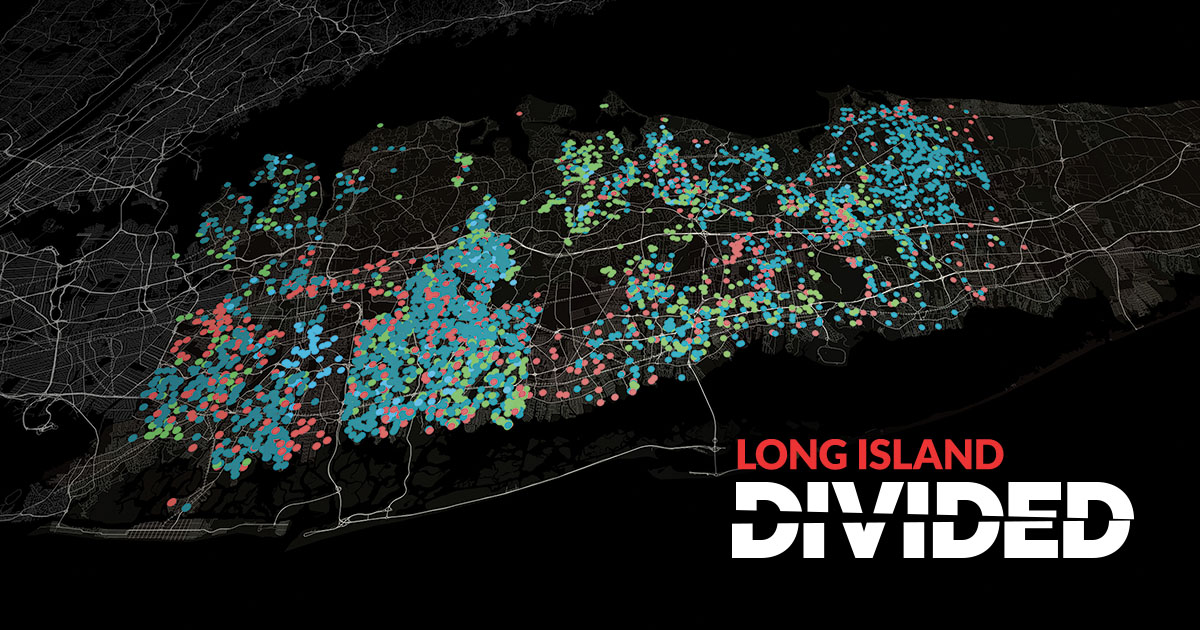

An investigation from The Real Deal reveals a pattern of discrimination New York City co-ops, which are the target of new disclosure bills.

therealdeal.com

“Not our kind”: How discrimination persists in New York co-ops

Boards continue to reject qualified buyers and get away with it

Stefani Berkin spent much of 2019 visiting apartments with two of her clients, a gay couple in their 30s.

The pair looked at about 50 units, hoping for a two-bedroom Downtown, preferably with private outdoor space. They thought they struck gold with a $6.8 million co-op in Chelsea — until the board turned them down.

“It definitely wasn’t because they didn’t have the financial wherewithal. They could have bought out the entire building,” said Berkin, president of R New York, who said she’d been warned by the listing agent that the seller, also gay, was known to throw loud parties that upset the neighbors.

Berkin’s clients weren’t ready to give up, so they sent a heartfelt letter, offering to pay for the lobby’s $250,000 renovation. The board didn’t budge.

“Did they get turned down because they were gay? Maybe,” she said. “Probably, in my opinion.”

But there was no way to prove it and little recourse.

For decades, federal, state and local fair housing laws have prohibited discrimination based on race, color, national origin, religion, sexual orientation, family status or disability. But New York City co-ops, which came into vogue more than a century ago, are run by boards that do not need to provide reasons for rejecting buyers. The closed-door system gives the city’s more than 6,800 co-op buildings carte blanche to deny even the most financially qualified applicants.

“It is the ultimate exclusionary tool in American housing, institutionalized and legal,” wrote Steven Gaines in “The Sky’s the Limit,” his 2005 chronicle of luxury real estate in New York.

The Real Deal interviewed more than 40 brokers, lawyers, co-op owners and activists, and found a consensus that while boards have evolved, discrimination persists in many of the city’s co-op buildings, which cling to opaque systems of power and control.

The influential co-op lobby has long stymied efforts by advocates and lawmakers to make the process more transparent, even as Westchester, Suffolk and Nassau counties have adopted such measures. Opponents argue that these laws amount to government overreach and could unleash a torrent of lawsuits from rejected buyers.

Now, a

national reckoning around race and social justice has brought the issue back to the fore, bolstered by a progressive shift in New York politics. That’s giving momentum to

co-op disclosure bills proposed in the state Senate and Assembly this year.

“The old guard has to be stopped,” said Brian Phillips, an agent at Douglas Elliman.

Few boards put financial criteria in writing, Phillips said, giving them license to discriminate. “There has to be accountability,” he said. “It cannot be ambiguous any longer.”

Designed to exclude

New York City has more co-op buildings than anywhere else in the country.

The first co-op in the city dates back to the late 19th century, when residents banded together to buy apartments in shared housing clubs.

The new form of homeownership promoted the idea of a jointly owned property, giving way to buildings that explicitly banned ethnic minorities. Later, boards placed informal limits on the religious and racial makeup of their neighbors.

“The fact is, co-ops acted with impunity,” said Cathy Taub of Sotheby’s International Realty.

The legal structure of co-ops lets boards wield tremendous power over who can buy into the building, under the guise of ensuring that candidates are financially qualified and will be a “good neighbor.” Co-ops are considered to be businesses, not real property, and they are bound by corporate law that requires them to act in the best interest of shareholders.

In 1959, the Anti-Defamation League found that one-third to one-half of the city’s 175 luxury co-ops had no Jewish residents. A decade later, the ADL’s Harold Braverman told

New York magazine it was “still very obvious” that limits were being maintained.

It wasn’t just Jews.

In the late 1950s, the singer and civil rights activist Harry Belafonte was turned down for a rental apartment at 300 West End Avenue. He famously purchased the entire building, turned it into co-ops and encouraged friends to buy in.

At One Sutton Place South, longtime board President Betty Sherrill allowed the designer Bill Blass, who was widely believed to be gay, to purchase a co-op in the building so long as he wrote a letter vowing to “never embarrass” the board, Gaines wrote in his book. In turning away Canadian fashion designer Arnold Scaasi, Sherrill reportedly said, “I don’t want to hurt your feelings, but you live with Parker [Ladd], and that’s not allowed in the building.”

The extent of discrimination today is hard to quantify, but one top broker, speaking on the condition of anonymity, estimated it is a factor in up to 20 percent of board decisions.

“You kind of sniff it out,” the broker said, even “with no proof.”

As recently as 2008, financier H. Fred Krimendahl II told the

Observer that 820 Fifth Avenue had no residents of color, but “if Tiger Woods wanted to live here, we’d be happy to talk to him.” The same article quoted a top broker saying, “You wouldn’t bring a rap singer into 19 East 72nd — just as you wouldn’t take 19 East 72nd into some rap building. They’re divergent cultures.”

The city’s Commission on Human Rights is charged with investigating housing discrimination claims, including those involving co-ops. The commission logged more than 1,340 housing-related complaints between July 2019 and June 2020, according to its annual report. Most had to do with disabilities and source of income; 103 had to do with race.

Agents still swap information on buildings that are notoriously difficult.

Brown Harris Stevens’ Miles Chapin said he’s been told, “All they want is WASPy old money.” Some agents use code words like “NQ,” which means “Not Quite,” or “NOK,” meaning “Not Our Kind.”

“The standard [rejection] is, ‘They don’t like the finances,’” Chapin said. “Another euphemism [is], ‘I think this is more of a condo profile than a co-op profile.’”

When buyers don’t take the hint, some boards have been known to stall by repeatedly requesting information or tacking on additional application fees.

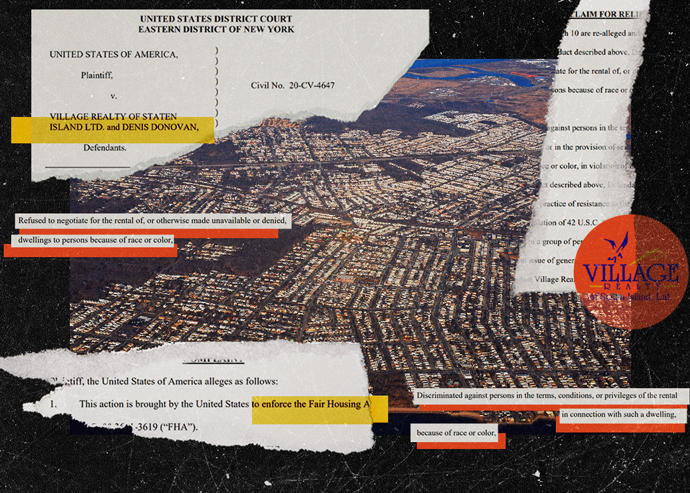

Last November, co-op owner Orlando Rymer sued the board at 65 West 87th Street for raising its application fee after learning his prospective buyers were Chinese. According to court documents, the board raised its standard fee sixfold, from $2,367 to $14,330. It then requested more and more information from the buyers, dragging the process out for eight months before turning them down.

Court documents also allege a pattern of anti-Asian sentiment by Rymer’s neighbors, including an incident in which one sprayed a Chinese man visiting his apartment with disinfectant. The board denied the allegations. The case is ongoing.

Gatekeepers

Many brokers contacted for this article said they are morally opposed to discrimination, but declined to speak on the record for fear of losing business.

Whether they’re representing buyers or sellers, brokers are a key conduit between applicants and boards, as are managing agents, who process board applications. Some of the city’s top brokerage firms also have property management arms, and the two businesses often feed off each other.

“The brokerage community has been a participant in this by being apprehensive about who would and wouldn’t get through the board, thus becoming what I’ve always considered inappropriate gatekeepers,” said Frederick Peters, CEO of Warburg Realty.

Years ago, he brought a Black couple to see a co-op. “The selling broker said, ‘Oh, for God’s sake, you had to make my life more complicated by bringing me this?’” Peters recalled. “I said, ‘Actually, if ever there were a slam dunk buyer it would be this. You can’t turn them down.’”

New York agents are bound by fair housing laws, which the Real Estate Board of New York helps enforce by screening listings shared on its syndicated listings feed. In September 2020, the trade organization instituted a fine for agents in violation of those laws; repeated offenders can lose access to the feed altogether. REBNY hasn’t found any violations in the last five months.

But it can be hard to pinpoint violations in an industry that prizes discretion.

Celebrity broker Ryan Serhant said that early in his career he represented a buyer in her 30s who was turned down. Officially, there was no reason. But the listing agent told him, “I think it’s because she’s a single woman and if they approve her, they’re approving her future husband.”

Agents say there can also be consequences for those who go against industry norms.

Elliman’s Joanne Douglas had a longstanding relationship with a co-op board in the 1990s that ended after she brought an interracial couple to a listing.

Douglas said the couple were Harvard graduates and financially qualified, but the board stalled — until Habitat magazine published an exposé about a board being successfully sued for discrimination.

“They got accepted a day later,” Douglas said. “I literally never got one single listing after that.”

“An all-out war”

The fact is, rejections by boards are common. In the mid-aughts, the billionaire Len Blavatnik was denied by two buildings — 927 Fifth and the San Remo — before paying a record $77.5 million for New York Jets owner Woody Johnson’s pad at 834 Fifth.

But Blavatnik didn’t fight back. Few spurned buyers do.

Suing a co-op board, particularly for discrimination, is rare. Many buyers fear being blacklisted by other co-ops. Also, discrimination is hard to prove.

“You can infer and you can make assumptions,” said attorney Marc Fitapelli, “but you can’t go to court with assumptions.”

He would know. In 2012, Fitapelli represented Goldwyn Thandrayen, a citizen of Mauritius, who sued the board of 210 East 36th Street for allegedly blocking his cash purchase of a $390,000 co-op. Court documents cite an email from a board member stating that although Thandrayen appeared to have “quite a lot of money,” his “entire financial portfolio is in some tiny little unknown country.”

Fitapelli declined to comment on the suit, which was settled.

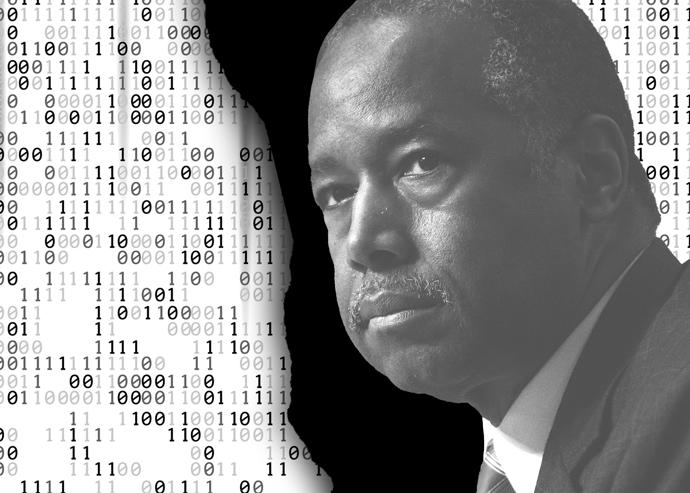

Perhaps the highest-profile case was a standoff between financier Alphonse “Buddy” Fletcher Jr. and board members at the Dakota, the legendary West 72nd Street building where John Lennon was shot in 1980.

In 2011, Fletcher, who is Black, sued the Dakota’s board for racial discrimination after it rejected his bid to buy another apartment there for $5.7 million. “That was an all-out war,” recalled Milton Williams, one of Fletcher’s attorneys. The New York Times labeled the suit an “embarrassing crack in the facade” of one of the city’s most famous addresses.

Friends had urged Fletcher not to fight the board, according to a 2013 profile in

Vanity Fair. When he did, his personal financials, including bank statements and Social Security number, were leaked to the public, triggering a rush of stories about his personal life.

“The stress of the Dakota fight would get so extreme that, according to Fletcher, he got shingles,” the article said.

A judge threw out the suit in 2015, saying Fletcher lacked evidence to prove discrimination.

Still, the case had a lasting impact. As part of the case, a panel of judges found that individual board members could be held liable for acts of discrimination.

“Up until that point,” Williams said, “they had no skin in the game.”

One of the few successful cases was won a quarter century ago.

In 1996, an interracial couple, Shannon and Gregory Broome, sued the board of the Beekman Hill House, at 425 East 51st Street, after being turned down for a sublet. During the interview, court documents said, a board member scrawled “black man” on a notepad. A jury awarded the couple $640,000 in damages and found board president Nicholas Biondi personally liable for $124,000.

Biondi had to give up his apartment and moved to Long Island, where he died in 2018. Long after the case, he maintained he was a victim of circumstance. “His is the story of a successful business man, family man, and community leader who nearly lost it all,” he wrote on his blog, PunitiveDamage.com, “just for being a ‘good neighbor.’”

“I will get this done before I die”

Barbara Ford, a Long Island broker and lawyer, has spent two decades trying to bring transparency to co-ops.

In 2009, she was instrumental in getting Suffolk County to pass legislation that requires co-op boards to disclose in writing why they have rejected an application.

Ford works with others in the industry to target villages and small communities across New York, hoping to create a patchwork of policies that will lead to her ultimate goal: a statewide co-op disclosure law.

“It’s taking me decades here,” she said, “but I will get this done before I die.”

One of the big challenges is documenting housing discrimination.

The Fair Housing Justice Center can’t send testers before co-op boards because doing so would require identity checks and submitting Social Security numbers, said Craig Waletzko, the group’s community engagement coordinator.

“I will say,” he said, “whenever we do investigate for it, we tend to find it.”

Despite failing to get previous iterations of the bill through the legislature, its sponsor, Sen. Brian Kavanagh, said he hopes that increased attention on fair housing issues this year will make the difference. New York City Council Member Brad Lander has also proposed a co-op disclosure bill.

“It’s been a long road,” Kavanagh said. “The co-op boards and their representatives have been pretty well organized and really have resisted.”

Those lobbying against proposed changes include the Westchester-based Building & Realty Institute and the Council of New York Cooperatives & Condominiums, which counts more than 2,300 buildings as members. The CNYC has contracted to spend nearly $100,000 this year on lobbyists at Cozen O’Connor and Whiteman Osterman & Hanna, according to filings with the state’s Joint Commission on Public Ethics.

“We feel co-ops have functioned very, very nicely for a very, very long time without this sort of government imposition,” said Mary Ann Rothman, the CNYC’s executive director.

Critics say they believe the intent of the legislation is good, but that existing fair housing laws are sufficient.

“This legislation is a cure in search of a problem,” said John Van Der Tuin, an attorney who represented the Dakota board when Fletcher sued. “There aren’t very many instances in which there have been substantiated allegations of discrimination.”

According to Building & Realty Institute CEO Tim Foley, the problem with disclosure — and “this notion of a magic letter” — is that “there’s no track record, to us, that says that this is guaranteed to help the problem enough to make up for what we know will be increased liability.”

Ford, the Long Island lawyer, called that argument a red herring. In the more than 10 years since Suffolk County’s transparency measures passed, “There wasn’t one [lawsuit],” she said.

REBNY, whose members sit on both sides of the debate, said it agrees co-ops should disclose why applications are not approved. But in a statement, the lobbying group’s president, James Whalen, said any legislation should “be crafted in a way that is squarely focused on preventing housing discrimination and does not result in frivolous lawsuits.”

Boards also insist some flexibility is needed.

Marc Luxemburg, a real estate attorney and president of the CNYC, recalled how 40 years ago, real estate scion Robert Durst wanted to buy a co-op in his Upper West Side building. Durst’s first wife, Kathleen, had just gone missing.

“Nobody could prove he had anything to do with her disappearance,” recalled Luxemburg, who said the board decided not to take a chance. “Years later, it turned out he had a trail of disappearing people.”

Durst is currently on trial in Los Angeles for murder.

Demands

Vetting co-op buyers is invasive by design.

Neighbors in these buildings essentially go into business together, so before accepting a buyer, boards typically want to see financial statements and tax returns to make sure they are financially qualified. Most also ask for personal and professional references.

Real estate agents acknowledge that boards have a fiduciary responsibility to shareholders, but say many use their perch to ask probing questions. It is standard to ask buyers not only if they own pets and plan to renovate but also where they went to school and what clubs they belong to, according to

TRD’s review of several applications. Taub, of Sotheby’s, has seen applications that require prospective buyers to list marital status and age.

“They knew what I made, what I had saved, what I had for breakfast,” said one top agent who lives in an Upper West Side co-op.

Serhant said boards, which are made up of volunteers, tend to attract those “who enjoy having perceived power” over others. “You see that, it’s in the demands,” he said.

Over the past decade, the co-op market has not kept pace with condos.

The median sale price for a Manhattan condo in 2020 was $1.7 million, up 52.6 percent from 2011, according to Miller Samuel data. The median co-op price rose only 15.9 percent, to $779,750.

Condos command a premium in part because they are newer and have more amenities. But some say co-ops’ archaic policies are a factor.

Young buyers, in particular, are put off by the onerous approval process.

“They don’t want to undress financially for the board,” said Lisa Larson of Sotheby’s.

In Manhattan’s luxury market, condos now outsell co-ops four to one, according to Donna Olshan, who tracks high-end contracts in a weekly report.

Olshan said the co-op sector is “deteriorating” for several reasons, not least of which is that people can’t buy and sell freely without the “blessing of a handful of people.”

Some co-ops also require buyers to have a certain amount of cash on hand, even after the sale has closed.

Berkin, for example, has clients shopping for a $2.5 million co-op. They make $1 million a year, but she said they will probably need financial help from relatives to be approved by most boards. “When these boards ask for 2.5 times the purchase price in post-purchase liquidity, who has that?” she asked.

The system benefits old money, which Black buyers tend not to have because of historic, systemic racism in the labor market, said Dorothy Brown, the author of “The Whiteness of Wealth.”

“If you need someone to make $1 million, it will be an overwhelmingly white pool,” she said. “Even if you wind up with a Black banker who is making $1 million, the Black banker is more likely to be first-generation. They don’t come from $1 million parents.”

Some believe co-op boards have dug in their heels even more because of Covid. Strict financial requirements served co-ops well in the wake of the financial crisis because they had well-funded reserves.

Lately, some boards have taken to rejecting offers they deem too low to protect the value of other apartments in the building.

But that can be a double-edged sword: Units that stay on the market longer are likely to sell for less.

In one case, a $1 million co-op on East 57th Street sold at a $60,000 loss months after the board rejected a higher offer from an elderly gay couple.

“I really was in shock,” said the seller, who was pained to be party to the board’s actions. “It was clearly wrong.”

Speaking on the condition of anonymity, the seller said he reported his board to the city’s Commission on Human Rights, which notified him last year that it would investigate.

Others choose not to pursue their grievances. Berkin, the broker whose clients were rejected in Chelsea, said she offered to fight on their behalf. They weren’t interested.

“They didn’t want to sue,” she said. “[The buyers] didn’t feel they had to explain themselves.”

In a system with little transparency, it was another decision made quietly and leaving no trace.