New Development Sales Surge in New York City

Deals were up by 25 percent in March across the five boroughs compared to pre-pandemic averages, according to data from Marketproof.

therealdeal.com

Condo sales are booming in Brooklyn

Marketproof data reveal March was a hot month across the cityMarch was a good month for brokers selling condos across the boroughs.

The spring season is starting off hot with 39 percent more deals closed in March versus February, according to data firm Marketproof.

Deals for newly built or newly converted apartments across the city were up by 25 percent compared to pre-pandemic averages for the month. March saw 350 contract signings this year. The average between 2015-2019 was 280.

“In February’s new dev market report we said ‘worry not, new devs did nicely.’ In March, as the Spring selling season begins, deal volume is surprisingly strong,” Marketproof CEO Kael Goodman wrote in his firm’s March report. “New dev buyers seized the opportunity to buy in prime Manhattan and Brooklyn projects.”

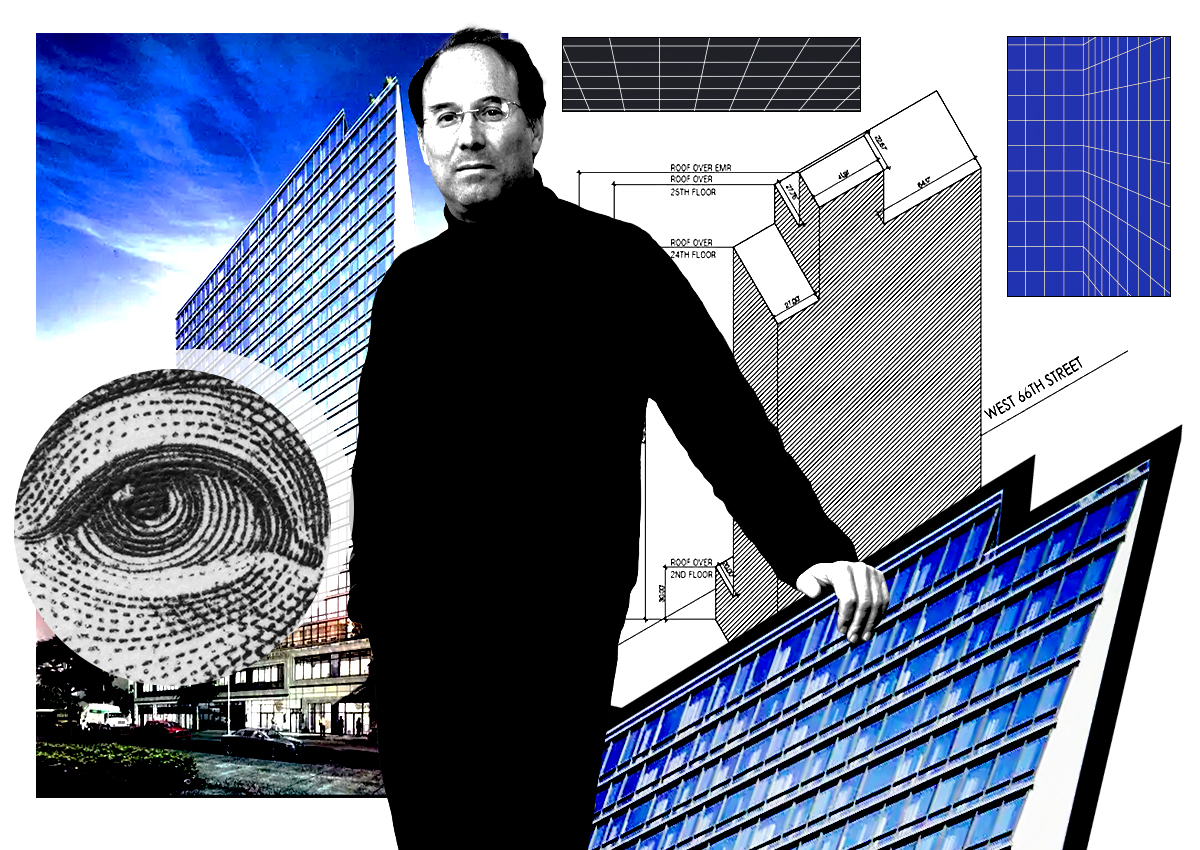

The largest contract to close in March was a $66.5 million ($4,000 per square foot) sale for two penthouse apartments spanning four floors at the top of Naftali Group’s The Bellemont in the Upper East Side. The sale smashed records in the neighborhood.

Over in the Penn District, Aleksey Gavrilov and Joseph Grosso of Corcoran closed 22 contracts at 300 West 30 Street in March, the first development project by Queens-based Hiwin Group USA. Deals at the Mondrian-inspired residence ranged from $950,000 to $1.7 million.

As impressive as Manhattan’s numbers were last month, the sales activity pointed to a shifting tide, with Brooklyn competing for the bulk of the city’s business.

“The shift back to Brooklyn was very visible,” said Marketproof CEO Kael Goodman. “Manhattan’s deals are still bigger but not by much.”

The outer borough saw 145 new development contracts, which is a 61 percent growth over pre-pandemic levels.

Not only are there more sales in general, but also more inventory to sell in Brooklyn, according to Goodman.

In Boerum Hill, Sterling Town Equities’ Post House topped Brooklyn sales, closing eight contracts for one, two and three-bedroom units, with prices ranging between $1 million to just shy of $3.5 million.

The second tallest tower in the borough, Extell’s Brooklyn Point, placed second again, securing six contracts for one and two-bedroom apartments. The Downtown Brooklyn highrise saw prices ranging from $1.2 million to $2.6 million.

Growth dotted the entirety of Brooklyn, with dozens of contracts signed “deep into the borough,” according to Goodman.

That could be linked to a sharp decrease in the demand for luxury units across the city, which are down 31 percent compared to the 2015-2019 average for the month. While more units were sold in March versus February, closings were 12 percent cheaper, with a median price of $5.5 million.

“In Brooklyn there’s a lot more room and more land to build new stuff. The borough is filling the market for more affordable units,” Goodman said.