REBNY’s efforts to kill a rental-agent fee reform bill will test the strength of the real estate lobby after several stinging defeats.

therealdeal.com

Has REBNY stopped the bleeding? Broker bill poses test

Real estate group gearing up to defeat rental agent fee reform

There’s nothing more quintessentially New York than ordering two slices to go, cursing at the subway system or paying thousands of dollars to a rental agent who failed to answer basic questions about the apartment you just leased, the building it’s in and the landlord.

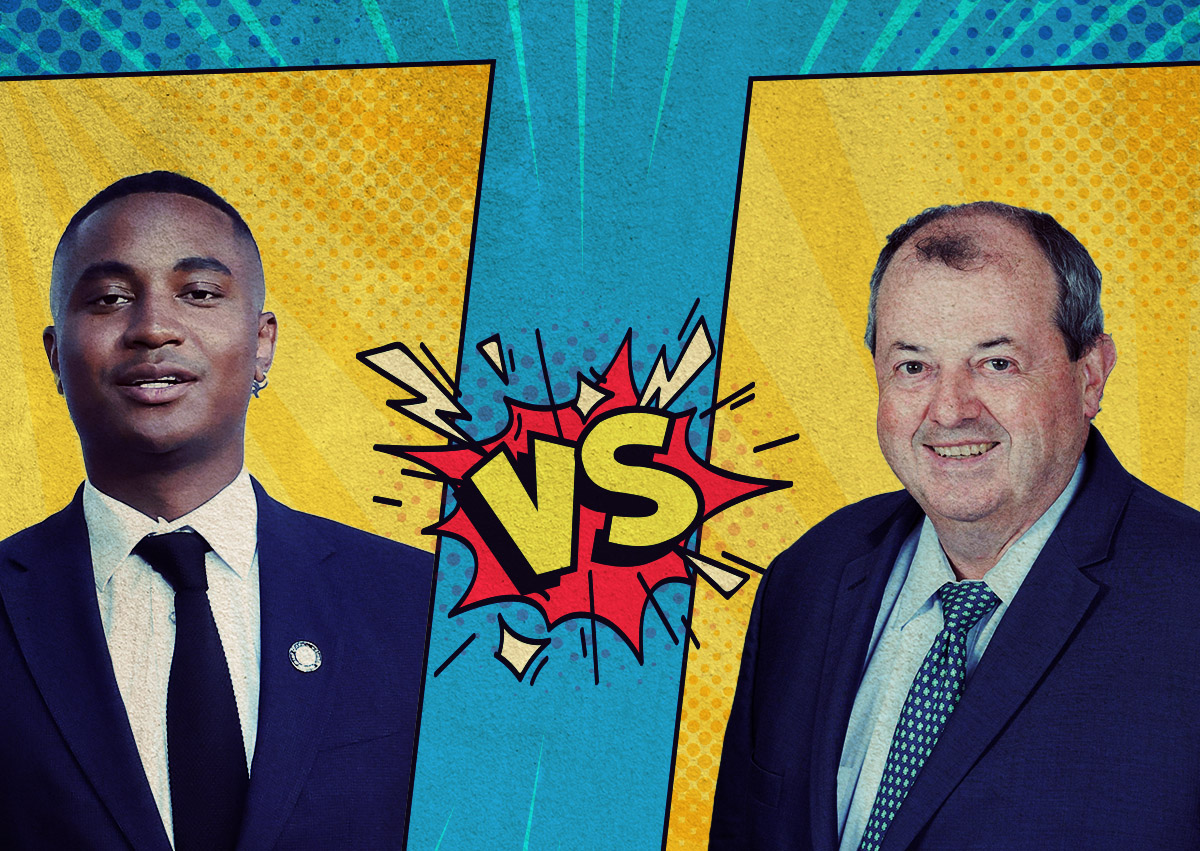

That seemingly universal experience for tenants helped inspire City Council member Chi Ossé to introduce a bill that would flip the rental business on its head. Should his FARE Act become law, rental agents would only be paid by the party who hired them. In the current system, tenants often must pay agents who represent the landlord.

The bill is a litmus test for the Real Estate Board of New York after a string of painful defeats for the industry’s highest-profile advocacy group — notably

Local Law 97 and

rent stabilization reform in 2019 and the end of the

421a tax break last year.

Its victories now come on the defensive side, such as blocking

good cause eviction and a 2019 decision by the New York Department of State that briefly shifted the cost of rental agent fees to landlords. That Ossé has a majority of Council members backing his bill reflects the erosion of REBNY’s political power.

In the 2000s, when real estate seemed to be flourishing, the group had more allies in City Hall and Albany. Yet the seeds of future political troubles were taking root.

The Bloomberg administration ushered in a golden era of development in New York City, but its policies didn’t increase housing supply enough to meet demand. For average New Yorkers, finding affordable housing became like hunting for unicorns.

Meanwhile, the industry used its political capital to

whittle away at rent regulation and developers reshaped the skyline with

ultra-luxury supertalls. Big Real Estate became the face of the housing affordability problem.

In the 2018 election, that bill came due: Progressive Democrats took control of the state Senate. Refusing to accept donations from real estate was a standard element of their campaigns.

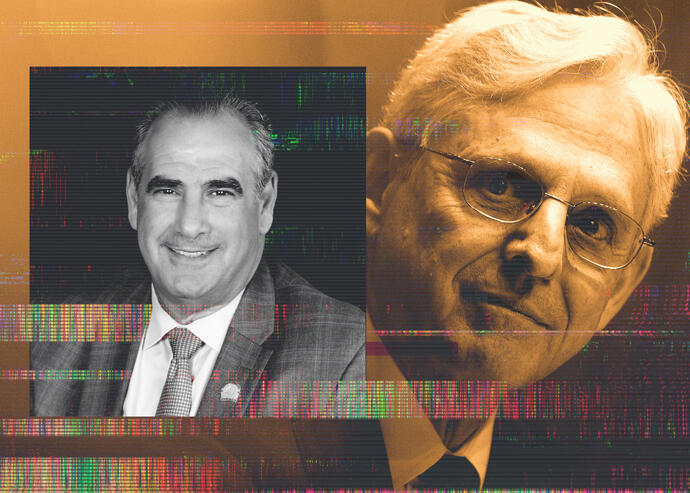

In a recent interview, REBNY President Jim Whelan, who took the helm in the wake of that failure, said factors outside of the group’s control have led politicians to limit housing growth, fueling the affordability crisis.

As an example, Whelan noted that the late Assembly Speaker Sheldon Silver resisted rezoning in Lower Manhattan.

“Shelly did not want to introduce more residents to Lower Manhattan,” said Whelan. “He didn’t want to risk what his voting base was.”

REBNY estimates that 40 percent of New York City is zoned for single-family housing, which the organization chalks up to politicians’ focus on their next election.

“I don’t think the incentive structure is towards thinking about the city holistically or in thinking about, What is this district going to need 10, 15, 20 years from now?” said Zachary Steinberg, senior vice president of policy at REBNY. “It’s, ‘What do I need four years from now?’ And that’s not more housing.”

Where rezoning did lead to more homes being built, such as in northern Brooklyn and western Queens, the pace and extent of the changes may have alienated residents, speculated Marc Norman, associate dean of the Schack Institute of Real Estate at NYU. The blowback made future rezoning more difficult.

“You’ve seen growth in housing but it’s harder to see some of the other things that were promised, like better transportation, increased school funding, libraries, parks,” said Norman. “It’s like, ‘We saw what happened in Williamsburg and what happened in Long Island City, and while we like affordable housing, we’re not sure the other things are going to come.’”

Norman said REBNY could do a better job of explaining to residents what increased density looks like. “It’s not catastrophic,” he said.

But he acknowledged the difficulty of that task, especially when some Democrats reject the evidence that more units, even market-rate ones, lower housing costs overall. Norman said REBNY may be wasting its time trying to persuade detractors like Kristin Richardson Jordan, the Harlem City Council member who

blocked Bruce Teitelbaum’s 917-unit project in her district.

“Even if they did it the best they could possibly do it, I’m not sure how much that would move the needle because there’s also the issue of how are the politicians explaining it, or how are the advocates explaining it,” he said. “Everybody gets something out of creating a narrative.”

In a promising sign for the industry, Jordan’s narrative did not pay off for her, as Teitelbaum

revived his project and the increasingly isolated Council member

did not run for re-election.

The rental-broker bill will again test REBNY’s ability to play defense. To defeat a 2019 bill that sought to cap rental broker fees at one month’s rent, the group brought 1,000 agents to protest at City Hall — the kind of grassroots tactic typically employed by tenant advocates. It also used its legal and lobbying muscle to undo the Department of State decision that temporarily made landlords pay for rental agents.

Ironically, the lack of housing supply that REBNY constantly bemoans is the underlying cause for Ossé’s bill. The tightness of the market gives landlords leverage to insist applicants pay broker fees, and also raises those fees by pushing up rents. The standard fee, 15 percent of the annual rent, works out to an average of $9,000 in Manhattan.

The industry argues that the bill will raise costs for some tenants because landlords will pass the fees along in the form of a higher base rent that persists for years.

REBNY previously said it does not anticipate Ossé’s bill coming to a vote. The legislation was assigned to the Consumer and Worker Protection Committee, which is chaired by Bronx Council member Marjorie Velazquez. Sources told the

New York Daily News that Velazquez assured REBNY — which raised $11,500 for her campaign — that she would slow or stop the bill.

Velazquez denied making a deal with REBNY but told the outlet she wouldn’t bring it to a vote this year.

As a result, Ossé has been trying to get City Council Speaker Adrienne Adams to assign the bill to

another committee, a source told the News.

“We’re prepared for any contingency,” a REBNY spokesperson said this week.

Both sides have promised fireworks if a hearing is scheduled: Ossé said he has hundreds of agents ready to testify in support, while REBNY has vowed to follow the playbook it used in 2019 to kill the commission-cap bill.

The lobby group is better able to organize now than it was four years ago, when its staffers had to manually look up members’ zip codes before sending them call-to-action emails.

“Now we can geo-target exactly which letters came from which addresses, which blocks and neighborhoods,” said Reggie Thomas, senior vice president of government affairs at REBNY.

The group got the jump on Ossé by starting an email campaign against his bill two days before it was introduced. REBNY has since been organizing meetings between its members and their representatives in the City Council.

Ryan Monell, vice president of government affairs, said REBNY doesn’t see the need to demonstrate publicly against Ossé’s bill — yet.

“Quite honestly, if it does get a hearing, you’re going to see that again,” he said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BGGOGCUYW5M4TOE46B2X3R25MA.jpg)