I don’t understand even enough of this stuff to have an opinion on the additional comments, but I will continue reading. This is so far from clicking in my mind that it makes me feel the education gap is insurmountable. I am conventionally well-educated beyond what the vast majority of the population is and I just cannot wrap my head around any of this. I honestly don’t think any amount of reading will get me there.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2021 The Year To Get Out

- Thread starter David Goldsmith

- Start date

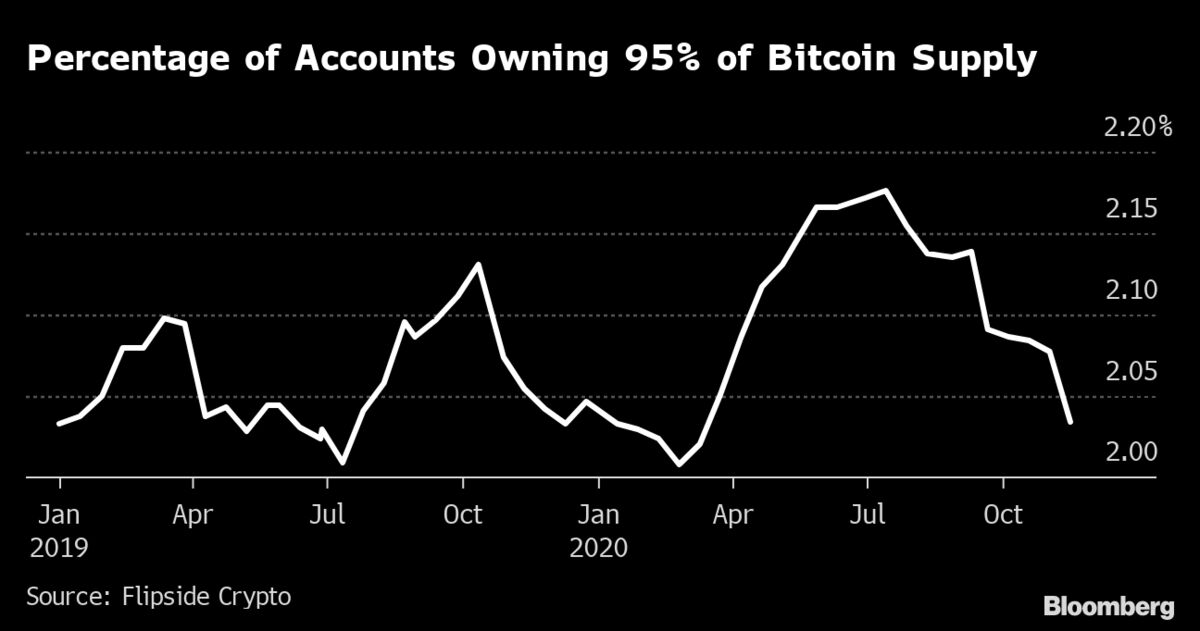

right! this is one of 2 things that scare me about the concept..the whales and potential regulation from govtsI think currently the price is too easily manipulated since apparently 95% of all coins are held by a few large players. Also I'm not sure how it works with the cap of 21 million Bitcoin ever to be mined.

Bitcoin Whales’ Ownership Concentration Is Rising During Rally

A lot of theories have emerged on why Bitcoin has skyrocketed almost 60% in the past month, with most heralding widespread adoption by institutions and individuals.The fact remains that there’s nothing widespread about Bitcoin ownership.www.bloomberg.com

Here’s why Satoshi Nakamoto set Bitcoin’s supply limit to 21 million

There will be a maximum of 21 million Bitcoin, and that's it. But why 21 million? Why not more? Why not less? Tell me, damnit!thenextweb.com

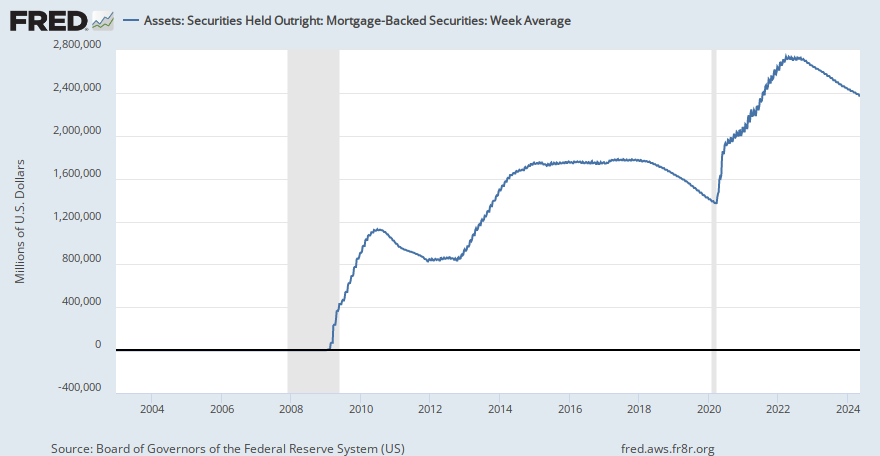

Wall Street loves financial instruments which are too complicated for people to understand and must turn to them for their expertise. Back when I was at Arthur Andersen I was at Salomon working on pricing models for Collateralized Mortgage Obligations running as complicated models as possible for regulators to approve pricing based on repayment/prepayment scenarios.

But the simple fact is when interest rates go up, no one prepays/repays early because property values go down so they can't sell and no one refinances to get a higher rate. When interest rates go down everyone prepays/repays early because they either sell because prices go up or refinance to get a lower rate.

This became obvious when the CMO market fell apart when interest rates fell and everyone got their money back too soon and at the worse possible time because it then had to be invested at lower rates when they had been promised long term stability. So The Street changed the name, made them more complex, more risky, and they eventually became the major driver of the 2008 financial collapse. And for years the only purchaser was The Fed because no one else would touch them. It had promised an exit to this starting in 2010, but then started buying again, tried again to start exiting again in 2018, but this year began buying again at a unprecedented rate and currently holds a record amount - and is still buying.

But the simple fact is when interest rates go up, no one prepays/repays early because property values go down so they can't sell and no one refinances to get a higher rate. When interest rates go down everyone prepays/repays early because they either sell because prices go up or refinance to get a lower rate.

This became obvious when the CMO market fell apart when interest rates fell and everyone got their money back too soon and at the worse possible time because it then had to be invested at lower rates when they had been promised long term stability. So The Street changed the name, made them more complex, more risky, and they eventually became the major driver of the 2008 financial collapse. And for years the only purchaser was The Fed because no one else would touch them. It had promised an exit to this starting in 2010, but then started buying again, tried again to start exiting again in 2018, but this year began buying again at a unprecedented rate and currently holds a record amount - and is still buying.

Assets: Securities Held Outright: Mortgage-Backed Securities: Week Average

Graph and download economic data for Assets: Securities Held Outright: Mortgage-Backed Securities: Week Average (WMBSEC) from 2002-12-18 to 2023-03-08 about outright, mortgage-backed, credits, reserves, securities, banks, depository institutions, and USA.

fred.stlouisfed.org

Mortgage bankers warn Fed mortgage purchases unbalanced market, forcing margin calls

Mortgage bankers warned the U.S. housing market risks a "large-scale disruption," due to efforts by the Fed that were meant to help it.

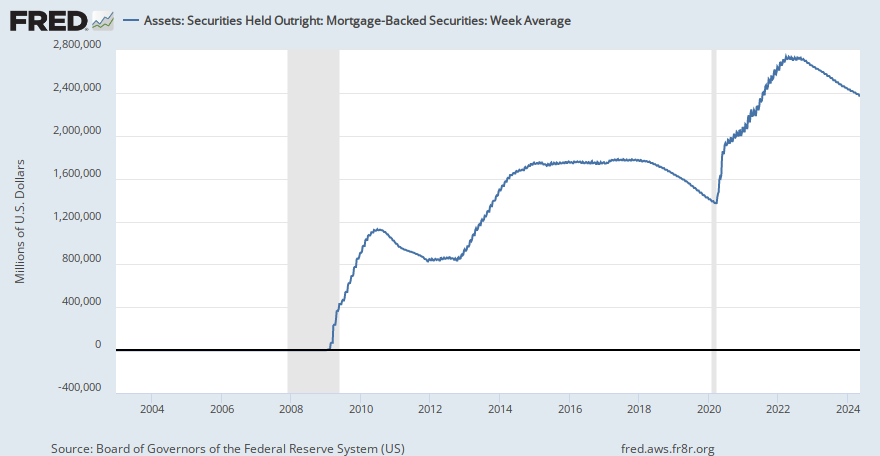

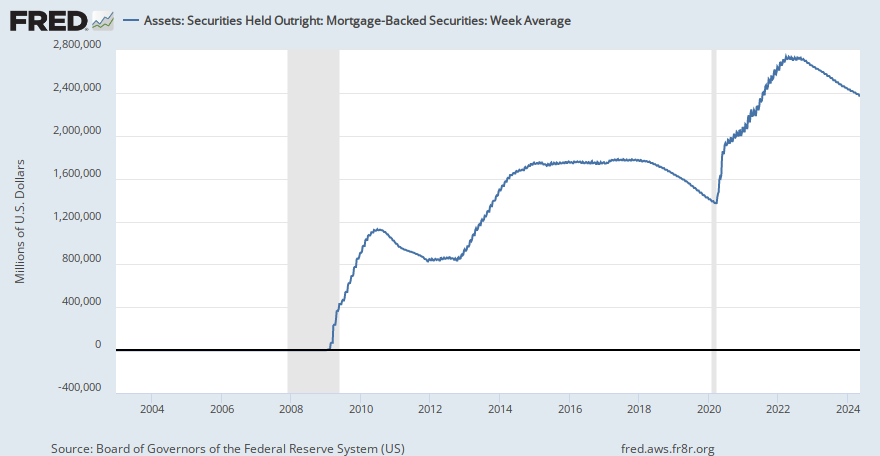

This graph will go MUCH higher over the next few years as the Fed is forced to bailout cmbs and rmbs related to this pandemic, as they fear a 2008 style collapse if they let it all play out. Rising interest rates will be the killer. Thats when Fed steps in and I do think we see some form of YCC at some pointWall Street loves financial instruments which are too complicated for people to understand and must turn to them for their expertise. Back when I was at Arthur Andersen I was at Salomon working on pricing models for Collateralized Mortgage Obligations running as complicated models as possible for regulators to approve pricing based on repayment/prepayment scenarios.

But the simple fact is when interest rates go up, no one prepays/repays early because property values go down so they can't sell and no one refinances to get a higher rate. When interest rates go down everyone prepays/repays early because they either sell because prices go up or refinance to get a lower rate.

This became obvious when the CMO market fell apart when interest rates fell and everyone got their money back too soon and at the worse possible time because it then had to be invested at lower rates when they had been promised long term stability. So The Street changed the name, made them more complex, more risky, and they eventually became the major driver of the 2008 financial collapse. And for years the only purchaser was The Fed because no one else would touch them. It had promised an exit to this starting in 2010, but then started buying again, tried again to start exiting again in 2018, but this year began buying again at a unprecedented rate and currently holds a record amount - and is still buying.

Assets: Securities Held Outright: Mortgage-Backed Securities: Week Average

Graph and download economic data for Assets: Securities Held Outright: Mortgage-Backed Securities: Week Average (WMBSEC) from 2002-12-18 to 2023-03-08 about outright, mortgage-backed, credits, reserves, securities, banks, depository institutions, and USA.fred.stlouisfed.org

John Walkup

Talking Manhattan on UrbanDigs.com

Good stuff. I'm not yet convinced what the value of BTC is, but blockchain will power some amazing innovations in the coming years. Perhaps the DeFi (decentralize finance) crowd will even figure out how to disintermediate the Fed.

Just a little year end "I told you so."