Forfeited profits: Why the feds chronically undersell seized property

Analysis shows DOJ flipped seized 1MDB assets for 41% less, on average, than fraudsters paid for them

The image of a U.S. Marshal giving a tour of Bernie Madoff’s seized Montauk beach house, gun bulging beneath a black windbreaker, is one that’s stayed with appraiser Jonathan Miller.

“He’s a big dude,” Miller said of the 2009 video. “His arm sweeps across the room: ‘Notice the understated elegance.’”

Times have since changed for the Marshals Service, the agency tasked with the seizure and sale of properties obtained by convicted criminals using their ill-gotten gains.

Today, Marshals seldom set foot inside seized properties. A federal contract awarded in 2017 entrusts Colliers with overseeing the sale of forfeited real estate, and the Justice Department sends press releases about its big wins.

This summer, there was a lot to celebrate. In August, the DOJ

repatriated $452 million misappropriated from a taxpayer-funded Malaysian development vehicle, bringing the total the DOJ has returned to Malaysia to a staggering $1.2 billion.

Known as 1Malaysia Development Berhad, the fund once had $8 billion to invest in big deals that would bring hefty returns to the people of Malaysia. Instead, officials tasked with managing 1MDB treated it as their personal piggy bank, pilfering an estimated $4.5 billion between 2009 and 2015. Those involved included Malaysia’s then-Prime Minister Najib Razak, his step-son Riza Aziz, Emirati businessman Khadem al-Qubaisi and enigmatic dealmaker Jho Low, the alleged mastermind.

Money diverted from 1MDB funded the production of Martin Scorsese’s “The Wolf of Wall Street,” Low’s extravagant birthday parties, diamond jewelry for Razak’s wife, a reelection campaign, works by Monet and Van Gogh and luxury real estate in New York City and Los Angeles — though that list is far from exhaustive.

The case was a dream for the Justice Department. Splashy and alluring, it gripped headlines and yielded a mostly happy ending — the feds seized the assets and liquidated them to repatriate cash. But the picture loses its rosy haze when the government’s handling of the trophy real estate implicated in the scheme is put under closer scrutiny.

The nine U.S. properties seized by feds in the 1MDB probe were bought with about $664.5 million in stolen funds. Almost all were luxury homes, save for a majority stake in the Park Lane Hotel in New York and the Viceroy L’Ermitage Hotel in Beverly Hills. An analysis of court and property records show that, since 2018, the government has sold eight of these properties for 41 percent less on average than fraudsters paid for them (the ninth, a condo, is listed for sale).

Of the six homes the feds seized and sold, only one was sold for more than the fraudsters paid for it. That was Low’s Beverly Hills mansion, which he bought for $17.5 million in 2010. Low transferred the ownership to Aziz, who then spent at least $22.5 million renovating the property, according to

reports. It was sold by the Marshals for $19 million in November 2019 and was resold for $27.4 million this year.

Based on an analysis of completed sales, the Marshals sold homes tied to the scandal for 48 percent less, on average, than Low and his associates spent purchasing and renovating them.

The Marshals’ best deal was the auction of the luxurious Viceroy L’Ermitage Hotel for $100 million in October 2020, 22 percent more than the $82 million Low spent to buy and renovate it.

The most egregious loss was the sale of a penthouse at Walker Tower in Manhattan. Entities tied to Low bought the unit for $50.9 million in 2014. The Marshals sold it last year for $18.25 million, a 64 percent discount.

“They don’t care about the market,” said Ryan Serhant, the celebrity broker who represented the buyer of Low’s forfeited condo at 80 Columbus Circle. “They care about liquidating the assets as quickly as possible for what the market can bear so they can repay victims as quickly as possible. They’re not here to set comps.”

Serhant’s client purchased the 4,822-square-foot unit for $23 million in May last year, about a quarter less than the $30.55 million Low paid for it in 2011.

Stefan Cassella, a former chief of the Asset Forfeiture and Money Laundering division in the U.S. Attorney’s office in Maryland, now runs a forfeiture consultancy business and reviewed TRD’s analysis of the sales.

He said the losses could be attributed to a down market, deterioration, liens on the properties or the fraudsters dramatically overpaying.

“The only way to know what factors were at work in this case would be to ask the person in the Marshals Service who handled these particular sales,” he said in an email. “I can only say that none of this is unusual.”

The Marshals Service and a representative for the DOJ declined to comment.

Seizing the moment

Civil forfeiture was nearly abolished in the 18th century after the Americans ousted the British, but a provision remained allowing the newly formed U.S. government to seize ships that didn’t pay customs duties. That clause in maritime law is the basis for federal forfeitures today.

Real estate seizures didn’t come into regular use until the 1980s, when the Reagan administration frequently wielded them to wage the War on Drugs.

“[Reagan] dusted off forfeiture and RICO and decided this would be good to use against organized crime,” said Steven L. Kessler, a prominent foreclosure defense attorney. “Very few people had an objection to that.”

Despite a

history of abuses, prosecutors argue that civil forfeiture is one of the few ways victims can receive restitution when criminal prosecution is not possible. In the case of 1MDB, the $1.2 billion in stolen funds has been recovered through 42 civil forfeiture actions filed in federal court.

But under-selling forfeited real estate

has long been a problem for the Marshals Service.

In 2010, Leonard Briskman, a top official at the agency,

was accused of selling assets without competitive bidding and operating a side business to dispose of distressed real estate to his “business contacts.” A subsequent investigation corroborated the substance of the allegations and he was reassigned before retiring in 2015.

In an interview, Briskman said he was ultimately cleared of the charges and returned to “pretty much the same work.” He said he “always tried to get the highest and best price that I possibly could,” but said the constraints of the job could frustrate the effort.

Case in point: the seizure of the notorious mob-run Las Vegas strip club Crazy Horse Too in 2007. The club, founded by Tony Albanese — whose severed head was discovered in a California desert in 1981 — was being run by Rick Rizzolo when the FBI began investigating it after multiple severe beatings of patrons. One man died in the desert behind the club after a fight in 1995.

Briskman said they’d found a buyer ready to pay $35 million for the club on the condition that the purchase came with a gambling and liquor license. In order to get the license, the club would have to open for one hour. That was a deal breaker for the agency — the government would not open and operate a strip club, even for an hour.

“We walked away from $35 million to nothing,” he said. “Was it a mistake? Well, personally I thought it was a mistake, but I was a government employee so I abided by what the government wanted.”

In 2018, Sen. Chuck Grassley released a lengthy memo documenting a culture of misconduct among the agency’s top officials. The Marshals’ asset forfeiture division was accused of wasteful spending in connection with a pricey office renovation and a rarely-used training facility.

The memo followed a 2016 report into improper hiring practices and reprisals against whistleblowers, in which it was revealed the DOJ had suggested the Marshals’ handling of real property be turned over to the Treasury Department. The rationale was that the Treasury’s forfeiture program, which contracts out management and sales, generated “far fewer complaints” from DOJ prosecutors.

Jason Wojdylo, who was the chief inspector of asset forfeiture for the Marshals until he retired in April, was one of the internal whistleblowers cited in both the 2016 and 2018 reports.

He said the general policy was to sell properties for a minimum of 85 percent of the appraised value, often determined via drive-by because the Marshals can’t gain entry to properties without a court order. That means certain unexpected surprises inside could be discovered much later. In one such case, it was only after entering a home that Wojdylo realized its pipes weren’t connected to the sewage system.

“Every day an asset sits in our custody, it costs us money,” he said. “But we’re not just giving it away.”

Lapse of luxury

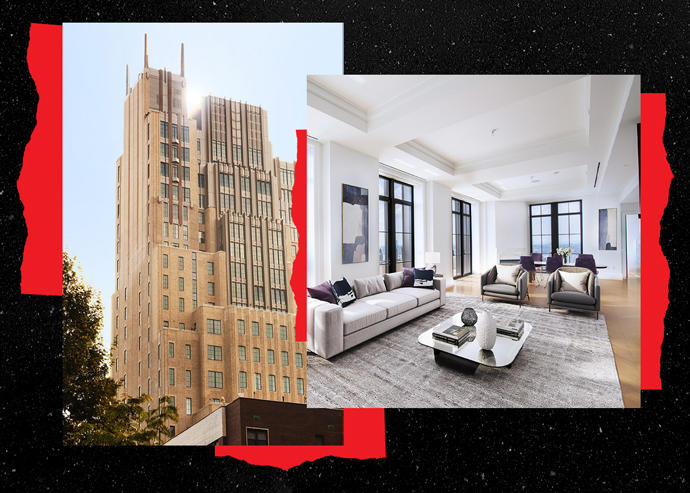

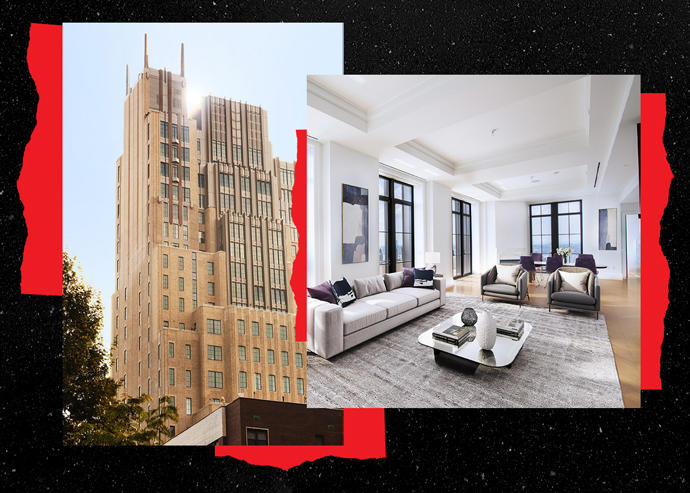

Among the biggest mysteries of the 1MDB case is how the U.S. Marshals managed to get just $18.25 million for a sprawling, 6,000-square-foot, five-bedroom penthouse in Tribeca. When it was bought for $51 million in 2014 by 1MDB co-conspirator Khadem al-Qubaisi, it was the most expensive apartment ever sold in downtown Manhattan.

The government first moved to seize the property through civil forfeiture in 2016 but paused the action to complete a criminal investigation. Meanwhile, al-Qubaisi’s wife tried to block the seizure, claiming ownership on behalf of their four children as innocent third-parties.

The property appeared on the market as early as 2017, with listing agents Emily Beare and Shaun Osher of CORE Real Estate, asking $45 million. In early 2019, the price dropped to $35 million.

In July 2019, an agreement was reached between the family and government to sell the condo despite the pending forfeiture case. Unpaid common charges were piling up to the tune of $250,000 a year and both parties wanted to prevent the penthouse’s condition from deteriorating.

Over the next six months, the listing took a turn for the bizarre. Three potential buyers came forward, but each offer was lower than the one before, according to DOJ lawyer Barbara Levy, citing reports from CORE. The listing agents attributed that to cockroach sightings, a plumbing leak and an odor from the apartment’s six toilets, according to the lawyer’s March 2020 affidavit. The condo was in such a state of disrepair that “one prospective [buyer] had a difficult time staying inside.”

In March, the parties were considering an offer made in November. But as the arrival of Covid roiled markets, the bidder reduced the offer by $2 million and gave the parties one week to sign. In a court declaration, Beare said the offer was for $23 million.

“The current offer appears to be the highest available reasonable offer in light of current market conditions,” Levy wrote.

The Walker Tower’s condo board approved the $23 million offer, its lawyer told the court.

The al-Qubaisi family objected, claiming it was “unreasonably low” and “inconsistent with the offer history,” filings show. Court documents show there had been at least one $30 million offer.

Compass broker Michael Graves submitted a $20 million all-cash, no-contingency offer to the listing agents in March 2020 but was told a higher offer was being entertained, he said in an interview. His account was corroborated with documentation.

The judge ultimately gave the government permission to sell the unit for $23 million, “or any offer that is within 25 percent of the value” — between $17.25 million and $28.75 million. But the $23 million buyer balked and revised his offer to $18 million. Around the same time, Beare received a second offer for $18.25 million. The Marshals went with the higher of the two, executing the contract in May.

Graves was shocked when the final sales price became public. “I was stunned that we were unable to make any traction,” he said. “My client was ready and able to close immediately.”

The condo board tried to block the sale by exercising its first right of refusal and even offered to buy the unit from the government. But the judge agreed with the government and the sale proceeded, closing in August 2020. The al-Qubaisis were awarded a sum of $870,000 and their claim to the property was wiped out.

A year later, questions remain.

“I’m just puzzled,” said Compass broker Vickey Barron, who lives at Walker Tower and sells in the building. “I know there were other people willing to step up and pay more. Why they didn’t have the opportunity, I don't know.”

Levy did not respond to a request for comment nor did CORE’s Beare and Osher.

Competing priorities

Though the disappointing sale at Walker Tower can be seen as emblematic of the problems plaguing New York’s luxury market during the onset of the pandemic, some argue the Marshals faced stacked odds from the outset.

“When someone wildly overpays for a property, it’s doomed from the day they close,” said Miller, the appraiser.

Wojdylo, who did not work on the 1MDB case, also pushed back on any suggestion that losses were the result of agency mismanagement.

“Nobody's being lazy and saying, ‘We don’t care about victims, just take whatever we can get for it,’” he said. “I don’t believe that there is anybody sitting in an office in Washington who is making decisions without considering their responsibility to victims.”

The recent case of Paul Manafort, the chairman of Donald Trump’s 2016 presidential campaign, illustrates his point. In 2018, Manafort agreed to forfeit five properties spread throughout New York City and the Hamptons to repay an $11 million monetary judgement after he was convicted on bank fraud and tax charges.

The government abandoned forfeiture actions after Trump pardoned Manafort in January, though not before selling two of the homes at a loss. (Wojdylo did not work on the case.)

But the Marshals were destined to fail from the start. Manafort had nearly $23 million in mortgages on the properties and had accrued so much debt that the homes would have had to sell at absurd premiums to make a profit.

A source who used to work in law enforcement said the agency typically wouldn’t go forward unless it stood to make at least $50,000 on a sale, but the person noted that in a high-profile case with a political figure like Manafort, refusing to seize his homes would look “like the government is not doing its job.”

“Forfeiture is not about profit. It’s not about money,” Wojdylo explained. “It’s about law enforcement.”

Walker Tower condo board opposes heavily discounted sale of 1MBD unit

Walker Tower condo board opposes heavily discounted sale of 1MBD unit