You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buyer discount window starting to close?

- Thread starter Noah Rosenblatt

- Start date

Contract Activity Flourishes for NYC’s Priciest Homes

Signings continued to outpace new listings in Manhattan and Brooklyn, while the lack of supply put a damper on sales in the suburbs.

therealdeal.com

Deals continued to outpace listings in NYC, while the lack of supply put a damper on sales in the suburbs

Contract signings continued to outpace new listings in Manhattan and Brooklyn in November, but slowed in the suburbs, according to the latest Douglas Elliman report compiled by Miller Samuel.The report examines one- to three-family homes, as well as condominiums and co-ops in Manhattan, Brooklyn, Long Island, Westchester County and Fairfield County.

Most property types in Manhattan and Brooklyn saw contract activity rise compared to last year, when the market began to rebound from pandemic-related setbacks.

“We’ve just gotten beyond the year-ago distortion period, but we’re seeing an unusual elevated activity in sales,” said Jonathan Miller, who authored the report.

Increases varied by price point and property type: Co-ops asking $1 million to $2 million in Manhattan saw 3.5 percent fewer contracts signed than last year, while condos in the same price range jumped 22.5 percent.

Homes asking $10 million to $20 million, however, saw contract activity increase 150 percent year-over-year for co-ops and a whopping 633 percent for condos.

Brooklyn saw contract activity rise for all property types except co-ops. While condo contract activity rose by 38.2 percent over last year, co-ops experienced a 4.7 percent decrease in contract activity as demand was stifled by a 10.6 percent decline in supply.

The lack of co-op listings in Brooklyn tells a story similar to the suburbs, where a drop in signed contracts does not mean demand fell.

On Long Island, excluding the Hamptons and the North Fork, contracts for single family homes were down 12.8 percent, but listings were down 26 percent. Contracts for condos were up 11.9 percent, despite listings dropping 19 percent.

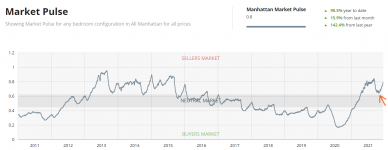

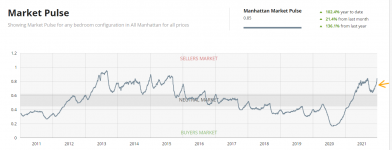

“Inventory is continuing to collapse, and that’s why we anticipate continued price growth into the new year,” Miller said.

Niche markets like the Hamptons are behaving like Long Island as a whole: New listings can’t keep up demand, causing the number of signed contracts to fall. In the North Fork, inventory fell twice as fast as signed contracts did.

Westchester County, New York, was similar, with new listings falling at a faster rate than contracts.

In Fairfield County, Connecticut, new listings fell 32.9 percent year-over-year for single-family homes and 28.8 percent for condos. Yet contract activity still boomed, jumping 54.9 percent for single-family homes and 90.2 percent for condos.

In the volatile market of Greenwich, sales fell sharply because of declines in supply. Although activity was down 43.3 percent for single-family homes, it was still up 75.6 percent from two years ago, before the pandemic.

Not even rising interest rates could spare the market from elevated prices driven by historically low supply, Miller said. With the bulk of listings being resales or existing product, there hasn’t been enough time for the market to be replenished.

“People are just not ready to put their homes up for sale,” Miller said.

Upstairs Realty

Well-known member

This is a very typical seasonal pattern, I think... as a broker, I beat the bushes for buyers in September/October, and no one wants to play ... then right near Xmas buyers feel their bonuses (which appear to be coming in strong) and all try to shop at the same time. I am looking for buyers (call me!) but I do expect, honestly, that things will be tight through the spring.

I think in many years the seasonality is different than most other places around the country. In a lot of places the seasonality is dictated by school years and holidays. In NYC there are many years where it is more dictated by year end bonuses with a huge rush of liquidity coming right at the beginning of the year. I agree with Ali that this year looks to be strong bonus wise so it should also be strong demand wise.

I do think that for the short to medium term future the market will be reflective of whatever actually happens with inflation and mortgage rates. Last time we saw inflation at its current pace we also saw mortgage rates at North of 10%.

I do think that for the short to medium term future the market will be reflective of whatever actually happens with inflation and mortgage rates. Last time we saw inflation at its current pace we also saw mortgage rates at North of 10%.

looks more and more likely that will be the caseThis is a very typical seasonal pattern, I think... as a broker, I beat the bushes for buyers in September/October, and no one wants to play ... then right near Xmas buyers feel their bonuses (which appear to be coming in strong) and all try to shop at the same time. I am looking for buyers (call me!) but I do expect, honestly, that things will be tight through the spring.

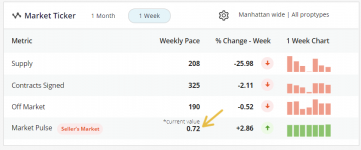

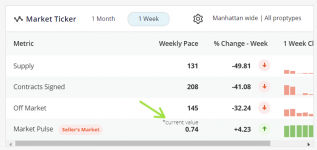

Such a crazy time looking at inflation and yields. Disconnect with Fed keeping rates low + I guess delfnationary fears from $$$ everywhere. It looks like 2022 will be abother year of elevated demand...the question is supply. Its all about supply right now, given the unseasonally high demand htat keeps going. How long can new listing trends remain above trend like they did this year? I question that for 2022I think in many years the seasonality is different than most other places around the country. In a lot of places the seasonality is dictated by school years and holidays. In NYC there are many years where it is more dictated by year end bonuses with a huge rush of liquidity coming right at the beginning of the year. I agree with Ali that this year looks to be strong bonus wise so it should also be strong demand wise.

I do think that for the short to medium term future the market will be reflective of whatever actually happens with inflation and mortgage rates. Last time we saw inflation at its current pace we also saw mortgage rates at North of 10%.