “it’s freezing here,” Mr. Vourderis said in an interview. “A casino in Coney Island? I have a lot of unanswered questions. I’m not convinced.”

Mr. Sitt, who grew up in south Brooklyn, describes the idea as a passion project, the product of a childhood spent skipping school to hang out at amusement parks. He says his childhood nickname was Joey Coney Island, and he still lives nearby in the Gravesend neighborhood of Brooklyn.

Known as the “People’s Playground” since the turn of the 20th century, Coney Island featured roller coasters and freak shows and even new technologies — there was a time when incubators populated by premature babies were a popular attraction. It was also the progenitor of the modern-day amusement park.

Mr. Sitt made his name investing in retail properties across the country, but on the side, he has accumulated large tracts of land in Coney Island, becoming one of the largest private property owners there.

His efforts to revitalize the beachfront neighborhood — which is also home to a cluster of public housing developments — have been halting.

Nearly two decades ago, Mr. Sitt pitched city officials on turning Coney Island into a year-round entertainment hub. In a 2005 interview with New York magazine, Mr. Sitt described his hopes that a Las Vegas-style Bellagio Hotel would rise by the boardwalk.

Mr. Sitt’s thirst for city subsidies and desire to build luxury housing and time-shares in Coney Island prompted opposition from the Bloomberg administration, which developed its own plans for the area.

Ultimately, the city bought much of Mr. Sitt’s land and leased it out to an amusement operator.

Mr. Sitt now says that to make his current $3 billion vision fly, a casino is required. Otherwise he says he cannot lure major retailers and hotel operators to open in Coney Island.

But potential obstacles await. The area currently only has a handful of smaller hotels, including a Best Western near the beach.

And although the Coney Island beach and boardwalk are right off the subway, it is still about an hour on the Q train from Midtown Manhattan — and potentially even longer than that by car.

Bill Rhoda, the president of Legends Global Planning, the project’s entertainment and hospitality adviser, said the goal was to build out the area in such a way that it would lure people year-round. One possibility, he said, was to build a convention center in Coney Island that could attract business travelers and potentially rival the Jacob K. Javits Convention Center in Manhattan.

The neighborhood is already home to the annual Nathan’s Famous International Hot Dog Eating Contest and the Mermaid Parade, along with the Cyclone, the wooden roller coaster that opened in 1927. And, if Mr. Sitt has his way, perhaps a casino.

“The sun, the moon and the stars have aligned for this potential moment for Coney Island,” Mr. Sitt said.