hallmark1

New member

Or, have they been 'spoiled' by what they believe to be the 'fast and easy' money offered by certain aspects of stock market 'investing', along with a belief that there's no downside and only upside?

The Wall Street Casino, 2020/2021-style vs. Tried and True Wealth-Building Through Real Estate!

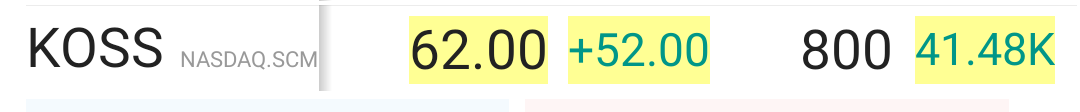

GameStop, a video selling brick and mortar hemorrhaging money, is the perfect poster child for the power of 'chat room' investing' gone wild!

And, a reminder of the 2018 article from

Bloomberg Opinion

...

'Rational Markets Theory Keeps Running Into Irrational Humans'

https://www.bloomberg.com/.../rational-markets-theory...

Some will likely make millions from these parabolic moves but, you don't want to be the last one standing when the music stops!

For tried and true investing and wealth building, real estate is the asset class

Hallmark Abstract Service LLC

will stay with!

The Wall Street Casino, 2020/2021-style vs. Tried and True Wealth-Building Through Real Estate!

GameStop, a video selling brick and mortar hemorrhaging money, is the perfect poster child for the power of 'chat room' investing' gone wild!

And, a reminder of the 2018 article from

Bloomberg Opinion

...

'Rational Markets Theory Keeps Running Into Irrational Humans'

https://www.bloomberg.com/.../rational-markets-theory...

Some will likely make millions from these parabolic moves but, you don't want to be the last one standing when the music stops!

For tried and true investing and wealth building, real estate is the asset class

Hallmark Abstract Service LLC

will stay with!