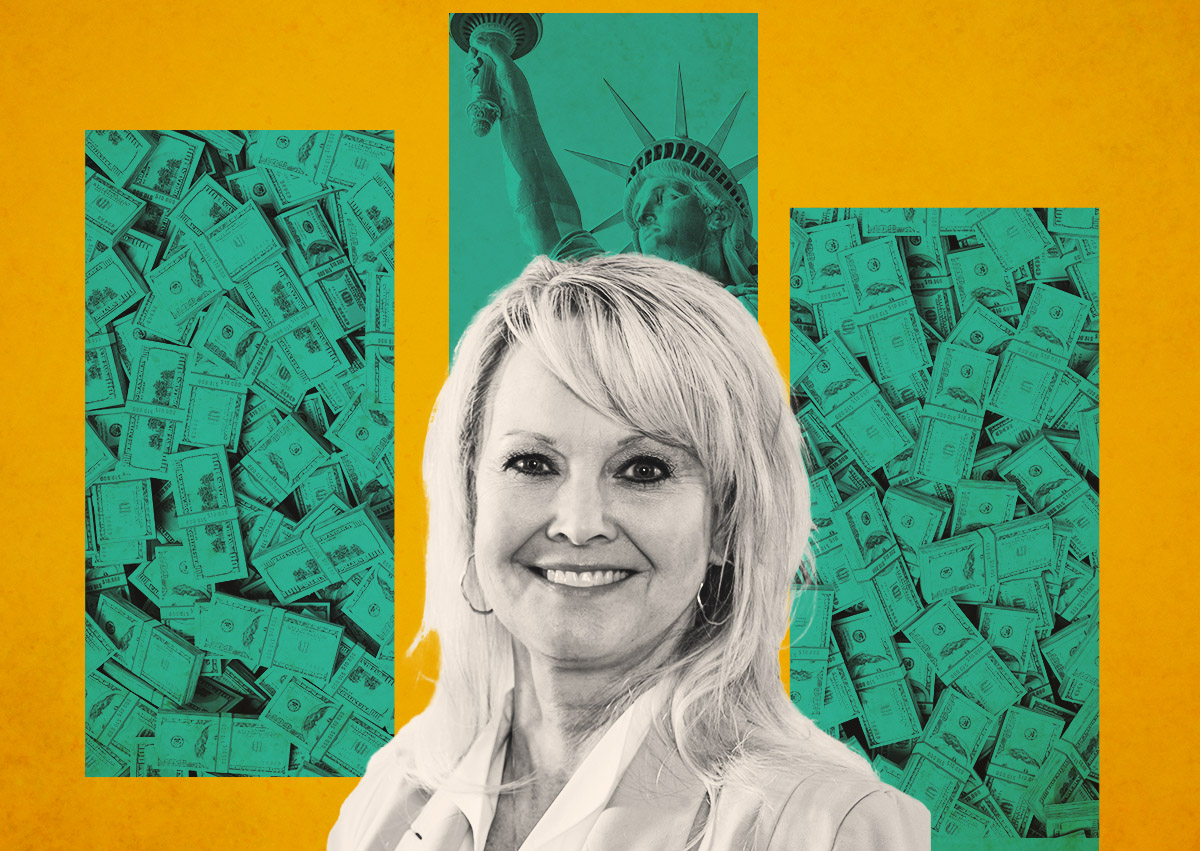

Compass agent and NYRAC co-founder Heather Domi sounded off on the antitrust commission lawsuits and what she wants from REBNY.

therealdeal.com

Ex-REBNY board member talks antitrust lawsuits landing in NYC

Compass agent and NYRAC co-founder Heather Domi has plenty to say about the state of real estate

New York: the city so nice, commission lawsuits have struck twice.

The lawsuits mimic claims in actions filed against the National Association of Realtors’ participation rule that mandates commission sharing in exchange for access to multiple listing services.

Both suits, one filed in November and the other in late December, hinge on a similar rule by the Real Estate Board of New York requiring the listing broker in a home sale to split commission with the buyer’s broker. The city’s reigning residential real estate authority is joined by 26 New York City residential firms, some of which appear poised to

fight the legal action in the Big Apple and beyond.

Change has already sprouted at the organization, which as of Jan. 1

changed buyer’s agent commission rules to prohibit listing brokers from paying buyer’s agents and require sellers to pay them directly.

The rule budge is a small shift for the group as brokers in markets across the United States appear

One year earlier, Heather Domi resigned from her board seat with the city’s top residential agency, going out with a public call for change.

The Compass agent, who in 2018

co-founded agent advocacy group New York Residential Agent Continuum, resigned from her REBNY board position in Oct. 2022 with a

fiery letter that accused the group of “taxation without representation.”

Scrutiny has risen over the trade group she disparaged as having “overlooked, disrespected and disregarded” her voice as an agent, as it faces down the antitrust action in New York.

But in an interview with

The Real Deal, the veteran agent came to REBNY’s defense and shared her perspective on the changes coming to the industry

The conversation has been edited for concision.

First, what’s your take on the increase in scrutiny over antitrust issues?

I’m not surprised with where we are. There’s been so many changes in our industry over the last decade to 15 years. There are people that have been targeting our industry, and that goes for the corporate side of things, that goes for the tech side of things, that goes for the government side of things. So as far as I’m concerned, it’s just one more thing that we have to work around.

I think there is going to be a wholesale change to the way we do business and there’s going to be some good things that are going to come out of it and some unintended consequences that are going to come out of it.

(Compass CEO Robert Reffkin in the third quarter earnings call referenced a rule change by the Northwest MLS, changed its rules in 2018 to stop requiring sellers to pay buyers’ brokers. )

I actually had a breakfast at the [Compass annual retreat] with a Seattle agent and she was able to explain very clearly what has happened, and not a lot has changed other than it creates a lot more transparency up front with the seller.

It spells it out very clearly with the different scenarios. It brings clarity to the table and then on the flip side of it, we’ve had to prove our worth and sell ourselves to sellers all of these years and now we’re just going to have to prove our worth to buyers.

What are some of the unintended consequences you alluded to, that the rule changes may have?

That remains to be seen, precisely what’s going to happen as far as buyer behavior. I don’t know if it’s going to create a situation where there’s a different percentage in the amount of buyers represented. If there’s a higher percentage of buyers that are unrepresented what are those complications we’re going to start to see? Are they going to have problems with the process?

Do you place the blame on REBNY for the lawsuit?

Sign Up for the National Weekly Newsletter

SIGN UP

By signing up, you agree to TheRealDeal Terms of Use and acknowledge the data practices in our Privacy Policy.

I just think there was a genealogy of the way the industry evolved and there’s a reason that MLSs and cooperative commissions came into effect to try to create a more fair marketplace.

From my knowledge, and this was before my time, I don’t think the coupling of commissions was created to create an unfair market, but to create more balance and fairness in the market and more sharing. Back in the day before listings were shared and brokerages would hoard them and only sell within their company … there was a reason why we got to where we did.

Are we going to go back to some of those ways which either cause some disadvantage in the marketplace or that lack of transparency in the marketplace?

Moving forward, what do you want to see from REBNY?

I would like to see them offer lots of education and lots of support to the agent community.

There’s a lot of professionals in the industry that haven’t found success, came in at the wrong time or just really haven’t quite figured out the industry and the ones that are willing to work and put their heads down…. Those are the ones that are going to do well and come out of it. It’s going to weed out a lot of agents from the business, I just hope that it makes the industry as a whole stronger in making agents more educated and knowledgeable.

When you’re an attorney it’s really no different. When you’re an attorney, you have to represent agreements on both sides, you take retainers, your clients typically don’t try to negotiate the fees too much because they’re worried you’re not going to work too hard for them.

Has NYRAC done any education outreach for agents?

Yesterday we had a Zoom call where we had 195 agents at peak, and we had Neil Garfinkel at the beginning of the call. He set the stage for what the rules are … some people are still waking up to what’s going on.

And then I had someone from Seattle, a Compass agent from Seattle … and she explained the sell-side component because in Seattle they de-coupled commissions in 2019. So they’ve been selling this decoupled commission on the sell-side. She just went through what her pitch is and what her conversation is for sellers and she sells the decoupled commission and what the added value is. What it does is provide more value for the seller and by explaining it in the right way you’re building trust, so I think it’s very additive and beneficial for the consumer.

On the buy-side, I had Lori Gilmore, who’s at Compass, she coaches with Steve Schulz, the national coach, and she really has that buy-side conversation agreement down pat. So she went over the buy-side pitch and was incredible and one hour into the call I still had 161 people.

Are agents more concerned now that lawsuits have been filed in New York?

I don’t think it’s on people’s radars as much as what we’re actually going through with the decoupling of the commissions and the buyer agreements. I think everybody’s focused on that instead of worrying and projecting about so many unknowns.

Anything else?

There’s things about [the changes] I’m excited about.

At least you know when you’re getting a buyer, you’re getting a commitment. There’s a saying in the business: list to last. With a buyer, when you don’t have any kind of signed agreement, they could be working with somebody else, they could flake out. Now you’re going to have that same opportunity and be building that same relationship where there is a true commitment that’s going to be signed.

With every challenge there is opportunity and I think that it’s important to be positive about this. I think people are going to see this as a huge disruption and I think it’s not going to be that big of a deal.

www.inman.com

www.inman.com