Amid generational office distress, Commercial Observer explains what happens in negotiations when borrowers hand back the keys.

commercialobserver.com

Inside the Room: How Handing Back the Keys On Commercial Real Estate Works

Amid generational office distress, Commercial Observer breaks down what happens when borrowers hand back the keys

Real estate world that appears to be unraveling, the headlines tell only part of the story.

For much of the past six months, commercial real estate’s beleaguered office sector has been dogged by negative news, with some of the industry’s most prestigious names either struggling to refinance formerly performing properties, defaulting on commercial mortgage-backed securities (CMBS) loans worth hundreds of millions of dollars, or attempting to hand back the keys to underwater office buildings to lenders.

SEE ALSO:

Examining the Dulles Corridor

Some of this might be a game of chicken between lender and borrower:

renegotiate my terms or take my asset. And, indeed, that seems to be the way it’s playing out.

In February,

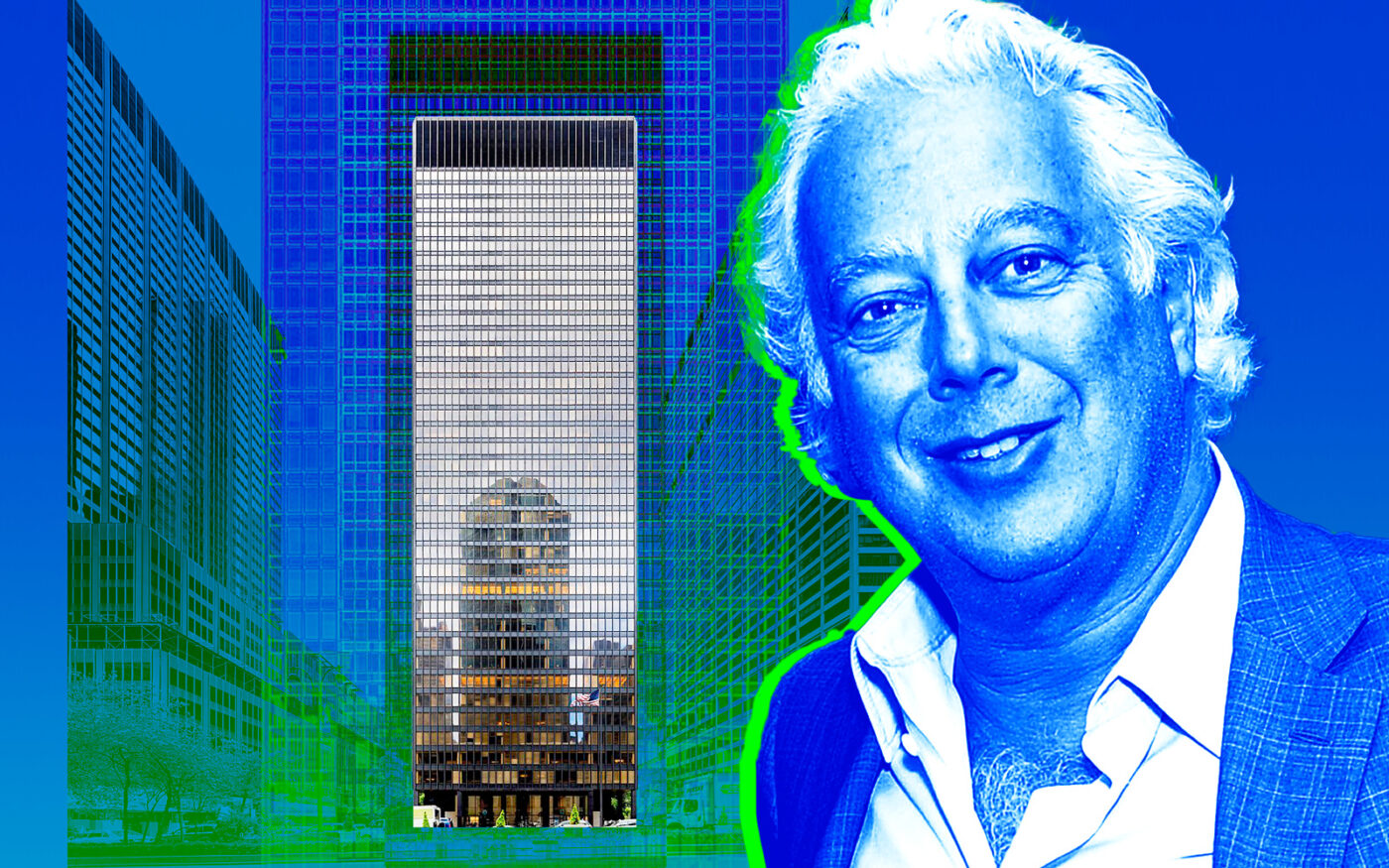

Brookfield (BN) defaulted on loans tied to two Downtown Los Angeles skyscrapers carrying $784 million worth of debt; in May, Scott Rechler’s

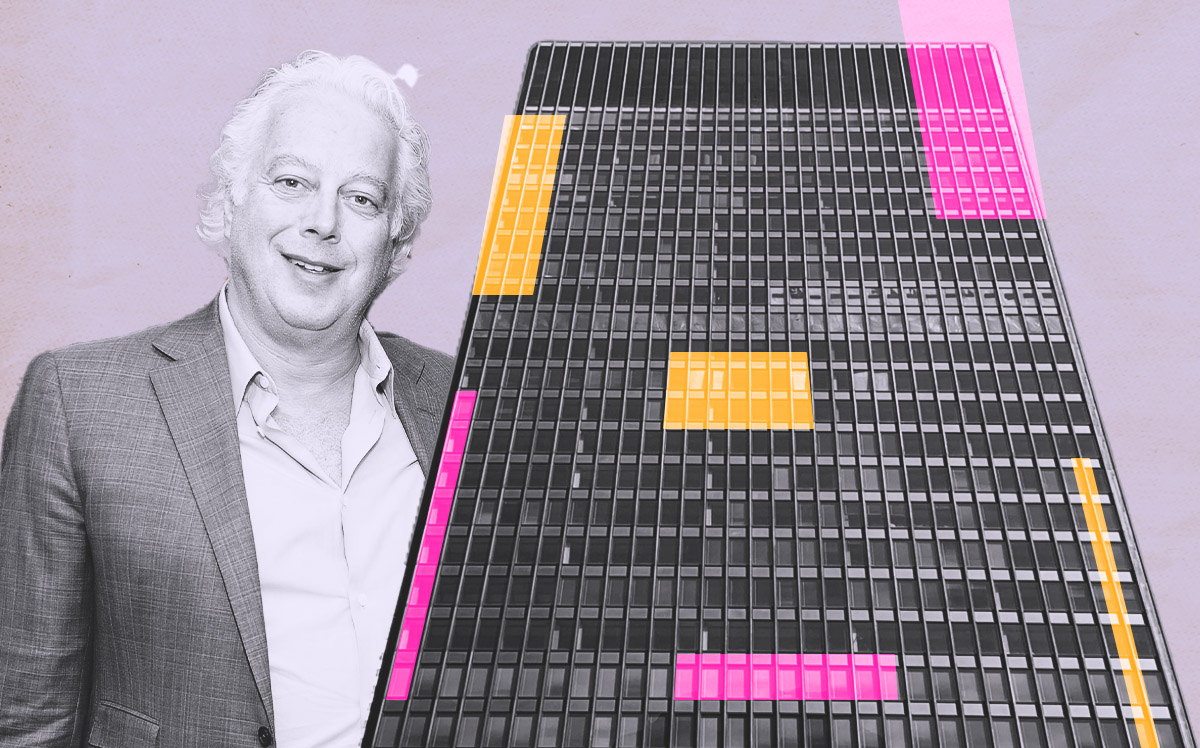

RXR handed back the keys to 61 Broadway in Manhattan’s Financial District, and defaulted on $240 million in outstanding debt; and last December, Jeffrey Gural’s

GFP Real Estate defaulted on the $130 CMBS loan tied to 515 Madison Avenue, before receiving a three-year extension in March.

As jarring as it may be to see some of commercial real estate’s biggest owners turn over the keys to once-trophy assets, things are likely to get worse. All told, the Mortgage Bankers Association estimates $92 billion in debt for office buildings comes due in 2023 with another $58 billion maturing in 2024, according to

Bloomberg.

“No one is surprised this is happening. The asset class has become structurally impaired by technology that facilitates remote work,” said Nitin Chexal, CEO of Palladius Capital Management, a real estate investment firm, referring to commercial office space. “Larger institutions have already run the calculus on whether or not to hold, and many are handing back the keys. It clears the way for smaller firms to follow suit.”

But the headlines only scratch the surface of the machine. In fact, the variety of paths lenders and borrowers can end up taking amid a workout, default or foreclosure — and the complexity of the negotiations inherent in each scenario — make the act of handing back the keys one of the great untold stories in commercial real estate, and one of increasing importance for the American economy.

“Many of the lenders [on office assets] aren’t even the sole lenders, especially in CMBS they’re not, and in a whole loan, or a portfolio loan, there may be co-lenders, participations, and some may want out of the deal under no uncertain terms even if it’s at a loss,” explained Jay Neveloff, partner and chair of the real estate practice at

Kramer Levin. “Depending on who the sponsor is, depending on what the building is, the response is, ‘You know what? You’re absolutely right, you can foreclose,’ and you’ll sell the note at a distressed sale or in two years … but most lenders don’t want to own assets because they don’t know what to do with them.

“So, this is lawyer heaven,” Neveloff added.

Those who’ve been at the round table during workouts, modifications, restructurings, defaults and foreclosures have come back with harrowing tales of what goes on inside the proverbial “room where it happens,” to steal a line from

Hamilton.

Meet me inside

“There’s a high level of tribalism,” said Shlomo Chopp, managing partner at Terra Strategies, a real estate advisory firm that specializes in distress. “Usually when a borrower gets involved, it gets contentious.”

GFP’s Gural, who owns dozens of buildings in Manhattan and recently worked out a loan extension, said that he’s generally been able to stay in the good graces of lenders throughout his career by paying down a portion of the loan at the lender’s request.

“The trick to avoid [default] is you need not be over-levered, and be able to maintain a decent occupancy in your buildings,” Gural explained. “Then you can usually avoid having to give the keys back.”

Others put the negotiations in more colorful terms.

“A lot of these borrowers are so aggressive in terms of ripping the face off the lender, but they don’t like it when the lender rips their face off when they default,” said Robert Verrone, principal of

Iron Hound Management, an industry specialist in workout advisory. “Some borrowers are smart and understand that everything is a balance, and the ones who don’t stop, it’s harder to get accommodation from their lenders.”

Verrone emphasized that no two workouts are the same, and that multiple wildcards come up in the course of these negotiations — often radically changing the direction of the workout.

“Every lender, and every negotiation strategy, is different depending on who your lender is and how that lender finances themselves,” Verrone said. “Are they a bank with deposits or are they a non-mortgage lender or a life company or a CMBS lender? That matters a lot in terms of what happens inside these rooms.”

Moreover, those industry experts who’ve sat either between — or on either side of — lenders and borrowers, underscored how handing back the keys is nowhere near as simplistic as it sounds.

“You can’t

not operate the property, or you’d violate some recourse carve-out triggers … then tenants put you in default and the lender doesn’t have cash flow,” explained Chopp. “Borrowers think they can do that, but you can’t tell a lender, ‘I’m leaving.’ You can’t just send back the keys and say, ‘Take it,’ because there’s no clause for that in loan documents.”

Besides, even if borrowers could get away with dumping their nonperforming or underwater office properties, oftentimes their lender — for instance, a balance sheet lender such as

JPMorgan Chase (JPM), or a private equity syndicate made up of numerous, disparate capital sources — has virtually no experience managing downtown office properties.

“Banks are not set up for it, they don’t have the expertise, nor the manpower allocated to it,” said a longtime capital markets executive, who requested anonymity. The executive added that office buildings are also extremely capital intensive, which makes them difficult for banks to manage.

Stay alive

Those lenders who are most reluctant to take a property back are usually the balance sheet lenders, or banks, who originated the loan themselves, hold it on their balance sheets for the lifetime of the loan, and typically have a personal relationship with their borrower.

Other times, it’s not so benign, and the late payment on the loan, or request for a workout, triggers a business decision for the balance sheet lender — so, what’s the property worth, what are my remedies, and how do I squeeze the borrower?

Michael Cohen, managing partner at

Brighton Capital Advisors in Charlotte, has over 25 years of experience in restructurings. He broke down the path an underwater balance sheet loan usually takes:

The first thing that happens if a property goes into default — usually triggered by a missed loan payment — is the lender sends a note to the borrower stating that they’re in default. If the borrower doesn’t respond, they send a foreclosure notice to begin the dual tracking, when a lender pursues a foreclosure while simultaneously exploring other resolutions such as a loan modification or a sale, explained Cohen. If the lender can see the borrower isn’t running the property correctly, they’ll put in a receiver — a third party elected by the bank — to oversee it temporarily.

Within this bizarre state of real estate limbo are the Scylla and Charybdis of recourse and nonrecourse carve-outs inside the loan documents, which lenders study with a fine-tooth comb during the receivership phase to see whether the default has triggered additional judgments on the underwater property.

Recourse loans allow a lender to seize additional assets if the borrower’s debt surpasses the property value; nonrecourse loans protect a borrower by limiting a lender’s clawbacks to collateral specified in the loan agreement, even if that collateral is less than the outstanding debt.

While every nonrecourse loan document carries language specifying that the lender won’t pursue money judgments against the borrower, but rather only a judgment to foreclose on the property, there are two exceptions: above-the-line recourse items and below-the-line recourse items, both of which allow the lender to go after the borrower personally, according to Chopp.

Above-the-line items include allegations that the borrower committed fraud, failed to cover insurance payments, or committed waste or damage to the building, and the lender needs to prove this before submitting a money judgment for the damages. Below-the-line judgments occur mainly when the borrower declares bankruptcy, which triggers full recourse against the borrower, even beyond the damages.

This might make balance sheet lenders out to be something like Scrooge, but below-the-line covenants have been included in loan documents only since the Global Financial Crisis, and for good reason.

“Fifteen years ago, borrowers would say to lenders, ‘Screw you, we’re filing for bankruptcy,’ and lenders would be held up in their tracks,” Neveloff recalled.

An element of memory is also taking precedence in the proceedings.

“Depending on the situation, and within reason, many institutional sponsors are endeavoring to be as cooperative as possible because they understand the importance of maintaining strong lender relationships,” explained Jack Howard, executive vice president at

CBRE (CBRE) Capital Markets. “Institutional memories are long, and as we move out of this cycle into the next period of growth, lenders will remember who their best counterparties were.”

At least, this is the case for some sponsors.

Duel commandments

Of course, not all lenders are created equal in the world of commercial real estate. Sometimes there will be competing interests and approaches within one loan, just to further complicate matters.

In lending syndicates, where multiple funding sources originate the loan, all lenders have to agree on major decisions. So when one lender might argue for foreclosure, another might argue against it, a third might push to sell the loan, while a fourth could try to muck things up just to create their own financial leverage.

“The truth is, a lot of time, one or two people in that syndicate really want to get paid off, so they’ll say no because they don’t care about future business, and what they’ll do is they force the syndicate to try to buy them out,” Verrone explained. “The guys who run the syndicate have to walk that line, and see what’s the bluff, what’s not the bluff, and who’ll they’ll buy out, or they must buy out, to get the deal closed.”

While these messy internal machinations are going on, many sponsors are left in the dark about the state of their loan — especially when it’s a whole loan, which is usually sold off on the secondary market into different tranches of debt, not unlike CMBS loans.

“In whole loans, you don’t know who the lender has as a co-lender. There is a whole market of people trading participations in deals,” said Neveloff.

The segment of the commercial real estate lending universe that leans most into the sale of whole loans and the splicing of debt and other sources of financing is the poorly understood non-bank lender section of the market, a.k.a. debt funds: the private equity piece of the puzzle.

Debt funds like

Apollo Global Management (APO) or

Starwood Property Trust might have originated the loan and continue to hold a small piece of it, say 5 percent, but they have participated out 95 percent of its interest to other debt funds or private equity firms or hedge funds, according to an example from real estate attorney Brian Cohen, director at

Goulston & Storrs. Moreover, if the debt fund has a credit facility on which they originated the loan, that credit facility has rules that say the debt fund must lower its exposure when the loan is out of balance or near default, Cohen added.

“What’s happening is there’s an agreement between lenders

and who they actually participate it out to, and that agreement is driving the decision-making process of the lender when there’s distress,” Cohen explained. “So [when you’re a borrower], you think you’re talking to the lender, but you’re not, because your lender has someone else telling them what to do.

“Sometimes your lender’s arms are tied,” he added.

If this all sounds complicated, it might be wise to buckle up, because diving a bit deeper into the CRE financial ocean enters the cavernous world of CMBS loan defaults, arguably the most byzantine nether region of real estate waters — one that makes balance sheet loans and debt fund distress look like small puddles by comparison.

Helpless

“CMBS is just infinitely complex in this sort of situation,” said Neveloff. “CMBS is more challenging because there’s so many different tranches of debt … and control often depends on valuation of the property.”

In CMBS, all debt payments into the CMBS trust flow to investors, and because the trust and its master servicer handle the bundled loans in a passive manner, any individual loan isn’t supposed to be modified, so cash flows and loan terms are each fixed. To this end, every single CMBS loan is nonrecourse, ensuring that only the asset itself serves as collateral in the event of default. Both of these elements — together with the risk grade system — theoretically make CMBS an attractive, relatively safe investment.

A default, however, triggers an avalanche of complications for the borrowers between CMBS servicers, and the different levels of bondholders.

On one side of the equation is the capital stack that’s investing equity and debt to fund the real estate asset. Each part of the stack has priority over the others and different rates of return on their investment. And if one of the holders in one of the tranches of that debt puts the loan into default, it causes the capital behind that tranche to get nervous, and now you have a war — or “tranche warfare,” according to Goulston & Storrs’s Cohen.

“If you’re a borrower, and you know the property is no longer worth the equity, and the value might be below the debt, and you don’t see a path out, the first thing you want to say to yourself is: Let me understand the capital stack and find where the leverage is,” explained Cohen.

“As a borrower, you must do the groundwork to understand the nonrecourse carve-outs of your loan and what your personal guarantee obligations are at each level of debt, because those are the lever points that will dictate how that workout is structured,” he continued.

Then there’s the lender, CMBS trust, and the servicing side of the equation, which is

even more complicated.

When things are normal, the master servicer is the day-to-day point of contact for the borrower’s performing loans, as they collect the cash flow and conduct traditional loan servicing.

Wells Fargo (WFC),

Midland Loan Services and

Key Bank conduct a vast majority of master servicing in the U.S.

A loan default, however, starts an elaborate dance between the borrower and the special servicer, who steps in at the time of default.

Here’s where all hell breaks loose: The problem is at the loan’s time of transfer, the special servicer knows little about the loan, or the borrower, because they are too busy handling other distressed assets. The new asset is a mystery that requires the special servicer to first hire an asset manager to appraise the property, then underwrite the loan, then figure out who in the investment pool is the controlling class bondholder (more on them later), then decide what’s the best course for the bondholders, and that’s before they even follow up with the borrower on what’s best for them — a process that usually takes up to half a year.

“The special servicer is not your friend. They will never be your friend,” emphasized Richard Fischel, partner at Brighton Capital Advisors. “They are there to maximize the [CMBS trust’s] return on the property.”

Not your obedient servant

Furthermore, there’s an inherent conflict of interest once the defaulted loan is controlled by the special servicer: the special servicer is paid each month the loan is in default.

“The special servicer has zero motivation to move fast. They get paid a fee every month the loan is in special servicing,” said an executive who requested anonymity. “Whereas, if I’m a balance sheet lender, I might want to do a workout in two months. The average CMBS workout is in nine to 12 months.”

Neveloff echoed this point.

“There are conflicts [of interest] in that situation because the servicer is getting fees, so they aren’t letting go so fast,” he explained. “Some special servicers are easier to deal with, some are not easy to deal with, and some of them don’t want to give too many concessions because word will spread they’re giving concessions and that makes their lives difficult.”

Even if the special servicer isn’t in the mood to be difficult, they still control the path the entire negotiations takes, and ultimately what happens to the loan and asset.

“If they see inherent value in the building, then they’ll want to hold onto the asset and they’re not going to want to give a discounted payoff,” said Brighton Capital’s Cohen, who added they could also sell the note to another buyer.

“But another reason they may want to hold onto is because the controlling class holder is the ultimate decision-maker with what happens in a loan modification or a foreclosure,” he continued.

Ah, yes, the controlling class representative, or CCR, often the ultimate wrench in the proceedings.

While the special servicer’s job is to work out the loan in accordance to what’s best for all certificate holders, the special servicer is ultimately taking orders from only one interested party: the CCR, or the B-Piece — the lowest level of bondholder in the waterfall structure of the investor pyramid.

Because they are the last ones to be paid, this entity has all the decision-making power.

And when it gets to the point when the CCR is dictating the future of a defaulted CMBS loan, all bets are off in regard to what happens next.

“Nobody really contemplated having to go this deep into servicing prior to COVID,” said Cohen. “As long as you paid your loan, you kind of went on with life … we didn’t have this situation.”

This tangled web of CMBS loans is already impacting the greater American economy, mainly because the CMBS sector has its own wall of maturities coming due as we speak, with many of the 10-year loans signed in 2013 and 2014 hitting their maturity dates in the coming months.

Between January and March 2023, there have been roughly $3.7 billion in new maturity defaults with CMBS unable to be paid off on time, while the aggregate amount of CMBS debt in maturity default has increased 28 percent over the past 12 months, according to CRED iQ, a national data analytics firm.

“Oh, my gosh, there’s a problem here,” said Chopp. “I would liken what’s happening now to if we had a downturn just as Henry Ford came out with the car and we had a lot of horse and buggy loans due.

“It’s not what it used to be. A lot of office just isn’t viable in its current form.”