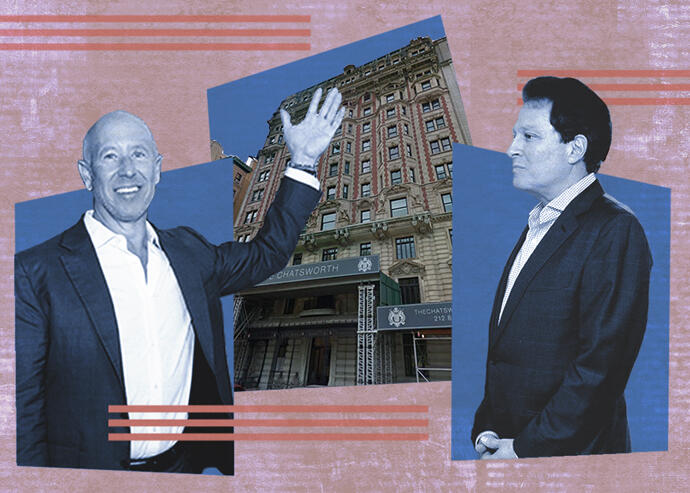

Scott Rechler & Larry Silverstein have been bargain shopping but opportunities in NYC real estate remain scarce.

therealdeal.com

The art of the (discounted) deal

Rechler and Silverstein have been bargain shopping but opportunities in NYC remain scarce

One of the biggest investment-sale bargains in New York since the beginning of the pandemic happened just last month. That’s when Scott Rechler’s RXR Realty acquired a

42 percent stake in hundreds of Manhattan rental units from Gary Barnett’s Extell Development. RXR valued the two buildings at $800 million, a 20 percent discount from their pre-Covid valuation of $1 billion.

But while the pandemic has emptied out New York offices and strained landlords, renters and homeowners, it hasn’t unleashed the flood of distress selling experts predicted early on. That’s in large part because banks have offered extensions to loan borrowers and government action has prevented

mass foreclosures.

And Rechler said he’s now seeing “a tremendous amount of pent-up demand” in the market.

Sellers have also been reluctant to slash prices because they know investors have billions in dry powder.

“There is a ton of capital on the sidelines and sometimes too much capital creates a self-fulfilling prophecy of modest distress,” said Richard Mack, CEO of Mack Real Estate Group, a major investor and mezzanine lender on development projects.

There is certainly some stress, but lots of the rescue jobs are happening behind the scenes, in the form of debt and equity placements as opposed to outright sales.

“The biggest news is the activity [which] the market won’t readily see because it’s in the capital stack,” said Jay Neveloff, who chairs the real estate group at New York-based law firm Kramer Levin. “You will not see it, it will be under the kimono.”

Alternative lenders are also looking to find ways to either foreclose on defaulted properties or bring on new management to take over struggling projects.

CIM Group and Mack Real Estate — via their lending divisions — have sought to take over properties in default through a

Uniform Commercial Code foreclosure, a process that bypasses state courts.

CIM did just that in February, when it foreclosed on the junior mezzanine positions tied to

four of HFZ Capital Group’s Manhattan condo conversion projects. The move gave it control of prime development properties on which CIM claims it was owed about $90 million.

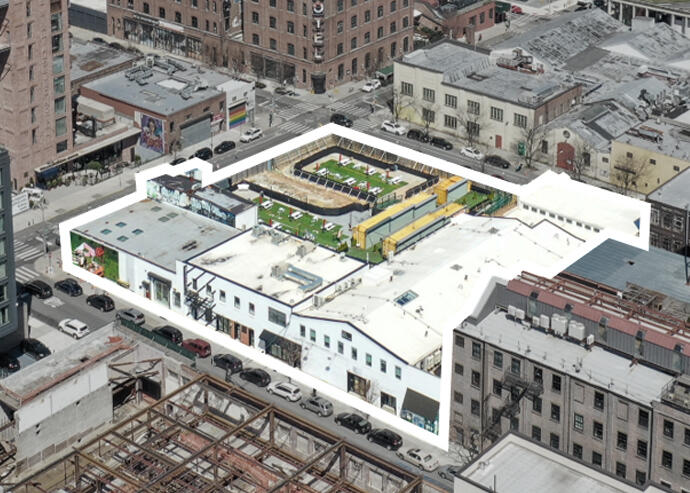

Mack could also take control of half of a

Brooklyn luxury rental project, The Denizen, from troubled developer All Year Management through a UCC foreclosure. Silverstein Properties made a bid to pay $200 million for the

other half of that project, which would be a substantial discount. All Year,

led by Yoel Goldman, had valued that portion of the complex at $313 million pre-pandemic, according to an appraisal report on the Tel Aviv Stock Exchange.

In another project involving HFZ, hedge fund Children’s Investment Fund has sought to bring on Zeckendorf Development and Suffolk Construction to take control of the XI, a $2 billion hotel and condo project in Chelsea. Children’s had initially provided HFZ with a $1.25 billion loan to complete the Bjarke Ingels-designed development. In January Children’s filed suit, alleging HFZ was on the hook for at least

$160 million in outstanding interest payments.

Holding on

Owners who can are choosing to hold onto their properties until the market stabilizes and pricing becomes more clear, according to Jonathan Adelsberg, a partner in the real estate group at New York law firm Herrick Feinstein.

At that point, they can “assess the level of damage” the pandemic has had, Adelsberg added.

Estimates are that Covid will lead to $146 billion in pending and existing commercial real estate distressed debt, according to an end-of-year report from Real Capital Analytics.

“The bank accommodations are holding everything together,” said Lisa Knee, tax partner and co-leader of accounting firm EisnerAmper’s national real estate practice. But when banks start marking down their loans, more distress sales are likely to occur.

The current wait-and-see strategy is a slight departure from what followed the Great Recession.

RXR — which Rechler formed in 2007 — made a name for itself by buying massive commercial buildings in New York as the economy was just rising from the depths. In 2011, it acquired the 2.3 million-square-foot

Starrett-Lehigh Building in West Chelsea for $900 million.

Two years later, RXR partnered with Walton Street Capital to buy a 1.2 million-square-foot

237 Park Avenue from Lehman Brothers Holdings paying $810 million. The Midtown office building was appraised at $1.3 billion in 2017, according to Trepp, which tracks mortgage-backed securities.

Today, some firms are looking to put money to work as a form of rescue capital, including in the struggling hospitality sector. Last month, Acore Capital said it had already

raised $1 billion for its hotel fund to provide financing to hotel borrowers who are no longer being offered extensions with their lenders through preferred equity or mezzanine financing across the United States.

But Michael May, president of Silverstein’s real estate lending arm, said that injecting equity into troubled projects will not always help solve the problem.

“More often than not, unfortunately, the reason that the project is in the situation [it is] in is because the ownership is dysfunctional,” he said.

www.cityrealty.com

www.cityrealty.com